Key Insights

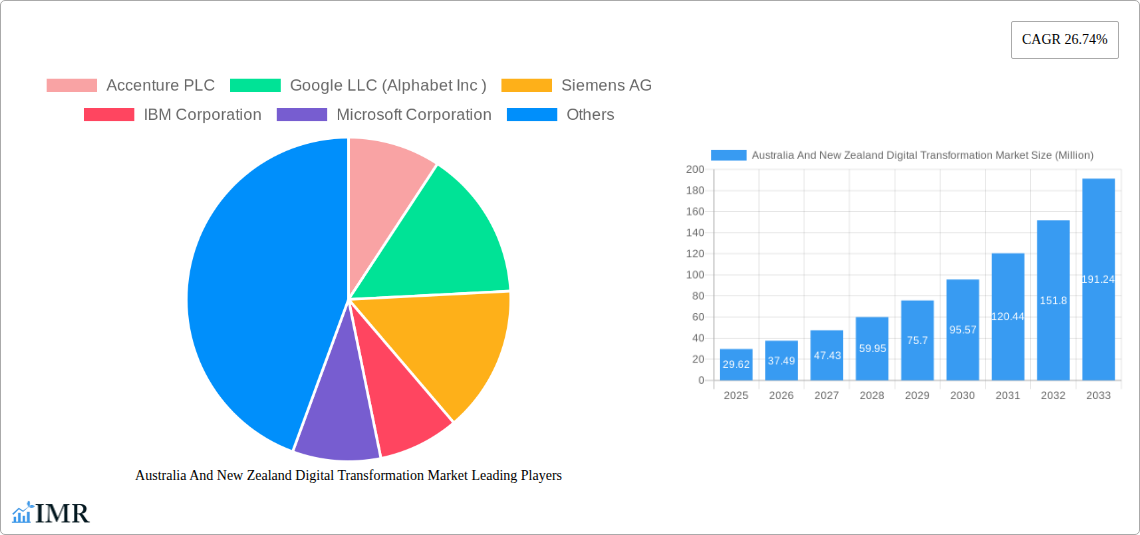

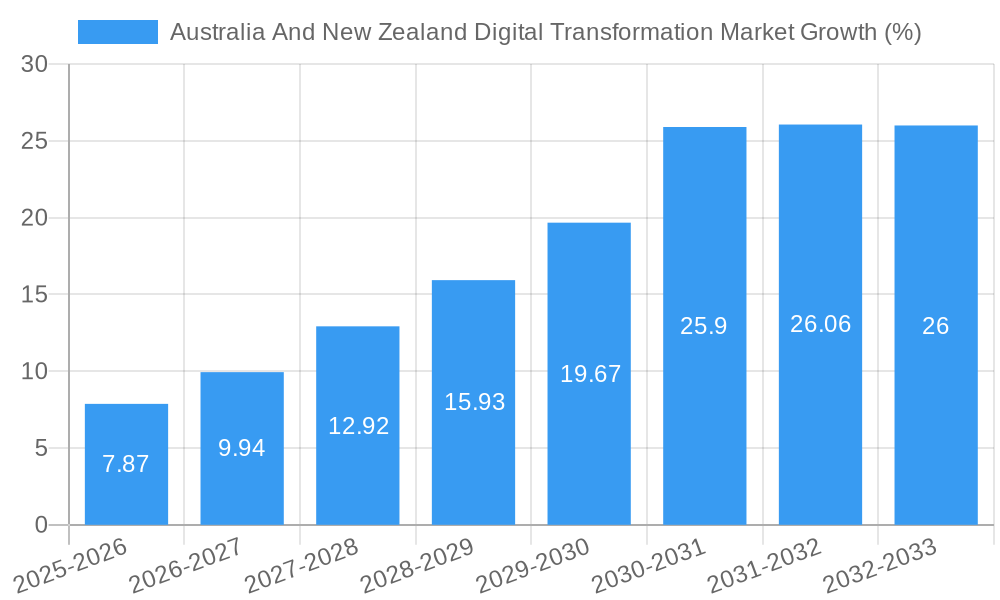

The Australia and New Zealand digital transformation market is experiencing robust growth, projected to reach a market size of $29.62 million in 2025, with a Compound Annual Growth Rate (CAGR) of 26.74% from 2019 to 2033. This significant expansion is driven by several key factors. Firstly, increasing government initiatives promoting digital adoption across various sectors, including healthcare, finance, and education, are fueling demand for digital solutions. Secondly, the rise of cloud computing, big data analytics, and artificial intelligence (AI) is enabling businesses to optimize operations, improve efficiency, and gain a competitive edge. Furthermore, the growing adoption of mobile technologies and the increasing penetration of high-speed internet are creating a favorable environment for digital transformation initiatives. The strong focus on cybersecurity and data privacy regulations also contributes to the market's growth, as organizations invest heavily in robust security infrastructure and solutions to comply with the latest standards. The market is segmented across various sectors, with significant contributions from industries such as finance, healthcare, and retail.

Major players like Accenture, Google, IBM, Microsoft, and Salesforce are actively shaping the market landscape through strategic partnerships, acquisitions, and the development of innovative digital transformation solutions tailored to the unique needs of Australian and New Zealand businesses. The competitive landscape is characterized by both established technology giants and specialized firms catering to niche markets. The forecast period (2025-2033) anticipates continued strong growth, propelled by ongoing technological advancements and increasing digital maturity among organizations. While challenges such as skills shortages and high implementation costs exist, the overall market outlook remains positive, indicating a sustained expansion of the digital transformation sector in Australia and New Zealand over the coming years.

Australia & New Zealand Digital Transformation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia and New Zealand digital transformation market, offering valuable insights for businesses, investors, and industry professionals. With a focus on market dynamics, growth trends, key players, and future opportunities, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market is segmented by various factors, providing a granular understanding of its structure and growth potential. This report helps understand the parent market (Digital Transformation) and its child market segments (e.g., Cloud Computing, AI, Cybersecurity) within the context of Australia and New Zealand. The market size is presented in Million units.

Australia And New Zealand Digital Transformation Market Market Dynamics & Structure

The Australia and New Zealand digital transformation market is characterized by a moderately concentrated landscape with several multinational corporations and local players vying for market share. The market size in 2024 is estimated at xx Million. Technological innovation, particularly in areas like Artificial Intelligence (AI), cloud computing, and the Internet of Things (IoT), are key drivers. Regulatory frameworks, including data privacy laws and cybersecurity regulations, significantly influence market growth. Competitive product substitutes, such as legacy systems, often pose challenges to adoption.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (estimated at xx% combined in 2024).

- Technological Innovation: Strong driver, with increasing adoption of AI, cloud, and IoT solutions across various industries.

- Regulatory Framework: Significant influence on data privacy, cybersecurity, and digital infrastructure investments.

- Competitive Product Substitutes: Legacy systems pose challenges to full digital transformation.

- End-User Demographics: Growth driven by large enterprises, followed by SMEs showing increasing adoption.

- M&A Trends: Moderate level of M&A activity, with strategic acquisitions focused on expanding capabilities and market reach (xx deals in the last 5 years). A significant barrier to entry is securing skilled talent.

Australia And New Zealand Digital Transformation Market Growth Trends & Insights

The Australia and New Zealand digital transformation market is experiencing robust growth, driven by increased government investment in digital infrastructure and a growing focus on improving operational efficiency. The market witnessed considerable expansion during the historical period (2019-2024), and this positive momentum is expected to continue throughout the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period, fueled by rising digital literacy rates, increased government initiatives, and a growing preference for digital solutions among businesses. Technological disruptions, such as the emergence of 5G and edge computing, are further accelerating market growth. Consumer behaviour shifts towards digital services and remote work are supporting this expansion. Market penetration is increasing steadily, expected to reach xx% by 2033.

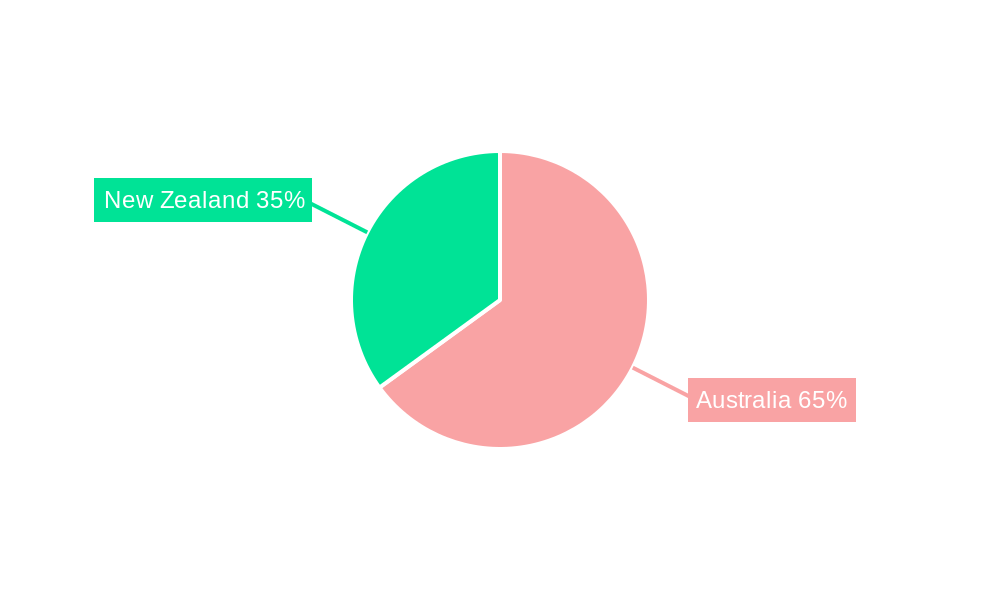

Dominant Regions, Countries, or Segments in Australia And New Zealand Digital Transformation Market

The major cities of Australia and New Zealand (Sydney, Melbourne, Auckland) are driving the market, benefitting from robust digital infrastructure, higher concentration of businesses and skilled talent. The financial services, healthcare, and retail sectors are leading the adoption of digital transformation technologies.

- Key Drivers:

- Strong government support for digital infrastructure development.

- Growing investments from businesses to improve operational efficiency.

- High concentration of skilled IT professionals.

- Favorable regulatory environment supporting digital innovation.

- Dominance Factors:

- High digital literacy rates and early adoption of new technologies.

- Government initiatives promoting digital transformation.

- Increasing competition in the market encouraging higher investment in innovation.

Australia And New Zealand Digital Transformation Market Product Landscape

The market features a diverse range of products and services, including cloud computing solutions, AI-powered analytics tools, cybersecurity software, and digital workplace platforms. Product innovations focus on improving efficiency, security, and scalability, enhancing user experience and integration capabilities. Unique selling propositions often centre on ease of use, customization, and robust security features. Advancements in AI, machine learning, and automation are driving product innovation.

Key Drivers, Barriers & Challenges in Australia And New Zealand Digital Transformation Market

Key Drivers: Government initiatives promoting digital adoption (e.g., funding for AI research), rising demand for enhanced efficiency and customer experience, and the growing need for robust cybersecurity measures.

Key Challenges: The high cost of implementation, shortage of skilled IT professionals (estimated shortage of xx thousand by 2030), legacy system integration complexities, and concerns around data security and privacy, along with potential disruption to existing business processes and potential resistance to change.

Emerging Opportunities in Australia And New Zealand Digital Transformation Market

Emerging opportunities include the expansion of digital transformation in the education and agriculture sectors. The development of innovative applications for AI and IoT in various industry verticals, such as smart cities, sustainable agriculture, and precision healthcare, presents significant growth potential. The increasing demand for personalized digital experiences also presents opportunities for businesses to leverage data analytics and AI.

Growth Accelerators in the Australia And New Zealand Digital Transformation Market Industry

Long-term growth will be significantly driven by advancements in edge computing and 5G technology. Strategic partnerships between technology providers and industry leaders will accelerate innovation. The expansion of digital transformation into previously untapped sectors will further unlock growth potential.

Key Players Shaping the Australia And New Zealand Digital Transformation Market Market

- Accenture PLC

- Google LLC (Alphabet Inc)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation (Dell EMC)

- Oracle Corporation

- Adobe Inc

- Amazon Web Services Inc

- Apple Inc

- Salesforce com Inc

- Cisco Systems Inc

- List Not Exhaustive

Notable Milestones in Australia And New Zealand Digital Transformation Market Sector

- June 2024: Tompkins Robotics acquired Primary Sight, expanding its presence in the ANZ supply chain technology market.

- May 2024: USD 6 million allocated to the University of Adelaide's AIML to boost AI capabilities and support SMEs.

In-Depth Australia And New Zealand Digital Transformation Market Market Outlook

The future of the Australia and New Zealand digital transformation market is bright, with continued growth anticipated across all segments. Strategic investments in digital infrastructure, coupled with increasing government support and private sector initiatives, will fuel innovation and adoption. The focus on emerging technologies such as AI, IoT, and 5G will unlock new opportunities and drive significant market expansion in the coming years, presenting lucrative opportunities for businesses and investors alike.

Australia And New Zealand Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud and Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-User Industry

-

2.1. Manufacturing

- 2.1.1. Oil, Gas and Utilities

- 2.1.2. Retail & e-commerce

- 2.1.3. Transportation and Logistics

- 2.1.4. Healthcare

- 2.1.5. BFSI

- 2.1.6. Telecom and IT

- 2.1.7. Government and Public Sector

- 2.1.8. Others (Education, Media &

-

2.1. Manufacturing

Australia And New Zealand Digital Transformation Market Segmentation By Geography

- 1. Australia

Australia And New Zealand Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. The IoT Segment is Expected to Occupy the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud and Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.1.1. Oil, Gas and Utilities

- 5.2.1.2. Retail & e-commerce

- 5.2.1.3. Transportation and Logistics

- 5.2.1.4. Healthcare

- 5.2.1.5. BFSI

- 5.2.1.6. Telecom and IT

- 5.2.1.7. Government and Public Sector

- 5.2.1.8. Others (Education, Media &

- 5.2.1. Manufacturing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Accenture PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cognex Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hewlett Packard Enterprise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAP SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EMC Corporation (Dell EMC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adobe Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Amazon Web Services Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Apple Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Salesforce com Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cisco Systems Inc *List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Accenture PLC

List of Figures

- Figure 1: Australia And New Zealand Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia And New Zealand Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Digital Transformation Market?

The projected CAGR is approximately 26.74%.

2. Which companies are prominent players in the Australia And New Zealand Digital Transformation Market?

Key companies in the market include Accenture PLC, Google LLC (Alphabet Inc ), Siemens AG, IBM Corporation, Microsoft Corporation, Cognex Corporation, Hewlett Packard Enterprise, SAP SE, EMC Corporation (Dell EMC), Oracle Corporation, Adobe Inc, Amazon Web Services Inc, Apple Inc, Salesforce com Inc, Cisco Systems Inc *List Not Exhaustive.

3. What are the main segments of the Australia And New Zealand Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

The IoT Segment is Expected to Occupy the Largest Market Share.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

June 2024: Tompkins Robotics announced that Primary Sight, a provider of supply chain technology solutions in Australia, became Tompkins Robotics ANZ. Bringing Primary Sight into the Tompkins Robotics organization marked a significant milestone as it continued to expand its global footprint and enhance its service offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence