Key Insights

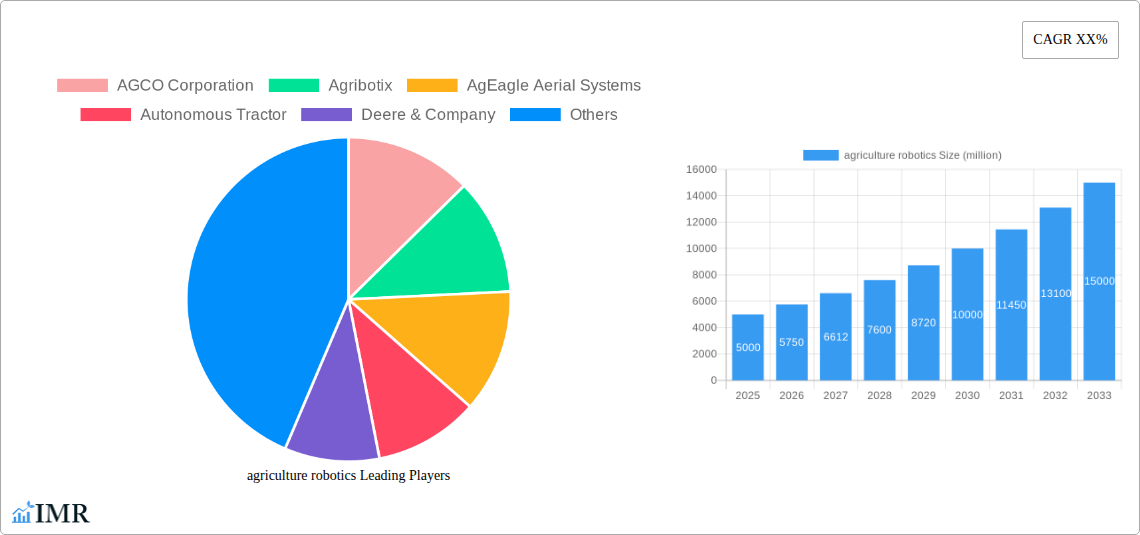

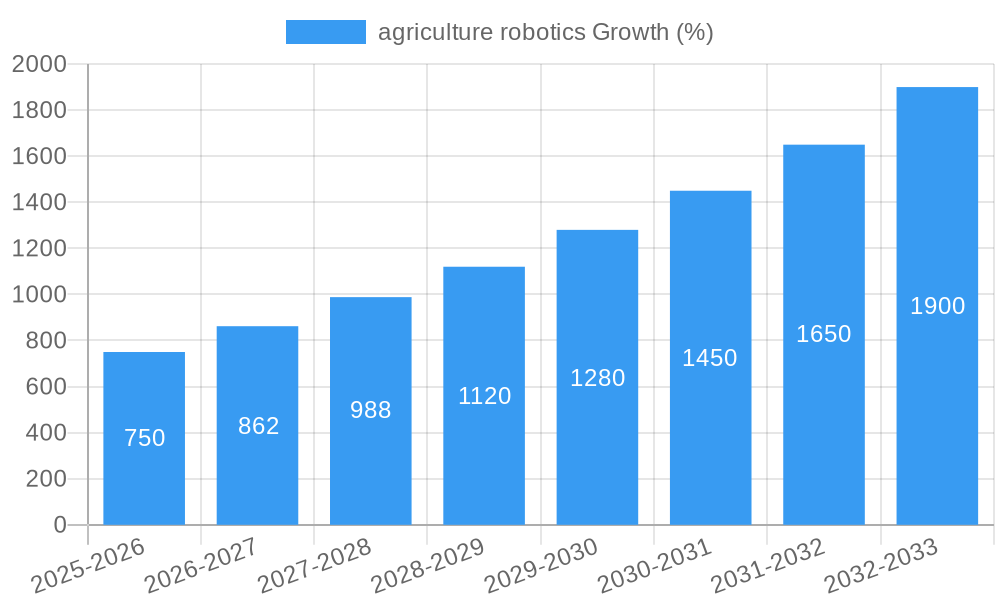

The agricultural robotics market is experiencing robust growth, driven by the increasing need for automation in farming to address labor shortages, improve efficiency, and enhance crop yields. The market, currently estimated at $5 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $17 billion by 2033. Key drivers include advancements in artificial intelligence (AI), machine learning (ML), and sensor technologies, enabling the development of sophisticated robotic systems capable of performing various tasks, from planting and harvesting to weeding and spraying. Growing adoption of precision agriculture techniques and the increasing demand for sustainable farming practices further fuel market expansion. While high initial investment costs and the need for robust infrastructure present challenges, the long-term benefits of increased productivity, reduced labor costs, and improved crop quality are overcoming these restraints. Market segmentation reveals strong growth across various robotic applications, including autonomous tractors, drones for crop monitoring, and robotic harvesters. Leading companies like John Deere, AGCO, and Yamaha are actively investing in research and development to enhance their offerings and gain a competitive edge.

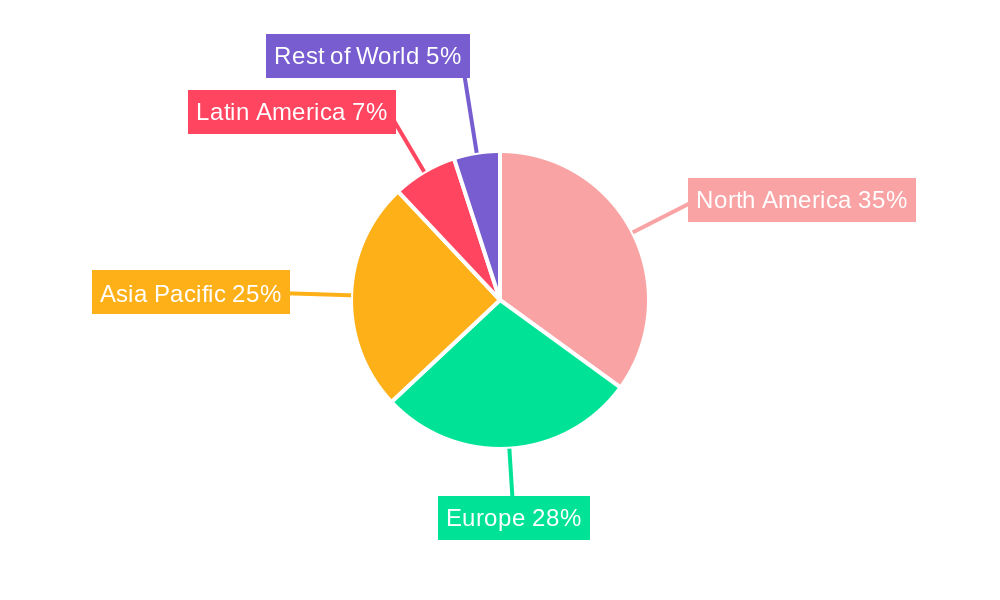

The regional landscape exhibits variations in market penetration, with North America and Europe currently leading the adoption of agricultural robotics due to higher technological advancements and favorable government policies. However, emerging economies in Asia and Latin America are witnessing increasing interest in automation, presenting significant future growth opportunities. The market’s evolution will likely see greater integration of robotics with data analytics and the Internet of Things (IoT), leading to more intelligent and adaptable systems capable of optimizing farm operations in real-time. This will involve increased collaboration between robotics manufacturers, software developers, and agricultural businesses to create comprehensive solutions tailored to specific farming needs. The continued focus on sustainability and reducing environmental impact will also shape future innovation in agricultural robotics.

Agriculture Robotics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the agriculture robotics market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning opportunities within this rapidly evolving sector. The parent market is agricultural machinery and the child market is precision farming technologies. The report's quantitative analysis projects a market value reaching xx million by 2033.

Agriculture Robotics Market Dynamics & Structure

The agriculture robotics market is characterized by a moderately fragmented landscape, with key players vying for market share through technological advancements and strategic partnerships. Market concentration is currently low, estimated at xx%, reflecting the presence of numerous niche players and startups alongside established agricultural machinery manufacturers. Technological innovation is a primary driver, with ongoing developments in AI, machine learning, and sensor technologies fueling the adoption of automated solutions. Regulatory frameworks vary across regions, influencing the pace of adoption. While some regions embrace supportive policies, others face regulatory hurdles. Competitive product substitutes, such as manual labor and traditional machinery, continue to exist but are increasingly challenged by the efficiency and scalability offered by robotics. End-user demographics are shifting toward larger farms and agricultural businesses seeking improved productivity and reduced labor costs. M&A activity has seen an uptick in recent years, with xx major deals recorded between 2019 and 2024, predominantly focused on acquiring smaller technology companies with specialized expertise.

- Market Concentration: xx% in 2025, projected to increase to xx% by 2033.

- Technological Innovation Drivers: AI, Machine Learning, Computer Vision, GPS/GNSS.

- Regulatory Frameworks: Vary significantly across regions; influencing adoption rates.

- M&A Activity: xx deals between 2019-2024, with an average deal value of xx million.

- Innovation Barriers: High initial investment costs, lack of skilled labor for operation and maintenance, data security concerns.

Agriculture Robotics Growth Trends & Insights

The agriculture robotics market has experienced significant growth during the historical period (2019-2024), driven by factors such as increasing labor costs, growing demand for food production, and technological advancements. The market size grew from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This growth trajectory is expected to continue throughout the forecast period (2025-2033), with the market size reaching xx million by 2033 and a projected CAGR of xx%. Adoption rates are rising, particularly among large-scale farms and commercial agricultural operations. Technological disruptions, such as the emergence of autonomous tractors and drones, are further accelerating market expansion. Consumer behavior is shifting towards precision agriculture practices, emphasizing data-driven decision-making and optimized resource utilization, all of which positively impact robotics adoption. Furthermore, growing awareness of sustainability and the need for efficient resource management are additional growth factors.

Dominant Regions, Countries, or Segments in Agriculture Robotics

North America currently holds the dominant position in the global agriculture robotics market, fueled by technological advancements, substantial investments in agricultural technology, and the presence of key players like Deere & Company and AGCO Corporation. High levels of automation in existing farming practices and a robust agricultural industry infrastructure contribute to the region's dominance. The market in North America is expected to grow at a CAGR of xx% during the forecast period. Europe follows as a significant market, experiencing considerable growth owing to supportive government policies and a focus on sustainable agricultural practices. The Asia-Pacific region presents substantial growth potential in the coming years, driven by increasing agricultural output, rising labor costs, and government initiatives to modernize the sector.

- North America: High adoption rate, strong presence of major players, robust infrastructure.

- Europe: Supportive government policies, focus on sustainable agriculture.

- Asia-Pacific: High growth potential, driven by increasing agricultural output and labor costs.

- Market Share (2025): North America (xx%), Europe (xx%), Asia-Pacific (xx%), Rest of World (xx%).

Agriculture Robotics Product Landscape

The agriculture robotics market offers a diverse range of products, including autonomous tractors, drones for crop monitoring and spraying, robotic harvesters, and automated weeding systems. These products incorporate advanced technologies like GPS, sensors, AI, and machine learning to enhance precision and efficiency in various agricultural operations. Key innovations include advancements in autonomous navigation, improved sensor accuracy for real-time data analysis, and the integration of data analytics platforms for enhanced decision-making. The unique selling propositions of these robotic systems often lie in their ability to reduce labor costs, improve yield, optimize resource utilization, and minimize environmental impact.

Key Drivers, Barriers & Challenges in Agriculture Robotics

Key Drivers:

- Rising labor costs and labor shortages in the agricultural sector.

- Growing demand for higher yields and improved crop quality.

- Technological advancements leading to increased efficiency and accuracy.

- Government initiatives and subsidies promoting the adoption of precision agriculture.

Challenges & Restraints:

- High initial investment costs for robotic systems.

- Lack of skilled labor for operation and maintenance of robotic equipment.

- Concerns regarding data security and privacy.

- Regulatory hurdles and safety standards related to autonomous systems. This represents a xx million impediment to market growth annually.

Emerging Opportunities in Agriculture Robotics

Untapped markets in developing economies offer significant growth potential, driven by increasing agricultural production needs and a growing adoption of technology. The integration of robotics with other precision agriculture technologies (e.g., IoT sensors, data analytics) creates opportunities for comprehensive farm management solutions. Consumer preference for sustainably produced food is driving demand for robotic solutions that minimize environmental impact.

Growth Accelerators in the agriculture robotics Industry

Technological breakthroughs in AI, machine learning, and sensor technology are continuously improving the capabilities and efficiency of agricultural robots. Strategic partnerships between robotics companies, agricultural machinery manufacturers, and software providers are accelerating innovation and market penetration. Market expansion strategies focusing on underserved regions and the development of tailored solutions for specific crops and farming practices are also contributing to overall growth.

Key Players Shaping the agriculture robotics Market

- AGCO Corporation

- Agribotix

- AgEagle Aerial Systems

- Autonomous Tractor

- Deere & Company

- BouMatic Robotics

- Harvest Automation

- Precision Hawk

- Yamaha Motor Corporation

Notable Milestones in agriculture robotics Sector

- 2020: Deere & Company launched its autonomous tractor.

- 2021: Several companies announced partnerships to integrate AI and machine learning into robotic systems.

- 2022: Significant investments in agriculture robotics startups were observed.

- 2023: Regulations on drone use in agriculture were updated in several key markets.

- 2024: The first fully autonomous farm was established in the US (Illustrative example).

In-Depth agriculture robotics Market Outlook

The agriculture robotics market is poised for continued strong growth driven by technological advancements, rising demand for efficient and sustainable farming practices, and supportive government policies. The forecast period (2025-2033) promises significant opportunities for market participants focusing on innovation, strategic partnerships, and market expansion. Focus areas for success include developing robust, reliable robotic systems with lower initial investment costs, addressing labor skill gaps through training programs, and proactively managing regulatory compliance. The market's long-term potential is substantial, promising a transformation of the agricultural landscape through increased productivity, efficiency, and sustainability.

agriculture robotics Segmentation

-

1. Application

- 1.1. Field Farming

- 1.2. Diary Management

- 1.3. Indoor farming

- 1.4. Horticulture

-

2. Types

- 2.1. Driverless Tractors

- 2.2. Milking Robots

- 2.3. Automated Harvesting Machine

- 2.4. Agricultural Uav

agriculture robotics Segmentation By Geography

- 1. CA

agriculture robotics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. agriculture robotics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Field Farming

- 5.1.2. Diary Management

- 5.1.3. Indoor farming

- 5.1.4. Horticulture

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Driverless Tractors

- 5.2.2. Milking Robots

- 5.2.3. Automated Harvesting Machine

- 5.2.4. Agricultural Uav

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AGCO Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agribotix

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AgEagle Aerial Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Autonomous Tractor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deere & Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BouMatic Robotics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Harvest Automation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Precision Hawk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamaha Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 AGCO Corporation

List of Figures

- Figure 1: agriculture robotics Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: agriculture robotics Share (%) by Company 2024

List of Tables

- Table 1: agriculture robotics Revenue million Forecast, by Region 2019 & 2032

- Table 2: agriculture robotics Revenue million Forecast, by Application 2019 & 2032

- Table 3: agriculture robotics Revenue million Forecast, by Types 2019 & 2032

- Table 4: agriculture robotics Revenue million Forecast, by Region 2019 & 2032

- Table 5: agriculture robotics Revenue million Forecast, by Application 2019 & 2032

- Table 6: agriculture robotics Revenue million Forecast, by Types 2019 & 2032

- Table 7: agriculture robotics Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the agriculture robotics?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the agriculture robotics?

Key companies in the market include AGCO Corporation, Agribotix, AgEagle Aerial Systems, Autonomous Tractor, Deere & Company, BouMatic Robotics, Harvest Automation, Precision Hawk, Yamaha Motor Corporation.

3. What are the main segments of the agriculture robotics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "agriculture robotics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the agriculture robotics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the agriculture robotics?

To stay informed about further developments, trends, and reports in the agriculture robotics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence