Key Insights

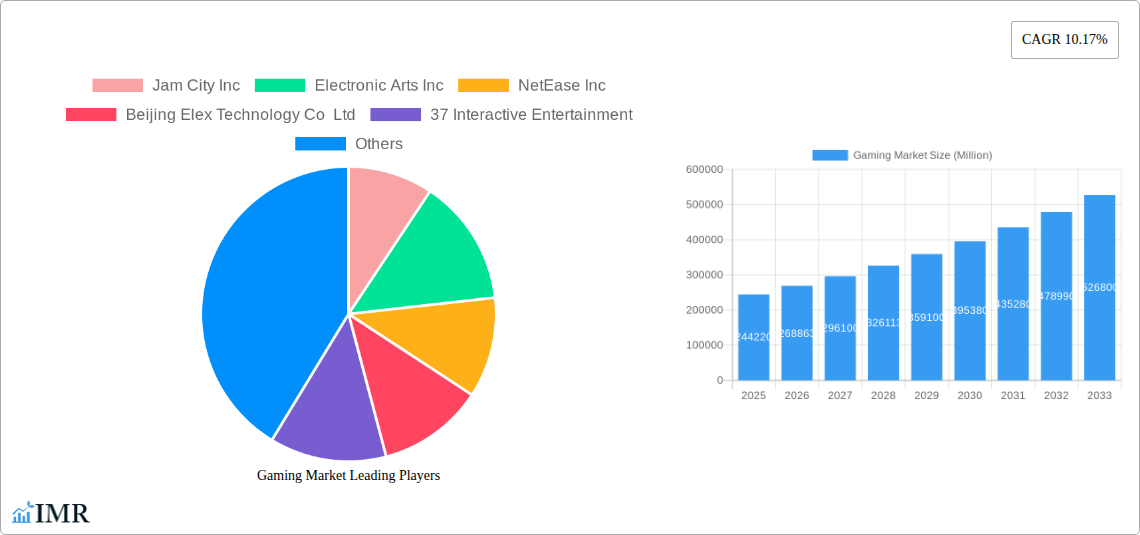

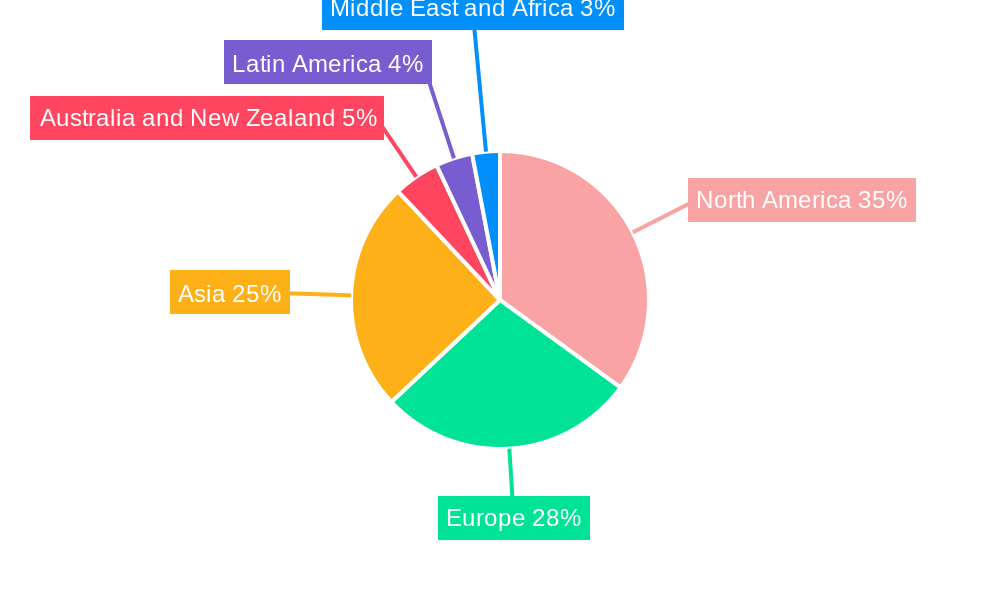

The global gaming market, valued at $244.22 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of smartphones and readily available high-speed internet access fuels the mobile gaming segment's expansion. Furthermore, the rising popularity of esports, coupled with significant investments in game development and marketing, contributes to overall market expansion. Technological advancements, such as virtual reality (VR) and augmented reality (AR), are creating immersive gaming experiences, further driving demand. However, challenges remain, including concerns regarding gaming addiction and the need for robust regulatory frameworks to address these concerns. The market is segmented by gaming type (mobile, console, PC, esports), geographic region, and major players, each exhibiting unique growth trajectories. North America and Asia currently dominate the market, benefiting from established gaming cultures and substantial consumer spending. However, emerging markets in Latin America and the Middle East and Africa present significant untapped potential for future growth. The competitive landscape is characterized by a mix of established industry giants like Tencent, Sony, and Microsoft, alongside innovative independent developers, leading to continuous innovation and a diverse range of gaming experiences. The forecast period of 2025-2033 anticipates continued expansion, albeit at a potentially moderating CAGR, as market saturation in certain segments may emerge. Nevertheless, ongoing technological advancements and shifting consumer preferences suggest the gaming industry will remain a significant and dynamic sector within the global entertainment landscape.

Gaming Market Market Size (In Billion)

The continued expansion of the gaming market hinges on factors such as the development of innovative game mechanics, the improvement of graphics and game play, and the expansion of esports. Strategic alliances and mergers and acquisitions amongst key industry players will also reshape the competitive landscape. Regional disparities in growth rates will likely persist, reflecting economic conditions, digital infrastructure, and cultural preferences. Factors such as fluctuating economic conditions and the cyclical nature of gaming trends could impact growth projections. Nevertheless, the long-term prospects for the gaming market remain positive, fueled by ongoing technological advancements and the ever-increasing appeal of interactive entertainment. The consistent release of high-quality games across various platforms, coupled with the growing appeal of esports and streaming platforms, ensures sustained engagement and potential for market expansion. The industry’s capacity for adaptation and innovation guarantees its continuing relevance and evolutionary growth throughout the forecast period.

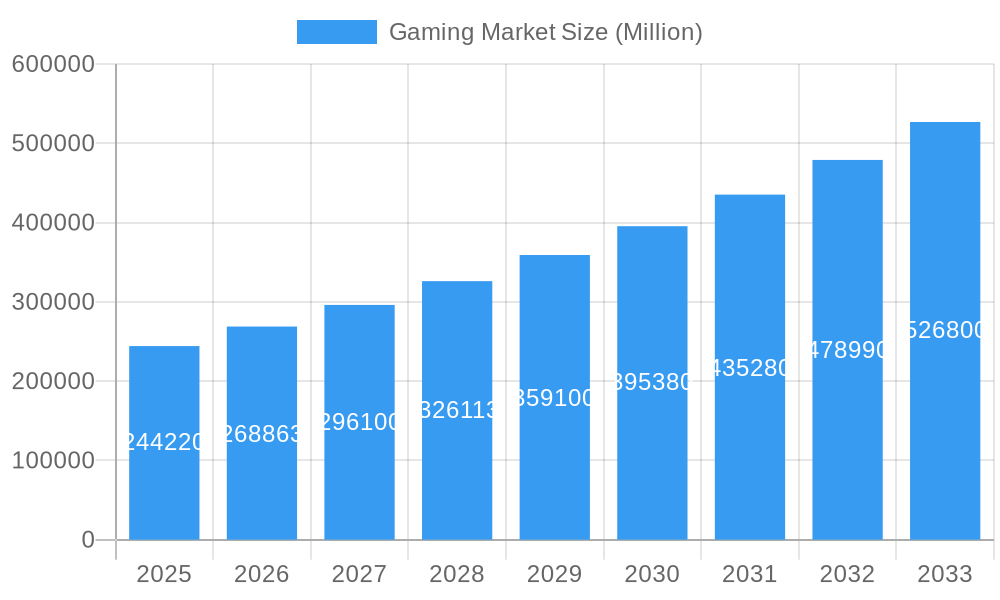

Gaming Market Company Market Share

Gaming Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global gaming market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). We delve into market dynamics, growth trends, key players, and emerging opportunities across various segments, including mobile games, console games, PC games (downloaded/box), and esports. This report is an invaluable resource for industry professionals, investors, and anyone seeking to understand the evolving landscape of the gaming industry. The market is segmented into parent market and child market. Parent Market is Global Gaming Market and Child market is the segmentation of gaming market into different gaming type like Mobile Games, Console Games, Downloaded/Box PC, E-sports.

Gaming Market Dynamics & Structure

The global gaming market, valued at xx million units in 2025, is characterized by high dynamism and intense competition. Market concentration is relatively high, with a few major players holding significant market share. Technological innovation, particularly in areas like cloud gaming, VR/AR, and AI, is a primary driver of growth. Regulatory frameworks concerning data privacy, content restrictions, and loot boxes vary across regions, influencing market dynamics. Competitive product substitutes, such as streaming services and other forms of entertainment, pose a challenge, while end-user demographics are expanding to include diverse age groups and geographical locations. M&A activity has been significant, with xx major deals recorded in the past five years, consolidating market power and accelerating innovation.

- Market Concentration: Top 5 players hold approximately xx% of market share in 2025.

- Technological Innovation: Significant investments in cloud gaming, VR/AR, and AI technologies drive market evolution.

- Regulatory Landscape: Varied regulations across regions impact market access and content development.

- Competitive Substitutes: Streaming services and other forms of entertainment present competitive challenges.

- End-User Demographics: Expanding to encompass diverse age groups and geographic locations.

- M&A Activity: xx major mergers and acquisitions in the past five years.

Gaming Market Growth Trends & Insights

The gaming market exhibits robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is expected to reach xx million units by 2033, driven by increasing smartphone penetration, rising internet accessibility, and evolving consumer preferences. Technological disruptions, such as the shift towards cloud gaming and the integration of esports into mainstream culture, are accelerating growth. Consumer behavior is shifting towards mobile gaming and free-to-play models, impacting revenue streams and monetization strategies. Adoption rates for new technologies, such as VR/AR headsets, are steadily increasing, creating exciting opportunities for new gaming experiences.

Dominant Regions, Countries, or Segments in Gaming Market

The mobile gaming segment is the dominant force within the gaming market, capturing xx% of total revenue in 2025. This dominance is fueled by the widespread accessibility of smartphones and the ease of access to mobile games. Asia, particularly China, Japan, and South Korea, represent key regional markets, boasting high mobile penetration rates and a large player base. North America and Europe also contribute significantly, benefiting from advanced infrastructure, strong consumer spending, and a vibrant esports scene.

- Mobile Games: Dominant segment driven by high smartphone penetration and readily available games.

- Asia (China, Japan, South Korea): Strong regional growth fuelled by high mobile penetration and large player base.

- North America & Europe: Contribute significantly due to robust infrastructure and high consumer spending.

- Esports: Growing rapidly due to increased viewership, sponsorships, and professionalization.

Gaming Market Product Landscape

The gaming market offers a diverse range of products, from AAA console titles to indie mobile games and cloud-based experiences. Product innovation is rapid, with developers continuously introducing new mechanics, graphics, and storytelling techniques. Performance metrics, such as frame rates, resolution, and online connectivity, are key factors influencing consumer choice. Unique selling propositions focus on innovative gameplay, compelling narratives, and engaging community features. Technological advancements drive enhancements in graphics fidelity, gameplay mechanics, and the implementation of new technologies, such as VR/AR and AI.

Key Drivers, Barriers & Challenges in Gaming Market

Key Drivers:

- Technological advancements: VR/AR integration, improved graphics, cloud gaming.

- Increased smartphone penetration: Expanding access to gaming across demographics.

- Growth of esports: Driving viewer engagement and game adoption.

Key Challenges:

- Intense competition: Creating pressure on pricing and profit margins.

- Regulatory uncertainty: Varying regulations impacting game development and distribution.

- Supply chain disruptions: Potential delays and increased costs for hardware and software.

Emerging Opportunities in Gaming Market

Emerging opportunities lie in untapped markets, particularly in developing economies, where mobile gaming penetration is still growing. The integration of blockchain technology offers new possibilities for decentralized game economies and NFT integration. Evolving consumer preferences, such as the demand for more personalized and immersive experiences, will drive innovation. The metaverse and Web3 gaming are attracting significant investment and have the potential to disrupt the industry.

Growth Accelerators in the Gaming Market Industry

Technological breakthroughs in areas such as AI, VR/AR, and cloud gaming are driving long-term growth. Strategic partnerships between gaming companies and other technology providers, including telecom companies and hardware manufacturers, are fostering market expansion. The development and refinement of innovative monetization models, such as subscription services and in-app purchases, are critical for sustainable growth. Market expansion into new regions and demographics is also key for continuous growth.

Key Players Shaping the Gaming Market Market

- Jam City Inc

- Electronic Arts Inc

- NetEase Inc

- Beijing Elex Technology Co Ltd

- 37 Interactive Entertainment

- Microsoft Corporation

- Sega Sammy Holdings Inc

- Square Enix Holdings Co Ltd

- Ubisoft Entertainment SA

- Tencent Holdings Ltd

- Nintendo Co Ltd

- ZeptoLab UK limited

- Realnetworks LLC (Gamehouse)

- Take-Two Interactive Software Inc

- Apple Inc

- Bandai Namco Holdings Inc

- Nexon Co Ltd

- Sony Corporation

- Capcom Co Ltd

Notable Milestones in Gaming Market Sector

- June 2024: Microsoft unveiled all-digital Xbox Series X and S consoles, including a 2TB premium model, alongside new game previews. This impacted the market by increasing console accessibility and competition.

- April 2024: Sony launched the PlayStation 5 Slim in India, a lighter, more compact version of its flagship console. This move targeted a price-sensitive market and expanded the PS5’s reach.

In-Depth Gaming Market Market Outlook

The gaming market is poised for continued robust growth, driven by technological innovations, expanding user bases, and evolving consumer preferences. Strategic opportunities exist in emerging markets, metaverse development, and the continued evolution of esports. Companies focused on innovation, strategic partnerships, and adaptability will be best positioned to succeed in this dynamic and competitive landscape. The future of gaming is exciting and full of potential, promising engaging new experiences and revenue streams.

Gaming Market Segmentation

-

1. Gaming Type

- 1.1. Mobile Games

- 1.2. Console Games

- 1.3. Downloaded/Box PC

- 1.4. E-sports

Gaming Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. Iran

- 6.4. Egypt

Gaming Market Regional Market Share

Geographic Coverage of Gaming Market

Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Internet Penetration; Emergence of Cloud Gaming; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Issues such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Console Games Gaming Type Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 5.1.1. Mobile Games

- 5.1.2. Console Games

- 5.1.3. Downloaded/Box PC

- 5.1.4. E-sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6. North America Gaming Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6.1.1. Mobile Games

- 6.1.2. Console Games

- 6.1.3. Downloaded/Box PC

- 6.1.4. E-sports

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7. Europe Gaming Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7.1.1. Mobile Games

- 7.1.2. Console Games

- 7.1.3. Downloaded/Box PC

- 7.1.4. E-sports

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8. Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8.1.1. Mobile Games

- 8.1.2. Console Games

- 8.1.3. Downloaded/Box PC

- 8.1.4. E-sports

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9. Australia and New Zealand Gaming Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9.1.1. Mobile Games

- 9.1.2. Console Games

- 9.1.3. Downloaded/Box PC

- 9.1.4. E-sports

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10. Latin America Gaming Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10.1.1. Mobile Games

- 10.1.2. Console Games

- 10.1.3. Downloaded/Box PC

- 10.1.4. E-sports

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11. Middle East and Africa Gaming Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11.1.1. Mobile Games

- 11.1.2. Console Games

- 11.1.3. Downloaded/Box PC

- 11.1.4. E-sports

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Jam City Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Electronic Arts Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NetEase Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Beijing Elex Technology Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 37 Interactive Entertainment

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sega Sammy Holdings Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Square Enix Holdings Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ubisoft Entertainment SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tencent Holdings Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nintendo Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ZeptoLab UK limited

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Realnetworks LLC (Gamehouse)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Take-Two Interactive Software Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Apple Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Bandai Namco Holdings Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Nexon Co Ltd

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Sony Corporation

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Capcom Co Ltd

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.1 Jam City Inc

List of Figures

- Figure 1: Global Gaming Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 3: North America Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 4: North America Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 7: Europe Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 8: Europe Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 11: Asia Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 12: Asia Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 15: Australia and New Zealand Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 16: Australia and New Zealand Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 19: Latin America Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 20: Latin America Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 23: Middle East and Africa Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 24: Middle East and Africa Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Gaming Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 2: Global Gaming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 4: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 8: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 16: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: China Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 21: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 23: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 28: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: United Arab Emirates Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Iran Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Egypt Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Market?

The projected CAGR is approximately 10.17%.

2. Which companies are prominent players in the Gaming Market?

Key companies in the market include Jam City Inc, Electronic Arts Inc, NetEase Inc, Beijing Elex Technology Co Ltd, 37 Interactive Entertainment, Microsoft Corporation, Sega Sammy Holdings Inc, Square Enix Holdings Co Ltd, Ubisoft Entertainment SA, Tencent Holdings Ltd, Nintendo Co Ltd, ZeptoLab UK limited, Realnetworks LLC (Gamehouse), Take-Two Interactive Software Inc, Apple Inc, Bandai Namco Holdings Inc, Nexon Co Ltd, Sony Corporation, Capcom Co Ltd.

3. What are the main segments of the Gaming Market?

The market segments include Gaming Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 244.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration; Emergence of Cloud Gaming; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Console Games Gaming Type Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Issues such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

June 2024: Microsoft unveiled an all-digital variant of its Xbox Series X and S consoles alongside previews for over a dozen games, notably the next "Call of Duty" installment. The tech giant showcased not just one but three consoles: a disc-less iteration of the Xbox Series X and S and a premium Series X model boasting a capacious 2-terabyte storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Market?

To stay informed about further developments, trends, and reports in the Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence