Key Insights

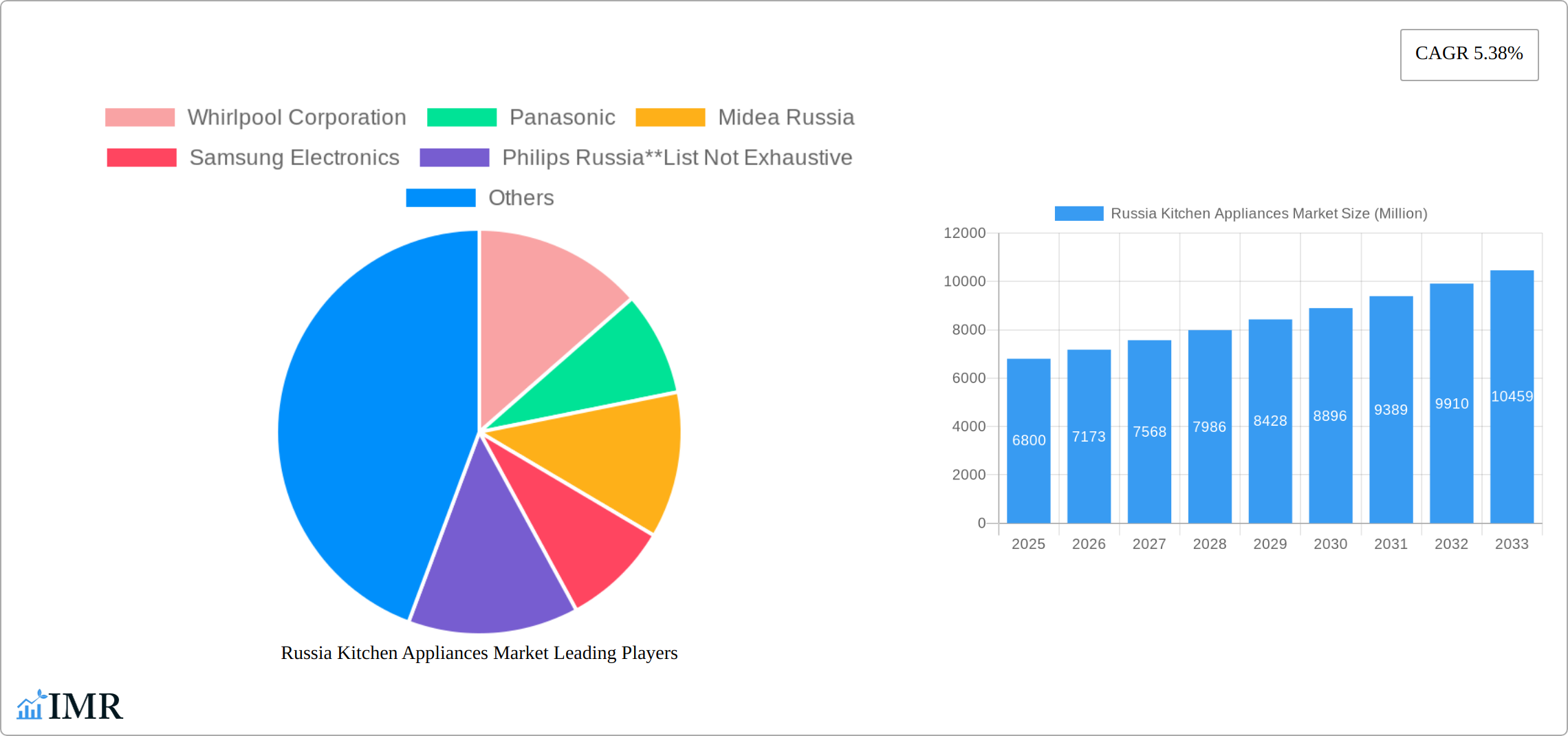

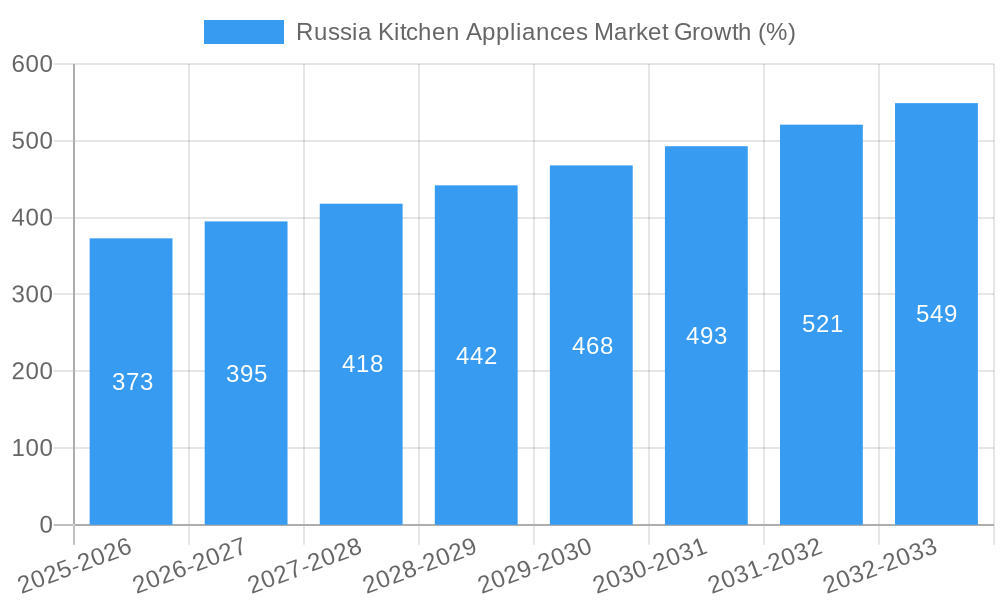

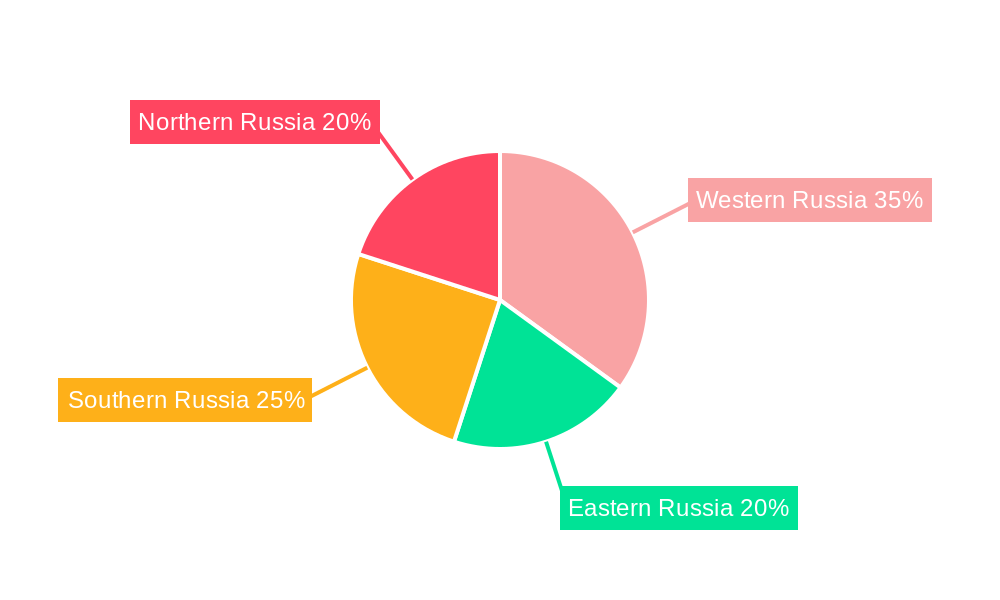

The Russia kitchen appliances market, valued at $6.80 billion in 2025, is projected to experience robust growth, driven by a rising middle class with increased disposable incomes and a preference for modern, convenient kitchen solutions. Factors such as urbanization, changing lifestyles, and the growing popularity of online shopping are further fueling market expansion. The market is segmented by product type (food processing appliances, small kitchen appliances like blenders and toasters, large kitchen appliances such as refrigerators and ovens, and other product types) and distribution channel (specialist retailers, e-commerce platforms, supermarkets and hypermarkets, department stores, and other channels). E-commerce is expected to witness significant growth, driven by increased internet penetration and consumer preference for online convenience. While the market faces challenges such as economic fluctuations and competition from international brands, the long-term outlook remains positive, fueled by sustained demand and technological advancements leading to innovative product offerings. The consistent CAGR of 5.38% suggests a steady and predictable growth trajectory over the forecast period (2025-2033). Leading brands like Whirlpool, Panasonic, Midea, Samsung, and Electrolux are vying for market share, employing strategies focused on product differentiation, brand building, and strategic partnerships to maintain competitiveness. Regional variations exist, with potential for growth in all areas (Western, Eastern, Southern, and Northern Russia), however, investment in infrastructure and distribution networks may influence regional performance differently.

The diverse range of product types creates various opportunities for growth within distinct market segments. Large kitchen appliances, due to their higher price point, could see more significant profit margins, while the small kitchen appliances segment is likely to benefit from higher volume sales and the growing trend of multi-functional appliances. Successful players will likely focus on providing energy-efficient, technologically advanced products that cater to the evolving consumer preferences in Russia. Understanding the nuances of regional preferences and adapting distribution strategies will be key factors in achieving success within this dynamic market. Furthermore, exploring opportunities within the burgeoning e-commerce segment presents substantial potential for increased reach and market penetration. Analyzing specific consumer needs and preferences in each region will enable effective targeting of marketing campaigns and product development initiatives.

Russia Kitchen Appliances Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia kitchen appliances market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by product type (Food Processing, Small Kitchen, Large Kitchen, Other Product Types) and distribution channel (Specialist Retailers, E-commerce, Supermarket and Hypermarkets, Department Stores, Other Distribution Channels), providing granular data and analysis. The market size is presented in million units.

Russia Kitchen Appliances Market Dynamics & Structure

The Russia kitchen appliances market exhibits a complex interplay of factors influencing its structure and growth trajectory. Market concentration is currently moderate, with several key players vying for market share, alongside a number of smaller, regional players. Technological innovation, particularly in smart appliances and energy efficiency, is a significant driver, though hindered by factors such as fluctuating energy prices and consumer purchasing power. Regulatory frameworks impacting energy consumption standards and safety regulations influence both product design and market access. The presence of competitive product substitutes, such as traditional cooking methods, also impacts market growth. End-user demographics, particularly the rise of urban middle-class households with increasing disposable incomes, present significant growth opportunities. M&A activity has been notable, with recent examples such as Whirlpool's divestment impacting market consolidation.

- Market Concentration: Moderate, with xx% market share held by the top 5 players in 2024.

- Technological Innovation: Significant driver, focusing on smart appliances and energy efficiency. Innovation is challenged by high R&D costs and sanctions.

- Regulatory Framework: Influences product safety and energy efficiency standards.

- Competitive Substitutes: Traditional cooking methods present competition, particularly in rural areas.

- End-User Demographics: Growing urban middle class fuels demand for modern kitchen appliances.

- M&A Activity: Recent examples include Whirlpool's sale of its Russian operations in July 2022, indicating market consolidation and adaptation to geopolitical factors.

Russia Kitchen Appliances Market Growth Trends & Insights

The Russia kitchen appliances market experienced fluctuating growth during the historical period (2019-2024), influenced by economic sanctions and geopolitical instability. Market size in 2024 is estimated at xx million units. The forecast period (2025-2033) projects a CAGR of xx%, driven by factors including rising disposable incomes, urbanization, and increasing adoption of modern kitchen appliances. Technological disruptions, including the rise of smart appliances with integrated connectivity and AI features, are transforming consumer preferences. Consumer behavior is shifting towards premium, feature-rich appliances, while value-conscious consumers still represent a large segment of the market. Adoption rates vary significantly across different product segments and distribution channels.

Dominant Regions, Countries, or Segments in Russia Kitchen Appliances Market

The Moscow and Saint Petersburg regions dominate the Russia kitchen appliances market due to high population density, higher disposable incomes, and greater access to modern retail channels. Within product types, the Small Kitchen Appliances segment (blenders, toasters, etc.) holds the largest market share (xx%) due to relatively lower price points and broad consumer appeal. E-commerce is exhibiting strong growth (xx% CAGR), driven by increasing internet penetration and convenience for consumers. However, specialist retailers retain a significant market share (xx%) due to their expertise and ability to offer personalized services.

- Key Drivers: Urbanization, rising disposable incomes, growing e-commerce penetration.

- Dominant Segments: Small Kitchen Appliances, Specialist Retailers.

- Regional Dominance: Moscow and Saint Petersburg regions, driven by population density and higher purchasing power.

Russia Kitchen Appliances Market Product Landscape

The Russia kitchen appliances market features a diverse range of products, from basic models to sophisticated, smart appliances. Innovation focuses on energy efficiency, improved functionality, and smart connectivity features, mirroring global trends. Unique selling propositions (USPs) often center around design aesthetics, advanced technology (AI, connectivity), and ease of use. Technological advancements are particularly evident in built-in appliances, reflecting growing preference for integrated kitchen designs.

Key Drivers, Barriers & Challenges in Russia Kitchen Appliances Market

Key Drivers:

- Rising disposable incomes among the urban middle class.

- Increasing preference for modern, convenient kitchen appliances.

- Technological advancements, including smart appliances and energy-efficient models.

Challenges & Restraints:

- Economic sanctions and geopolitical instability impacting imports and investment.

- Fluctuating exchange rates increasing price volatility.

- Supply chain disruptions potentially limiting product availability.

Emerging Opportunities in Russia Kitchen Appliances Market

- Growth of the e-commerce sector presents opportunities for expansion.

- Demand for energy-efficient and eco-friendly appliances is increasing.

- Focus on customizable and modular appliances to cater to individual needs.

Growth Accelerators in the Russia Kitchen Appliances Market Industry

Strategic partnerships between domestic and international brands can accelerate market growth, enabling access to technology and distribution networks. Technological breakthroughs in areas such as AI-powered appliances and smart kitchen integration will further drive market expansion. Government initiatives promoting energy efficiency in household appliances can stimulate demand for advanced, energy-saving products.

Key Players Shaping the Russia Kitchen Appliances Market Market

- Whirlpool Corporation

- Panasonic

- Midea Russia

- Samsung Electronics

- Philips Russia

- Moulinex

- Electrolux

- De'Longhi Russia

- Bosch Russia

- LG Electronics

Notable Milestones in Russia Kitchen Appliances Market Sector

- March 2023: Samsung launched its 2023 Bespoke home appliance range, including 27 models with wireless connectivity and AI features. This signifies a push towards premium, smart appliances.

- July 2022: Whirlpool sold its Russian operations to Arcelik for USD 231 million, reflecting adjustments to the geopolitical landscape.

- March 2022: LG Electronics suspended shipments to Russia, highlighting the impact of sanctions on market supply.

In-Depth Russia Kitchen Appliances Market Market Outlook

The Russia kitchen appliances market is poised for continued growth, driven by a combination of factors including improving consumer purchasing power, technological innovation, and the expansion of e-commerce. Strategic investments in advanced manufacturing and distribution networks will be crucial for companies seeking to capitalize on this growth. Focus on energy efficiency, smart features, and customized product offerings will become increasingly important in attracting and retaining consumers.

Russia Kitchen Appliances Market Segmentation

-

1. Product type

- 1.1. Food Processing

- 1.2. Small Kitchen

- 1.3. Large Kitchen

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Specialist Retailers

- 2.2. E-Commerce

- 2.3. Supermarket and Hypermarkets

- 2.4. Department Stores

- 2.5. Other Distribution Channels

Russia Kitchen Appliances Market Segmentation By Geography

- 1. Russia

Russia Kitchen Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Rising competition among the players

- 3.4. Market Trends

- 3.4.1. Solid Demand Growth For Small Cooking Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Food Processing

- 5.1.2. Small Kitchen

- 5.1.3. Large Kitchen

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialist Retailers

- 5.2.2. E-Commerce

- 5.2.3. Supermarket and Hypermarkets

- 5.2.4. Department Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. Western Russia Russia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Whirlpool Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Panasonic

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Midea Russia

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung Electronics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Philips Russia**List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Moulinex

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electrolux

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 De'Longhi Russia

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Russia

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LG Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Russia Kitchen Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Kitchen Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Kitchen Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Kitchen Appliances Market Revenue Million Forecast, by Product type 2019 & 2032

- Table 3: Russia Kitchen Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Russia Kitchen Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Kitchen Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Kitchen Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Kitchen Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Kitchen Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Kitchen Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Kitchen Appliances Market Revenue Million Forecast, by Product type 2019 & 2032

- Table 11: Russia Kitchen Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Russia Kitchen Appliances Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Kitchen Appliances Market?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Russia Kitchen Appliances Market?

Key companies in the market include Whirlpool Corporation, Panasonic, Midea Russia, Samsung Electronics, Philips Russia**List Not Exhaustive, Moulinex, Electrolux, De'Longhi Russia, Bosch Russia, LG Electronics.

3. What are the main segments of the Russia Kitchen Appliances Market?

The market segments include Product type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Solid Demand Growth For Small Cooking Appliances.

7. Are there any restraints impacting market growth?

Rising competition among the players.

8. Can you provide examples of recent developments in the market?

March 2023: Samsung's electronics new home appliances introduced Samsung’s 2023 Bespoke products will expand to 27 models. Can be wirelessly connected. Fifteen of them boast AI-enabled functions to cater to the users’ demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Kitchen Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Kitchen Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Kitchen Appliances Market?

To stay informed about further developments, trends, and reports in the Russia Kitchen Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence