Key Insights

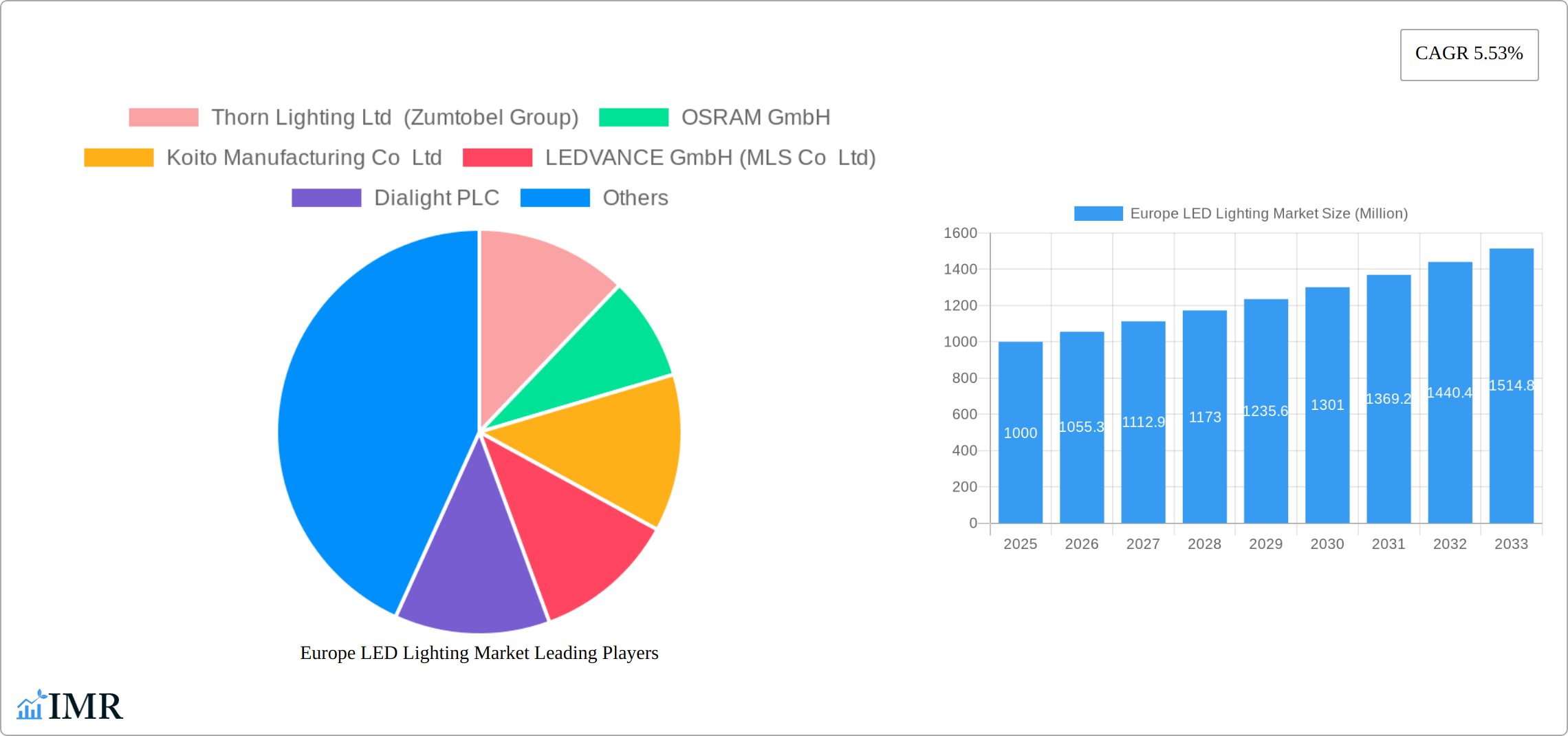

The European LED lighting market, valued at approximately €[Estimate based on market size XX and value unit Million – Assume XX = 1000 for example, then value is €1000 Million in 2025], is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.53% from 2025 to 2033. This surge is driven by several key factors. Stringent government regulations promoting energy efficiency and reducing carbon emissions are compelling the adoption of energy-saving LED technologies across various sectors. Furthermore, the increasing demand for smart lighting solutions, offering enhanced control, automation, and energy optimization, is fueling market expansion. Technological advancements, including improved LED efficacy and lifespan, alongside decreasing manufacturing costs, are making LED lighting a more attractive and cost-effective alternative to traditional lighting solutions. Significant investments in infrastructure development, particularly in smart cities and transportation networks, further stimulate the adoption of energy-efficient LED lighting systems. The automotive sector, encompassing passenger cars, commercial vehicles, and two-wheelers, represents a substantial segment, driven by the integration of advanced lighting features for enhanced safety and aesthetics. Similarly, the indoor lighting segment, including commercial, residential, and agricultural applications, shows strong growth potential due to increasing awareness of energy savings and the benefits of better light quality.

The market segmentation highlights the diverse applications of LED lighting across Europe. Germany, France, and the United Kingdom remain leading markets, reflecting robust economies and early adoption of energy-efficient technologies. However, growth opportunities exist in other European countries as well, fueled by government initiatives and rising consumer awareness. While the market faces challenges, such as the initial higher upfront costs compared to traditional lighting, and potential supply chain disruptions, the long-term cost savings and environmental benefits are outweighing these constraints. Leading players such as Signify (Philips), Osram, and others are continuously innovating and expanding their product portfolios to cater to the evolving needs of diverse market segments and maintain their competitive edge within this dynamic and expanding market.

Europe LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe LED lighting market, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the market in Million units.

Europe LED Lighting Market Dynamics & Structure

The European LED lighting market is characterized by a moderately concentrated landscape, with key players like Signify (Philips), OSRAM GmbH, and Thorn Lighting Ltd (Zumtobel Group) holding significant market share. Technological innovation, driven by advancements in LED chip technology, power efficiency, and smart lighting capabilities, is a major growth driver. Stringent environmental regulations promoting energy efficiency and the phasing out of incandescent bulbs further fuel market expansion. The market witnesses continuous M&A activity, with larger players acquiring smaller companies to expand their product portfolios and market reach. Competitive pressure from traditional lighting technologies remains a factor, though LED's cost competitiveness and superior performance are steadily eroding this challenge.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on higher efficacy, smart features, and customized lighting solutions.

- Regulatory Framework: Stringent energy efficiency standards driving LED adoption.

- Competitive Substitutes: Halogen and incandescent lighting, facing declining market share.

- End-User Demographics: Strong demand from residential, commercial, and automotive sectors.

- M&A Trends: Consolidation expected to continue, with xx M&A deals predicted in the forecast period.

Europe LED Lighting Market Growth Trends & Insights

The European LED lighting market experienced robust growth during the historical period (2019-2024), driven by factors such as increasing energy efficiency concerns, government incentives, and declining LED prices. The market size reached xx million units in 2024 and is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by increasing adoption rates across various segments, particularly in the automotive and indoor lighting sectors. Technological disruptions, such as the introduction of smart lighting systems and Internet of Things (IoT) integration, are creating new growth avenues. Consumer behavior shifts towards energy-conscious choices and preference for aesthetically pleasing lighting solutions also contribute significantly. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions, Countries, or Segments in Europe LED Lighting Market

Germany, the United Kingdom, and France are the leading countries in the European LED lighting market, driven by robust economic growth, well-developed infrastructure, and significant investments in energy-efficient technologies. Within the segments, Automotive Vehicle Lighting (particularly Passenger Cars) and Indoor Lighting (Commercial) show the strongest growth potential.

- Germany: Strong industrial base, high energy efficiency standards, and early adoption of LED technologies.

- United Kingdom: Growing demand from commercial and residential sectors, supportive government policies.

- France: Significant investments in infrastructure projects incorporating LED lighting.

- Automotive Vehicle Lighting: High growth due to increasing vehicle production and stringent safety regulations.

- Indoor Lighting (Commercial): Driven by energy savings, improved aesthetics, and long lifespan of LEDs.

- Market Share: Germany holds approximately xx%, UK xx%, France xx%, and Rest of Europe xx% of the market in 2024.

Europe LED Lighting Market Product Landscape

The European LED lighting market showcases a diverse product landscape, featuring a wide range of LEDs with varying power outputs, color temperatures, and functionalities. Product innovation focuses on enhancing energy efficiency, improving color rendering index (CRI), and integrating smart features like dimming, color-changing capabilities, and IoT connectivity. Unique selling propositions include high lumen output, extended lifespan, and reduced energy consumption compared to traditional lighting technologies.

Key Drivers, Barriers & Challenges in Europe LED Lighting Market

Key Drivers:

- Increasing government regulations promoting energy efficiency.

- Growing consumer awareness about energy saving and environmental benefits.

- Technological advancements leading to improved efficiency and cost reduction.

- Rising demand from various sectors, including automotive and commercial buildings.

Challenges:

- Intense competition from established players and emerging market entrants.

- Supply chain disruptions impacting the availability of raw materials and components.

- High initial investment costs for LED lighting solutions, potentially acting as a barrier for adoption in some segments. This results in a xx% reduction in market growth in specific areas.

Emerging Opportunities in Europe LED Lighting Market

- Growing demand for smart lighting systems and IoT-enabled solutions.

- Increasing penetration of LED lighting in the agricultural sector for horticulture applications.

- Expansion into niche markets like architectural and decorative lighting.

- Development of LED-based lighting solutions for sustainable infrastructure projects.

Growth Accelerators in the Europe LED Lighting Market Industry

Technological breakthroughs in LED chip technology, driving higher lumen output and improved energy efficiency, are key growth accelerators. Strategic partnerships between LED manufacturers and lighting system integrators are also facilitating market expansion. Government initiatives promoting energy efficiency and the adoption of sustainable lighting solutions further bolster growth.

Key Players Shaping the Europe LED Lighting Market Market

- Thorn Lighting Ltd (Zumtobel Group)

- OSRAM GmbH

- Koito Manufacturing Co Ltd

- LEDVANCE GmbH (MLS Co Ltd)

- Dialight PLC

- HELLA GmbH & Co KGaA

- Marelli Holdings Co Ltd

- Vale

- Signify (Philips)

- Panasonic Holdings Corporation

Notable Milestones in Europe LED Lighting Market Sector

- July 2023: OSRAM introduced Osconiq E 2835 CRI 90 (QD) LED, boasting over 200 lm/W efficiency.

- June 2023: HELLA launched a multifunctional full-LED rear lamp for trucks and trailers.

- May 2023: Osram released the OSLON Optimum family of LEDs for horticulture lighting.

In-Depth Europe LED Lighting Market Market Outlook

The future of the European LED lighting market is bright, driven by continued technological innovation, increasing consumer demand for energy-efficient and aesthetically pleasing solutions, and supportive government policies. The market is expected to witness significant growth across all segments, creating lucrative opportunities for established players and new entrants. Strategic partnerships, investments in R&D, and expansion into new applications will be crucial for success in this dynamic market.

Europe LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

Europe LED Lighting Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Deployments Bolster the Market Growth; High Regional Demand for Broadband

- 3.3. Market Restrains

- 3.3.1. Lack of awareness about serious games among end-users

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. Germany Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Thorn Lighting Ltd (Zumtobel Group)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OSRAM GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Koito Manufacturing Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LEDVANCE GmbH (MLS Co Ltd)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dialight PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 HELLA GmbH & Co KGaA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Marelli Holdings Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vale

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Signify (Philips)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Thorn Lighting Ltd (Zumtobel Group)

List of Figures

- Figure 1: Europe LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Europe LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 3: Europe LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Europe LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: Europe LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: Europe LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 16: Europe LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 17: Europe LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 18: Europe LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 19: Europe LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Denmark Europe LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe LED Lighting Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Europe LED Lighting Market?

Key companies in the market include Thorn Lighting Ltd (Zumtobel Group), OSRAM GmbH, Koito Manufacturing Co Ltd, LEDVANCE GmbH (MLS Co Ltd), Dialight PLC, HELLA GmbH & Co KGaA, Marelli Holdings Co Ltd, Vale, Signify (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Europe LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5G Deployments Bolster the Market Growth; High Regional Demand for Broadband.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of awareness about serious games among end-users.

8. Can you provide examples of recent developments in the market?

July 2023: OSRAM introduced Osconiq E 2835 CRI 90 (QD) that expands ams OSRAM's portfolio of lighting solutions that provide prominent quality in a new mid-power LED. Its In-house Quantum Dot technology ensures outstanding efficiency values of over 200 lm/W, even at high color rendering indices (CRI).June 2023: HELLA launched a multifunctional rear lamp for trucks and trailers. The full-LED rear lamp has a central direction indicator light, a stop light, a reverse light and a rear fog light. The tail light with the 144 cm² patented LED light curtain is a real highlight.May 2023: Osram announced the release of the OSLON Optimum family of LEDs in May 2022. These LEDs are based on the most recent ams Osram 1mm2 chip and are designed for horticulture lighting. They offer an exceptional combination of high efficiency, dependable performance, and great value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe LED Lighting Market?

To stay informed about further developments, trends, and reports in the Europe LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence