Key Insights

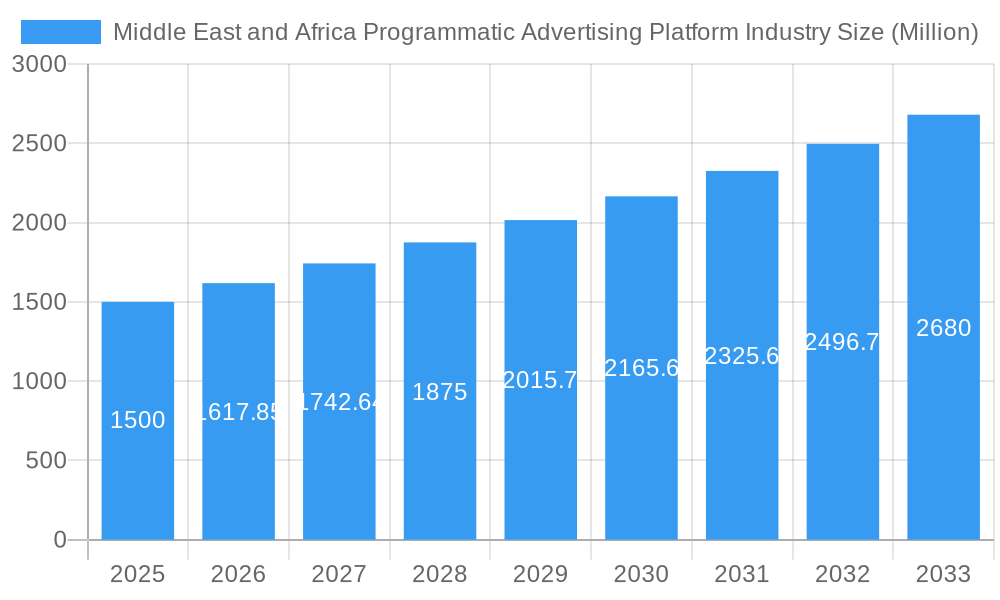

The Middle East and Africa (MEA) Programmatic Advertising Platform market is poised for substantial expansion, driven by increasing digital advertising adoption. The market is projected to reach $8.48 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.17% during the forecast period from 2025 to 2033. Key growth drivers include rising smartphone penetration, expanding internet accessibility, and the growing preference for targeted advertising solutions among businesses.

Middle East and Africa Programmatic Advertising Platform Industry Market Size (In Billion)

The market is segmented by enterprise size (SMBs and large enterprises), trading platform (RTB, Private Marketplace Guaranteed, Automated Guaranteed, Unreserved Fixed-rate), and advertising media (digital display and mobile display). Large enterprises currently represent the dominant segment, with RTB trading platforms capturing the largest market share due to their efficiency and cost-effectiveness. Advancements in data analytics are expected to further enhance audience targeting precision and campaign ROI.

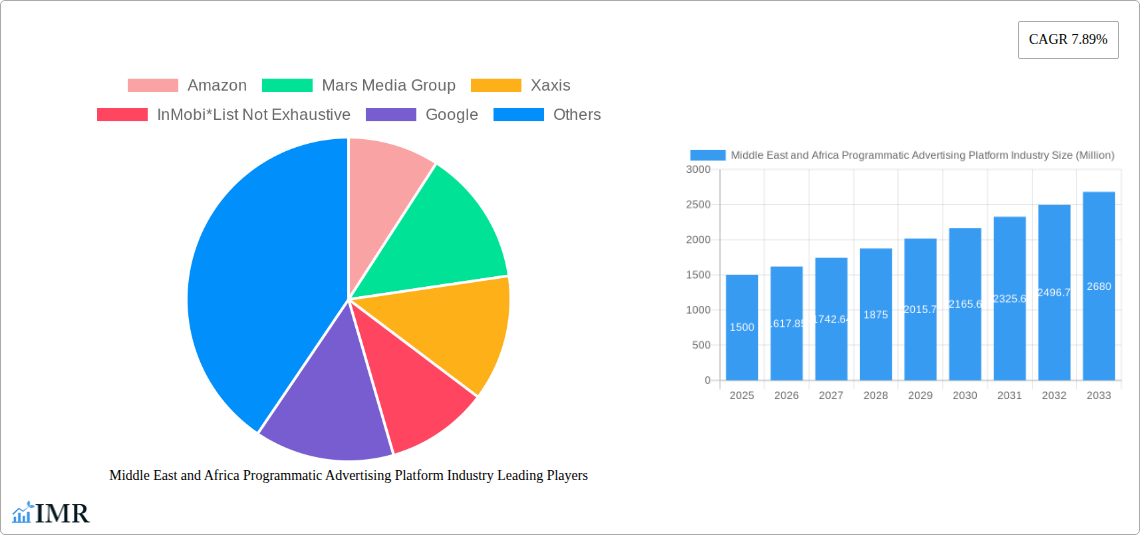

Middle East and Africa Programmatic Advertising Platform Industry Company Market Share

Despite challenges such as varying digital literacy levels, data privacy concerns, and infrastructure limitations in certain regions, the MEA Programmatic Advertising Platform market presents significant investment opportunities. Prominent global players like Google, Amazon, and Xaxis, alongside regional leaders such as InMobi and Tonic International, are actively participating in this dynamic market. While some countries demonstrate advanced digital adoption, others require strategic market penetration efforts. The focus on mobile advertising is anticipated to escalate, mirroring the region's high mobile penetration rates. Continued growth is expected, accelerated by strategic investments in technology and infrastructure development. Addressing data privacy and fostering digital literacy are critical for realizing the market's full potential.

Middle East & Africa Programmatic Advertising Platform Market: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) programmatic advertising platform industry, offering valuable insights for stakeholders across the advertising technology ecosystem. The report covers the period 2019-2033, with a focus on the estimated year 2025 and forecast period 2025-2033. We analyze market dynamics, growth trends, dominant segments, key players, and future opportunities, delivering crucial data to inform strategic decision-making. The total market size is projected to reach XX Million by 2033.

Middle East and Africa Programmatic Advertising Platform Industry Market Dynamics & Structure

The MEA programmatic advertising platform market is characterized by a dynamic interplay of technological advancements, regulatory landscapes, and competitive pressures. Market concentration is relatively moderate, with a mix of global giants and regional players vying for market share. Technological innovation, particularly in areas like AI-powered ad optimization and programmatic DOOH, is a significant driver. However, regulatory complexities and data privacy concerns present challenges. The market is witnessing increased M&A activity as larger companies seek to consolidate their position and expand their capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Key drivers include AI, machine learning, and the expansion into new advertising channels like in-game advertising and DOOH.

- Regulatory Framework: Varying regulations across different MEA countries impact data privacy and ad transparency, creating compliance challenges.

- Competitive Substitutes: Traditional advertising methods still compete, but programmatic's efficiency and targeting capabilities are driving adoption.

- End-User Demographics: Growth is fueled by the increasing internet penetration and smartphone adoption across the MEA region, especially amongst younger demographics.

- M&A Trends: A moderate number of M&A deals (XX in 2024) are expected, driven by consolidation and expansion into new markets.

Middle East and Africa Programmatic Advertising Platform Industry Growth Trends & Insights

The MEA programmatic advertising platform market exhibits strong growth potential. Driven by increasing digital adoption, mobile penetration, and the expanding e-commerce landscape, the market size has shown consistent growth from XX Million in 2019 to an estimated XX Million in 2025. This translates to a CAGR of XX% during the historical period (2019-2024) and is projected to reach XX Million by 2033. Technological disruptions, such as the rise of CTV advertising and the integration of programmatic with other marketing channels, are further accelerating growth. Consumer behavior shifts, notably increased reliance on mobile devices and the adoption of streaming platforms, are key factors influencing this expansion. The market penetration rate is expected to reach XX% by 2033.

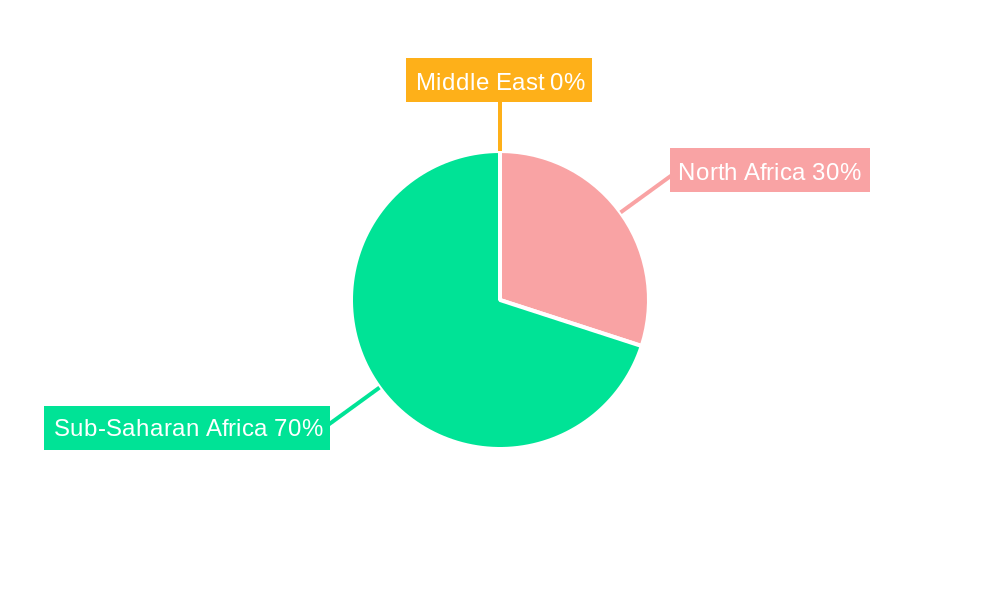

Dominant Regions, Countries, or Segments in Middle East and Africa Programmatic Advertising Platform Industry

The South Africa and the United Arab Emirates are currently the leading markets, representing XX% and XX% of the total market value respectively, in 2025. This dominance is attributed to their relatively advanced digital infrastructure, higher internet and smartphone penetration, and a thriving e-commerce sector.

By Enterprise Size: Large enterprises currently dominate, accounting for XX% of spending, but SMB adoption is rapidly growing.

By Trading Platform: Real-Time Bidding (RTB) is the most prevalent platform, holding XX% of the market share in 2025, followed by Private Marketplace Guaranteed.

By Advertising Media: Mobile display advertising shows the fastest growth, exceeding Digital display advertising in market share by 2025.

- Key Drivers for South Africa and the UAE: Robust digital infrastructure, high mobile penetration rates, progressive regulatory frameworks (relatively speaking), and a burgeoning digital advertising ecosystem.

- Growth Potential in other regions: Significant untapped potential exists across North Africa and sub-Saharan Africa, fueled by increasing internet accessibility and smartphone adoption.

Middle East and Africa Programmatic Advertising Platform Industry Product Landscape

The MEA programmatic advertising platform market offers a diverse range of solutions, from self-serve platforms designed for SMBs to sophisticated enterprise-grade solutions tailored for large agencies and brands. Product innovations focus on enhancing targeting capabilities, improving measurement and reporting, and integrating with other marketing technologies (MarTech) to provide a unified view of campaign performance. The key differentiators among these platforms include their technological capabilities (AI-powered optimization, advanced analytics), the breadth of inventory they access, and the level of support and service they provide.

Key Drivers, Barriers & Challenges in Middle East and Africa Programmatic Advertising Platform Industry

Key Drivers:

- Increasing digital adoption and smartphone penetration.

- Growth of e-commerce and digital marketing spending.

- Technological advancements in ad targeting and measurement.

- Growing demand for data-driven advertising solutions.

Challenges and Restraints:

- Limited digital infrastructure in certain regions.

- Data privacy concerns and regulatory complexities.

- Lack of skilled workforce in programmatic advertising.

- Competition from traditional advertising channels.

- Fragmentation of the media landscape. This leads to difficulties in securing high-quality inventory and reaching a broad audience. The estimated cost associated with this fragmentation is xx million annually.

Emerging Opportunities in Middle East and Africa Programmatic Advertising Platform Industry

- Expansion into untapped markets within sub-Saharan Africa.

- Growth of programmatic DOOH (Digital Out-of-Home) advertising.

- Increasing adoption of CTV (Connected TV) advertising.

- Development of innovative programmatic solutions for specific industries.

- Growing demand for advanced analytics and measurement solutions.

Growth Accelerators in the Middle East and Africa Programmatic Advertising Platform Industry Industry

Sustained long-term growth will be driven by continued investment in digital infrastructure across the MEA region, fostering greater access to the internet and mobile technologies. Strategic partnerships between technology providers and local media companies will be crucial in expanding the reach of programmatic advertising and driving wider adoption among advertisers. Further innovation in targeting and measurement technologies, together with the emergence of new advertising channels and formats, will continue to attract new clients and fuel market expansion.

Notable Milestones in Middle East and Africa Programmatic Advertising Platform Industry Sector

- July 2022: StackAdapt launches in-game advertising inventory, expanding its multi-channel offering.

- June 2022: Lemma partners with Continuum to accelerate programmatic DOOH adoption in the Middle East.

In-Depth Middle East and Africa Programmatic Advertising Platform Industry Market Outlook

The MEA programmatic advertising platform market is poised for significant growth over the next decade. Continued digital transformation, expanding mobile penetration, and the rise of new advertising channels will drive increased demand. Companies that focus on innovation, data privacy compliance, and building strong partnerships will be best positioned to capitalize on the substantial opportunities that exist within this dynamic market. The market is expected to show a CAGR of XX% between 2025 and 2033, reaching a projected value of XX Million.

Middle East and Africa Programmatic Advertising Platform Industry Segmentation

-

1. Trading Platform

- 1.1. Real Time Bidding (RTB)

- 1.2. Private Marketplace Guaranteed

- 1.3. Automated Guaranteed

- 1.4. Unreserved Fixed-rate

-

2. Advertising Media

- 2.1. Digital Display

- 2.2. Mobile Display

-

3. Enterprise size

- 3.1. SMB's

- 3.2. Large Enterprises

Middle East and Africa Programmatic Advertising Platform Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Programmatic Advertising Platform Industry Regional Market Share

Geographic Coverage of Middle East and Africa Programmatic Advertising Platform Industry

Middle East and Africa Programmatic Advertising Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Digital Media Advertisement; Better use of Data for Programmatic Advertising

- 3.3. Market Restrains

- 3.3.1. Growth in Gesture Recognition Market

- 3.4. Market Trends

- 3.4.1. Increase in adoption of Digital Advertising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Programmatic Advertising Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Trading Platform

- 5.1.1. Real Time Bidding (RTB)

- 5.1.2. Private Marketplace Guaranteed

- 5.1.3. Automated Guaranteed

- 5.1.4. Unreserved Fixed-rate

- 5.2. Market Analysis, Insights and Forecast - by Advertising Media

- 5.2.1. Digital Display

- 5.2.2. Mobile Display

- 5.3. Market Analysis, Insights and Forecast - by Enterprise size

- 5.3.1. SMB's

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Trading Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mars Media Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Xaxis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InMobi*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tonic International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Executive Digital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boopin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gamned!

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Middle East and Africa Programmatic Advertising Platform Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Programmatic Advertising Platform Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Trading Platform 2020 & 2033

- Table 2: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Advertising Media 2020 & 2033

- Table 3: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Enterprise size 2020 & 2033

- Table 4: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Trading Platform 2020 & 2033

- Table 6: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Advertising Media 2020 & 2033

- Table 7: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Enterprise size 2020 & 2033

- Table 8: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Programmatic Advertising Platform Industry?

The projected CAGR is approximately 4.17%.

2. Which companies are prominent players in the Middle East and Africa Programmatic Advertising Platform Industry?

Key companies in the market include Amazon, Mars Media Group, Xaxis, InMobi*List Not Exhaustive, Google, Tonic International, Executive Digital, Boopin, Gamned!.

3. What are the main segments of the Middle East and Africa Programmatic Advertising Platform Industry?

The market segments include Trading Platform, Advertising Media, Enterprise size.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Digital Media Advertisement; Better use of Data for Programmatic Advertising.

6. What are the notable trends driving market growth?

Increase in adoption of Digital Advertising.

7. Are there any restraints impacting market growth?

Growth in Gesture Recognition Market.

8. Can you provide examples of recent developments in the market?

July 2022 - StackAdapt, a self-serve programmatic advertising platform, launched an emerging channel of in-game inventory, adding a new element of non-intrusive, highly visible advertising to StackAdapt's robust multi-channel offering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Programmatic Advertising Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Programmatic Advertising Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Programmatic Advertising Platform Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Programmatic Advertising Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence