Key Insights

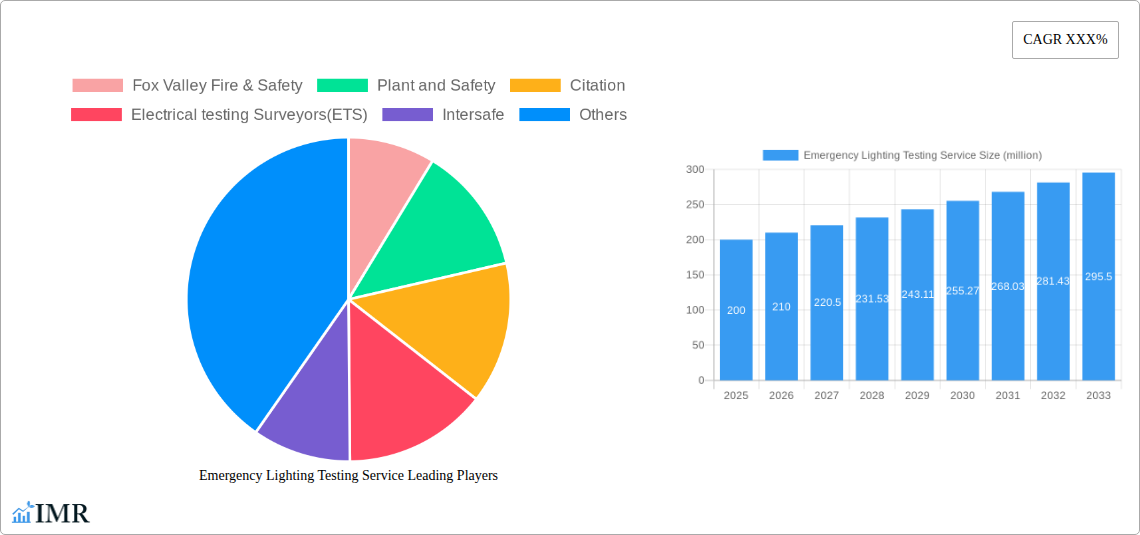

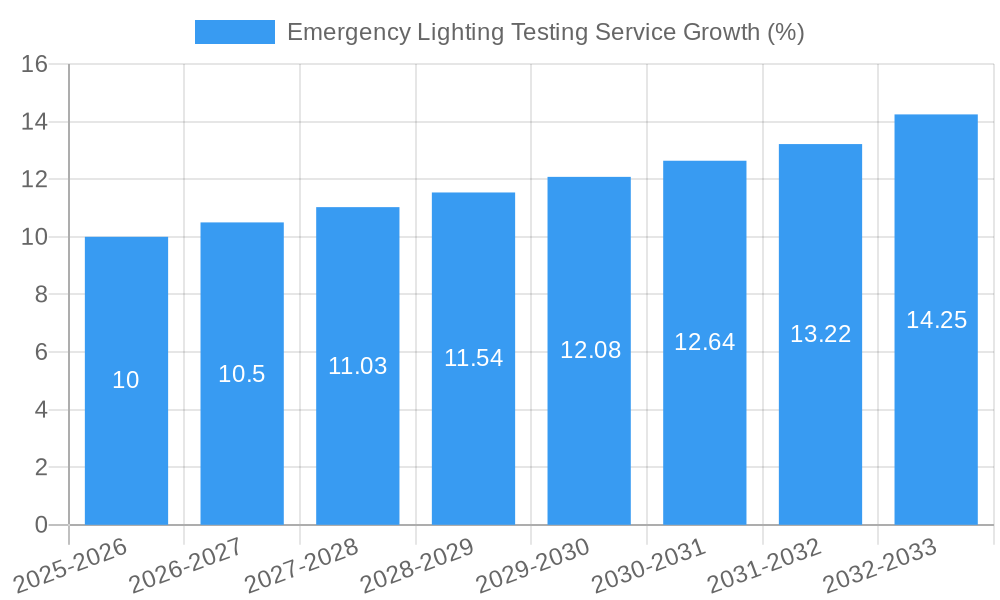

The Emergency Lighting Testing Service market is experiencing robust growth, driven by increasingly stringent safety regulations across various sectors, including commercial buildings, healthcare facilities, and industrial sites. The rising awareness of workplace safety and the potential liabilities associated with non-compliance are significant factors fueling market expansion. Technological advancements in testing equipment, leading to more efficient and accurate inspections, further contribute to market growth. While the precise market size for 2025 isn't provided, considering a plausible CAGR (let's assume a conservative 5% based on industry growth trends) and a starting point (let's assume a 2019 market size of $150 million), the 2025 market size can be reasonably estimated to be around $200 million. This growth is expected to continue, reaching an estimated value of around $260 million by 2030. Companies such as Fox Valley Fire & Safety, Plant and Safety, and Intersafe are key players, competing on the basis of service quality, geographical reach, and specialized expertise in different sectors.

Market segmentation within the industry includes varied service offerings (e.g., routine testing, emergency repair, compliance consulting), as well as target sectors (e.g., healthcare, education, manufacturing). Restraints on market growth might include the relatively high cost of testing and the potential for economic downturns to impact spending on maintenance and compliance. However, the long-term trend is clearly towards increased demand, driven by evolving safety standards and regulations worldwide. The forecast period of 2025-2033 suggests a continued positive outlook for the industry, with opportunities for companies to differentiate themselves through innovative testing methods and value-added services. The presence of numerous regional players demonstrates a geographically diverse market, suggesting ample opportunities for expansion and specialization across various regions.

Emergency Lighting Testing Service Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Emergency Lighting Testing Service market, projecting significant growth from $XX million in 2025 to $XX million by 2033. The study covers the period 2019-2033, with 2025 serving as both the base and estimated year. This report is crucial for businesses operating within the fire safety and building compliance sectors, offering invaluable insights for strategic planning and investment decisions.

Emergency Lighting Testing Service Market Dynamics & Structure

The Emergency Lighting Testing Service market is moderately fragmented, with several key players vying for market share. Market concentration is expected to remain relatively stable through 2033, although strategic acquisitions (M&A) could impact the competitive landscape. Technological innovation, driven by advancements in sensor technology and data analytics, plays a significant role. Regulatory frameworks, varying across regions, impose compliance requirements influencing market growth. Substitutes, such as simpler visual inspection methods, exist but offer less comprehensive data and are unlikely to fully replace thorough testing services. End-users span diverse sectors including commercial buildings, healthcare facilities, and industrial plants.

- Market Concentration: Moderately fragmented (HHI of xx); Top 5 players hold approximately xx% market share in 2025.

- M&A Activity: An average of xx M&A deals per year were recorded during 2019-2024, with a predicted increase to xx deals annually during the forecast period.

- Technological Innovation: Advancements in sensor technologies and data analytics enable more efficient and comprehensive testing.

- Regulatory Landscape: Stringent regulations in regions like North America and Europe drive market growth, while less stringent regulations in other regions present opportunities for expansion.

- Innovation Barriers: High initial investment costs for advanced testing equipment can act as an entry barrier for new players.

Emergency Lighting Testing Service Growth Trends & Insights

The Emergency Lighting Testing Service market has experienced steady growth over the past five years, propelled by increasing awareness of workplace safety regulations and a growing emphasis on building compliance. The market size is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by factors including stringent safety regulations, rising construction activity, and increasing demand for sophisticated testing methodologies. Adoption rates are higher in developed economies compared to developing countries, however, the latter are exhibiting strong growth potential. Technological disruptions, particularly the integration of IoT devices and cloud-based data management, are reshaping the industry. Consumer behavior shifts towards proactive compliance and risk management further drive demand for these services. Market penetration is currently estimated at xx% in developed nations, with a projected increase to xx% by 2033.

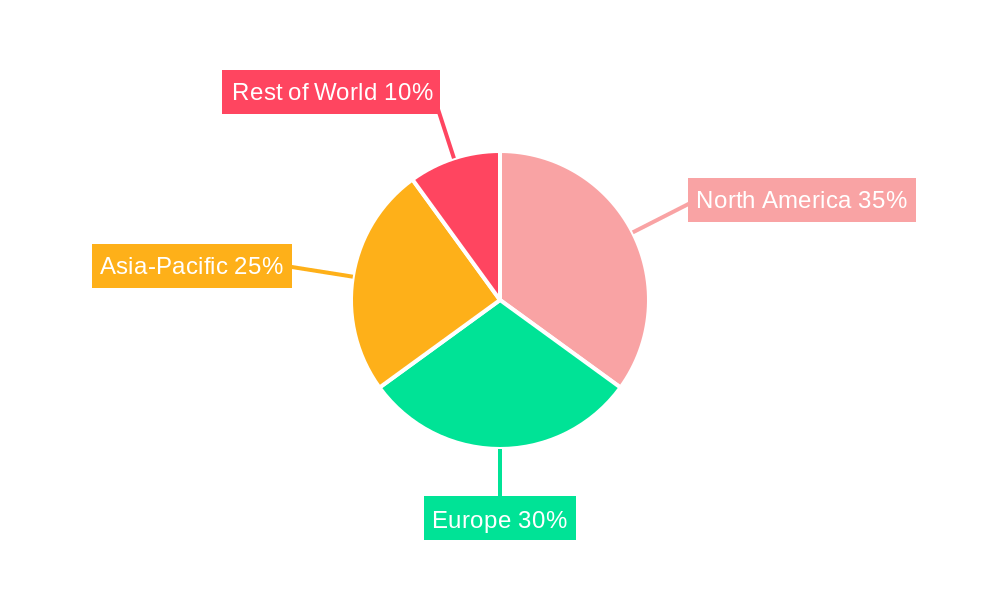

Dominant Regions, Countries, or Segments in Emergency Lighting Testing Service

North America currently holds the largest market share in the Emergency Lighting Testing Service sector, driven by stringent safety regulations and robust construction activity. Europe follows closely, with significant growth expected in emerging economies across Asia-Pacific. The commercial building segment dominates the market, accounting for xx% of the total revenue.

- Key Drivers in North America: Stringent building codes and a strong emphasis on workplace safety.

- Growth Potential in Asia-Pacific: Rapid urbanization and increased construction activity.

- Market Share: North America (xx%), Europe (xx%), Asia-Pacific (xx%), Rest of World (xx%).

- Dominant Segment: Commercial buildings (xx%), followed by industrial (xx%) and healthcare (xx%).

Emergency Lighting Testing Service Product Landscape

The product landscape encompasses a range of testing services, from basic visual inspections to advanced automated testing using sophisticated equipment. The unique selling propositions often revolve around speed, accuracy, and comprehensive reporting capabilities. Technological advancements, particularly in data analytics and remote monitoring technologies, continue to drive innovation, allowing for more efficient testing and data-driven insights.

Key Drivers, Barriers & Challenges in Emergency Lighting Testing Service

Key Drivers:

- Stringent safety regulations and compliance requirements

- Growing construction activity across various sectors

- Increasing awareness of workplace safety

- Technological advancements in testing methodologies

Challenges and Restraints:

- High initial investment costs for advanced testing equipment.

- Skilled labor shortages in the industry.

- Competitive pricing pressures from smaller players.

- The need for continuous technological upgrades to maintain competitiveness.

Emerging Opportunities in Emergency Lighting Testing Service

- Expanding into untapped markets in developing economies.

- Developing specialized testing services for emerging technologies and building types (e.g., smart buildings).

- Offering value-added services, such as predictive maintenance and compliance consulting.

- Leveraging data analytics for improved service efficiency and cost optimization.

Growth Accelerators in the Emergency Lighting Testing Service Industry

Technological innovation continues to play a crucial role in accelerating growth. Strategic partnerships between testing service providers and technology companies can enhance service offerings and reach. Expansion into new geographical markets, particularly emerging economies, presents significant growth opportunities.

Key Players Shaping the Emergency Lighting Testing Service Market

- Fox Valley Fire & Safety

- Plant and Safety

- Citation

- Electrical testing Surveyors(ETS)

- Intersafe

- phs Compliance

- Amthal Fire & Security

- RFC Fire And Security Systems

- Keller Fire & Safety

- Metro Safety Group

- TI Security

- Analytical Testing Solutions(ATS)

- EIAT UK - Compliance Group

- UK Safety Management

- A-OK

- Electrical Compliance and Safety

- Majestic Fire Protection

Notable Milestones in Emergency Lighting Testing Service Sector

- 2020: Introduction of new automated testing systems by several key players.

- 2022: Increased adoption of cloud-based data management systems for improved reporting and data analysis.

- 2023: Several mergers and acquisitions amongst smaller players to consolidate market share.

In-Depth Emergency Lighting Testing Service Market Outlook

The Emergency Lighting Testing Service market is poised for continued growth, driven by ongoing technological advancements, increasing regulatory compliance requirements, and rising awareness of workplace safety. Strategic partnerships and market expansion into emerging economies will play a pivotal role in shaping the future of the industry. The integration of IoT and AI will enable predictive maintenance and greatly increase the efficiency of testing and compliance reporting.

Emergency Lighting Testing Service Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Individual

-

2. Type

- 2.1. Three Hours Emergency Lighting Test

- 2.2. Lighting Level Assessment

- 2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 2.4. Cleaning of Emergency Lighting Luminaires

- 2.5. Inspection of Emergency Signage

- 2.6. Maintaining Emergency Lighting Log Book

- 2.7. Emergency Lighting Test Certificate

Emergency Lighting Testing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Emergency Lighting Testing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Individual

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Three Hours Emergency Lighting Test

- 5.2.2. Lighting Level Assessment

- 5.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 5.2.4. Cleaning of Emergency Lighting Luminaires

- 5.2.5. Inspection of Emergency Signage

- 5.2.6. Maintaining Emergency Lighting Log Book

- 5.2.7. Emergency Lighting Test Certificate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise

- 6.1.2. Individual

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Three Hours Emergency Lighting Test

- 6.2.2. Lighting Level Assessment

- 6.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 6.2.4. Cleaning of Emergency Lighting Luminaires

- 6.2.5. Inspection of Emergency Signage

- 6.2.6. Maintaining Emergency Lighting Log Book

- 6.2.7. Emergency Lighting Test Certificate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise

- 7.1.2. Individual

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Three Hours Emergency Lighting Test

- 7.2.2. Lighting Level Assessment

- 7.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 7.2.4. Cleaning of Emergency Lighting Luminaires

- 7.2.5. Inspection of Emergency Signage

- 7.2.6. Maintaining Emergency Lighting Log Book

- 7.2.7. Emergency Lighting Test Certificate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise

- 8.1.2. Individual

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Three Hours Emergency Lighting Test

- 8.2.2. Lighting Level Assessment

- 8.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 8.2.4. Cleaning of Emergency Lighting Luminaires

- 8.2.5. Inspection of Emergency Signage

- 8.2.6. Maintaining Emergency Lighting Log Book

- 8.2.7. Emergency Lighting Test Certificate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise

- 9.1.2. Individual

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Three Hours Emergency Lighting Test

- 9.2.2. Lighting Level Assessment

- 9.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 9.2.4. Cleaning of Emergency Lighting Luminaires

- 9.2.5. Inspection of Emergency Signage

- 9.2.6. Maintaining Emergency Lighting Log Book

- 9.2.7. Emergency Lighting Test Certificate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Emergency Lighting Testing Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise

- 10.1.2. Individual

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Three Hours Emergency Lighting Test

- 10.2.2. Lighting Level Assessment

- 10.2.3. Inspection of Emergency Lighting Luminaire Lamps and Batteries

- 10.2.4. Cleaning of Emergency Lighting Luminaires

- 10.2.5. Inspection of Emergency Signage

- 10.2.6. Maintaining Emergency Lighting Log Book

- 10.2.7. Emergency Lighting Test Certificate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fox Valley Fire & Safety

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plant and Safety

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Citation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Electrical testing Surveyors(ETS)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intersafe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 phs Compliance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amthal Fire & Security

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RFC Fire And Security Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Keller Fire & Safety

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Metro Safety Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TI Security

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Analytical Testing Solutions(ATS)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 EIAT UK - Compliance Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 UK Safety Management

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 A-OK

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Electrical Compliance and Safety

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Majestic Fire Protection

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Fox Valley Fire & Safety

List of Figures

- Figure 1: Global Emergency Lighting Testing Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Emergency Lighting Testing Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Emergency Lighting Testing Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Emergency Lighting Testing Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Emergency Lighting Testing Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Emergency Lighting Testing Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Emergency Lighting Testing Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Emergency Lighting Testing Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Emergency Lighting Testing Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Emergency Lighting Testing Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Emergency Lighting Testing Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Emergency Lighting Testing Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Emergency Lighting Testing Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Emergency Lighting Testing Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Emergency Lighting Testing Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Emergency Lighting Testing Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Emergency Lighting Testing Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Emergency Lighting Testing Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Emergency Lighting Testing Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Emergency Lighting Testing Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Emergency Lighting Testing Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Emergency Lighting Testing Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Emergency Lighting Testing Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Emergency Lighting Testing Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Emergency Lighting Testing Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Emergency Lighting Testing Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Emergency Lighting Testing Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Emergency Lighting Testing Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Emergency Lighting Testing Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Emergency Lighting Testing Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Emergency Lighting Testing Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Emergency Lighting Testing Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Emergency Lighting Testing Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Emergency Lighting Testing Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Emergency Lighting Testing Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Emergency Lighting Testing Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Emergency Lighting Testing Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Emergency Lighting Testing Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Emergency Lighting Testing Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Emergency Lighting Testing Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Emergency Lighting Testing Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Emergency Lighting Testing Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Emergency Lighting Testing Service?

Key companies in the market include Fox Valley Fire & Safety, Plant and Safety, Citation, Electrical testing Surveyors(ETS), Intersafe, phs Compliance, Amthal Fire & Security, RFC Fire And Security Systems, Keller Fire & Safety, Metro Safety Group, TI Security, Analytical Testing Solutions(ATS), EIAT UK - Compliance Group, UK Safety Management, A-OK, Electrical Compliance and Safety, Majestic Fire Protection.

3. What are the main segments of the Emergency Lighting Testing Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Emergency Lighting Testing Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Emergency Lighting Testing Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Emergency Lighting Testing Service?

To stay informed about further developments, trends, and reports in the Emergency Lighting Testing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence