Key Insights

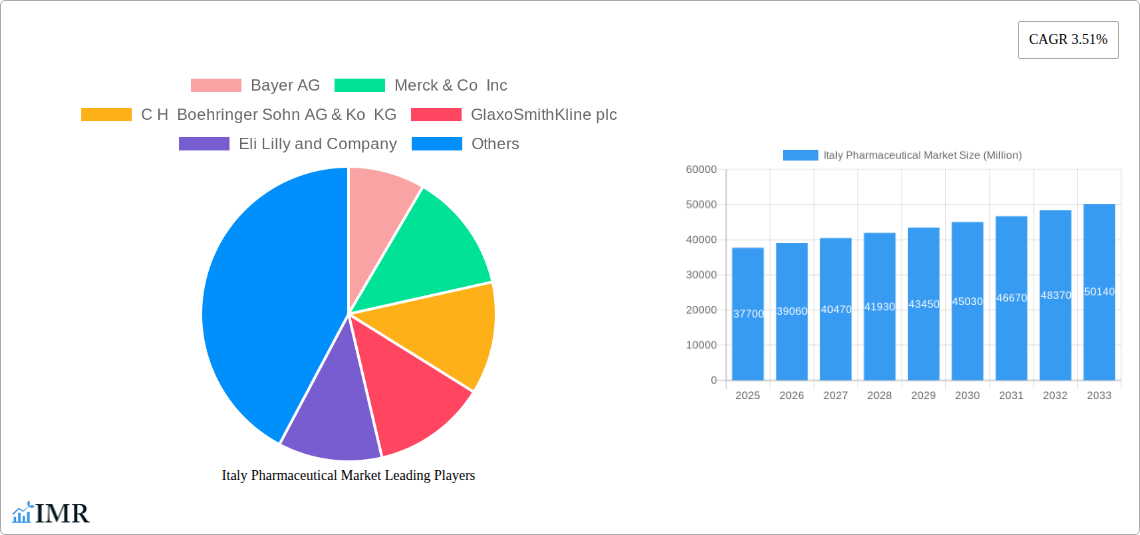

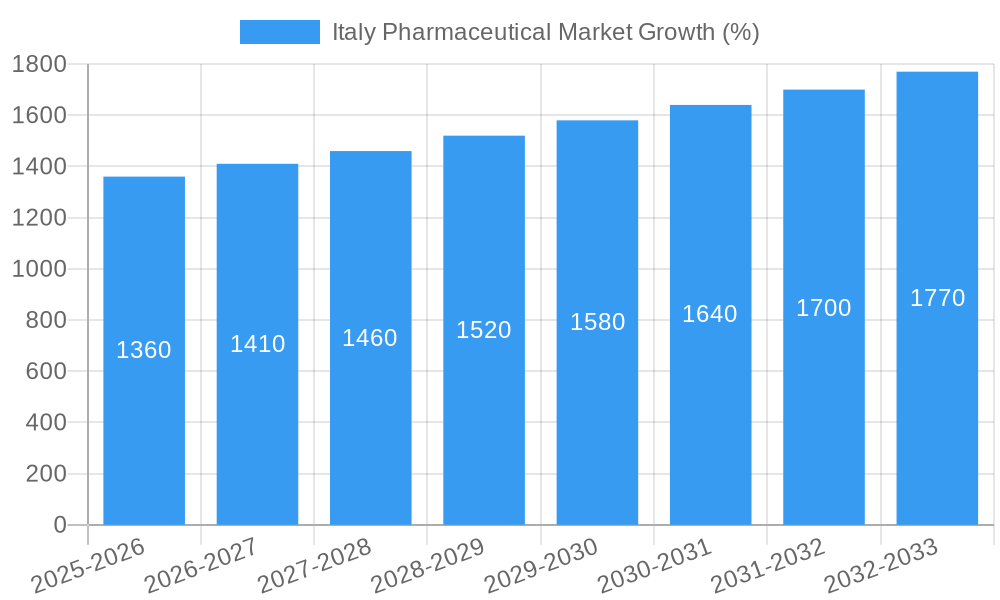

The Italian pharmaceutical market, valued at €37.70 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.51% from 2025 to 2033. This growth is driven by several key factors. An aging population, leading to increased demand for chronic disease management medications, plays a significant role. Furthermore, rising healthcare expenditure and increased government initiatives promoting healthcare accessibility contribute to market expansion. The market is segmented by therapeutic area (e.g., cardiovascular, oncology, and neurological), drug type (branded vs. generic), and prescription type (Rx vs. OTC). Branded drugs currently hold a larger market share, but the generic segment is anticipated to experience substantial growth due to cost-effectiveness and increasing affordability concerns. Technological advancements in drug delivery systems and personalized medicine are also shaping the market landscape, driving innovation and creating opportunities for new drug development and market entry. However, stringent regulatory approvals, pricing pressures from generic competition, and potential reimbursement challenges represent key constraints.

Major players like Bayer AG, Merck & Co Inc, Boehringer Ingelheim, GlaxoSmithKline, and others compete fiercely in this market. Their strategies often revolve around innovative drug development, strategic partnerships, and expanding their product portfolios to cater to the evolving needs of the Italian healthcare system. The competitive landscape is characterized by both intense competition and collaboration, as companies seek to secure market share and develop novel treatment options. The market's future growth is expected to be particularly influenced by the success of new drug launches, the expansion of telemedicine and remote patient monitoring, and the evolving regulatory landscape. The increasing focus on value-based healthcare will also likely drive changes in market dynamics, prioritizing cost-effectiveness and patient outcomes.

Italy Pharmaceutical Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy pharmaceutical market, covering market dynamics, growth trends, key segments, and competitive landscape from 2019 to 2033. The report leverages extensive data and expert insights to offer actionable intelligence for industry professionals, investors, and strategic decision-makers. It includes detailed forecasts, highlighting growth opportunities and potential challenges within the Italian pharmaceutical sector. This analysis delves into both parent and child markets, offering a granular view of this dynamic industry.

Italy Pharmaceutical Market Dynamics & Structure

The Italian pharmaceutical market is a complex ecosystem characterized by a blend of multinational giants and domestic players. Market concentration is moderate, with several key players holding significant market share, yet leaving room for smaller, specialized firms. Technological innovation, particularly in areas like personalized medicine and biosimilars, is a crucial driver, but faces challenges including high R&D costs and regulatory hurdles. The regulatory framework, while stringent, aims to ensure drug safety and efficacy. Generic competition exerts significant pressure on branded drug prices, forcing innovation in delivery systems and drug formulations. The market is influenced by an aging population, leading to increased demand for treatments of chronic conditions. M&A activity has been significant, with larger companies strategically acquiring smaller firms to expand their product portfolios and market reach. The xx deals closed in the past five years illustrate this trend.

- Market Concentration: Moderate, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Significant driver, focused on personalized medicine, biosimilars, and advanced drug delivery systems.

- Regulatory Framework: Stringent, emphasizing drug safety and efficacy, but can create barriers to entry.

- Competitive Landscape: Intense competition between branded and generic drug manufacturers.

- End-User Demographics: Aging population increases demand for chronic disease treatments.

- M&A Activity: Significant activity observed in the last five years, driven by strategic expansion and portfolio diversification.

Italy Pharmaceutical Market Growth Trends & Insights

The Italy pharmaceutical market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of €xx Million in 2024. This growth is projected to continue, with a forecast CAGR of xx% during the period 2025-2033, reaching a market value of €xx Million by 2033. Several factors contribute to this growth trajectory, including the increasing prevalence of chronic diseases, rising healthcare expenditure, and government initiatives to improve healthcare access. Technological advancements, such as the development of innovative therapies and personalized medicine, are further accelerating market expansion. However, pricing pressures from generic drugs and stringent regulatory requirements pose challenges to sustained growth. Consumer behavior is shifting towards greater awareness of treatment options and cost-effectiveness, influencing purchasing decisions. Market penetration of innovative therapies remains a key growth indicator.

Dominant Regions, Countries, or Segments in Italy Pharmaceutical Market

Within the Italian pharmaceutical market, the Prescription Drugs (Rx) segment dominates, accounting for xx% of the market in 2024. Within therapeutic classes, the Cardiovascular System and Nervous System segments are leading the market, driven by the high prevalence of cardiovascular and neurological disorders. The Northern region displays the highest market share due to higher healthcare expenditure and better access to healthcare services. Key drivers include the aging population, increasing prevalence of chronic diseases, and government investments in healthcare infrastructure. Growth potential lies in the expansion of generic drugs and the adoption of innovative therapies.

- By ATC/Therapeutic Class: Cardiovascular System, Nervous System, and Gastrointestinal System and Metabolism dominate.

- By Drug Type: Prescription Drugs (Rx) segment holds the largest market share.

- By Prescription Type: Prescription drugs are the dominant segment.

- Regional Dominance: Northern Italy leads in terms of market size and growth.

Italy Pharmaceutical Market Product Landscape

The Italian pharmaceutical market boasts a diverse product landscape, encompassing innovative branded drugs, cost-effective generics, and a growing range of biosimilars. Technological advancements drive the introduction of new formulations, improved delivery systems, and targeted therapies. Unique selling propositions frequently center on efficacy, safety, and improved patient compliance. The continuous development of personalized medicine and advanced diagnostic tools further enhances the product landscape's sophistication.

Key Drivers, Barriers & Challenges in Italy Pharmaceutical Market

Key Drivers: The aging population and rising prevalence of chronic diseases are primary drivers. Government healthcare initiatives and investments also stimulate market growth. Technological advances in drug development and delivery systems fuel innovation.

Challenges & Restraints: Stringent regulatory requirements pose significant barriers to market entry and approval. Pricing pressures from generic competition impact profitability. Supply chain disruptions and fluctuating raw material costs can impact production and availability. The intense competition among both domestic and international companies further complicates the market.

Emerging Opportunities in Italy Pharmaceutical Market

Emerging opportunities are presented by the increasing demand for biosimilars, the growing focus on personalized medicine, and the development of innovative therapies for previously untreatable diseases. The expansion of telehealth and digital health solutions creates new pathways to patient care and improved medication adherence. Untapped market segments include niche therapeutic areas and the adoption of advanced technologies in healthcare.

Growth Accelerators in the Italy Pharmaceutical Market Industry

Strategic partnerships and collaborations are driving innovation and market expansion. Technological breakthroughs in drug discovery and delivery systems enhance treatment options and efficacy. Government support for research and development and healthcare infrastructure improvements stimulate growth. Investment in digital healthcare solutions further enhances efficiency and accessibility.

Key Players Shaping the Italy Pharmaceutical Market Market

- Bayer AG

- Merck & Co Inc

- C H Boehringer Sohn AG & Ko KG

- GlaxoSmithKline plc

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Bristol Myers Squibb Company

- Sanofi S A

Notable Milestones in Italy Pharmaceutical Market Sector

- August 2021: Cadila Healthcare partners with CHEMI SpA to launch a generic Deep Vein Thrombosis drug in the US market. (This milestone indirectly impacts the Italian market through the experience gained and potential future collaborations.)

- April 2020: Primex Pharmaceuticals and TheSi Farma launch OZASED, oral midazolam, in the Italian pediatric anesthesia market.

In-Depth Italy Pharmaceutical Market Market Outlook

The Italian pharmaceutical market is poised for continued growth, driven by technological advancements, strategic partnerships, and increasing healthcare spending. The focus on innovative therapies and personalized medicine presents significant opportunities for market expansion. Companies should focus on adapting to evolving regulatory landscapes and managing pricing pressures to maintain profitability and market share. Strategic investments in R&D and collaborations will be crucial for success in this competitive and dynamic market.

Italy Pharmaceutical Market Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Blood and Hematopoietic Organs

- 1.2. Cardiovascular System

- 1.3. Dermatological

- 1.4. Gastrointestinal System and Metabolism

- 1.5. Nervous System

- 1.6. Respiratory System

- 1.7. Others

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. OTC Drugs

Italy Pharmaceutical Market Segmentation By Geography

- 1. Italy

Italy Pharmaceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Expenditure; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. High Cost of Drugs

- 3.4. Market Trends

- 3.4.1. Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Pharmaceutical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Blood and Hematopoietic Organs

- 5.1.2. Cardiovascular System

- 5.1.3. Dermatological

- 5.1.4. Gastrointestinal System and Metabolism

- 5.1.5. Nervous System

- 5.1.6. Respiratory System

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. OTC Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Boehringer Sohn AG & Ko KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GlaxoSmithKline plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly and Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AbbVie Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Italy Pharmaceutical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Pharmaceutical Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Italy Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Italy Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 5: Italy Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 8: Italy Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 9: Italy Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 10: Italy Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Pharmaceutical Market?

The projected CAGR is approximately 3.51%.

2. Which companies are prominent players in the Italy Pharmaceutical Market?

Key companies in the market include Bayer AG, Merck & Co Inc, C H Boehringer Sohn AG & Ko KG, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Sanofi S A.

3. What are the main segments of the Italy Pharmaceutical Market?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Expenditure; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drugs.

8. Can you provide examples of recent developments in the market?

In August 2021, Cadila Healthcare entered into a partnership with Italian firm CHEMI SpA to launch a generic drug used in the treatment of Deep Vein Thrombosis, in the United States market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Pharmaceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Pharmaceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Pharmaceutical Market?

To stay informed about further developments, trends, and reports in the Italy Pharmaceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence