Key Insights

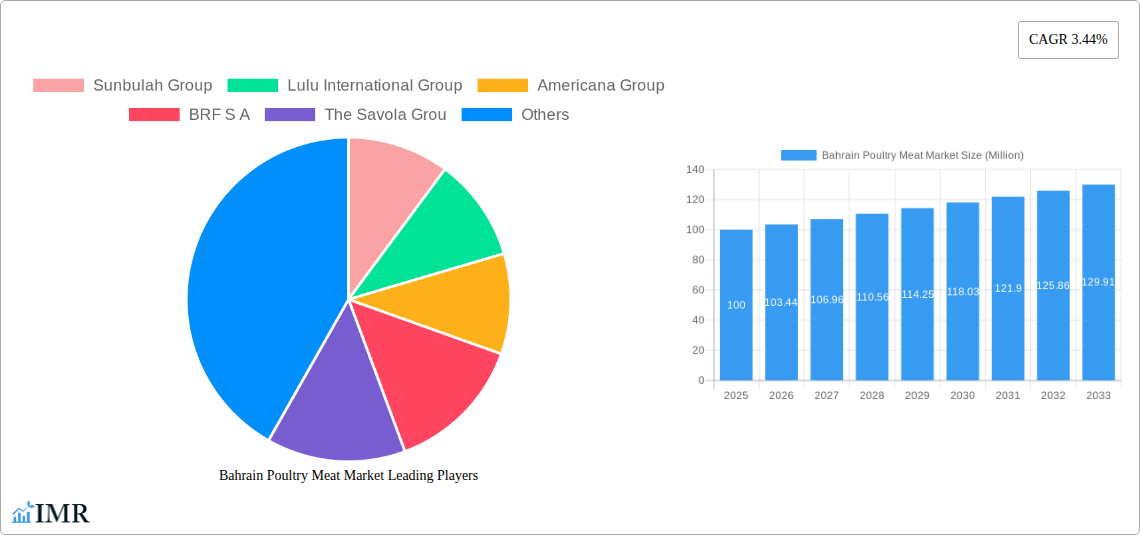

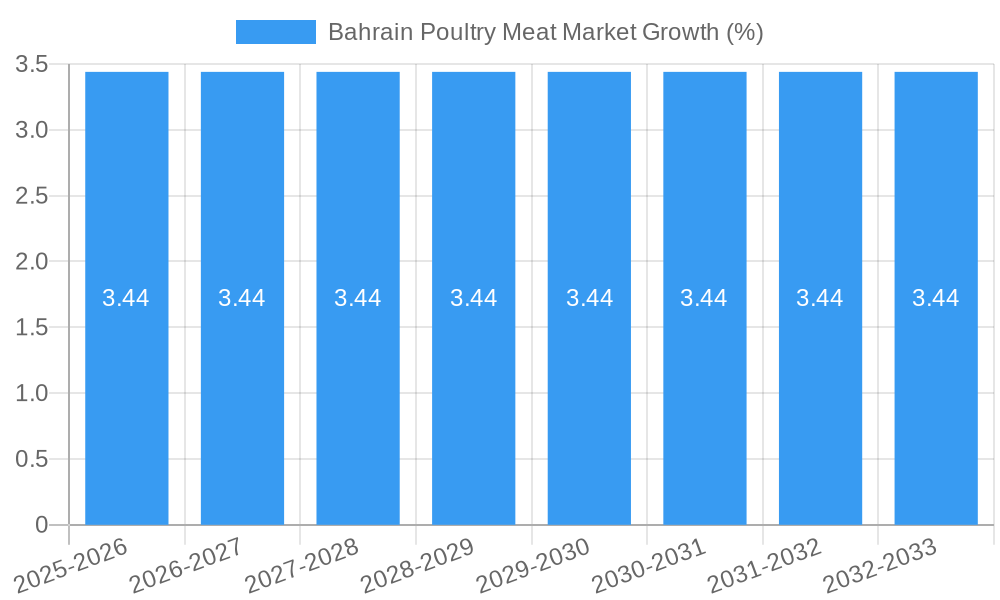

The Bahrain poultry meat market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR of 3.44% and market size XX million), exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 3.44% from 2025 to 2033. This growth is driven by several factors, including rising disposable incomes, increasing urbanization leading to a shift towards convenient protein sources, and a growing preference for healthier dietary options. The market is segmented by form (canned, fresh/chilled, frozen, processed), distribution channel (on-trade, off-trade), and other factors. Key players like Sunbulah Group, Lulu International Group, Americana Group, BRF S.A., The Savola Group, JBS S.A., Tanmiah Food Company, and Almarai Food Company compete in this dynamic market, each striving to cater to evolving consumer preferences and distribution strategies. The sustained growth reflects Bahrain's increasing population and a growing demand for poultry meat as a staple protein source.

The relatively small size of the Bahrain market suggests opportunities for specialized niches and premium product offerings. While restraints could include import dependencies for certain feedstock or fluctuations in global poultry prices, the strong growth outlook suggests resilience to these challenges. The fresh/chilled segment likely commands a significant market share due to consumer preference for freshness and quality. The off-trade channel (supermarkets, hypermarkets etc.) is expected to dominate distribution, reflecting modern consumer shopping habits. Future market developments will be shaped by government policies promoting food security, evolving consumer health consciousness, and the continued expansion of the retail sector in Bahrain. Strategic investments in advanced poultry farming technologies and innovative product development will be key for sustained growth within the competitive landscape.

Bahrain Poultry Meat Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Bahrain poultry meat market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The study delves into market dynamics, growth trends, key players, and future opportunities within the Bahrain poultry meat sector and its parent market (Gulf Cooperation Council poultry market) and child market (Bahrain processed meat market). The report is meticulously structured to deliver clear, actionable intelligence, maximizing its value for your business strategy. Market values are presented in million units.

Bahrain Poultry Meat Market Dynamics & Structure

This section analyzes the competitive landscape of the Bahrain poultry meat market, encompassing market concentration, technological advancements, regulatory frameworks, and influential external factors. The market is characterized by a moderate level of concentration, with key players like Sunbulah Group, Lulu International Group, and Americana Group holding significant market share. However, smaller regional players and imports also contribute significantly.

- Market Concentration: The market exhibits an xx% concentration ratio (CR4) in 2025, indicating a moderately competitive environment.

- Technological Innovation: Technological advancements in feed efficiency, disease control, and processing techniques are driving productivity improvements. However, adoption is slowed by initial investment costs.

- Regulatory Framework: Bahrain's regulatory environment concerning food safety and hygiene is robust, influencing operational practices and product standards. This creates a barrier to entry for less-regulated importers.

- Competitive Substitutes: Red meat and seafood pose competitive pressure on poultry consumption, creating market segmentation based on pricing and consumer preferences.

- End-User Demographics: The growing population and changing dietary habits, particularly among younger generations, are bolstering demand for poultry products. XX% of the population consumes poultry regularly.

- M&A Trends: The market has witnessed xx M&A deals in the past five years, primarily focused on expanding production capacity and enhancing distribution networks.

Bahrain Poultry Meat Market Growth Trends & Insights

This section presents a detailed analysis of the Bahrain poultry meat market's growth trajectory, incorporating historical data (2019-2024) and future projections (2025-2033). The market has experienced consistent growth, driven by rising disposable incomes, increasing population, and a preference for affordable protein sources. Technological advancements in poultry farming and processing have also played a significant role. The market size in 2025 is estimated at xx million units, projected to reach xx million units by 2033, exhibiting a CAGR of xx%.

Dominant Regions, Countries, or Segments in Bahrain Poultry Meat Market

This section identifies the leading segments within the Bahrain poultry meat market, analyzing their growth drivers and market share. The fresh/chilled segment commands the largest market share (xx%), fueled by consumer preference for freshness and taste. The off-trade distribution channel (supermarkets, hypermarkets) dominates with xx% of total sales, benefiting from increased retail penetration and convenience.

- Key Drivers for Fresh/Chilled Segment: Consumer preference for freshness, wider availability in retail stores, and increasing health awareness.

- Key Drivers for Off-Trade Channel: Expansion of retail infrastructure, increasing urbanization, and changing consumer shopping patterns.

Bahrain Poultry Meat Market Product Landscape

The Bahrain poultry meat market offers a diverse range of products, including fresh, chilled, frozen, canned, and processed poultry. Innovation focuses on value-added products like marinated poultry, ready-to-cook meals, and convenience items, catering to changing consumer lifestyles. Technological advancements like improved packaging and preservation techniques enhance product quality and shelf life.

Key Drivers, Barriers & Challenges in Bahrain Poultry Meat Market

Key Drivers: Increased disposable income, population growth, changing dietary habits, and government initiatives promoting local food production are key drivers.

Challenges: Fluctuations in feed prices, disease outbreaks, stringent regulatory compliance, and intense competition from imported poultry pose challenges to market growth. Import tariffs and logistics costs can impact price competitiveness, further adding to the challenges.

Emerging Opportunities in Bahrain Poultry Meat Market

Untapped opportunities exist in the development of value-added poultry products catering to health-conscious consumers (organic, free-range). Growing food safety awareness creates demand for products with high traceability and certification. Expansion into online retail channels can further drive market growth.

Growth Accelerators in the Bahrain Poultry Meat Market Industry

Strategic partnerships between local and international companies, coupled with technological advancements in poultry farming and processing, will significantly accelerate growth. Government initiatives supporting the local poultry sector will further boost production capacity and competitiveness.

Key Players Shaping the Bahrain Poultry Meat Market Market

- Sunbulah Group

- Lulu International Group

- Americana Group

- BRF S.A

- The Savola Group

- JBS S.A

- Tanmiah Food Company

- Almarai Food Company

Notable Milestones in Bahrain Poultry Meat Market Sector

- July 2022: BRF Sadia inaugurates its new Al Joody plant in Saudi Arabia, increasing production capacity by 1200 metric tons per month. This indirectly impacts Bahrain through regional supply chains.

- July 2022: Tanmiah Food Company and Tyson Foods' strategic partnership aims to double Tanmiah’s value-added poultry production capacity, potentially influencing supply to Bahrain.

- December 2021: LuLu Group launches a new poultry meat range, enhancing product variety and competition in the Bahrain market.

In-Depth Bahrain Poultry Meat Market Outlook

The Bahrain poultry meat market exhibits promising long-term growth potential, driven by favorable demographics, economic development, and strategic investments. Companies focusing on innovation, sustainability, and efficient supply chains will be best positioned to capitalize on the expanding market opportunities. Increased focus on value-added products, convenient formats, and health-conscious options will shape the market's evolution in the coming years.

Bahrain Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Bahrain Poultry Meat Market Segmentation By Geography

- 1. Bahrain

Bahrain Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. High consumption and high personal disposable income boost sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu International Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americana Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BRF S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Savola Grou

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBS SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tanmiah Food Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Almarai Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Bahrain Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Bahrain Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Bahrain Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bahrain Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bahrain Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 7: Bahrain Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Bahrain Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Poultry Meat Market?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the Bahrain Poultry Meat Market?

Key companies in the market include Sunbulah Group, Lulu International Group, Americana Group, BRF S A, The Savola Grou, JBS SA, Tanmiah Food Company, Almarai Food Company.

3. What are the main segments of the Bahrain Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

High consumption and high personal disposable income boost sales.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

July 2022: BRF Sadia inaugurated its new Al Joody plant in Saudi Arabia after acquiring it in 2021. The new plant helps in increasing the production capacity to 1200 metric ton per month.July 2022: Tanmiah Food Company and Tyson Foods signed a strategic partnership to expand poultry production capacity. This investment is aligned with Tanmiah's strategic expansion agenda and is expected to result in doubling the company’s production capacity in value-added products.December 2021: LuLu Group launched its latest product categories, including the poultry meat range, in collaboration with world-class brands and leading manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Bahrain Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence