Key Insights

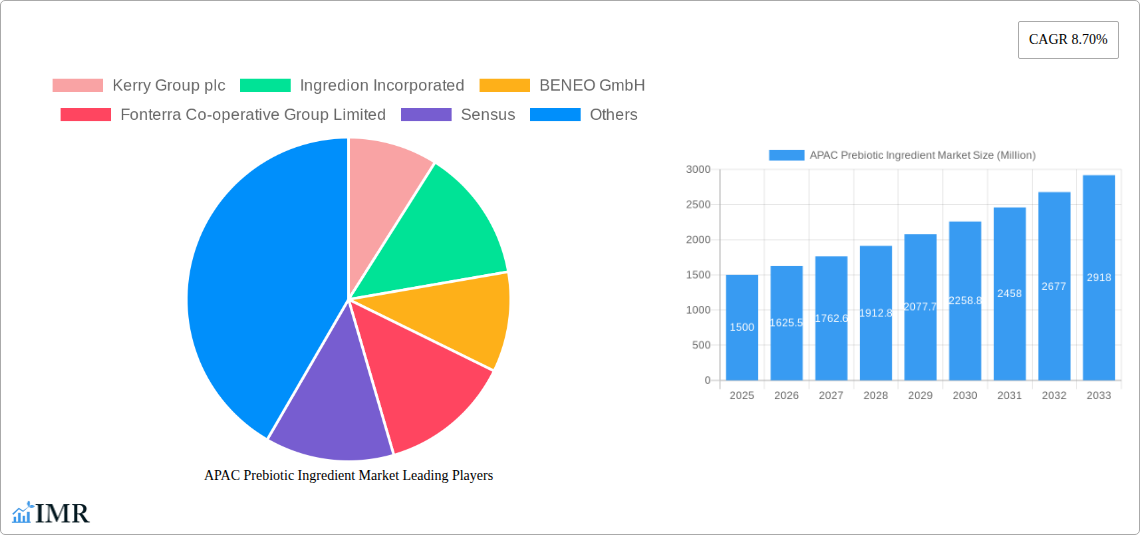

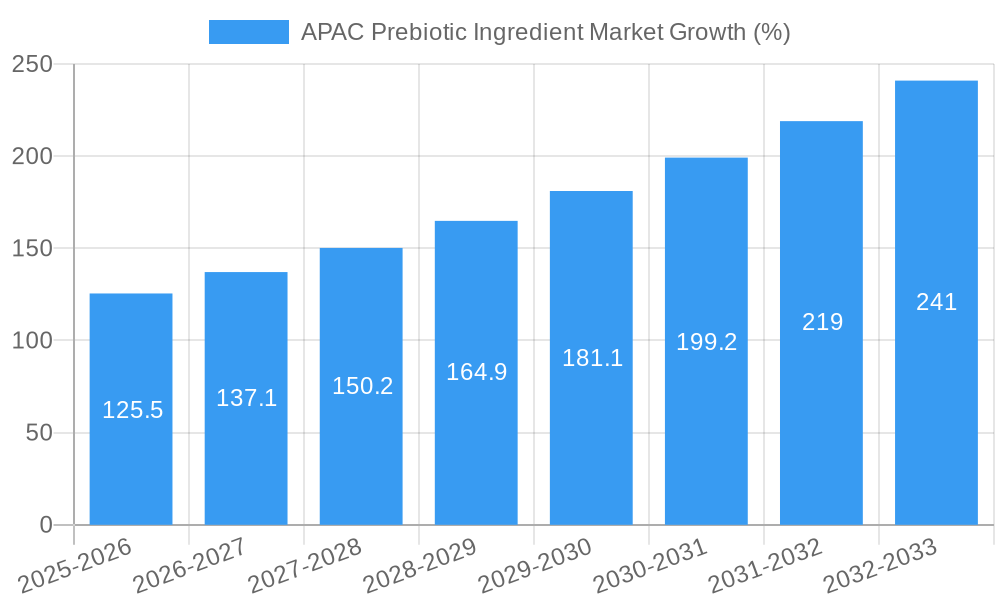

The APAC prebiotic ingredient market is experiencing robust growth, driven by increasing consumer awareness of gut health and its connection to overall well-being. The market, valued at approximately $X million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to expand at a compound annual growth rate (CAGR) of 8.70% from 2025 to 2033. This growth is fueled by several key factors. Firstly, rising disposable incomes across the region, particularly in rapidly developing economies, are enabling consumers to afford premium functional foods and supplements containing prebiotics. Secondly, a surge in the prevalence of lifestyle diseases like diabetes and obesity is driving demand for natural solutions that promote gut health and immune function, further boosting prebiotic ingredient consumption. The growing availability of functional foods and beverages incorporating prebiotics is also a significant contributor to market expansion. Furthermore, proactive research and development by key players like Kerry Group plc, Ingredion Incorporated, and BENEO GmbH, are continuously innovating and expanding the range of prebiotic ingredients available in the market, catering to diverse applications and consumer preferences. Finally, strong government support for the health and wellness sector in several APAC countries is encouraging further investment and growth within the industry.

However, market growth isn't without its challenges. Pricing fluctuations in raw materials and supply chain complexities can impact profitability and accessibility. Furthermore, educating consumers about the specific benefits of different prebiotic ingredients and their impact on gut health remains a crucial aspect for driving wider adoption. Nevertheless, the overall market outlook remains positive, with continued expansion anticipated throughout the forecast period (2025-2033). Market segmentation by ingredient type (e.g., inulin, fructooligosaccharides, galactooligosaccharides), application (food and beverages, dietary supplements), and geography will offer further granular insights into specific growth trajectories within the dynamic APAC prebiotic ingredient market. Companies are focusing on strategic partnerships and acquisitions to bolster their market position and reach a wider consumer base.

APAC Prebiotic Ingredient Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) prebiotic ingredient market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This analysis is crucial for businesses involved in the food and beverage, dietary supplements, and animal feed industries within the broader APAC functional food and health ingredients market. The report is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033.

APAC Prebiotic Ingredient Market Market Dynamics & Structure

The APAC prebiotic ingredient market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, particularly in prebiotic extraction and formulation, is a major driver. Stringent regulatory frameworks governing food safety and labeling influence market dynamics. Competitive pressure from product substitutes, such as probiotics and synbiotics, needs to be considered. End-user demographics, notably the rising health-conscious population and increasing prevalence of digestive issues, significantly impact market demand. The market has witnessed several mergers and acquisitions (M&A) in recent years, reflecting consolidation and strategic expansion within the industry.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of market share in 2025.

- Technological Innovation: Focus on improved extraction techniques, novel prebiotic sources, and enhanced stability.

- Regulatory Landscape: Stringent regulations regarding labeling, claims, and safety standards vary across APAC countries.

- Competitive Substitutes: Probiotics, synbiotics, and other functional ingredients pose competitive challenges.

- M&A Activity: An average of xx M&A deals per year between 2019 and 2024.

- Innovation Barriers: High R&D costs and challenges in scaling up production for novel prebiotics.

APAC Prebiotic Ingredient Market Growth Trends & Insights

The APAC prebiotic ingredient market is experiencing robust growth, driven by increasing awareness of gut health benefits and rising demand for functional foods and dietary supplements. Market size has shown a CAGR of xx% during the historical period (2019-2024) and is projected to continue growing at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing disposable incomes, changing lifestyles, and a growing preference for natural and clean-label products. Technological disruptions, such as advancements in fermentation and extraction processes, are further enhancing product quality and expanding market applications. Consumer behavior shifts towards preventative healthcare and personalized nutrition are also contributing to market expansion. Market penetration in key segments remains relatively low, indicating substantial untapped potential.

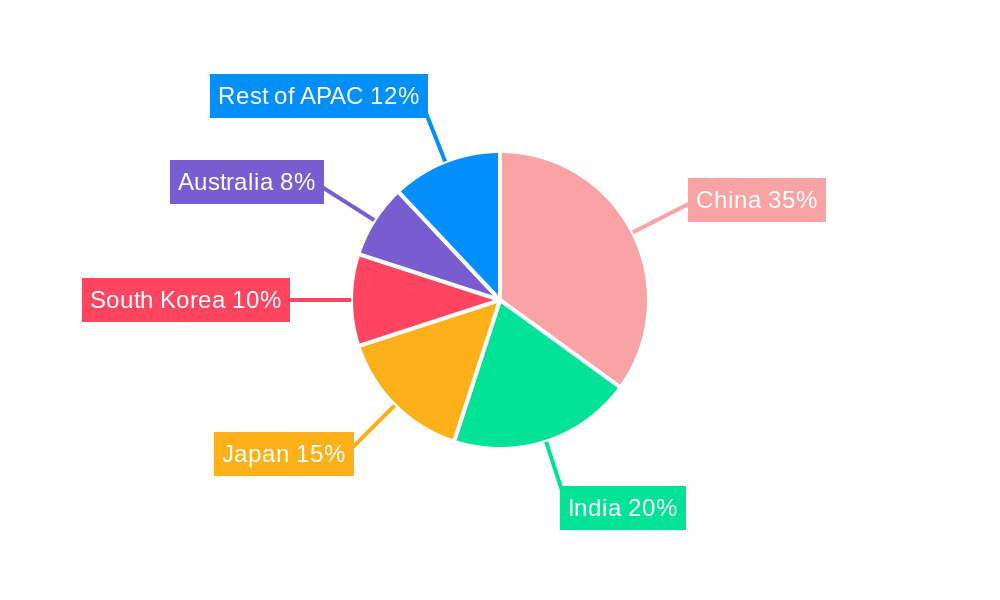

Dominant Regions, Countries, or Segments in APAC Prebiotic Ingredient Market

China and Japan are currently the dominant markets within the APAC region, accounting for xx% and xx% of total market value in 2025, respectively. Their dominance stems from several factors:

- China: Large population, rapidly expanding middle class, increasing health awareness, and substantial government support for the food and beverage industry.

- Japan: High per capita income, strong demand for premium functional food products, and a sophisticated regulatory framework.

- India: High growth potential driven by a young and growing population, although market penetration is still relatively low due to limited awareness and affordability constraints.

Other countries such as South Korea, Australia, and Singapore also exhibit strong growth potential due to factors such as:

- South Korea: High adoption of functional foods and dietary supplements.

- Australia: High health consciousness and high disposable incomes.

- Singapore: Rapid urbanization and strong preference for healthy and convenient food options.

The dietary supplement segment holds the largest market share, followed by the food and beverage segment, and animal feed applications are also showing rapid growth.

APAC Prebiotic Ingredient Market Product Landscape

The APAC prebiotic ingredient market offers a diverse range of products derived from various sources, including inulin, fructooligosaccharides (FOS), galactooligosaccharides (GOS), and others. Recent innovations focus on enhancing prebiotic stability, improving solubility, and developing novel delivery systems. These advancements allow for broader applications across various food and beverage products, resulting in improved product functionalities and better consumer acceptance. Key innovations include microencapsulation for improved stability and tailored blends catering to specific health benefits.

Key Drivers, Barriers & Challenges in APAC Prebiotic Ingredient Market

Key Drivers:

- Growing awareness of gut health: Increased consumer understanding of the gut microbiome and its impact on overall health.

- Rising demand for functional foods: Growing preference for foods with added health benefits.

- Technological advancements: Innovations in extraction, processing, and formulation techniques.

Key Challenges and Restraints:

- Supply chain disruptions: Fluctuations in raw material prices and availability.

- Regulatory complexities: Varied regulations across different countries in APAC, leading to compliance difficulties.

- High production costs: Scaling up production of novel prebiotic ingredients can be expensive.

- Intense competition: Presence of numerous players offering diverse products leads to price competition.

Emerging Opportunities in APAP Prebiotic Ingredient Market

- Untapped markets: Significant growth potential in smaller APAC countries with rising health consciousness.

- Innovative applications: Expanding into new product categories, such as pet food and cosmetics.

- Personalized nutrition: Tailoring prebiotic products to address individual needs based on gut microbiome profiles.

Growth Accelerators in the APAC Prebiotic Ingredient Market Industry

Technological breakthroughs in prebiotic extraction and formulation, coupled with strategic collaborations between ingredient suppliers and food manufacturers, are accelerating market growth. Furthermore, the expansion of distribution channels and increased marketing efforts promoting the health benefits of prebiotics are boosting market penetration.

Key Players Shaping the APAC Prebiotic Ingredient Market Market

- Kerry Group plc

- Ingredion Incorporated

- BENEO GmbH

- Fonterra Co-operative Group Limited

- Sensus

- Nexira SAS

- Royal FrieslandCampina

- Shandong Bailong Group Co

- Baolingbao Biology Co Ltd

- List Not Exhaustive

Notable Milestones in APAC Prebiotic Ingredient Market Sector

- 2020/Q3: Launch of a new inulin-based prebiotic product by Kerry Group plc.

- 2021/Q1: Acquisition of a leading prebiotic supplier by Ingredion Incorporated.

- 2022/Q4: Introduction of a novel galactooligosaccharide (GOS) product by BENEO GmbH. (Specific examples need to be researched and filled)

In-Depth APAC Prebiotic Ingredient Market Market Outlook

The APAC prebiotic ingredient market is poised for continued strong growth, driven by several factors. Increasing consumer awareness, technological innovation, and strategic partnerships will fuel market expansion. Opportunities exist in developing tailored prebiotic solutions targeting specific health conditions and demographics. Furthermore, exploring novel prebiotic sources and applications can unlock significant market potential in the coming years. The market shows a high potential for growth, with increasing opportunities in personalized nutrition, new product categories, and untapped market segments.

APAC Prebiotic Ingredient Market Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. Australia

- 4. India

- 5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Prebiotics for Fortifying Food & Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. Australia

- 5.3.4. India

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. Australia

- 5.4.4. India

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. Australia

- 6.3.4. India

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. Australia

- 7.3.4. India

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Australia APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. Australia

- 8.3.4. India

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inulin

- 9.1.2. FOS (Fructo-oligosaccharide)

- 9.1.3. GOS (Galacto-oligosaccharide)

- 9.1.4. Other In

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infant Formula

- 9.2.2. Fortified Food and Beverage

- 9.2.3. Dietary Supplements

- 9.2.4. Animal Feed

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. Australia

- 9.3.4. India

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inulin

- 10.1.2. FOS (Fructo-oligosaccharide)

- 10.1.3. GOS (Galacto-oligosaccharide)

- 10.1.4. Other In

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infant Formula

- 10.2.2. Fortified Food and Beverage

- 10.2.3. Dietary Supplements

- 10.2.4. Animal Feed

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. Australia

- 10.3.4. India

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kerry Group plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ingredion Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BENEO GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fonterra Co-operative Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sensus

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nexira SAS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Royal FrieslandCampina

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Bailong Group Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baolingbao Biology Co Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kerry Group plc

List of Figures

- Figure 1: APAC Prebiotic Ingredient Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Prebiotic Ingredient Market Share (%) by Company 2024

List of Tables

- Table 1: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: APAC Prebiotic Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Prebiotic Ingredient Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the APAC Prebiotic Ingredient Market?

Key companies in the market include Kerry Group plc, Ingredion Incorporated, BENEO GmbH, Fonterra Co-operative Group Limited, Sensus, Nexira SAS, Royal FrieslandCampina, Shandong Bailong Group Co, Baolingbao Biology Co Ltd *List Not Exhaustive.

3. What are the main segments of the APAC Prebiotic Ingredient Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Acquisitive Demand of Prebiotics for Fortifying Food & Beverages.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Prebiotic Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Prebiotic Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Prebiotic Ingredient Market?

To stay informed about further developments, trends, and reports in the APAC Prebiotic Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence