Key Insights

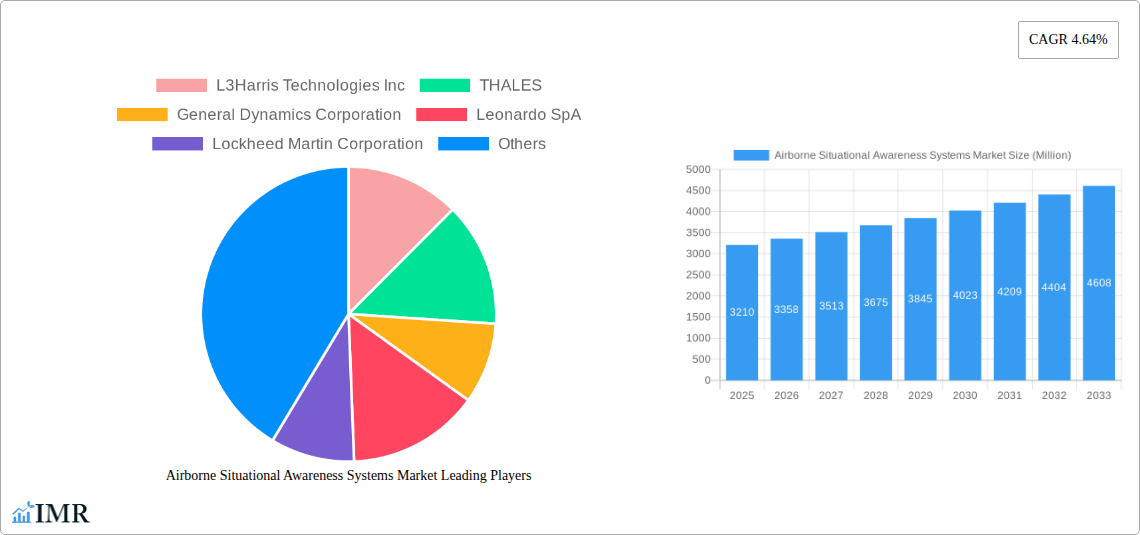

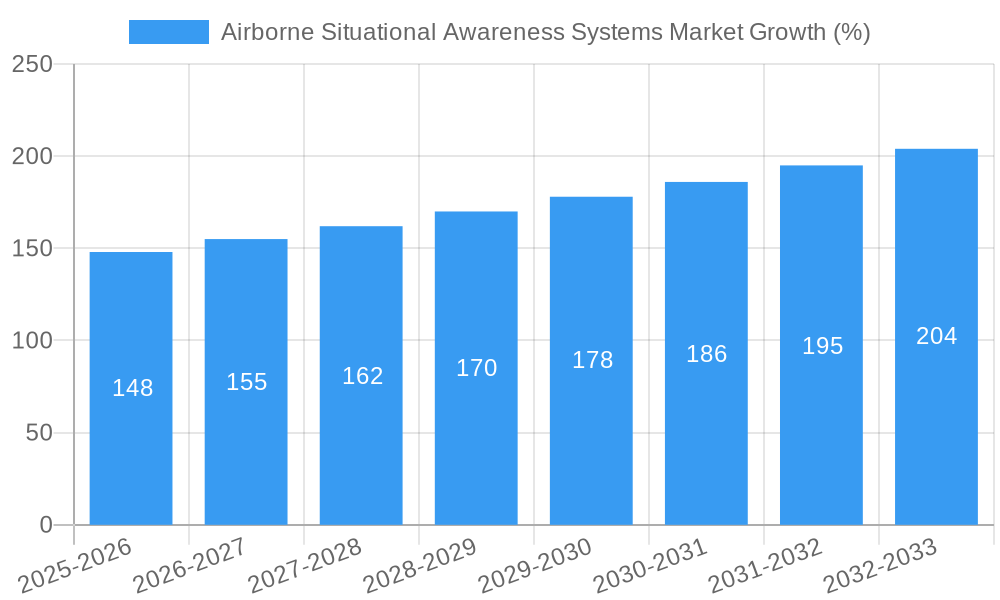

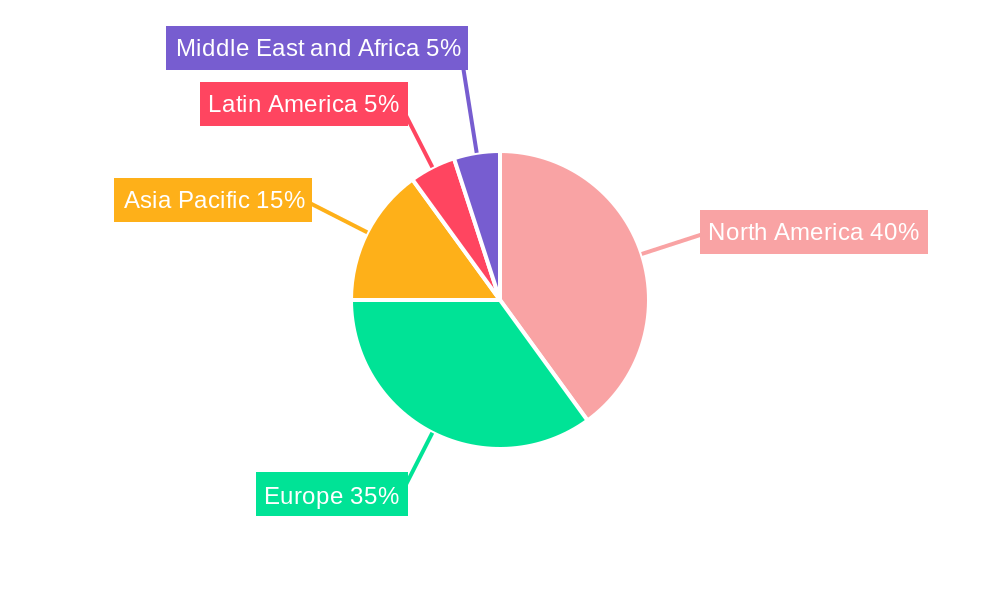

The Airborne Situational Awareness Systems market, valued at $3.21 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, increasing cross-border conflicts, and the persistent need for enhanced military preparedness. The market's Compound Annual Growth Rate (CAGR) of 4.64% from 2025 to 2033 indicates a steady expansion, fueled by technological advancements in sensor technology, improved data processing capabilities, and the integration of artificial intelligence (AI) and machine learning (ML) for real-time threat detection and analysis. Key segments driving growth include Command and Control systems, crucial for coordinated operations, and advanced RADARs and Optronics, offering enhanced target identification and tracking capabilities. The increasing demand for improved situational awareness across diverse military platforms, including fighter jets, helicopters, and unmanned aerial vehicles (UAVs), further contributes to market expansion. Competitive landscape analysis reveals key players such as L3Harris, Thales, and Lockheed Martin actively investing in research and development to maintain their market share and introduce innovative solutions. Regional growth is expected to be geographically diverse, with North America and Europe maintaining significant market shares due to their robust defense budgets and technological advancements, while the Asia-Pacific region is projected to witness considerable growth driven by increasing defense spending and modernization initiatives.

The market's growth, however, faces certain restraints. High initial investment costs associated with the development and deployment of sophisticated Airborne Situational Awareness Systems can limit adoption, particularly in developing nations. Furthermore, stringent regulatory frameworks and security concerns surrounding data integrity and cybersecurity pose significant challenges. The market will likely see increased focus on the development of more cost-effective, lightweight, and energy-efficient systems to overcome these limitations. The integration of diverse sensor data sources and the development of robust data fusion algorithms are crucial for improving the overall effectiveness and reliability of these systems, making interoperability and seamless data exchange critical areas for future innovation. The market's success will depend on the ongoing development of advanced technologies and the successful mitigation of the existing constraints.

Airborne Situational Awareness Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Airborne Situational Awareness Systems market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by Type (Command and Control, RADARs, Optronics, Other Types) and Component (Sensors, Displays and Notification Systems, Other Components), offering granular insights into this crucial sector of the defense and aerospace industries. The market is projected to reach xx Million units by 2033.

Airborne Situational Awareness Systems Market Dynamics & Structure

The Airborne Situational Awareness Systems market is characterized by a moderately consolidated structure, with key players holding significant market share. Market concentration is driven by high barriers to entry, including substantial R&D investments and stringent regulatory approvals. Technological innovation, particularly in sensor technology and AI-driven data analytics, is a major growth driver. Regulatory frameworks, including export controls and cybersecurity standards, significantly influence market dynamics. The market also witnesses competitive substitution from emerging technologies, such as improved satellite imagery. M&A activity is relatively frequent, with larger companies acquiring smaller firms to bolster their technology portfolios and expand their market reach. Over the historical period (2019-2024), an estimated xx M&A deals were recorded, contributing to a xx% increase in market consolidation.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant advancements in sensor fusion, AI, and data analytics are driving market growth.

- Regulatory Frameworks: Stringent export controls and cybersecurity regulations shape market access and product development.

- Competitive Substitutes: Advances in satellite imagery and other remote sensing technologies pose competitive challenges.

- End-User Demographics: Primarily defense forces (Air Force, Navy, Army), but also expanding to civil aviation and homeland security.

- M&A Trends: Ongoing consolidation through acquisitions of smaller technology companies by larger defense contractors.

Airborne Situational Awareness Systems Market Growth Trends & Insights

The Airborne Situational Awareness Systems market experienced robust growth during the historical period (2019-2024), driven by increasing defense budgets globally and the growing demand for enhanced situational awareness capabilities across various platforms. The market size is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is fueled by technological advancements, such as the integration of AI and machine learning algorithms for improved threat detection and target identification. Furthermore, the increasing adoption of unmanned aerial vehicles (UAVs) and the demand for enhanced cybersecurity are significant drivers. Consumer behavior shifts towards greater reliance on real-time data analysis and predictive intelligence are also contributing factors. Market penetration is expected to increase from xx% in 2025 to xx% by 2033. Increased adoption in civil aviation is projected to contribute significantly to market growth.

Dominant Regions, Countries, or Segments in Airborne Situational Awareness Systems Market

North America currently holds the dominant position in the Airborne Situational Awareness Systems market, driven by robust defense spending, a strong technological base, and the presence of major industry players. Europe follows as a significant market, with ongoing investments in defense modernization programs. Within the segment breakdown, the Command and Control segment holds the largest market share, owing to its crucial role in coordinating various airborne assets. The Sensors component also dominates, reflecting the significance of advanced sensor technologies in situational awareness.

- Key Drivers in North America: High defense budgets, advanced technological capabilities, presence of major industry players.

- Key Drivers in Europe: Investments in defense modernization, growing demand for enhanced security capabilities.

- Dominant Segment (Type): Command and Control systems, owing to their critical role in coordinating diverse assets.

- Dominant Segment (Component): Sensors, reflecting the importance of advanced sensor technologies.

- Growth Potential: Asia-Pacific presents significant growth potential, driven by rising defense spending and increasing geopolitical tensions.

Airborne Situational Awareness Systems Market Product Landscape

The Airborne Situational Awareness Systems market offers a diverse range of products, including integrated sensor suites, advanced radar systems, high-resolution electro-optical/infrared (EO/IR) sensors, and sophisticated data fusion and display systems. These systems are characterized by continuous innovation, focusing on improved performance metrics such as enhanced range, resolution, and processing speed. Unique selling propositions often center on the seamless integration of multiple sensor modalities and advanced AI-driven algorithms for enhanced situational awareness and threat identification. Recent technological advancements include miniaturization, improved power efficiency, and enhanced cybersecurity features.

Key Drivers, Barriers & Challenges in Airborne Situational Awareness Systems Market

Key Drivers:

- Increased defense spending globally.

- Growing demand for enhanced situational awareness capabilities.

- Advancements in sensor technology, AI, and data analytics.

- Rising adoption of UAVs and other unmanned systems.

Key Challenges:

- High development and integration costs.

- Stringent regulatory compliance requirements.

- Supply chain disruptions impacting component availability.

- Intense competition among established industry players. This competition has resulted in a xx% decrease in average profit margins over the past 5 years.

Emerging Opportunities in Airborne Situational Awareness Systems Market

- Expansion into the civil aviation sector for enhanced air traffic management.

- Integration of advanced AI and machine learning for improved threat prediction and response.

- Development of lightweight, energy-efficient systems for UAVs and other unmanned platforms.

- Growth in the cybersecurity market to secure situational awareness data and systems.

Growth Accelerators in the Airborne Situational Awareness Systems Market Industry

Technological breakthroughs in sensor fusion, AI-powered analytics, and advanced data processing are driving sustained market growth. Strategic partnerships between defense contractors and technology firms are accelerating innovation and expanding market reach. Furthermore, the ongoing expansion of global defense budgets and a rising focus on enhancing national security bolster long-term growth prospects.

Key Players Shaping the Airborne Situational Awareness Systems Market Market

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Rafael Advanced Defense Systems Ltd

- BAE Systems PLC

- HENSOLDT AG

- RTX Corporation

- Northrop Grumman Corporation

- Saab AB

- Teledyne FLIR LLC

Notable Milestones in Airborne Situational Awareness Systems Market Sector

- 2022-Q3: L3Harris Technologies Inc. launched a new advanced radar system with improved target detection capabilities.

- 2023-Q1: Thales and Leonardo SpA announced a strategic partnership to develop next-generation sensor fusion technology.

- 2024-Q2: Lockheed Martin Corporation acquired a smaller company specializing in AI-driven data analytics for situational awareness systems. (Further specific milestones require more data for accuracy.)

In-Depth Airborne Situational Awareness Systems Market Market Outlook

The Airborne Situational Awareness Systems market is poised for continued robust growth, fueled by technological innovation, increasing defense budgets, and the expansion into new market segments. Strategic partnerships, coupled with investments in R&D, will further drive market expansion. The integration of AI and machine learning holds particularly significant potential for enhancing situational awareness capabilities and driving future market growth. The market presents substantial opportunities for companies with innovative technologies and strong partnerships within the defense and aerospace industries.

Airborne Situational Awareness Systems Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Displays and Notification Systems

- 1.3. Other Components

-

2. Type

- 2.1. Command and Control

- 2.2. RADARs

- 2.3. Optronics

- 2.4. Other Types

Airborne Situational Awareness Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Airborne Situational Awareness Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Sensor Segment is Expected to Grow with Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Displays and Notification Systems

- 5.1.3. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Command and Control

- 5.2.2. RADARs

- 5.2.3. Optronics

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Sensors

- 6.1.2. Displays and Notification Systems

- 6.1.3. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Command and Control

- 6.2.2. RADARs

- 6.2.3. Optronics

- 6.2.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Sensors

- 7.1.2. Displays and Notification Systems

- 7.1.3. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Command and Control

- 7.2.2. RADARs

- 7.2.3. Optronics

- 7.2.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Sensors

- 8.1.2. Displays and Notification Systems

- 8.1.3. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Command and Control

- 8.2.2. RADARs

- 8.2.3. Optronics

- 8.2.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Sensors

- 9.1.2. Displays and Notification Systems

- 9.1.3. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Command and Control

- 9.2.2. RADARs

- 9.2.3. Optronics

- 9.2.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Sensors

- 10.1.2. Displays and Notification Systems

- 10.1.3. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Command and Control

- 10.2.2. RADARs

- 10.2.3. Optronics

- 10.2.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Airborne Situational Awareness Systems Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Israel

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 L3Harris Technologies Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 THALES

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 General Dynamics Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Leonardo SpA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lockheed Martin Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Elbit Systems Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rafael Advanced Defense Systems Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 BAE Systems PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 HENSOLDT AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 RTX Corporatio

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Northrop Grumman Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Saab AB

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Teledyne FLIR LLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Airborne Situational Awareness Systems Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Airborne Situational Awareness Systems Market Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Airborne Situational Awareness Systems Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Component 2024 & 2032

- Figure 31: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2024 & 2032

- Figure 32: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Component 2024 & 2032

- Figure 37: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Component 2024 & 2032

- Figure 38: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Airborne Situational Awareness Systems Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Mexico Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Brazil Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Israel Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 34: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 42: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 50: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Latin America Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 55: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Airborne Situational Awareness Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: United Arab Emirates Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Saudi Arabia Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Israel Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Airborne Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airborne Situational Awareness Systems Market?

The projected CAGR is approximately 4.64%.

2. Which companies are prominent players in the Airborne Situational Awareness Systems Market?

Key companies in the market include L3Harris Technologies Inc, THALES, General Dynamics Corporation, Leonardo SpA, Lockheed Martin Corporation, Elbit Systems Ltd, Rafael Advanced Defense Systems Ltd, BAE Systems PLC, HENSOLDT AG, RTX Corporatio, Northrop Grumman Corporation, Saab AB, Teledyne FLIR LLC.

3. What are the main segments of the Airborne Situational Awareness Systems Market?

The market segments include Component, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.21 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Sensor Segment is Expected to Grow with Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airborne Situational Awareness Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airborne Situational Awareness Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airborne Situational Awareness Systems Market?

To stay informed about further developments, trends, and reports in the Airborne Situational Awareness Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence