Key Insights

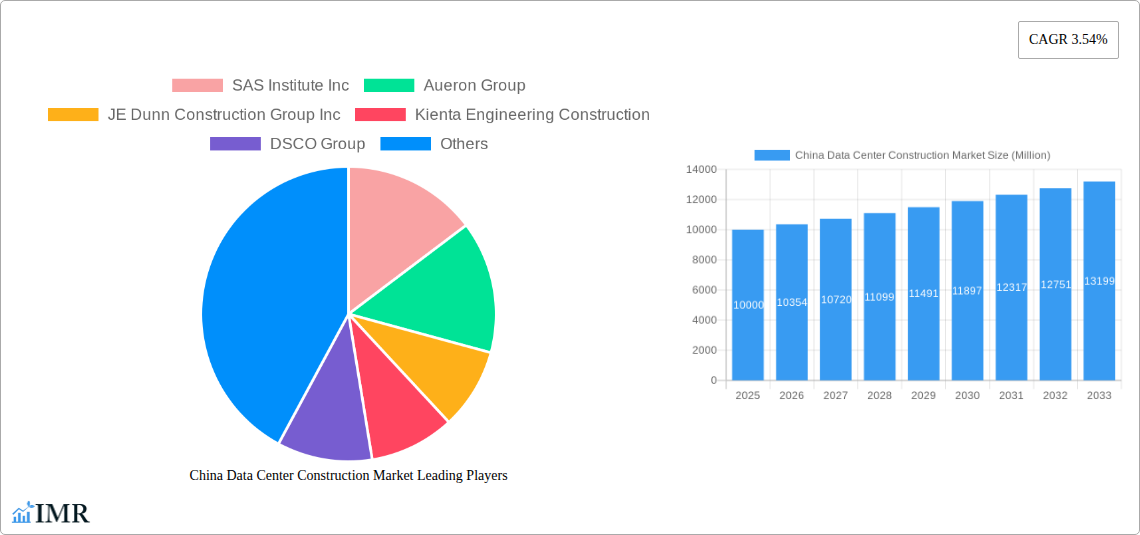

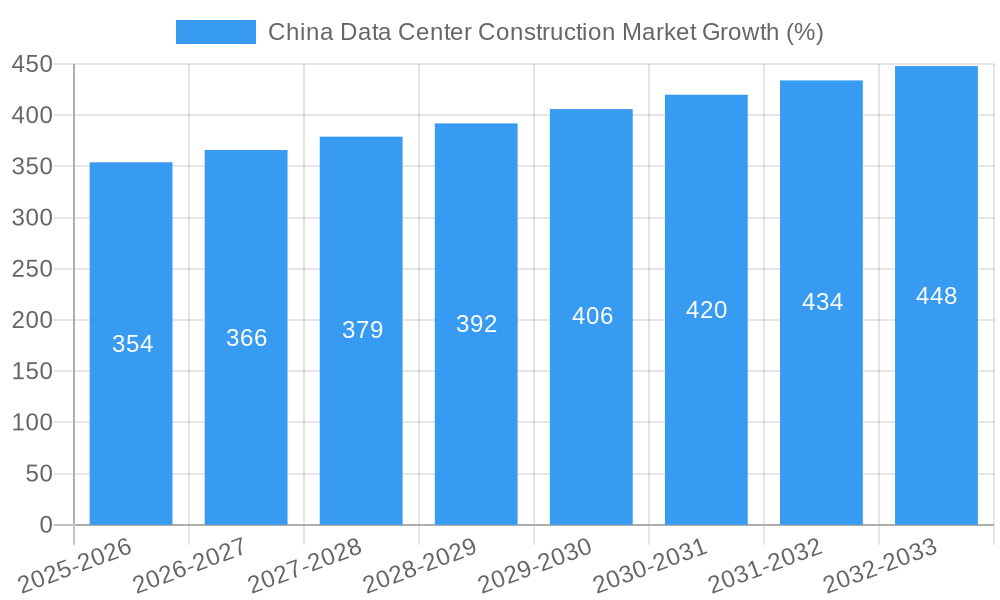

The China data center construction market is experiencing robust growth, driven by the nation's rapid digital transformation and increasing cloud adoption. With a current market size (estimated 2025) exceeding $10 billion USD (based on a typical market size for a developing nation with strong technological growth and a 3.54% CAGR, adjusting for the relatively high growth rate already implied), and a projected Compound Annual Growth Rate (CAGR) of 3.54%, the market is poised for significant expansion through 2033. Key drivers include government initiatives promoting digital infrastructure development, the burgeoning e-commerce sector, and the rising demand for big data analytics and artificial intelligence applications. The market is segmented by data center size (small, medium, large, mega, massive), infrastructure type (cooling, power, security, etc.), end-user industry (IT & telecommunication, BFSI, government, healthcare), and Tier type (Tier 1-4). While the market faces challenges such as land scarcity and energy consumption concerns, these are likely to be mitigated by technological advancements in energy-efficient cooling and power solutions and innovative data center designs. The large number of companies involved, including both international giants like IBM and local construction firms like Sato Kogyo (S) Pte Ltd, highlights the intense competition and significant investment in this sector.

The substantial growth trajectory is anticipated to continue throughout the forecast period (2025-2033), fueled by increasing investments in 5G network infrastructure, the expanding adoption of edge computing, and the growing demand for high-performance computing resources. The significant presence of large-scale data center projects, particularly in Tier 1 and Tier 2 cities, underscores the market's concentration in key technological hubs. Further expansion will likely be concentrated in regions supporting the country's expanding digital economy, specifically targeting areas with robust digital infrastructure already in place. Strategic partnerships between domestic and international companies are expected to continue to shape the market landscape, as both seek to leverage each other's expertise and market access.

China Data Center Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China data center construction market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, growth trends, and key players, this report illuminates the opportunities and challenges shaping this rapidly evolving sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The historical period analyzed is 2019-2024. Market values are presented in Million units.

China Data Center Construction Market Dynamics & Structure

The China data center construction market is experiencing robust growth, driven by increasing digitalization, government initiatives promoting digital infrastructure, and the expanding adoption of cloud computing. Market concentration is currently moderate, with several large international and domestic players vying for market share. Technological innovation, particularly in areas like AI-powered cooling systems and sustainable infrastructure, is a key driver, while regulatory frameworks focused on data security and energy efficiency are shaping industry practices. The market witnesses considerable M&A activity, particularly amongst smaller players seeking to scale their operations.

Market Structure Highlights:

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- M&A Activity: xx deals closed in the period 2019-2024, with a predicted xx in 2025.

- Innovation Barriers: High initial investment costs for advanced technologies and skilled labor shortages.

- Regulatory Landscape: Stringent data security regulations and energy efficiency standards are driving innovation.

- Competitive Substitutes: Limited direct substitutes, but alternative cloud solutions pose indirect competition.

- End-User Demographics: IT & Telecommunication remains the largest end-user segment, followed by BFSI and Government.

China Data Center Construction Market Growth Trends & Insights

The China data center construction market exhibits a robust growth trajectory, fueled by exponential data growth, the expansion of 5G networks, and the increasing demand for cloud-based services. The market size, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is driven by rising adoption rates across various end-user segments, particularly in the IT & Telecommunication and BFSI sectors. Technological disruptions, such as the adoption of AI and edge computing, are further accelerating market expansion. Consumer behavior shifts towards digital services and increased reliance on cloud-based platforms are also contributing to this growth.

Dominant Regions, Countries, or Segments in China Data Center Construction Market

The Greater Beijing area is currently the dominant region for data center construction, driven by robust government support and a concentration of major IT hubs. Within the segments, the Mega and Massive data center size categories are experiencing the most significant growth, reflecting the increasing demand for large-scale computing power. The cooling infrastructure segment is also a major driver, accounting for a significant portion of the overall market value.

Key Growth Drivers:

- Government Initiatives: Policies promoting digital infrastructure development and investment incentives.

- Technological Advancements: Innovations in cooling technologies, energy efficiency, and security systems.

- Strong Economic Growth: Rising disposable income and increased adoption of digital services.

- Data Center Size: Mega and Massive data centers account for xx% of market value in 2024.

- Infrastructure: Cooling Infrastructure segment holds approximately xx% of the market share.

- End-User: IT & Telecommunication sector contributes approximately xx% to the total market value.

China Data Center Construction Market Product Landscape

The data center construction product landscape is characterized by increasing sophistication and the integration of advanced technologies. This includes the deployment of AI-powered cooling solutions, improved energy efficiency designs, and enhanced security systems. Unique selling propositions focus on sustainability, resilience, and scalability, catering to the specific needs of diverse end-users. Modular design and prefabricated construction methods are gaining traction, reducing construction time and costs.

Key Drivers, Barriers & Challenges in China Data Center Construction Market

Key Drivers:

- Rapid growth of cloud computing and big data applications.

- Government initiatives aimed at digital infrastructure expansion.

- Increasing demand for data storage and processing capabilities.

- Technological advancements leading to more efficient and scalable data centers.

Key Challenges:

- High initial investment costs for advanced technologies.

- Stringent regulatory compliance requirements for data security.

- Supply chain disruptions affecting the availability of critical components.

- Competition from established and emerging players.

Emerging Opportunities in China Data Center Construction Market

Emerging opportunities lie in the development of sustainable data centers, edge computing infrastructure, and specialized data center solutions for specific industries such as healthcare and finance. Untapped markets in rural areas and the growing adoption of AI and IoT applications present further growth potential. The increasing demand for colocation services also offers significant opportunities.

Growth Accelerators in the China Data Center Construction Market Industry

Technological breakthroughs in areas like AI-powered cooling and renewable energy integration are key growth accelerators. Strategic partnerships between technology providers and construction companies are fostering innovation and market expansion. Furthermore, the adoption of modular construction methods is enhancing efficiency and reducing project timelines.

Key Players Shaping the China Data Center Construction Market Market

- SAS Institute Inc

- Aueron Group

- JE Dunn Construction Group Inc

- Kienta Engineering Construction

- DSCO Group

- IBM Corporation

- Sato Kogyo (S) Pte Ltd

- Nakano Corporation

- Turner Construction Co

- DPR Construction Inc

- Hensel Phelps Construction Co Inc

- Obayashi Corporation

- CSF Group

- Gammon Construction Limited

- M+W Group GmbH

- AECOM

- NTT Ltd

Notable Milestones in China Data Center Construction Market Sector

- February 2023: CapitaLand Investment Limited announces the construction of hyperscale data centers in Greater Beijing, aiming to deliver over 100MW by 2025 and targeting LEED Gold certification.

- January 2022: Beijing Highlander Digital Technology Co Ltd. announces the construction of a USD 880 million commercial underwater data center, aligning with national sustainability goals.

In-Depth China Data Center Construction Market Market Outlook

The China data center construction market is poised for continued strong growth, driven by sustained demand for digital infrastructure and technological innovation. Strategic investments in sustainable technologies and expansion into new markets will be key to realizing the market's full potential. The focus on enhancing energy efficiency and strengthening data security will continue to shape the industry's trajectory. The adoption of advanced construction methods and the strengthening of partnerships will play crucial roles in driving future market growth.

China Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Infrastructure

-

1.1.2. Power Back-up Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.1.5. Racks

- 1.2.1.6. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Infrastructure

-

2.2. Power Back-up Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Infrastructure

-

4. Power Back-up Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.1.5. Racks

- 6.1.6. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 7.5. Racks

- 7.6. Other Mechanical Infrastructure

- 8. General Construction

-

9. Tier Type

- 9.1. Tier 1 and 2

- 9.2. Tier 3

- 9.3. Tier 4

- 10. Tier 1 and 2

- 11. Tier 3

- 12. Tier 4

-

13. End User

- 13.1. Banking, Financial Services, and Insurance

- 13.2. IT and Telecommunications

- 13.3. Government and Defense

- 13.4. Healthcare

- 13.5. Other End Users

- 14. Banking, Financial Services, and Insurance

- 15. IT and Telecommunications

- 16. Government and Defense

- 17. Healthcare

- 18. Other End Users

China Data Center Construction Market Segmentation By Geography

- 1. China

China Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supercomputing; Phenomenal Growth in E-commerce and Hi-tech Industries; Major Initiatives Undertaken by Governments to Promote Digital Economy and Connectivity Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Power Consumption and emission contribution of Data Centers

- 3.4. Market Trends

- 3.4.1. Tier-3 is the largest Tier Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Infrastructure

- 5.1.1.2. Power Back-up Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.1.5. Racks

- 5.1.2.1.6. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Infrastructure

- 5.2.2. Power Back-up Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Infrastructure

- 5.4. Market Analysis, Insights and Forecast - by Power Back-up Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.1.5. Racks

- 5.6.1.6. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.7.5. Racks

- 5.7.6. Other Mechanical Infrastructure

- 5.8. Market Analysis, Insights and Forecast - by General Construction

- 5.9. Market Analysis, Insights and Forecast - by Tier Type

- 5.9.1. Tier 1 and 2

- 5.9.2. Tier 3

- 5.9.3. Tier 4

- 5.10. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.11. Market Analysis, Insights and Forecast - by Tier 3

- 5.12. Market Analysis, Insights and Forecast - by Tier 4

- 5.13. Market Analysis, Insights and Forecast - by End User

- 5.13.1. Banking, Financial Services, and Insurance

- 5.13.2. IT and Telecommunications

- 5.13.3. Government and Defense

- 5.13.4. Healthcare

- 5.13.5. Other End Users

- 5.14. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.15. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.16. Market Analysis, Insights and Forecast - by Government and Defense

- 5.17. Market Analysis, Insights and Forecast - by Healthcare

- 5.18. Market Analysis, Insights and Forecast - by Other End Users

- 5.19. Market Analysis, Insights and Forecast - by Region

- 5.19.1. China

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aueron Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JE Dunn Construction Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kienta Engineering Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DSCO Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IBM Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sato Kogyo (S) Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nakano Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Turner Construction Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DPR Construction Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hensel Phelps Construction Co Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Obayashi Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 CSF Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Gammon Construction Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 M+W Group GmbH

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 AECOM

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 NTT Ltd

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: China Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: China Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 4: China Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 5: China Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 6: China Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 7: China Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 8: China Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 9: China Data Center Construction Market Revenue Million Forecast, by Power Back-up Solutions 2019 & 2032

- Table 10: China Data Center Construction Market Volume K Unit Forecast, by Power Back-up Solutions 2019 & 2032

- Table 11: China Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: China Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 13: China Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 14: China Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 15: China Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 16: China Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 17: China Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 18: China Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 19: China Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: China Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 21: China Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 22: China Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 23: China Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 24: China Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 25: China Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 26: China Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 27: China Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: China Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: China Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 30: China Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 31: China Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 32: China Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 33: China Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 34: China Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 35: China Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 36: China Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 37: China Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 38: China Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 39: China Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 40: China Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 41: China Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: China Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 44: China Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 45: China Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 46: China Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2019 & 2032

- Table 47: China Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 48: China Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2019 & 2032

- Table 49: China Data Center Construction Market Revenue Million Forecast, by Power Back-up Solutions 2019 & 2032

- Table 50: China Data Center Construction Market Volume K Unit Forecast, by Power Back-up Solutions 2019 & 2032

- Table 51: China Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 52: China Data Center Construction Market Volume K Unit Forecast, by Service 2019 & 2032

- Table 53: China Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 54: China Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 55: China Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 56: China Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2019 & 2032

- Table 57: China Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 58: China Data Center Construction Market Volume K Unit Forecast, by General Construction 2019 & 2032

- Table 59: China Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 60: China Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 61: China Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 62: China Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2019 & 2032

- Table 63: China Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 64: China Data Center Construction Market Volume K Unit Forecast, by Tier 3 2019 & 2032

- Table 65: China Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 66: China Data Center Construction Market Volume K Unit Forecast, by Tier 4 2019 & 2032

- Table 67: China Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 68: China Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 69: China Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 70: China Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 71: China Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 72: China Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2019 & 2032

- Table 73: China Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 74: China Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2019 & 2032

- Table 75: China Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 76: China Data Center Construction Market Volume K Unit Forecast, by Healthcare 2019 & 2032

- Table 77: China Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 78: China Data Center Construction Market Volume K Unit Forecast, by Other End Users 2019 & 2032

- Table 79: China Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: China Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Data Center Construction Market?

The projected CAGR is approximately 3.54%.

2. Which companies are prominent players in the China Data Center Construction Market?

Key companies in the market include SAS Institute Inc, Aueron Group, JE Dunn Construction Group Inc, Kienta Engineering Construction, DSCO Group, IBM Corporation, Sato Kogyo (S) Pte Ltd, Nakano Corporation, Turner Construction Co , DPR Construction Inc, Hensel Phelps Construction Co Inc, Obayashi Corporation, CSF Group, Gammon Construction Limited, M+W Group GmbH, AECOM, NTT Ltd.

3. What are the main segments of the China Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Back-up Solutions, Service , Mechanical Infrastructure, Cooling Systems, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supercomputing; Phenomenal Growth in E-commerce and Hi-tech Industries; Major Initiatives Undertaken by Governments to Promote Digital Economy and Connectivity Infrastructure.

6. What are the notable trends driving market growth?

Tier-3 is the largest Tier Type.

7. Are there any restraints impacting market growth?

High Power Consumption and emission contribution of Data Centers.

8. Can you provide examples of recent developments in the market?

February 2023: CapitaLand Investment Limited announced to construction of hyperscale data centers in Greater Bejing with CapitaLand China Data Centre Partners (CDCP) and deliver more than 100MW by 2025. The construction aims to support sustainability by acquiring certification from Energy and Environmental Design (LEED) Gold standards. Thus providing opportunities for the vendors in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Data Center Construction Market?

To stay informed about further developments, trends, and reports in the China Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence