Key Insights

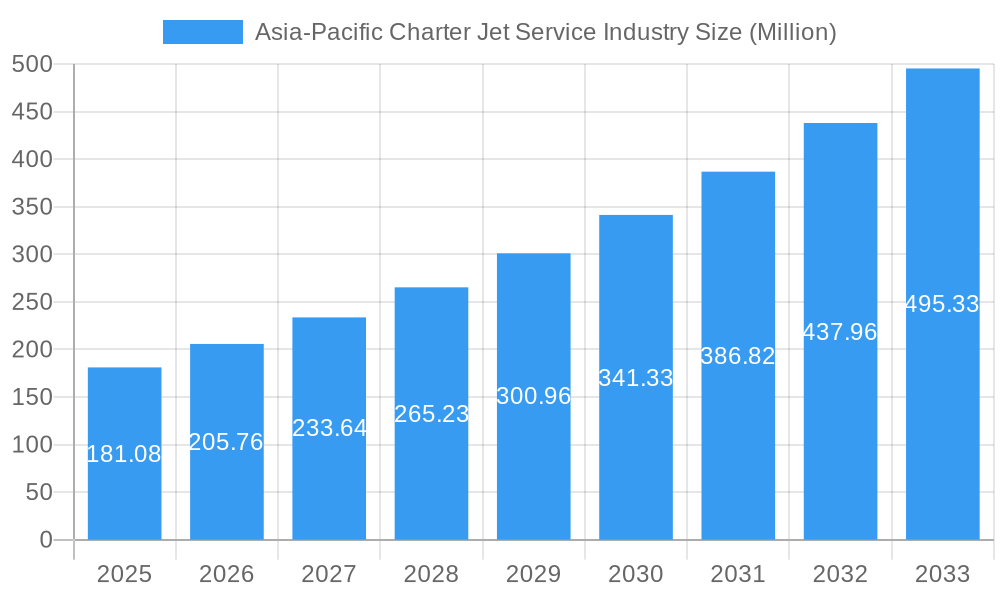

The Asia-Pacific charter jet service industry is experiencing robust growth, projected to reach \$181.08 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.77% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the burgeoning high-net-worth individual (HNWI) population across the region, particularly in China, India, and Australia, is driving increased demand for luxury and convenient air travel. Secondly, the rise of business aviation and the need for efficient corporate travel solutions further contributes to market growth. Finally, advancements in aircraft technology, offering enhanced comfort, safety, and fuel efficiency, are making charter jets increasingly attractive. However, the industry also faces challenges. Economic fluctuations can impact demand, and regulatory complexities in different countries within the region can create operational hurdles. Furthermore, competition from other modes of private transportation and the rising cost of fuel could potentially constrain growth. Segment-wise, the mid-size and large aircraft segments are expected to witness higher growth compared to light aircraft due to the increasing preference for spaciousness and added amenities. Within the region, China is likely to be the largest market followed by India and Australia, driven by economic growth and expanding business opportunities in these countries. The competitive landscape comprises both established international players and regional operators, creating a dynamic market with opportunities for both expansion and consolidation.

Asia-Pacific Charter Jet Service Industry Market Size (In Million)

The forecast period (2025-2033) suggests a continued upward trajectory for the Asia-Pacific charter jet service market. However, sustained growth will depend on mitigating the identified challenges, adapting to changing economic conditions, and capitalizing on emerging opportunities. Strategic partnerships, efficient fleet management, and investment in cutting-edge technology will be crucial for companies to thrive in this competitive environment. Focus on superior customer service and tailoring offerings to meet the diverse needs of the region's clientele will further bolster market position and drive growth. In summary, the industry's future is bright but dependent on proactive adaptation to the evolving landscape.

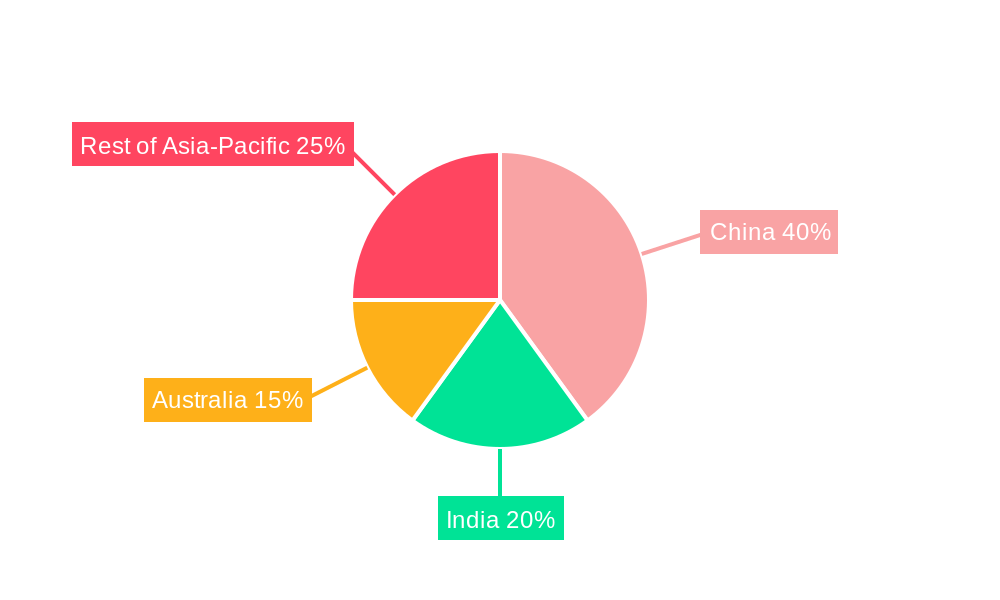

Asia-Pacific Charter Jet Service Industry Company Market Share

Asia-Pacific Charter Jet Service Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific charter jet service industry, covering market dynamics, growth trends, dominant segments, and key players. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report uses Million units as the unit of measurement for all values.

Asia-Pacific Charter Jet Service Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Asia-Pacific charter jet service industry. The market is characterized by a moderate level of concentration, with a few major players and numerous smaller operators. Technological innovation, particularly in areas like aircraft efficiency and in-flight connectivity, is a key driver of growth. Stringent safety regulations and varying airspace management across the region present challenges. The industry experiences mergers and acquisitions (M&A) activity, although the volume varies yearly. Substitute services like scheduled commercial flights or private helicopters also influence the market. End-user demographics are primarily high-net-worth individuals, corporations, and government entities.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on fuel efficiency, advanced avionics, and enhanced passenger experience.

- Regulatory Framework: Varies significantly across countries in the region, impacting operational costs and market entry.

- Competitive Substitutes: Scheduled airlines and helicopter services pose competition for short-haul travel.

- M&A Activity: An average of xx M&A deals per year were observed during the historical period (2019-2024).

- End-User Demographics: Predominantly high-net-worth individuals (HNWIs), corporate executives, and government officials.

Asia-Pacific Charter Jet Service Industry Growth Trends & Insights

The Asia-Pacific charter jet service market is experiencing robust growth, driven by rising disposable incomes, increasing business travel, and a preference for personalized travel experiences. The market size is projected to reach xx million in 2025 and is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements like improved aircraft efficiency and enhanced in-flight connectivity are accelerating adoption rates. Shifting consumer preferences towards premium and personalized travel further fuel market expansion. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Asia-Pacific Charter Jet Service Industry

China, followed by Australia and India, represent the largest segments within the Asia-Pacific charter jet service market. This dominance is attributed to strong economic growth, expanding HNWIs population, and improving infrastructure in these regions. Within aircraft segments, mid-size aircraft hold the largest market share due to their versatility in accommodating various group sizes and trip distances.

- China: Strong economic growth, expanding HNWIs population, and increasing business travel are key drivers. Market share: xx% in 2025.

- Australia: Developed infrastructure, significant tourism sector, and a robust business environment contribute to market growth. Market share: xx% in 2025.

- India: Rapid economic expansion, rising HNWIs, and growing air travel demand are fueling market growth. Market share: xx% in 2025.

- Singapore: Serves as a major hub for international business and leisure travel. Market share: xx% in 2025.

- South Korea: Growing business travel and increasing affluence drive demand. Market share: xx% in 2025.

- Aircraft Size Segment: Mid-size aircraft dominate due to their versatility and affordability compared to large aircraft. Market share: xx% in 2025.

Asia-Pacific Charter Jet Service Industry Product Landscape

The charter jet service industry offers a diverse range of aircraft sizes (light, mid-size, large), catering to various passenger capacities and travel distances. Key product innovations include advanced avionics for enhanced safety and efficiency, sophisticated in-flight entertainment systems, and customized cabin configurations to meet individual preferences. Unique selling propositions often include personalized service, seamless ground handling, and exclusive access to private terminals.

Key Drivers, Barriers & Challenges in Asia-Pacific Charter Jet Service Industry

Key Drivers:

- Rising disposable incomes across Asia-Pacific.

- Growing business travel and corporate demand for efficient travel solutions.

- Increasing preference for personalized and luxurious travel experiences.

- Technological advancements leading to improved aircraft efficiency and comfort.

Challenges:

- Stringent safety regulations and varying airspace management across the region.

- High operating costs, including fuel prices and maintenance expenses.

- Intense competition from scheduled airlines and other private aviation services.

- Infrastructure limitations in certain regions impacting accessibility and operational efficiency.

Emerging Opportunities in Asia-Pacific Charter Jet Service Industry

- Expansion into untapped markets: Smaller cities and regions in Asia-Pacific with growing affluence offer significant growth potential.

- Development of innovative service packages: Creating specialized offerings, such as medical evacuation or VIP transportation, can increase market share.

- Strategic partnerships with luxury travel operators: Collaborating with hotels, resorts, and other luxury providers can enhance brand positioning and customer loyalty.

Growth Accelerators in the Asia-Pacific Charter Jet Service Industry Industry

The Asia-Pacific charter jet service market's continued expansion will be driven by technological breakthroughs enhancing aircraft efficiency and passenger comfort, strategic partnerships to improve service delivery, and expansion into new markets with strong growth potential.

Key Players Shaping the Asia-Pacific Charter Jet Service Industry Market

- China Minsheng Investment Group

- Asian Aerospace Corporation

- Phenix Jet International LLC

- Global Jet International

- Pacific Flight Services

- Revesco Aviation Pty Ltd

- Deer Jet (Beijing) Co Ltd

- Club One Air

- AUSTRALIAN CORPORATE JET CENTRES

- Executive Jets Asia Pte Ltd

Notable Milestones in Asia-Pacific Charter Jet Service Industry Sector

- 2022-Q4: Deer Jet launches a new fleet of ultra-long-range aircraft, expanding its international reach.

- 2023-Q1: A major merger occurs between two significant players in the Australian market, creating a larger, more influential company. (Further details would be added here if available).

- 2023-Q2: Introduction of a new in-flight technology by Phenix Jet enhancing passenger communication.

In-Depth Asia-Pacific Charter Jet Service Industry Market Outlook

The Asia-Pacific charter jet service industry shows promising growth prospects due to several key factors. Rising affluence, coupled with technological advancements improving operational efficiency and passenger experience, will fuel significant market expansion. Strategic partnerships, regional infrastructure improvements, and expansion into less-developed markets represent key strategic opportunities for industry participants. The market is poised for continued growth and diversification in the coming years.

Asia-Pacific Charter Jet Service Industry Segmentation

-

1. Aircraft Size

- 1.1. Light

- 1.2. Mid-size

- 1.3. Large

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Australia

- 2.6. Singapore

- 2.7. Rest of Asia-Pacific

Asia-Pacific Charter Jet Service Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Singapore

- 7. Rest of Asia Pacific

Asia-Pacific Charter Jet Service Industry Regional Market Share

Geographic Coverage of Asia-Pacific Charter Jet Service Industry

Asia-Pacific Charter Jet Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Light Aircraft is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 5.1.1. Light

- 5.1.2. Mid-size

- 5.1.3. Large

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Australia

- 5.2.6. Singapore

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Singapore

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6. China Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6.1.1. Light

- 6.1.2. Mid-size

- 6.1.3. Large

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Australia

- 6.2.6. Singapore

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7. India Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7.1.1. Light

- 7.1.2. Mid-size

- 7.1.3. Large

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Australia

- 7.2.6. Singapore

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8. Japan Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8.1.1. Light

- 8.1.2. Mid-size

- 8.1.3. Large

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Singapore

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 9. South Korea Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 9.1.1. Light

- 9.1.2. Mid-size

- 9.1.3. Large

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Australia

- 9.2.6. Singapore

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 10. Australia Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 10.1.1. Light

- 10.1.2. Mid-size

- 10.1.3. Large

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Australia

- 10.2.6. Singapore

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 11. Singapore Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 11.1.1. Light

- 11.1.2. Mid-size

- 11.1.3. Large

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Australia

- 11.2.6. Singapore

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 12. Rest of Asia Pacific Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 12.1.1. Light

- 12.1.2. Mid-size

- 12.1.3. Large

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. South Korea

- 12.2.5. Australia

- 12.2.6. Singapore

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 China Minsheng Investment Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Asian Aerospace Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Phenix Jet International LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Global Jet International

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Pacific Flight Services

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Revesco Aviation Pty Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Deer Jet (Beijing) Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Club One Air

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AUSTRALIAN CORPORATE JET CENTRES

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Executive Jets Asia Pte Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 China Minsheng Investment Group

List of Figures

- Figure 1: Asia-Pacific Charter Jet Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Charter Jet Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 2: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 5: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 8: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 11: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 14: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 17: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 20: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 23: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Charter Jet Service Industry?

The projected CAGR is approximately 13.77%.

2. Which companies are prominent players in the Asia-Pacific Charter Jet Service Industry?

Key companies in the market include China Minsheng Investment Group, Asian Aerospace Corporation, Phenix Jet International LLC, Global Jet International, Pacific Flight Services, Revesco Aviation Pty Ltd, Deer Jet (Beijing) Co Ltd, Club One Air, AUSTRALIAN CORPORATE JET CENTRES, Executive Jets Asia Pte Ltd.

3. What are the main segments of the Asia-Pacific Charter Jet Service Industry?

The market segments include Aircraft Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 181.08 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Light Aircraft is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Charter Jet Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Charter Jet Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Charter Jet Service Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Charter Jet Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence