Key Insights

The high-end tourism market, encompassing luxury travel experiences and bespoke itineraries, is experiencing robust growth. While precise figures for market size and CAGR are not provided, industry analysis suggests a substantial market valued in the hundreds of billions of dollars globally. The segment's expansion is fueled by several key drivers: a rising global high-net-worth individual (HNWI) population with increased disposable income; a growing demand for personalized, unique travel experiences beyond mass tourism; and a surge in interest in sustainable and responsible luxury travel. Trends include a preference for experiential travel focusing on culture, adventure, and wellness; a rise in private jet travel and luxury yacht charters; and a growing demand for exclusive access to destinations and activities. However, restraints include economic volatility, geopolitical instability impacting travel destinations, and the potential for overtourism in popular luxury locations, requiring careful management of sustainable practices. The market is segmented by travel style (adventure, cultural, wellness, etc.), destination type (city breaks, cruises, safaris), and service provider type (tour operators, travel agents, concierge services). Key players such as TUI Group, Thomas Cook Group (though facing past challenges), and Abercrombie & Kent Ltd. compete by offering diverse luxury travel packages and unique experiences.

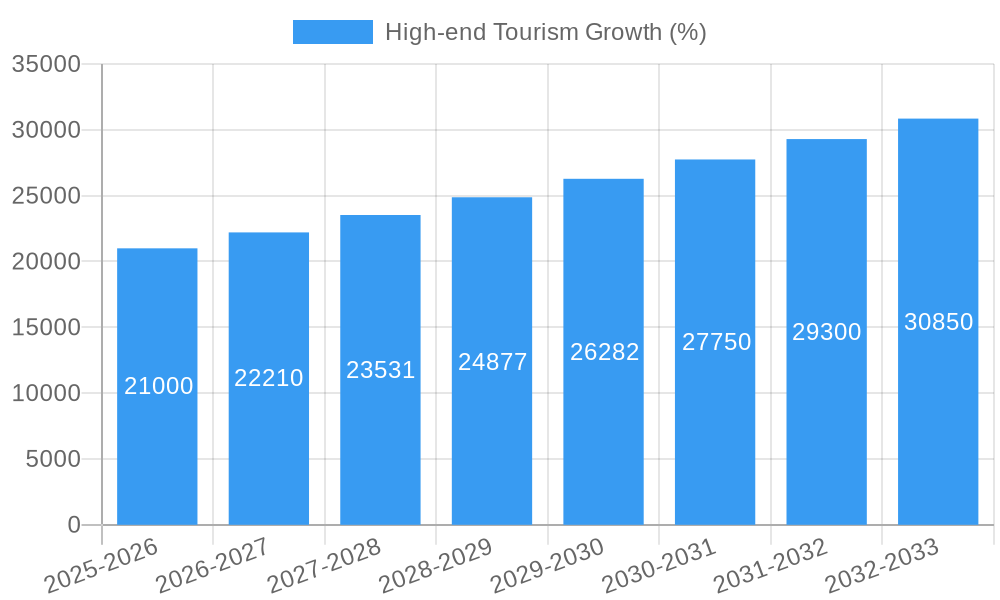

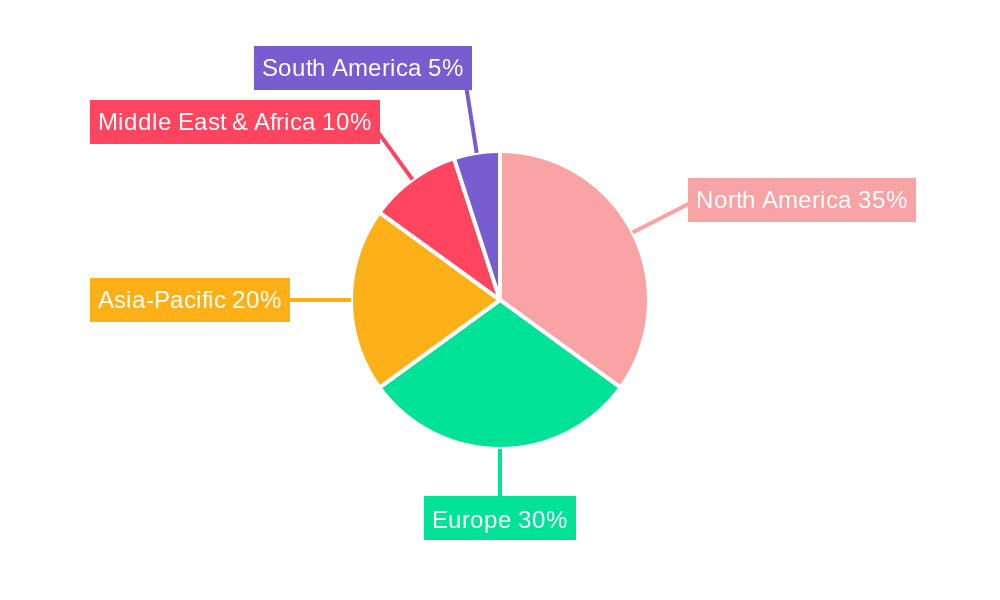

The forecast period (2025-2033) promises continued expansion, driven by the enduring appeal of luxury experiences and ongoing technological advancements in travel planning and service delivery. The market is expected to witness innovation in personalized itineraries, virtual reality previews of destinations, and enhanced customer service technologies. Regional variations will exist, with North America and Europe likely to maintain significant market shares, but emerging markets in Asia and the Middle East are expected to show strong growth. Sustained growth will depend on addressing the challenges of responsible tourism, offering authentic experiences, and maintaining a balance between exclusivity and accessibility. Competition will intensify as new entrants and established players strive for market share, particularly in niche segments like adventure tourism and wellness travel.

High-End Tourism Market Report: 2019-2033

Unlocking the Potential of Luxury Travel: A Comprehensive Market Analysis

This comprehensive report provides a detailed analysis of the high-end tourism market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). Targeting industry professionals, investors, and strategic planners, this report offers invaluable insights into market dynamics, growth drivers, competitive landscapes, and emerging opportunities within the luxury travel sector. We delve into specific segments like adventure tourism, wellness retreats, and bespoke experiences, providing granular data to aid in informed decision-making. The parent market encompasses the broader tourism industry, while the child market focuses specifically on the high-end, luxury travel segment.

High-end Tourism Market Dynamics & Structure

This section analyzes the high-end tourism market's structure, revealing its concentration levels, technological advancements influencing its growth, regulatory frameworks, competitive landscape, customer demographics, and merger & acquisition (M&A) activities. The global high-end tourism market size in 2025 is estimated at $xx billion.

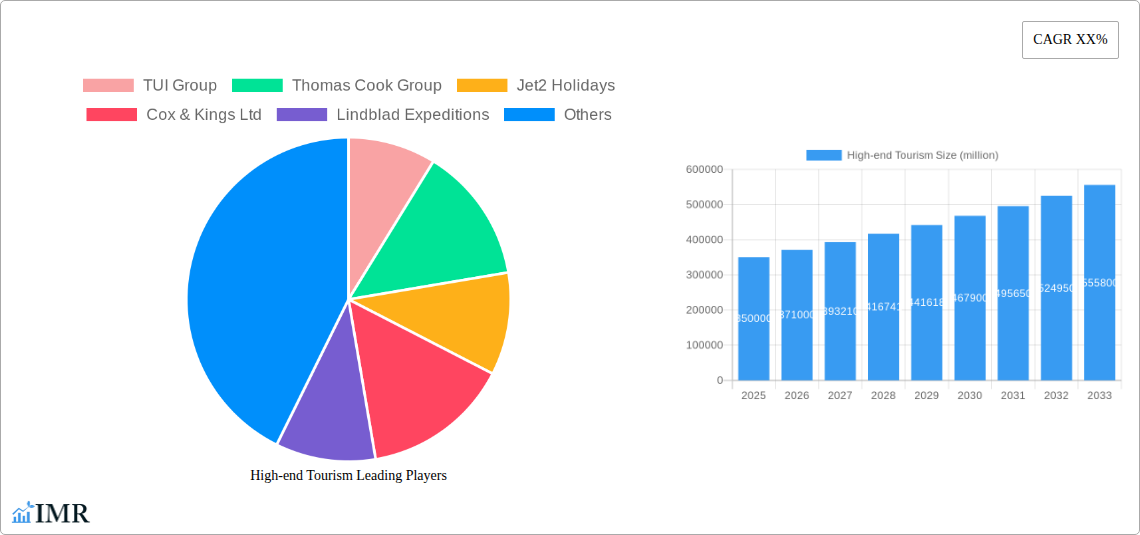

- Market Concentration: The market exhibits moderate concentration, with a few major players controlling a significant share (estimated at 35% combined market share for the top 5 players in 2025).

- Technological Innovation: Technological advancements such as AI-powered personalization, VR/AR experiences, and enhanced booking platforms are driving market growth. However, implementation costs and data security concerns pose significant barriers.

- Regulatory Frameworks: Varying regulations across countries, concerning visas, permits, and environmental protection, influence operational efficiency and costs. A simplification of these frameworks could significantly boost growth.

- Competitive Product Substitutes: The emergence of alternative luxury experiences, such as private yacht charters and exclusive home rentals, present competitive challenges to traditional high-end tourism operators.

- End-User Demographics: High-net-worth individuals (HNWIs) and affluent millennials are the primary drivers, with a growing emphasis on personalized, sustainable, and experiential travel.

- M&A Trends: The last five years have witnessed an average of xx M&A deals annually in the high-end tourism sector, primarily driven by consolidation and expansion strategies.

High-end Tourism Growth Trends & Insights

This in-depth analysis explores the evolution of the high-end tourism market size, adoption rates of innovative technologies, technological disruptions, and the changing behavior of luxury travelers. We use proprietary data and industry benchmarks to forecast a CAGR of xx% from 2025 to 2033, driven primarily by rising disposable incomes in emerging economies and increased demand for unique travel experiences. Market penetration of technologically enhanced services is projected to reach xx% by 2033. Shifting consumer preferences toward sustainable and responsible tourism also significantly influences market growth.

Dominant Regions, Countries, or Segments in High-End Tourism

This section identifies the leading regions and segments within the high-end tourism market, driving its growth. North America and Europe remain dominant, holding approximately 60% of the global market share in 2025. Asia-Pacific is experiencing rapid growth, with a projected CAGR of xx% from 2025 to 2033, driven by rising affluence in China and India.

- Key Drivers in North America: Strong domestic tourism, robust infrastructure, and a wide range of luxury offerings.

- Key Drivers in Europe: Diverse cultural attractions, established tourism infrastructure, and high spending power among European HNWIs.

- Key Drivers in Asia-Pacific: Rapid economic growth, expanding middle class, and increasing interest in experiential travel.

- Dominant Segment: Adventure and experiential tourism is the fastest-growing segment, with a projected market share of xx% by 2033.

High-end Tourism Product Landscape

The high-end tourism market is characterized by a focus on personalized experiences, bespoke itineraries, and exclusive access. Product innovations include curated travel packages combining luxury accommodations, private transportation, unique activities, and exceptional service. Technological integration, using AI for personalized recommendations and VR/AR to showcase destinations, further enhances the customer experience. The rise of sustainable and eco-friendly travel packages is also a notable trend, with businesses focusing on responsible practices.

Key Drivers, Barriers & Challenges in High-End Tourism

Key Drivers: Increasing disposable incomes, a desire for unique experiences, technological advancements (AI-powered personalization, VR/AR experiences), and growing awareness of sustainable travel options are major drivers.

Key Challenges: Geopolitical instability, economic downturns, environmental concerns, and intense competition (including alternative luxury experiences) pose significant challenges. The impact of these factors is estimated to result in a xx% reduction in market growth in years experiencing significant global economic downturn.

Emerging Opportunities in High-end Tourism

Untapped markets in emerging economies, particularly in Africa and South America, present significant growth opportunities. The increasing popularity of wellness tourism, adventure travel, and sustainable tourism presents substantial potential for new and innovative products and services. Customization and personalized experiences remain a focus for future growth.

Growth Accelerators in the High-end Tourism Industry

Strategic partnerships between luxury hotels, airlines, and tour operators will foster growth. Investment in technology, such as AI-powered travel planning platforms and virtual reality experiences, will attract new customers and improve efficiency. Expansion into emerging markets and the continued emphasis on sustainability will be key drivers for long-term expansion.

Key Players Shaping the High-end Tourism Market

- TUI Group

- Thomas Cook Group (Note: Thomas Cook Group went into liquidation, but the brand may have been reacquired or reformed. The provided link is to the former company website for historical context. Further research is recommended on this entity's current market position).

- Jet2 Holidays

- Cox & Kings Ltd

- Lindblad Expeditions

- Travcoa

- Scott Dunn

- Abercrombie & Kent Ltd

- Micato Safaris

- Tauck

- Al Tayyar

- Backroads

- Zicasso

- Exodus Travels

- Butterfield & Robinson

Notable Milestones in High-end Tourism Sector

- 2020: The COVID-19 pandemic severely impacted the high-end tourism sector, causing widespread travel restrictions and a significant drop in demand.

- 2022: A strong rebound in high-end travel was observed post-pandemic, driven by pent-up demand and a shift towards more personalized and experiential travel.

- 2023: Increased focus on sustainable and responsible travel practices by key players. Several significant M&A activities consolidate market share amongst major players.

In-Depth High-end Tourism Market Outlook

The high-end tourism market is poised for robust growth over the next decade, driven by the factors outlined above. Strategic investments in technology, sustainable practices, and expansion into emerging markets will be crucial for maintaining a competitive edge. The focus on personalized and experiential travel will continue to shape the future of luxury tourism, offering significant opportunities for innovation and growth. Continued monitoring of geopolitical and economic factors will remain paramount for successful navigation of the market.

High-end Tourism Segmentation

-

1. Application

- 1.1. Millennial

- 1.2. Generation X

- 1.3. Baby Boomers

-

2. Types

- 2.1. Customized and Private Vacation

- 2.2. Adventure and Safari

- 2.3. Cruise/Ship Expedition

- 2.4. Small Group Journey

- 2.5. Celebration and Special Event

- 2.6. Others

High-end Tourism Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High-end Tourism REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Millennial

- 5.1.2. Generation X

- 5.1.3. Baby Boomers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Customized and Private Vacation

- 5.2.2. Adventure and Safari

- 5.2.3. Cruise/Ship Expedition

- 5.2.4. Small Group Journey

- 5.2.5. Celebration and Special Event

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Millennial

- 6.1.2. Generation X

- 6.1.3. Baby Boomers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Customized and Private Vacation

- 6.2.2. Adventure and Safari

- 6.2.3. Cruise/Ship Expedition

- 6.2.4. Small Group Journey

- 6.2.5. Celebration and Special Event

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Millennial

- 7.1.2. Generation X

- 7.1.3. Baby Boomers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Customized and Private Vacation

- 7.2.2. Adventure and Safari

- 7.2.3. Cruise/Ship Expedition

- 7.2.4. Small Group Journey

- 7.2.5. Celebration and Special Event

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Millennial

- 8.1.2. Generation X

- 8.1.3. Baby Boomers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Customized and Private Vacation

- 8.2.2. Adventure and Safari

- 8.2.3. Cruise/Ship Expedition

- 8.2.4. Small Group Journey

- 8.2.5. Celebration and Special Event

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Millennial

- 9.1.2. Generation X

- 9.1.3. Baby Boomers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Customized and Private Vacation

- 9.2.2. Adventure and Safari

- 9.2.3. Cruise/Ship Expedition

- 9.2.4. Small Group Journey

- 9.2.5. Celebration and Special Event

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High-end Tourism Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Millennial

- 10.1.2. Generation X

- 10.1.3. Baby Boomers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Customized and Private Vacation

- 10.2.2. Adventure and Safari

- 10.2.3. Cruise/Ship Expedition

- 10.2.4. Small Group Journey

- 10.2.5. Celebration and Special Event

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TUI Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thomas Cook Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jet2 Holidays

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cox & Kings Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lindblad Expeditions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Travcoa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scott Dunn

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abercrombie & Kent Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Micato Safaris

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tauck

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Al Tayyar

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Backroads

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zicasso

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Exodus Travels

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Butterfield & Robinson

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 TUI Group

List of Figures

- Figure 1: Global High-end Tourism Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High-end Tourism Revenue (million), by Application 2024 & 2032

- Figure 3: North America High-end Tourism Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High-end Tourism Revenue (million), by Types 2024 & 2032

- Figure 5: North America High-end Tourism Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High-end Tourism Revenue (million), by Country 2024 & 2032

- Figure 7: North America High-end Tourism Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High-end Tourism Revenue (million), by Application 2024 & 2032

- Figure 9: South America High-end Tourism Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High-end Tourism Revenue (million), by Types 2024 & 2032

- Figure 11: South America High-end Tourism Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High-end Tourism Revenue (million), by Country 2024 & 2032

- Figure 13: South America High-end Tourism Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High-end Tourism Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High-end Tourism Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High-end Tourism Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High-end Tourism Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High-end Tourism Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High-end Tourism Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High-end Tourism Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High-end Tourism Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High-end Tourism Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High-end Tourism Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High-end Tourism Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High-end Tourism Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High-end Tourism Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High-end Tourism Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High-end Tourism Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High-end Tourism Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High-end Tourism Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High-end Tourism Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High-end Tourism Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High-end Tourism Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High-end Tourism Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High-end Tourism Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High-end Tourism Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High-end Tourism Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High-end Tourism Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High-end Tourism Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High-end Tourism Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High-end Tourism Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-end Tourism?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High-end Tourism?

Key companies in the market include TUI Group, Thomas Cook Group, Jet2 Holidays, Cox & Kings Ltd, Lindblad Expeditions, Travcoa, Scott Dunn, Abercrombie & Kent Ltd, Micato Safaris, Tauck, Al Tayyar, Backroads, Zicasso, Exodus Travels, Butterfield & Robinson.

3. What are the main segments of the High-end Tourism?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-end Tourism," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-end Tourism report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-end Tourism?

To stay informed about further developments, trends, and reports in the High-end Tourism, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence