Key Insights

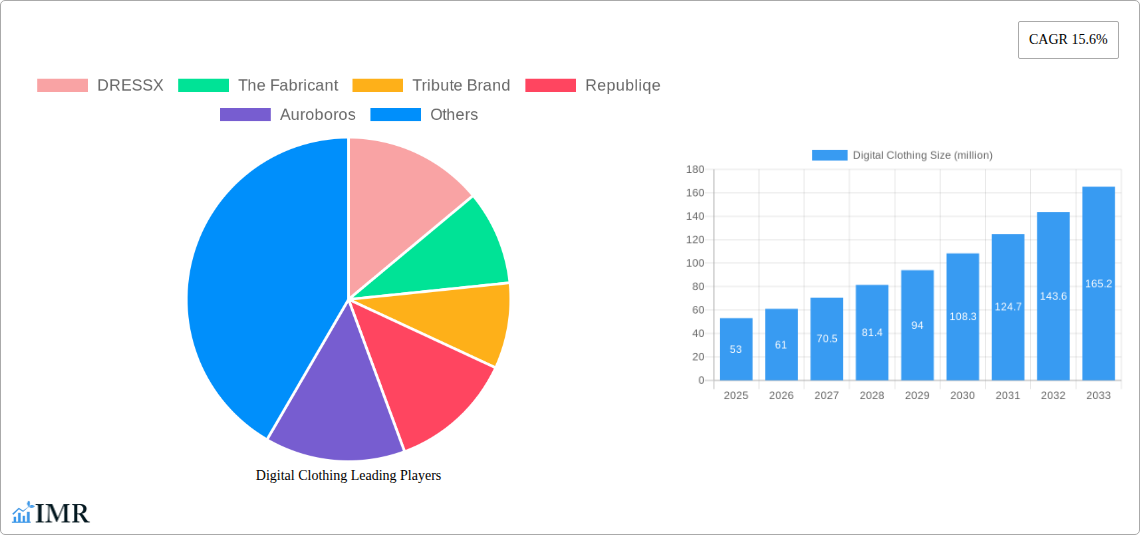

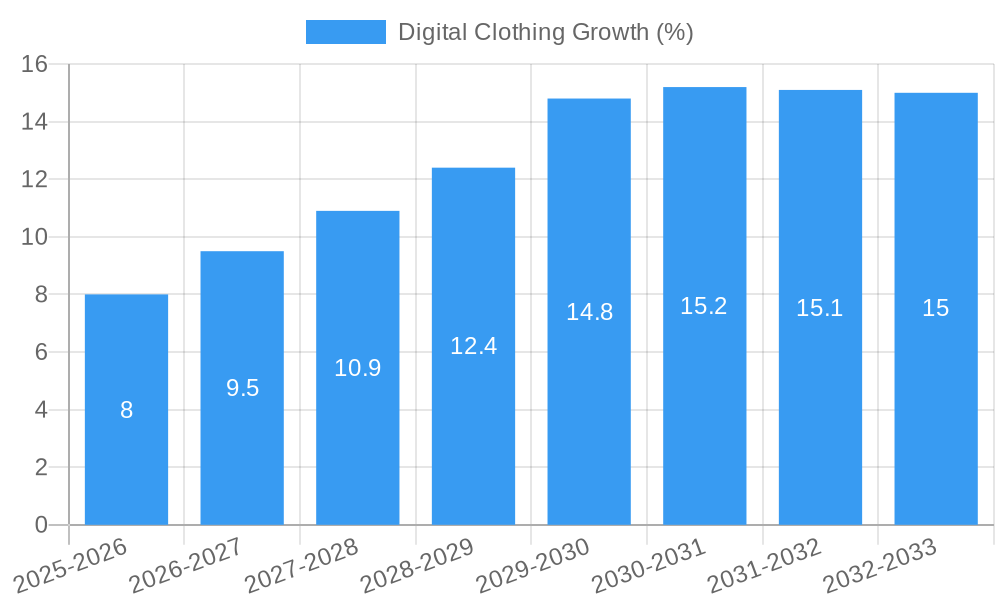

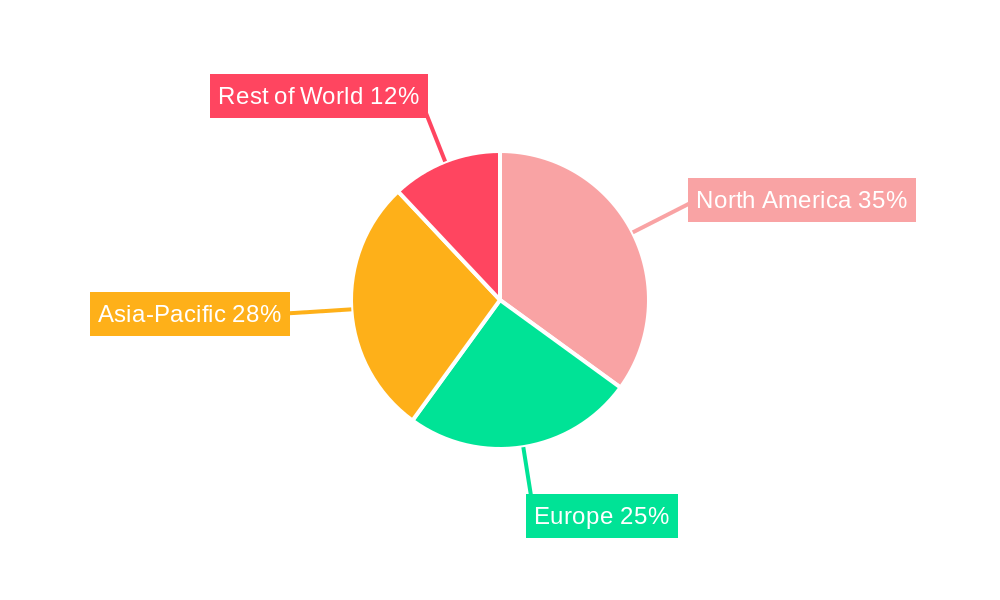

The digital clothing market, currently valued at $53 million in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.6% from 2025 to 2033. This burgeoning market is driven by several key factors. The increasing adoption of virtual and augmented reality technologies fuels demand for digital apparel within gaming, metaverse experiences, and virtual fashion shows. Furthermore, the rising popularity of NFTs (Non-Fungible Tokens) provides a unique mechanism for ownership and trading of digital clothing, adding a new layer of value and scarcity. Sustainability concerns are also contributing to the market's growth, as digital clothing offers an environmentally friendly alternative to traditional textile production, reducing waste and carbon emissions. Key players like DRESSX, The Fabricant, and Tribute Brand are leading the innovation, constantly developing new designs and technologies to enhance the digital clothing experience. The market is segmented by apparel type (e.g., tops, bottoms, accessories), consumer demographics (age, gender), and the platform of usage (gaming, social media, virtual worlds). Geographic segmentation likely reveals strong growth in regions with high internet penetration and a burgeoning gaming/metaverse culture, such as North America and East Asia.

The market's growth trajectory, however, is not without challenges. Technological limitations in replicating the feel and texture of real clothing, and potential concerns around digital asset security and intellectual property rights represent significant restraints. Furthermore, widespread adoption requires overcoming user familiarity hurdles and developing intuitive interfaces for browsing and purchasing digital fashion items. Despite these challenges, the long-term outlook remains positive, driven by continuous technological advancements, increasing consumer adoption of virtual environments, and the growing recognition of the market's sustainability benefits. The forecast period of 2025-2033 will likely see the emergence of new business models and further market segmentation as the technology matures and user base expands. This period will likely witness significant innovation in areas such as virtual try-on technologies, improved digital fabric rendering, and the integration of digital clothing into more mainstream platforms and applications.

Digital Clothing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning digital clothing market, encompassing market dynamics, growth trends, regional segmentation, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with 2025 serving as both the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking a deep understanding of this transformative sector. The parent market is the fashion industry, and the child market is virtual/augmented reality fashion.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Digital Clothing Market Dynamics & Structure

The digital clothing market is characterized by rapid innovation, increasing market concentration, and evolving regulatory landscapes. While still nascent, the market is experiencing significant growth driven by advancements in AR/VR technology, the metaverse's expansion, and changing consumer preferences. Market concentration is currently moderate, with a few key players establishing dominance, but fragmentation is expected to persist in the short term due to the relatively low barriers to entry for smaller creators. The rising adoption of NFTs also influences the market structure. The predicted market size in 2025 is estimated to be $xx million, with a projected CAGR of xx% during the forecast period. Mergers and acquisitions (M&A) activity remains relatively low to date, however, is expected to increase as larger companies seek to consolidate their position.

- Market Concentration: Moderate, trending towards higher concentration among leading players.

- Technological Innovation Drivers: AR/VR, 3D modeling, NFTs, blockchain technology.

- Regulatory Frameworks: Currently underdeveloped, necessitating the creation of clear guidelines and standards.

- Competitive Product Substitutes: Traditional clothing, virtual accessories in gaming environments.

- End-User Demographics: Primarily millennials and Gen Z, with expanding appeal across diverse age groups.

- M&A Trends: Low activity to date, predicted to increase by xx% by 2033.

Digital Clothing Growth Trends & Insights

The global digital clothing market is experiencing exponential growth, fueled by technological advancements and shifting consumer preferences. The adoption rate of digital clothing is climbing rapidly, particularly among younger demographics who are digitally native and embrace virtual experiences. The market size has witnessed substantial growth from $xx million in 2019 to an estimated $xx million in 2025, reflecting the increasing appeal of virtual fashion. Technological disruptions, such as the integration of AI in design and the development of more realistic virtual garments, are accelerating market expansion. Consumer behaviour shows a growing desire for personalized and unique digital items, creating significant opportunities for customization and co-creation. The market penetration rate is currently low but projected to increase significantly over the forecast period.

- Market Size Evolution: Significant growth from $xx million (2019) to $xx million (2025), projected to reach $xx million by 2033.

- Adoption Rates: Rapidly increasing, particularly among younger demographics.

- Technological Disruptions: AI-powered design, improved 3D modeling, and advancements in AR/VR technology.

- Consumer Behavior Shifts: Growing preference for personalization, uniqueness, and sustainable fashion alternatives.

- CAGR: xx% (2025-2033).

- Market Penetration: Low currently, projecting a significant increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Digital Clothing

The North American and European markets currently hold significant market share in the digital clothing industry, driven by strong technological infrastructure, high disposable incomes, and early adoption of virtual fashion. However, Asia-Pacific is emerging as a major growth region, with rapidly increasing internet and smartphone penetration rates fostering a considerable potential for market expansion. The segment of virtual avatars and game integrations is currently the dominant market segment. Specific countries like the U.S. and China will lead growth, supported by flourishing tech sectors and large consumer bases.

- Key Drivers: High internet penetration, advanced technological infrastructure, significant consumer spending, early adoption rates.

- Dominance Factors: High technological advancement, large consumer base, strong presence of key players.

- Growth Potential: Asia-Pacific showing significant growth potential due to increasing internet usage.

- Market Share: North America and Europe currently hold a larger share; Asia-Pacific projected to experience significant growth.

Digital Clothing Product Landscape

Digital clothing encompasses a range of products, from virtual garments for avatars in games and metaverse platforms to customizable digital apparel for social media and personal branding. These products leverage advanced 3D modeling, realistic textures, and innovative materials unavailable in physical clothing. Unique selling propositions include personalization, infinite variety, and sustainability through reduced material waste. Technological advancements continue to enhance realism, interactivity, and integration with augmented and virtual reality environments.

Key Drivers, Barriers & Challenges in Digital Clothing

Key Drivers:

Technological advancements in AR/VR, the growing metaverse, increasing demand for personalized fashion, and the rising adoption of NFTs are key drivers of the market’s expansion. The development of user-friendly design tools further fuels market growth.

Challenges & Restraints:

- Interoperability Issues: The lack of standardization across platforms hinders seamless integration.

- Regulatory Uncertainty: The absence of clear legal frameworks for digital assets presents challenges.

- Security and Intellectual Property Concerns: Protecting digital assets from theft or unauthorized use is a concern.

- Consumer Education: Many consumers remain unfamiliar with digital clothing and its benefits.

Emerging Opportunities in Digital Clothing

Emerging opportunities lie in expanding into untapped markets, developing innovative applications for digital clothing in various sectors (e.g., advertising, film, fashion shows), and catering to evolving consumer preferences for sustainable and personalized experiences. The integration of digital clothing into physical retail environments presents a unique opportunity.

Growth Accelerators in the Digital Clothing Industry

Technological breakthroughs in AR/VR and 3D modeling, strategic partnerships between fashion brands and technology companies, and expanding market penetration through increased consumer awareness are accelerating the digital clothing industry's long-term growth.

Key Players Shaping the Digital Clothing Market

- DRESSX

- The Fabricant

- Tribute Brand

- Republiqe

- Auroboros

- XR Couture

- Replicant

- The Dematerialised

- UNXD

Notable Milestones in Digital Clothing Sector

- 2020: DRESSX launched its virtual clothing platform.

- 2021: The Fabricant partnered with major brands to create digital clothing collections.

- 2022: Several brands integrated digital clothing into metaverse platforms.

- 2023: First significant NFT digital clothing sales occur. (Further milestones to be added based on the data analysis)

In-Depth Digital Clothing Market Outlook

The future of the digital clothing market looks exceptionally promising. Continued technological advancements, expanding metaverse adoption, and rising consumer demand for digital fashion experiences will drive significant market growth. Strategic partnerships and innovative business models will further accelerate market expansion, creating lucrative opportunities for businesses and creators alike. This is expected to result in a robust and diverse digital fashion ecosystem in the coming years.

Digital Clothing Segmentation

-

1. Application

- 1.1. Man

- 1.2. Woman

-

2. Types

- 2.1. For Avatars

- 2.2. For Social Media

- 2.3. Others

Digital Clothing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Clothing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Man

- 5.1.2. Woman

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. For Avatars

- 5.2.2. For Social Media

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Man

- 6.1.2. Woman

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. For Avatars

- 6.2.2. For Social Media

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Man

- 7.1.2. Woman

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. For Avatars

- 7.2.2. For Social Media

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Man

- 8.1.2. Woman

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. For Avatars

- 8.2.2. For Social Media

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Man

- 9.1.2. Woman

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. For Avatars

- 9.2.2. For Social Media

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Clothing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Man

- 10.1.2. Woman

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. For Avatars

- 10.2.2. For Social Media

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DRESSX

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Fabricant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tribute Brand

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Republiqe

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Auroboros

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XR Couture

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Replicant

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Dematerialised

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 UNXD

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 DRESSX

List of Figures

- Figure 1: Global Digital Clothing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Clothing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Clothing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Clothing Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Clothing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Clothing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Clothing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Clothing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Clothing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Clothing Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Clothing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Clothing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Clothing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Clothing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Clothing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Clothing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Clothing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Clothing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Clothing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Clothing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Clothing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Clothing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Clothing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Clothing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Clothing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Clothing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Clothing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Clothing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Clothing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Clothing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Clothing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Clothing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Clothing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Clothing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Clothing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Clothing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Clothing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Clothing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Clothing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Clothing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Clothing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Clothing?

The projected CAGR is approximately 15.6%.

2. Which companies are prominent players in the Digital Clothing?

Key companies in the market include DRESSX, The Fabricant, Tribute Brand, Republiqe, Auroboros, XR Couture, Replicant, The Dematerialised, UNXD.

3. What are the main segments of the Digital Clothing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 53 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Clothing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Clothing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Clothing?

To stay informed about further developments, trends, and reports in the Digital Clothing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence