Key Insights

The European coal market, facing decarbonization pressures and renewable energy transitions, is projected to reach $42.6 billion by 2025. The industry is expected to grow at a Compound Annual Growth Rate (CAGR) of 1.9% from 2025 to 2033. Key demand drivers include essential sectors like steel and cement production, particularly in regions with developing renewable infrastructure. However, stringent environmental regulations and the increasing competitiveness of renewable energy sources present significant market restraints. The market is segmented by coal type (anthracite, bituminous, sub-bituminous, lignite) and application (electricity generation, steel, cement, industrial uses). Germany, France, the UK, and Poland are anticipated to remain pivotal markets due to existing industrial footprints and energy demands. Despite long-term challenges, the near-term outlook reflects a complex balance between persistent demand and escalating environmental concerns, necessitating strategic industry adaptations.

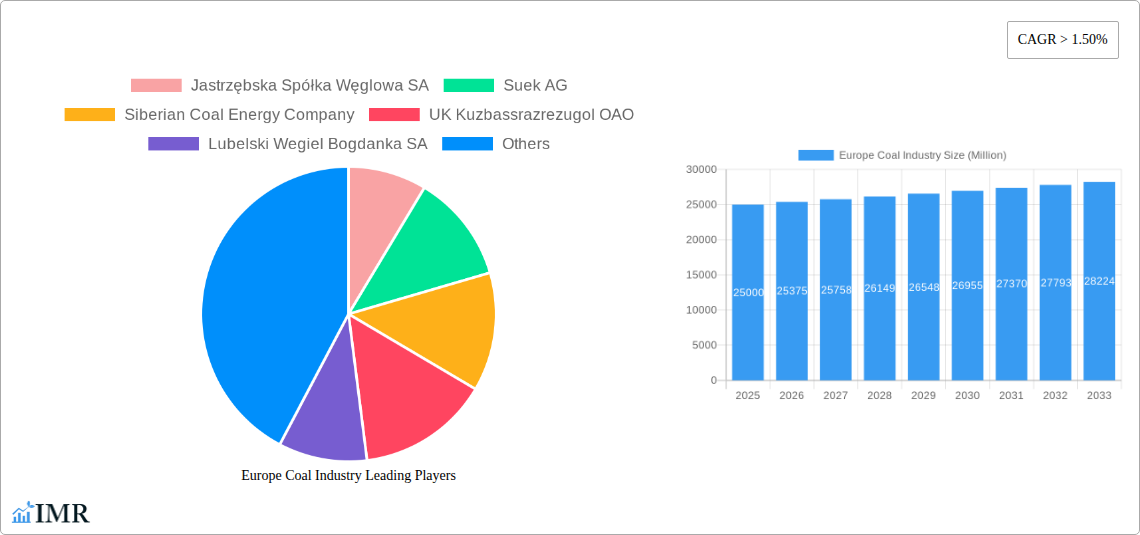

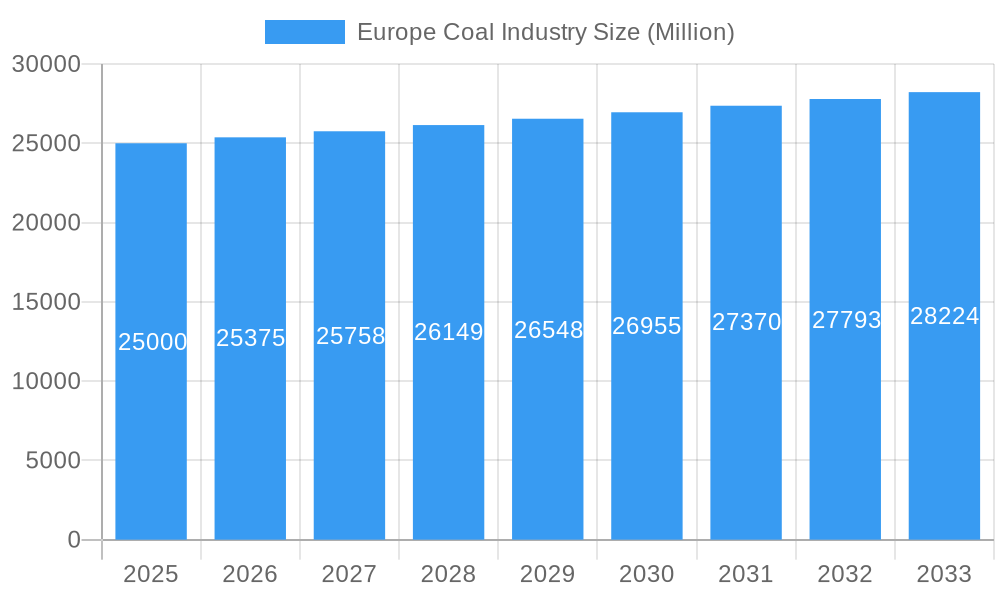

Europe Coal Industry Market Size (In Billion)

The competitive landscape is characterized by major players such as Jastrzębska Spółka Węglowa SA and Suek AG, with ongoing consolidation anticipated as companies navigate market shifts. Variations in regional regulatory frameworks and energy mixes will impact coal phase-out timelines across Europe. Future growth is likely to be concentrated in areas with continued industrial expansion and less aggressive decarbonization policies. Industry responses may involve exploring carbon capture and storage (CCS) technologies, prioritizing higher-quality coal, and diversifying operations. Understanding the specific application needs for each coal type within diverse European markets is vital for forecasting growth trajectories. This requires a thorough analysis of national energy mixes and transition policies, alongside an assessment of technological advancements in mitigating coal's environmental impact.

Europe Coal Industry Company Market Share

European Coal Industry Market Analysis: 2019-2033

This comprehensive report offers an in-depth analysis of the European coal industry, detailing market dynamics, growth trends, dominant segments, and key stakeholders. The study covers the period from 2019 to 2033, with 2025 designated as the base and forecast year. This detailed examination is essential for investors, industry professionals, and policymakers seeking insights into the current state and future trajectory of this evolving sector. The report utilizes extensive data and expert analysis to provide actionable intelligence for strategic decision-making.

Europe Coal Industry Market Dynamics & Structure

This section analyzes the intricate dynamics of the European coal market, encompassing market concentration, technological advancements, regulatory landscapes, competitive substitutions, end-user demographics, and mergers & acquisitions (M&A) activities. The report delves into the competitive intensity, identifying key players and their market shares. It assesses the influence of technological innovation, including efficiency improvements and emission reduction technologies, on market structure and competitiveness. Furthermore, the report examines the impact of regulatory frameworks, such as environmental regulations and carbon pricing mechanisms, on market operations. The analysis also considers the availability of substitute energy sources and their influence on coal demand.

- Market Concentration: The European coal market exhibits a moderately concentrated structure, with a few major players holding significant market share (xx%).

- Technological Innovation: Innovation in coal mining and utilization technologies focuses on improving efficiency and reducing environmental impact (e.g., carbon capture and storage). However, barriers include high upfront investment costs and regulatory uncertainties.

- Regulatory Frameworks: Stringent environmental regulations and carbon pricing policies are reshaping the market, driving the adoption of cleaner technologies and impacting the profitability of coal-based operations.

- Competitive Substitutes: Renewables (solar, wind) and natural gas pose significant competitive threats to coal, with their market share steadily increasing (xx% growth in the forecast period).

- End-User Demographics: The primary end-users remain the electricity generation sector and the steel industry, although demand varies across different European countries.

- M&A Trends: The M&A activity in the European coal sector has been relatively low in recent years (xx deals annually), reflecting consolidation and strategic restructuring within the industry.

Europe Coal Industry Growth Trends & Insights

This section provides a comprehensive overview of the growth trends and insights within the European coal industry, utilizing proprietary data to offer a nuanced understanding of the market's evolution. The report analyzes market size fluctuations, adoption rates of new technologies, technological disruptions that impact market dynamics, and shifting consumer behaviors related to energy choices. Key performance indicators (KPIs) such as Compound Annual Growth Rate (CAGR) and market penetration rates are employed to offer detailed insights into the market's trajectory. The impact of geopolitical factors and economic conditions on coal demand is also addressed. The report projects a CAGR of xx% for the period 2025-2033. Market penetration of coal in the electricity generation sector is anticipated to decline gradually to xx% by 2033. The analysis also incorporates various economic scenarios to provide a robust forecast.

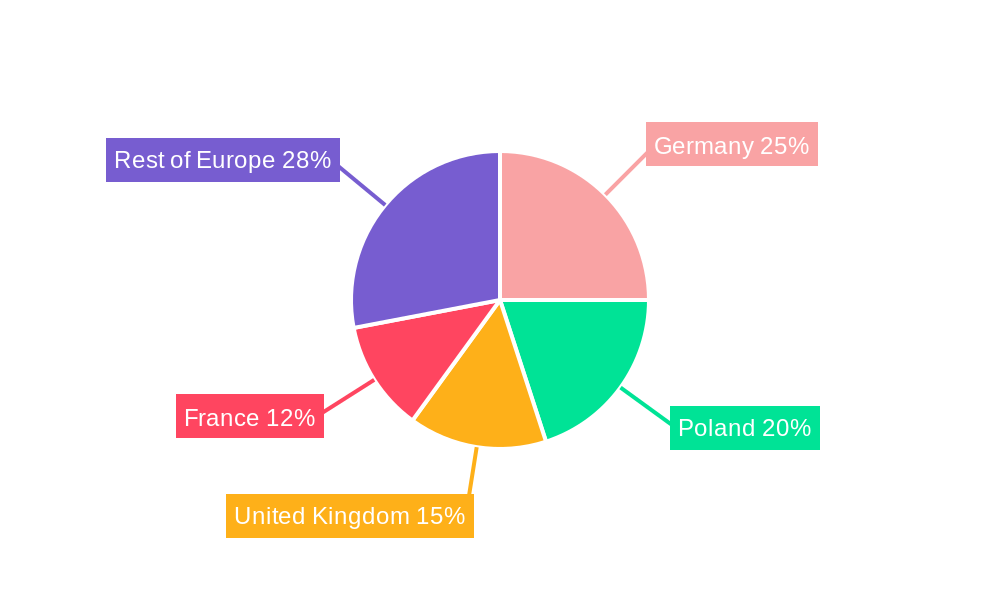

Dominant Regions, Countries, or Segments in Europe Coal Industry

Germany, Poland, and the Czech Republic represent the dominant regions for coal production and consumption in Europe. The report identifies leading segments within the coal industry—specifically anthracite, bituminous, sub-bituminous, and lignite—and assesses their contribution to overall market growth. Similarly, it analyses applications such as electricity generation, steel production, cement manufacturing, and other applications, highlighting the key drivers behind each segment's growth.

- Germany: Significant lignite production and consumption, driven by existing power plants, though facing substantial pressure from environmental regulations.

- Poland: Substantial bituminous coal production, predominantly serving domestic electricity generation. A gradual shift towards diversification of energy sources is anticipated.

- Czech Republic: High reliance on coal for electricity generation, with ongoing efforts toward energy transition.

- Electricity Generation: This remains the largest application segment for coal in Europe, despite the growing competition from renewable energy sources. Steel production represents a second significant segment, with varying dependence on coal across different European countries.

- Key Drivers: Favorable economic policies supporting domestic coal production in some countries contribute to growth, although these are increasingly challenged by environmental policies and the transition to renewable energy. Existing infrastructure for coal-fired power plants also plays a significant role.

Europe Coal Industry Product Landscape

The European coal industry is characterized by variations in coal types (anthracite, bituminous, sub-bituminous, lignite), each possessing unique properties influencing their applications. Technological advancements focus on improving mining efficiency and reducing environmental impacts through techniques such as carbon capture and storage. The most significant product innovation involves enhancing the quality and consistency of coal for different applications. The higher quality coal commands a premium price in the market due to its superior energy output and cleaner combustion characteristics.

Key Drivers, Barriers & Challenges in Europe Coal Industry

Key Drivers: The continued reliance on coal-fired power plants for electricity generation in several European countries, coupled with established infrastructure, constitutes a significant driver for market growth. Government subsidies and policies promoting domestic coal production in specific regions also bolster the industry.

Key Challenges: Stringent environmental regulations, including stricter emission standards and carbon pricing mechanisms, significantly impede the growth of the European coal industry. The increasing competition from renewable energy sources, and the resulting decline in coal demand, poses a major challenge. Supply chain disruptions and geopolitical uncertainties further exacerbate the situation. The forecast predicts a xx% decrease in overall coal demand by 2033 due to these combined factors.

Emerging Opportunities in Europe Coal Industry

Emerging opportunities lie in the potential for carbon capture and storage (CCS) technologies to mitigate the environmental impact of coal-fired power plants. Innovation in coal-based chemicals and materials production may open new avenues for growth. Furthermore, the export of coal to countries with less stringent environmental regulations presents a potential but ethically complex avenue for some European coal producers.

Growth Accelerators in the Europe Coal Industry Industry

Long-term growth in the European coal industry hinges on technological advancements that improve efficiency, reduce emissions, and enhance sustainability. Strategic partnerships between coal producers, technology developers, and energy companies can unlock new growth opportunities. Exploring new applications for coal derivatives and focusing on high-quality coal types with superior energy content can also stimulate market growth.

Key Players Shaping the Europe Coal Industry Market

- Jastrzębska Spółka Węglowa SA

- Suek AG

- Siberian Coal Energy Company

- UK Kuzbassrazrezugol OAO

- Lubelski Wegiel Bogdanka SA

- Mechel PAO

- Raspadskaya PAO

- Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)

- Severstal PAO

Notable Milestones in Europe Coal Industry Sector

- August 2022: Reactivation of the Heyden coal power plant in Petershagen, Germany (875 MW capacity). This reflects a short-term response to energy security concerns.

- October 2022: German government agreement to expand the Garzweiler lignite mine, potentially extracting 280 million metric tons by 2030. This highlights the complex interplay between energy needs and environmental concerns.

In-Depth Europe Coal Industry Market Outlook

The future of the European coal industry is intertwined with the broader energy transition. While long-term demand is expected to decline, short-term factors like geopolitical instability and energy security concerns may temporarily boost coal consumption. Opportunities for growth exist in niche applications, technological advancements focused on sustainability, and strategic partnerships, but the overall trend points towards a diminishing role for coal in Europe's energy mix. Companies that can adapt and innovate will be best positioned to navigate the challenges and capitalize on limited opportunities within this evolving landscape.

Europe Coal Industry Segmentation

-

1. Type

- 1.1. Anthracite

- 1.2. Bituminous

- 1.3. Sub-Bituminous

- 1.4. Lignite

-

2. Application

- 2.1. Electricity

- 2.2. Steel

- 2.3. Cement

- 2.4. Other Applications

Europe Coal Industry Segmentation By Geography

- 1. Russia

- 2. Germany

- 3. Poland

- 4. Rest of Europe

Europe Coal Industry Regional Market Share

Geographic Coverage of Europe Coal Industry

Europe Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Economic Instability

- 3.4. Market Trends

- 3.4.1. Electricity Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Anthracite

- 5.1.2. Bituminous

- 5.1.3. Sub-Bituminous

- 5.1.4. Lignite

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity

- 5.2.2. Steel

- 5.2.3. Cement

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Germany

- 5.3.3. Poland

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Russia Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Anthracite

- 6.1.2. Bituminous

- 6.1.3. Sub-Bituminous

- 6.1.4. Lignite

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electricity

- 6.2.2. Steel

- 6.2.3. Cement

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Anthracite

- 7.1.2. Bituminous

- 7.1.3. Sub-Bituminous

- 7.1.4. Lignite

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electricity

- 7.2.2. Steel

- 7.2.3. Cement

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Poland Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Anthracite

- 8.1.2. Bituminous

- 8.1.3. Sub-Bituminous

- 8.1.4. Lignite

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electricity

- 8.2.2. Steel

- 8.2.3. Cement

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Coal Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Anthracite

- 9.1.2. Bituminous

- 9.1.3. Sub-Bituminous

- 9.1.4. Lignite

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electricity

- 9.2.2. Steel

- 9.2.3. Cement

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jastrzębska Spółka Węglowa SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Suek AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siberian Coal Energy Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 UK Kuzbassrazrezugol OAO

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lubelski Wegiel Bogdanka SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mechel PAO

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Raspadskaya PAO*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Severstal PAO

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Jastrzębska Spółka Węglowa SA

List of Figures

- Figure 1: Europe Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Europe Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Coal Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Coal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Coal Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Europe Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Coal Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Europe Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Coal Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Coal Industry?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Europe Coal Industry?

Key companies in the market include Jastrzębska Spółka Węglowa SA, Suek AG, Siberian Coal Energy Company, UK Kuzbassrazrezugol OAO, Lubelski Wegiel Bogdanka SA, Mechel PAO, Raspadskaya PAO*List Not Exhaustive, Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG), Severstal PAO.

3. What are the main segments of the Europe Coal Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development.

6. What are the notable trends driving market growth?

Electricity Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political and Economic Instability.

8. Can you provide examples of recent developments in the market?

October 2022: The German government has an agreement with a German multinational energy company that plans to expand the Garzweiler coal mine over Lutzerath village. The company plans to extract 280 million metric tons of lignite by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Coal Industry?

To stay informed about further developments, trends, and reports in the Europe Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence