Key Insights

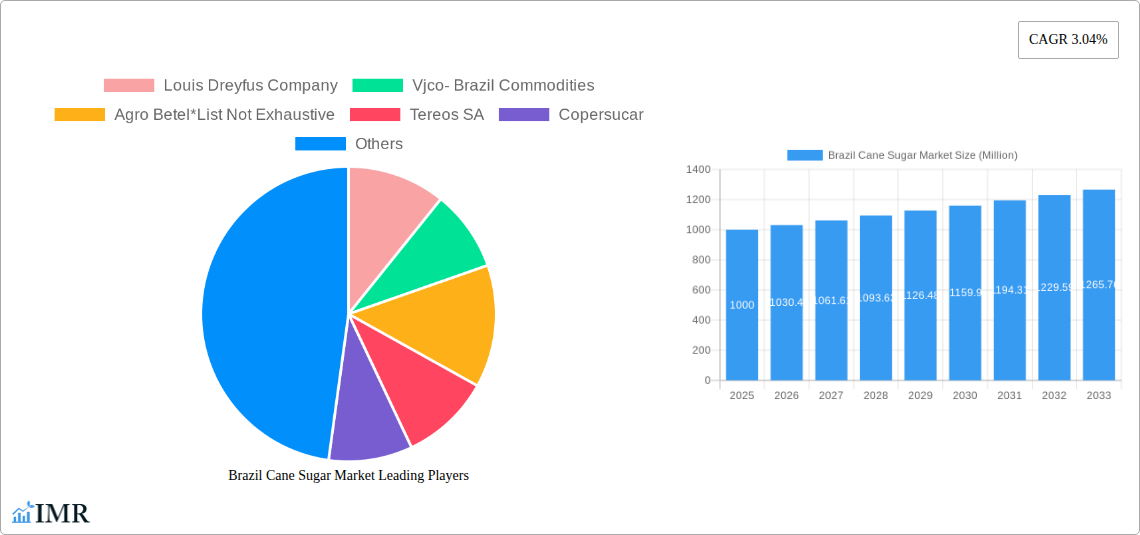

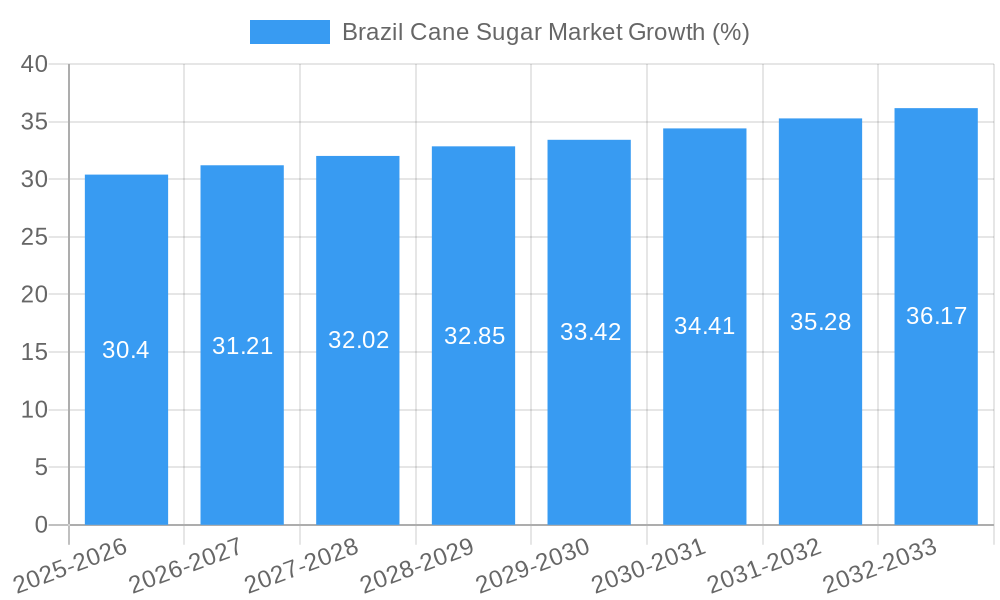

The Brazil cane sugar market, valued at approximately $X million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.04% from 2025 to 2033. This growth is driven by several factors. Firstly, Brazil's robust sugarcane production, fueled by favorable climatic conditions and efficient agricultural practices, provides a strong foundation for the industry. Secondly, the increasing demand for sugar from the food and beverage sector, particularly in domestic consumption and exports, is a significant contributor. The pharmaceutical and industrial sectors also contribute to market demand, albeit to a lesser extent. Furthermore, innovative applications of cane sugar, such as biofuels and bio-based materials, are emerging as potential growth drivers in the coming years.

However, the market faces certain challenges. Fluctuations in global sugar prices, influenced by international trade policies and competing sweeteners, pose a risk. Additionally, concerns about the environmental impact of sugarcane cultivation, including deforestation and water usage, are prompting stricter regulations and sustainable practices, potentially impacting production costs. Despite these restraints, the market segmentation reveals opportunities. The crystallized sugar segment is expected to maintain its dominant position due to widespread usage across various applications. The growth in the food and beverage sector, especially processed foods and beverages, will continue to fuel demand for both crystallized and liquid sugar. Leading players like Louis Dreyfus Company, Tereos SA, Copersucar, and Tate & Lyle PLC are well-positioned to capitalize on market expansion through strategic investments and efficient supply chain management. The focus on sustainable practices and diversification into value-added products will shape the market's future trajectory.

Brazil Cane Sugar Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil cane sugar market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market. The report delves into both the parent market (Brazilian agricultural commodities) and the child market (cane sugar within Brazil), offering granular insights into the various segments.

Brazil Cane Sugar Market Dynamics & Structure

The Brazilian cane sugar market is characterized by a moderately concentrated structure with key players like Copersucar, Tereos SA, and Cosan Limited holding significant market share. Technological advancements, particularly in automation and genetic modification (as seen with the CRISPR-modified sugarcane), are reshaping the industry landscape. Stringent regulatory frameworks governing sugar production and trade also play a crucial role. The market faces competition from alternative sweeteners, influencing consumer choices. M&A activity, such as Raizen's acquisition of Biosev SA, indicates ongoing consolidation and strategic expansion within the sector.

- Market Concentration: xx% held by top 5 players (2024).

- Technological Innovation: Focus on automation, CRISPR gene editing for improved yield and ethanol production.

- Regulatory Landscape: Stringent environmental and labor regulations impacting operational costs.

- Competitive Substitutes: High fructose corn syrup and other alternative sweeteners pose a competitive threat.

- M&A Activity: xx major deals completed between 2019-2024, reflecting industry consolidation.

- Innovation Barriers: High R&D costs and complexities in implementing new technologies.

Brazil Cane Sugar Market Growth Trends & Insights

The Brazilian cane sugar market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). This growth is attributed to factors like increasing global demand for sugar, rising ethanol production, and favorable government policies supporting the sugarcane industry. Technological disruptions, such as the introduction of CRISPR-modified sugarcane, are expected to further boost production efficiency and output. Consumer behavior, particularly towards healthier food choices, could influence the demand for certain sugar types. Market penetration of liquid sugar in the food and beverage sector is expected to increase at a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Brazil Cane Sugar Market

The Southeast region of Brazil dominates the cane sugar market due to its favorable climate, established infrastructure, and high sugarcane yields. Within the segments, crystallized sugar maintains the largest market share, driven by its traditional use in food and beverages. The food and beverage application segment itself holds the largest market share, followed by the industrial segment.

- Key Drivers (Southeast Region): Favorable climatic conditions, established sugarcane cultivation infrastructure, proximity to ports.

- Crystallized Sugar Dominance: Traditional usage in food & beverage industry; established distribution networks.

- Food & Beverage Application Leadership: High consumption of sugary products and robust food processing industry.

- Growth Potential: Expansion into new applications (e.g., biofuels, bioplastics) offers significant growth opportunities.

Brazil Cane Sugar Market Product Landscape

The Brazilian cane sugar market offers two primary product types: crystallized sugar and liquid sugar. Recent innovations center around improving sugar extraction efficiency and creating sugarcane varieties with higher sucrose content, driven by CRISPR technology. These advancements offer superior yield and improved ethanol production.

Key Drivers, Barriers & Challenges in Brazil Cane Sugar Market

Key Drivers: Growing global demand for sugar, increasing biofuel production (particularly ethanol), government support for the sugarcane industry, and technological advancements in sugarcane cultivation and processing.

Challenges: Fluctuations in global sugar prices, climate change impacts on sugarcane yields, competition from alternative sweeteners, and potential supply chain disruptions. xx% reduction in yields due to adverse weather conditions was observed in xx region during 2023.

Emerging Opportunities in Brazil Cane Sugar Market

The growing demand for biofuels and bio-based products presents significant opportunities. Moreover, the exploration of new applications for sugarcane byproducts and the development of sustainable sugarcane farming practices offer further growth prospects. Expansion into new markets and exploring innovative packaging solutions can also enhance market penetration.

Growth Accelerators in the Brazil Cane Sugar Market Industry

Technological advancements, particularly in genetic modification and automation, are key growth drivers. Strategic partnerships between producers and ethanol manufacturers are creating synergistic growth. Government policies supporting sustainable agriculture and biofuel production will further accelerate market expansion.

Key Players Shaping the Brazil Cane Sugar Market Market

- Louis Dreyfus Company

- Vjco- Brazil Commodities

- Agro Betel

- Tereos SA

- Copersucar

- Tate & Lyle PLC

- Cosan Limited

- Cevasa

- Sao Martinho SA

- DWL International Food Inc

Notable Milestones in Brazil Cane Sugar Market Sector

- February 2021: Raizen acquires Biosev SA, expanding ethanol production capacity.

- February 2022: Development of CRISPR-modified sugarcane, Flex I and Flex II, enhancing sugar extraction and ethanol production.

- September 2022: Tereos invests heavily in automation and digitization, improving efficiency and supply chain management in Brazil.

In-Depth Brazil Cane Sugar Market Market Outlook

The Brazilian cane sugar market is poised for continued growth, driven by technological advancements, increasing biofuel demand, and strategic industry partnerships. The focus on sustainability and efficiency will shape the future of the market, presenting lucrative opportunities for key players and new entrants. The market is expected to reach xx Million units by 2033.

Brazil Cane Sugar Market Segmentation

-

1. Type

- 1.1. Crystallized Sugar

- 1.2. Liquid Sugar

-

2. Application

- 2.1. Food and Beverage

- 2.2. Pharmaceuticals

- 2.3. Industrial

- 2.4. Other Applications

Brazil Cane Sugar Market Segmentation By Geography

- 1. Brazil

Brazil Cane Sugar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Large Production Base in the Country Supporting Demand Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cane Sugar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Crystallized Sugar

- 5.1.2. Liquid Sugar

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Pharmaceuticals

- 5.2.3. Industrial

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Louis Dreyfus Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vjco- Brazil Commodities

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agro Betel*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tereos SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Copersucar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tate & Lyle PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cosan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cevasa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sao Martinho SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DWL International Food Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Louis Dreyfus Company

List of Figures

- Figure 1: Brazil Cane Sugar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Cane Sugar Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Cane Sugar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Cane Sugar Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Cane Sugar Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Cane Sugar Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Brazil Cane Sugar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil Cane Sugar Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Brazil Cane Sugar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Cane Sugar Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Brazil Cane Sugar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Cane Sugar Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Cane Sugar Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Brazil Cane Sugar Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Brazil Cane Sugar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil Cane Sugar Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Brazil Cane Sugar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Cane Sugar Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cane Sugar Market?

The projected CAGR is approximately 3.04%.

2. Which companies are prominent players in the Brazil Cane Sugar Market?

Key companies in the market include Louis Dreyfus Company, Vjco- Brazil Commodities, Agro Betel*List Not Exhaustive, Tereos SA, Copersucar, Tate & Lyle PLC, Cosan Limited, Cevasa, Sao Martinho SA, DWL International Food Inc.

3. What are the main segments of the Brazil Cane Sugar Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Large Production Base in the Country Supporting Demand Growth.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Tereos invested heavily in automation and digitization of operations to handle the different processes, improve agricultural monitoring, reduce costs, and enhance the procurement chain and relationship with suppliers. Major projects are in Brazil, and a key focus is laid on supply chain and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cane Sugar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cane Sugar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cane Sugar Market?

To stay informed about further developments, trends, and reports in the Brazil Cane Sugar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence