Key Insights

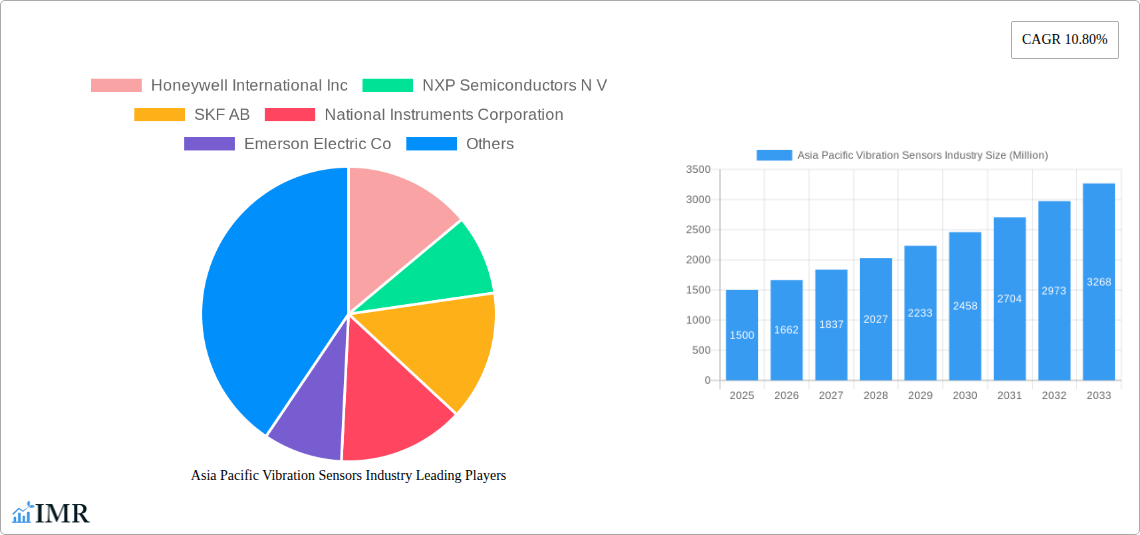

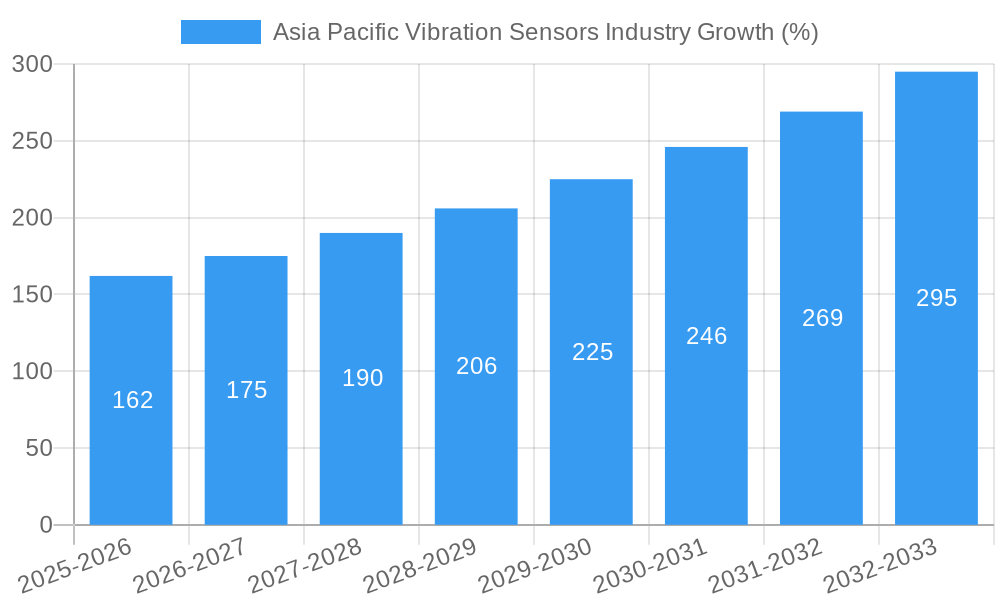

The Asia-Pacific vibration sensor market is experiencing robust growth, driven by increasing automation across diverse sectors and the burgeoning demand for advanced monitoring and predictive maintenance solutions. The region's strong manufacturing base, particularly in China, Japan, and India, fuels this expansion. A compound annual growth rate (CAGR) of 10.80% from 2019 to 2024 indicates significant market momentum. This growth is fueled by several key factors: the rising adoption of Industry 4.0 principles, which emphasize real-time data analysis for improved efficiency and reduced downtime; the increasing prevalence of smart factories and automated manufacturing processes; and the growing need for condition-based maintenance in critical infrastructure, such as power generation and transportation. The automotive sector, with its focus on enhanced vehicle safety and performance monitoring, is a significant contributor to market growth. Similarly, the healthcare industry's adoption of advanced medical devices incorporating vibration sensing technology further propels market expansion.

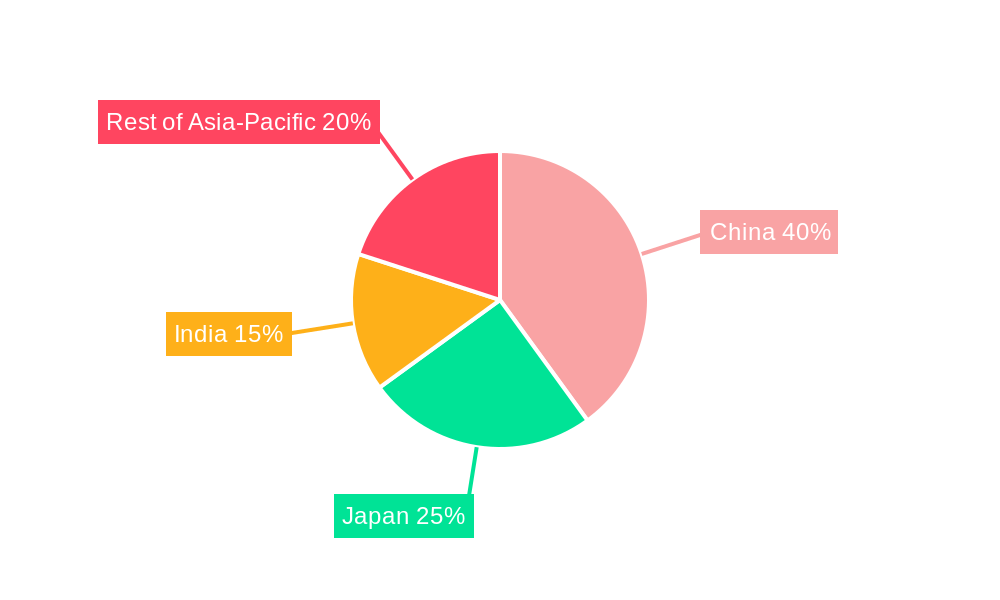

Within the Asia-Pacific region, China holds a dominant market share due to its large manufacturing sector and rapid industrialization. Japan and India are also experiencing strong growth, driven by investments in infrastructure development and technological advancements. The market segmentation reveals a strong demand for accelerometers and proximity probes, followed by tachometers and other specialized sensors. While the market faces challenges, such as the initial high investment costs associated with implementing vibration sensing technologies and the potential for supply chain disruptions, the overall outlook remains positive. Continued technological innovation, particularly in miniaturization, improved accuracy, and wireless connectivity, will further fuel the market's expansion throughout the forecast period (2025-2033). The entry of new players and strategic partnerships between sensor manufacturers and system integrators will further shape the competitive landscape.

Asia Pacific Vibration Sensors Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific vibration sensors industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by product (accelerometers, proximity probes, tachometers, others), industry (automotive, healthcare, aerospace & defense, consumer electronics, oil & gas, metals & mining, others), and country (China, Japan, India, others). The report values are presented in million units.

Asia Pacific Vibration Sensors Industry Market Dynamics & Structure

The Asia Pacific vibration sensors market is characterized by moderate concentration, with key players such as Honeywell International Inc, NXP Semiconductors N V, SKF AB, National Instruments Corporation, Emerson Electric Co, Bosch Sensortec GmbH, TE Connectivity Ltd, Hansford Sensors Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, and Analog Devices Inc. Technological innovation, particularly in miniaturization, wireless connectivity, and AI-driven data analysis, is a significant driver. Stringent regulatory frameworks regarding safety and emissions in various end-use industries also shape market dynamics. Competitive substitutes include other sensing technologies (e.g., optical sensors), impacting market share. The market is witnessing increasing adoption across diverse end-user demographics driven by industrial automation and IoT growth. Mergers and acquisitions (M&A) activity, such as TE Connectivity's acquisition of First Sensor AG, are reshaping the competitive landscape.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Significant advancements in miniaturization, wireless technologies (e.g., Bluetooth, LoRaWAN), and AI-powered predictive maintenance solutions.

- Regulatory Landscape: Stringent safety and environmental regulations (e.g., emission standards) are driving demand for advanced vibration sensors.

- Competitive Substitutes: Optical and acoustic sensors pose competitive pressure.

- M&A Activity: Significant M&A activity observed in recent years, with xx major deals completed between 2019 and 2024.

- End-User Demographics: Growing demand from industrial automation, IoT deployments, and smart infrastructure projects.

Asia Pacific Vibration Sensors Industry Growth Trends & Insights

The Asia Pacific vibration sensors market witnessed robust growth during the historical period (2019-2024), driven by increasing industrial automation, rising adoption of predictive maintenance strategies, and the expansion of the Internet of Things (IoT). The market size is estimated at xx million units in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx million units by 2033. This growth is fueled by technological advancements, including the development of smaller, more energy-efficient sensors, improved data analytics capabilities, and increased integration with cloud-based platforms. The market penetration rate is increasing, particularly in emerging economies like India and China, driven by government initiatives to promote industrial modernization and infrastructure development. Consumer behavior shifts towards greater safety and efficiency in various applications are also contributing factors. The report leverages [replace XXX with data source name] for comprehensive market size analysis.

Dominant Regions, Countries, or Segments in Asia Pacific Vibration Sensors Industry

China dominates the Asia Pacific vibration sensors market, driven by rapid industrialization, significant investments in infrastructure, and a burgeoning automotive sector. Japan follows as a major market due to its advanced manufacturing base and strong presence in industrial automation. India is experiencing significant growth due to increasing investments in infrastructure development and manufacturing. The automotive industry is the largest end-use segment, followed by the industrial automation and aerospace & defense sectors. Accelerometers represent the largest product segment due to their wide applicability in various industrial and consumer applications.

- Key Drivers:

- China: Rapid industrialization, robust infrastructure development, and large automotive manufacturing base.

- Japan: Advanced manufacturing technologies, industrial automation focus, and strong presence of sensor manufacturers.

- India: Growing investments in infrastructure, expansion of manufacturing capabilities, and increasing adoption of smart technologies.

- Automotive Industry: High demand for vibration sensors in vehicle diagnostics and safety systems.

- Industrial Automation: Growing adoption of predictive maintenance and IoT-enabled solutions.

- Dominance Factors: Strong manufacturing base, government support for industrial growth, and high adoption rates in key industries.

Asia Pacific Vibration Sensors Industry Product Landscape

The Asia Pacific vibration sensors market offers a wide range of products, including accelerometers, proximity probes, and tachometers. Accelerometers are the most prevalent, with diverse applications in industrial machinery monitoring, automotive safety systems, and consumer electronics. Proximity probes are widely used in industrial automation for position and distance measurement. Tachometers are crucial for monitoring rotational speed in various machinery. Recent product innovations focus on miniaturization, enhanced accuracy, improved power efficiency, and wireless connectivity. These improvements allow for easier integration into diverse applications and offer greater operational flexibility. The market is witnessing the adoption of smart sensors that integrate signal processing capabilities, enabling more sophisticated data analysis and predictive maintenance strategies.

Key Drivers, Barriers & Challenges in Asia Pacific Vibration Sensors Industry

Key Drivers:

- Increasing adoption of predictive maintenance and condition monitoring in industrial settings.

- Growing demand for IoT-enabled sensors in various applications.

- Stringent safety and environmental regulations driving the need for accurate and reliable sensors.

- Expansion of the automotive and industrial automation sectors.

Challenges & Restraints:

- High initial investment costs associated with implementing sensor-based systems can hinder adoption in some segments.

- Concerns about data security and privacy related to IoT-connected sensors.

- Intense competition among manufacturers can lead to price pressure and lower profit margins.

- Supply chain disruptions caused by geopolitical events or resource scarcity. This has resulted in xx% increase in sensor component costs in 2023.

Emerging Opportunities in Asia Pacific Vibration Sensors Industry

- Increasing adoption of smart infrastructure and smart cities initiatives presents significant opportunities for vibration sensors in monitoring structural health and optimizing energy efficiency.

- Growing demand for wearables and other consumer electronics incorporating vibration sensors for health monitoring, haptic feedback, and other applications.

- Expansion of industrial automation in developing economies opens up substantial market potential for vibration sensors.

- Development of advanced sensor technologies with improved accuracy, reliability, and data analytics capabilities will continue to drive growth.

Growth Accelerators in the Asia Pacific Vibration Sensors Industry

The long-term growth of the Asia Pacific vibration sensors industry is driven by several key factors. Technological advancements in sensor miniaturization, wireless communication, and data analytics are leading to more efficient and cost-effective solutions. Strategic partnerships between sensor manufacturers and end-use companies are accelerating the adoption of these technologies. Government initiatives to promote industrial automation and smart infrastructure development are fueling demand. The expansion of the IoT and the increasing focus on predictive maintenance and condition monitoring create further growth opportunities.

Key Players Shaping the Asia Pacific Vibration Sensors Industry Market

- Honeywell International Inc

- NXP Semiconductors N V

- SKF AB

- National Instruments Corporation

- Emerson Electric Co

- Bosch Sensortec GmbH

- TE Connectivity Ltd

- Hansford Sensors Ltd

- Texas Instruments Incorporated

- Rockwell Automation Inc

- Analog Devices Inc

Notable Milestones in Asia Pacific Vibration Sensors Industry Sector

- March 2020: SKF launched the Enlight Collect IMx-1 sensor, a compact vibration and temperature sensor for automated condition monitoring of rotating machinery, reducing downtime and maintenance costs.

- March 2020: TE Connectivity completed the acquisition of First Sensor AG, expanding its product portfolio and strengthening its position in the sensors market.

In-Depth Asia Pacific Vibration Sensors Industry Market Outlook

The Asia Pacific vibration sensors market is poised for significant growth in the coming years, driven by continued technological advancements, increasing industrial automation, and the widespread adoption of IoT technologies. The market's future potential lies in the development of advanced sensor technologies with enhanced capabilities and the integration of AI-powered analytics for predictive maintenance. Strategic partnerships and investments in R&D will further propel growth, creating lucrative opportunities for businesses to capitalize on this expanding market.

Asia Pacific Vibration Sensors Industry Segmentation

-

1. Product

- 1.1. Accelerometers

- 1.2. Proximity Probes

- 1.3. Tachometers

- 1.4. Others

-

2. Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Consumer Electronics

- 2.5. Oil And Gas

- 2.6. Metals and Mining

- 2.7. Others

Asia Pacific Vibration Sensors Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Vibration Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Need for Machine Monitoring and Maintenance; Longer Service Life

- 3.2.2 Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 3.3. Market Restrains

- 3.3.1. Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment

- 3.4. Market Trends

- 3.4.1. Aerospace & Defense End User to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Accelerometers

- 5.1.2. Proximity Probes

- 5.1.3. Tachometers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Consumer Electronics

- 5.2.5. Oil And Gas

- 5.2.6. Metals and Mining

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Vibration Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 NXP Semiconductors N V

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 SKF AB

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 National Instruments Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Emerson Electric Co

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TE Connectivity Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hansford Sensors Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Texas Instruments Incorporated

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockwell Automation Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Analog Devices Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Vibration Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Vibration Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 4: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 15: Asia Pacific Vibration Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Vibration Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Vibration Sensors Industry?

The projected CAGR is approximately 10.80%.

2. Which companies are prominent players in the Asia Pacific Vibration Sensors Industry?

Key companies in the market include Honeywell International Inc, NXP Semiconductors N V, SKF AB, National Instruments Corporation, Emerson Electric Co, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Hansford Sensors Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, Analog Devices Inc.

3. What are the main segments of the Asia Pacific Vibration Sensors Industry?

The market segments include Product, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Machine Monitoring and Maintenance; Longer Service Life. Self Generating Capability and Wide Range of Frequency of Vibration Sensors.

6. What are the notable trends driving market growth?

Aerospace & Defense End User to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment.

8. Can you provide examples of recent developments in the market?

Mar 2020: SKF has announced a compact vibration and temperature sensor that monitors the condition of rotating parts on heavy industrial machinery automatically. The SKF Enlight Collect IMx-1 sensor will allow users to cut both unplanned downtime and maintenance costs. They will also be able to collect data more frequently over hours and days instead of weeks and months from locations that were previously inaccessible, using fewer technicians.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Vibration Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Vibration Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Vibration Sensors Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Vibration Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence