Key Insights

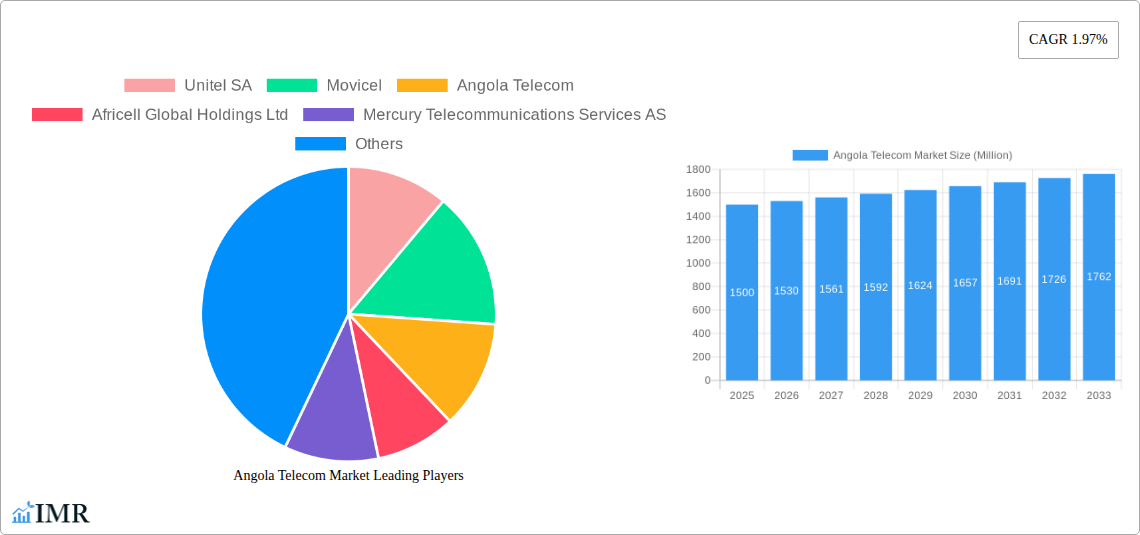

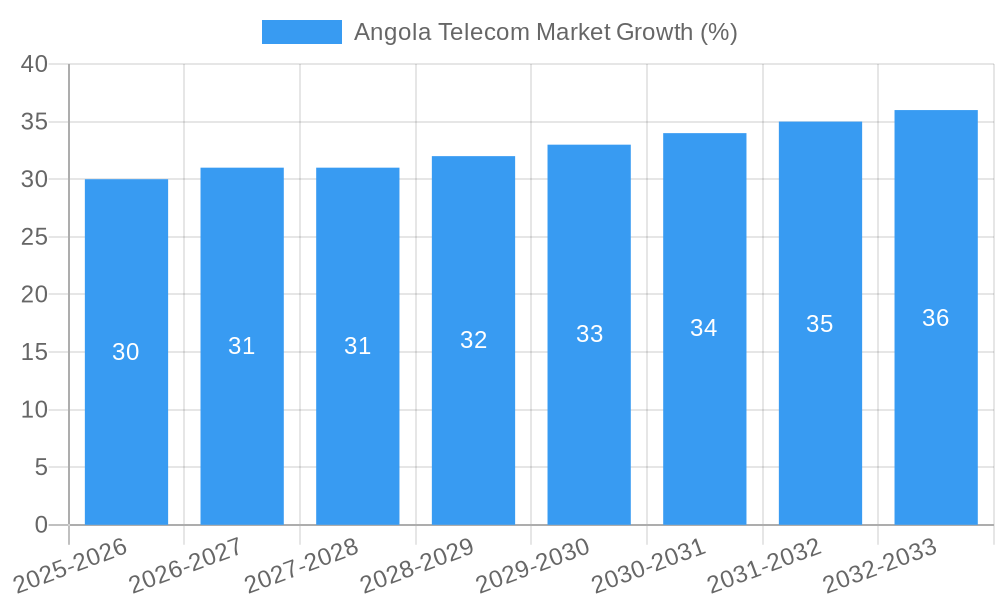

The Angolan telecom market, exhibiting a CAGR of 1.97%, presents a dynamic landscape shaped by several key factors. The market size in 2025 is estimated at $X million (assuming a reasonable market size based on comparable African nations with similar population and GDP). Growth is primarily driven by increasing mobile penetration, fueled by affordable smartphone adoption and the expansion of 4G/LTE networks. Data consumption is a significant contributor, driven by rising internet usage for social media, streaming services, and mobile banking. Government initiatives promoting digital inclusion further contribute to market expansion. However, challenges remain, including infrastructure limitations in rural areas, inconsistent electricity supply impacting network reliability, and competition from numerous operators. The segment breakdown likely includes mobile voice, mobile data, fixed-line services, and internet access. Key players such as Unitel SA, Movicel, and Angola Telecom hold substantial market share, but smaller operators and new entrants continue to exert competitive pressure. The forecast period (2025-2033) anticipates continued growth, albeit potentially at a slightly moderated rate as market saturation begins to play a role. Strategic investments in network infrastructure and the development of innovative digital services will be crucial for continued success in this evolving market.

The competitive landscape is fiercely contested, with established players like Unitel SA and Movicel facing pressure from both smaller local operators and international entrants like Africell. Future success hinges on adapting to changing consumer demands, investing in advanced technologies such as 5G and fiber optics, and creating attractive data packages that cater to the growing mobile data consumption. Furthermore, companies are likely focusing on improving network coverage and reliability, particularly in underserved regions. Regulatory developments and government policies related to spectrum allocation and licensing will significantly influence the market's trajectory. Expansion into value-added services, such as mobile money and cloud computing, is a key strategy for diversification and revenue growth. The ongoing digital transformation of Angola's economy promises significant opportunities, but companies must navigate the challenges of infrastructure development and market competition effectively to capitalize on this potential.

Angola Telecom Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Angola telecom market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market, providing granular insights into various sub-sectors, including mobile, fixed-line, broadband, and satellite communications. The total market value in 2025 is estimated at xx Million.

Angola Telecom Market Dynamics & Structure

The Angolan telecom market is characterized by a moderately concentrated structure, with a few dominant players and numerous smaller operators competing for market share. Unitel SA holds a significant market share, followed by Movicel and Angola Telecom. Technological innovation, driven primarily by the need for improved network infrastructure and higher data speeds, is a key dynamic. The regulatory framework, while evolving, presents both opportunities and challenges for market participants. The market exhibits limited substitution effects with alternative communication technologies relatively underdeveloped. The end-user demographic is predominantly young and increasingly tech-savvy, driving demand for mobile data and internet services. Mergers and acquisitions (M&A) activity has been moderate in recent years, with potential for future consolidation.

- Market Concentration: Unitel SA holds approximately xx% market share, Movicel xx%, and Angola Telecom xx%. The remaining market share is distributed amongst smaller players.

- Technological Innovation: 5G deployment is a major focus, alongside investments in fiber optic infrastructure to expand broadband access.

- Regulatory Framework: The government's focus on expanding digital inclusion and promoting competition shapes the regulatory landscape.

- M&A Activity: Over the historical period, xx M&A deals were recorded, with an average deal value of xx Million.

Angola Telecom Market Growth Trends & Insights

The Angolan telecom market has witnessed robust growth over the historical period (2019-2024). Driven by increasing mobile penetration, rising smartphone adoption, and growing demand for data services, the market exhibited a Compound Annual Growth Rate (CAGR) of xx% during this period. Market size in 2024 is estimated at xx Million. This positive trend is expected to continue into the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of xx%. Technological disruptions, such as the introduction of 5G and the expansion of fiber optic networks, will be major growth catalysts. Consumer behavior shifts towards increased digital media consumption and mobile commerce further fuel market expansion. The market penetration rate for mobile services is currently at xx%, and is projected to reach xx% by 2033.

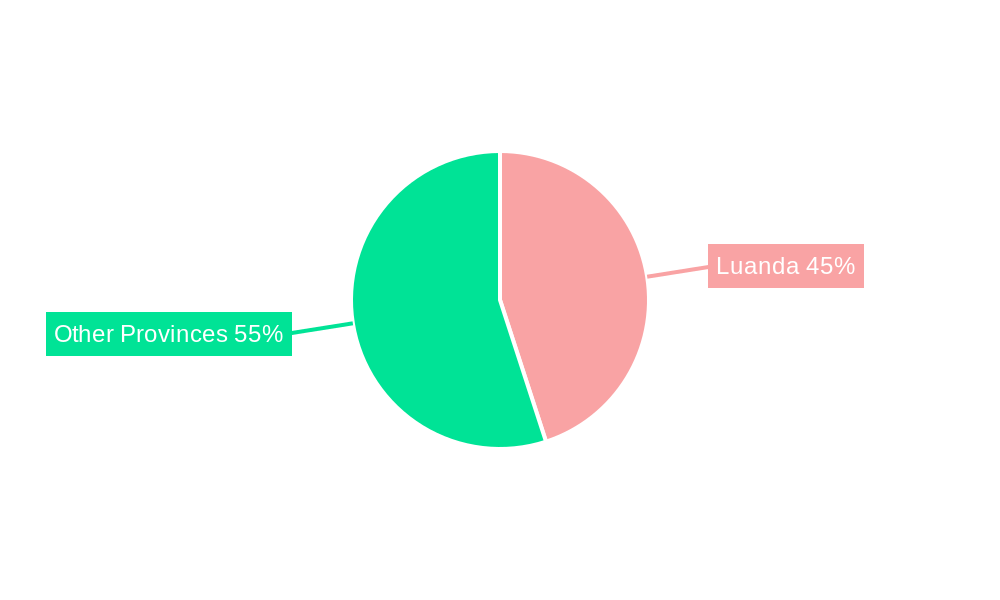

Dominant Regions, Countries, or Segments in Angola Telecom Market

The Luanda province, being the capital and largest city, represents the dominant region in the Angolan telecom market, accounting for approximately xx% of total market value in 2025. This dominance is driven by higher population density, greater economic activity, and improved infrastructure compared to other provinces. Key factors contributing to this dominance include:

- High Population Density: Luanda’s concentrated population creates a large consumer base for telecom services.

- Economic Activity: As the commercial and administrative center, Luanda generates high demand for communication services across various sectors.

- Infrastructure Development: Luanda benefits from comparatively better infrastructure (although still requiring significant improvement), facilitating the deployment of advanced telecom technologies.

Other regions show significant, albeit slower, growth potential fueled by government initiatives to bridge the digital divide and improve nationwide infrastructure.

Angola Telecom Market Product Landscape

The Angolan telecom market offers a range of products and services, including mobile voice and data, fixed-line telephony, broadband internet, and satellite communication. Recent product innovations focus on enhanced data packages, improved network coverage, and the introduction of value-added services tailored to the local market. The key selling propositions revolve around affordability, accessibility, and reliability. 5G deployment marks a significant technological advancement, promising faster speeds and lower latency.

Key Drivers, Barriers & Challenges in Angola Telecom Market

Key Drivers:

- Rising Smartphone Penetration: Increased smartphone adoption fuels demand for mobile data services.

- Government Initiatives: Government policies promoting digital inclusion and investment in infrastructure are driving market growth.

- Expanding 4G/5G Coverage: Improved network infrastructure expands access to high-speed internet.

Key Challenges:

- Infrastructure Gaps: Uneven infrastructure distribution across the country hinders market penetration, particularly in rural areas. The cost to remedy this is estimated at xx Million.

- Regulatory Hurdles: Navigating the regulatory environment can be complex and time-consuming for telecom operators.

- Competition: Intense competition among operators can pressure pricing and profitability.

Emerging Opportunities in Angola Telecom Market

- Expansion into Rural Areas: Untapped market potential exists in extending coverage to underserved rural populations.

- Growth of Mobile Money Services: The increasing use of mobile financial services presents a significant opportunity for telecom operators.

- IoT Applications: The application of IoT technologies across various sectors such as agriculture and mining offers significant growth potential.

Growth Accelerators in the Angola Telecom Market Industry

The long-term growth of the Angolan telecom market is significantly influenced by ongoing investments in infrastructure development, particularly the rollout of 5G networks and the expansion of fiber optic infrastructure. Strategic partnerships between the government and private sector players play a key role in unlocking market potential. Moreover, initiatives to improve digital literacy and promote wider adoption of digital technologies are crucial growth accelerators.

Key Players Shaping the Angola Telecom Market Market

- Unitel SA

- Movicel

- Angola Telecom

- Africell Global Holdings Ltd

- Mercury Telecommunications Services AS

- Internet Technologies Angola SA

- Telecom Namibia Ltd

- NEXUS

- Angola Cables SA

- Startel

Notable Milestones in Angola Telecom Market Sector

- April 2024: Kenya-Angola partnership to enhance telecommunications infrastructure and satellite capabilities across Africa. Leveraging Angosat 2 satellite for ICT, agriculture, mining, and climate monitoring.

- February 2024: Unitel announces preparations for an IPO, aiming to stimulate economic growth and attract foreign investment.

In-Depth Angola Telecom Market Market Outlook

The future of the Angolan telecom market looks promising, driven by continued infrastructure development, growing digital adoption, and supportive government policies. Strategic investments in 5G, fiber optics, and satellite technology will unlock significant growth potential. The market is projected to experience substantial expansion in the coming years, presenting attractive opportunities for both established players and new entrants. Strategic partnerships and innovative service offerings will be crucial for success in this dynamic market.

Angola Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Angola Telecom Market Segmentation By Geography

- 1. Angola

Angola Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Significant Investments in 4G and 5G Technologies

- 3.2.2 Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1 Significant Investments in 4G and 5G Technologies

- 3.3.2 Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Growth of IoT Usage in the Telecom Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Unitel SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Movicel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Angola Telecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Africell Global Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mercury Telecommunications Services AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Internet Technologies Angola SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telecom Namibia Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEXUS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angola Cables SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Startel*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unitel SA

List of Figures

- Figure 1: Angola Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Angola Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Angola Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Angola Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Angola Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Angola Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 5: Angola Telecom Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Telecom Market?

The projected CAGR is approximately 1.97%.

2. Which companies are prominent players in the Angola Telecom Market?

Key companies in the market include Unitel SA, Movicel, Angola Telecom, Africell Global Holdings Ltd, Mercury Telecommunications Services AS, Internet Technologies Angola SA, Telecom Namibia Ltd, NEXUS, Angola Cables SA, Startel*List Not Exhaustive.

3. What are the main segments of the Angola Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Significant Investments in 4G and 5G Technologies. Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Growth of IoT Usage in the Telecom Industry.

7. Are there any restraints impacting market growth?

Significant Investments in 4G and 5G Technologies. Enhancing the Infrastructure and Capabilities of Telecommunications Networks; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

April 2024: Kenya and Angola entered a partnership to enhance telecommunications infrastructure and satellite capabilities across Africa. Under the leadership of Minister Mário Oliveira, Angola leveraged its communication satellite, Angosat 2, to unlock opportunities in various industries, including information and communication technology (ICT), agriculture, mining, and climate monitoring.February 2024: Unitel, a telecommunications company in Angola, announced that it had been preparing for an IPO. This strategic initiative by the central African nation's company aims to stimulate economic growth and attract foreign investment. An IPO, or initial public offering, is a process where shares of a private company are made available to the public for the first time. This process allows a company to raise equity capital from public investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Telecom Market?

To stay informed about further developments, trends, and reports in the Angola Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence