Key Insights

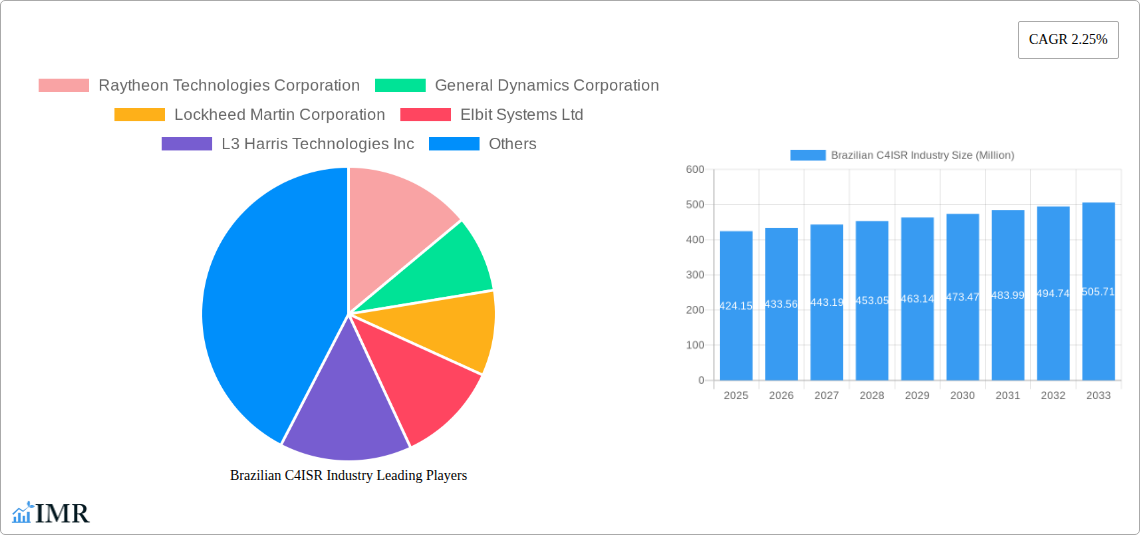

The Brazilian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market presents a compelling investment opportunity, projected to be worth $424.15 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 2.25% from 2025 to 2033. This growth is fueled by increasing government spending on defense modernization, particularly focused on enhancing national security capabilities and addressing internal threats. Brazil's strategic location and involvement in regional peacekeeping missions are key drivers, demanding sophisticated C4ISR systems for improved situational awareness and effective response capabilities. The market is segmented across air, land, sea, and space platforms, with significant demand across all sectors, driven by the need to integrate various surveillance and communication systems for enhanced operational efficiency and interoperability. Key players like Embraer, and international corporations like Lockheed Martin and Raytheon, are actively competing in this market, further contributing to its dynamism.

The relatively modest CAGR reflects a degree of market maturity and the cyclical nature of defense spending. However, technological advancements, particularly in areas such as artificial intelligence, big data analytics, and cyber security, are expected to revitalize growth and drive the adoption of more sophisticated, integrated systems within the forecast period. Government initiatives aimed at bolstering domestic technological capabilities, alongside the continuous need to upgrade aging infrastructure, contribute further to the market's ongoing expansion. While budgetary constraints and economic fluctuations could present challenges, the long-term outlook for the Brazilian C4ISR market remains positive, driven by the country's commitment to national security and its strategic role in the South American region.

Brazilian C4ISR Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazilian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. It leverages extensive primary and secondary research to deliver a detailed understanding of market dynamics, growth trends, key players, and future opportunities within the Brazilian C4ISR landscape. This report analyzes the parent market of Defense and Aerospace and the child market of C4ISR within Brazil.

Brazilian C4ISR Industry Market Dynamics & Structure

The Brazilian C4ISR market exhibits a moderately concentrated structure, with a handful of major international players alongside a growing number of domestic companies. Technological innovation is driven by the need for enhanced situational awareness, improved interoperability, and cybersecurity advancements. The regulatory framework, while evolving, presents both opportunities and challenges for market participants. Competitive product substitutes, including open-source intelligence solutions, also influence market dynamics. The end-user demographics are primarily comprised of the Brazilian Armed Forces, law enforcement agencies, and national security organizations. M&A activity has been relatively low in recent years but is expected to increase as the market consolidates.

- Market Concentration: Moderately concentrated; top 5 players hold approximately xx% market share (2025).

- Technological Innovation Drivers: Advanced analytics, AI, cloud computing, and cyber security.

- Regulatory Framework: Evolving regulations on data security and technology procurement.

- Competitive Substitutes: Open-source intelligence, commercial off-the-shelf (COTS) solutions.

- End-User Demographics: Brazilian Armed Forces (Army, Navy, Air Force), Police, Intelligence Agencies.

- M&A Trends: Low activity in recent years (2019-2024), projected xx deals per year (2025-2033).

Brazilian C4ISR Industry Growth Trends & Insights

The Brazilian C4ISR market is experiencing significant growth, driven by increasing defense budgets, modernization initiatives across various branches of the armed forces, and a growing need to enhance national security capabilities. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is fuelled by substantial investments in modernizing land, air, and naval platforms and strengthening cybersecurity infrastructure. Adoption rates for advanced C4ISR technologies are increasing, particularly in areas such as intelligence analysis and situational awareness. Technological disruptions, such as the rise of AI and cloud computing, are transforming the industry, leading to increased efficiency and improved decision-making capabilities. Consumer behavior shifts reflect a heightened emphasis on interoperability and seamless data sharing across different platforms and agencies.

Dominant Regions, Countries, or Segments in Brazilian C4ISR Industry

The Air segment currently dominates the Brazilian C4ISR market, driven by substantial investments in modernizing the Brazilian Air Force’s fleet and enhancing its surveillance capabilities. This is fuelled by the strategic importance of air superiority and the need for effective border control. The Southeast region shows the strongest growth potential because of its advanced infrastructure and concentration of key players.

- Key Drivers: Government investments in defense modernization, geopolitical instability, and growing cross-border threats.

- Dominance Factors: High defense expenditure on Air Force modernization, Brazil's vast geographical area and need for effective border surveillance, increasing cyber threats.

- Growth Potential: Significant potential for growth in Land and Sea segments, driven by requirements for improved ground-based surveillance and maritime security.

Brazilian C4ISR Industry Product Landscape

The Brazilian C4ISR product landscape encompasses a wide array of cutting-edge technologies, including advanced radar systems, satellite imagery analysis tools, secure communication networks, and sophisticated data fusion platforms. These products boast enhanced performance metrics, such as improved accuracy, increased range, and faster data processing speeds. Unique selling propositions often include specialized features tailored to the specific needs of Brazilian defense and security agencies, such as support for Portuguese language interfaces and integration with local infrastructure. Ongoing technological advancements continuously enhance system capabilities, particularly in areas like AI-powered threat detection and predictive analytics.

Key Drivers, Barriers & Challenges in Brazilian C4ISR Industry

Key Drivers: Increasing defense budgets, modernization efforts by the armed forces, demand for enhanced national security, growing cyber threats, and the need for improved border control.

Challenges: Budgetary constraints, complex procurement processes, dependence on foreign technologies, integration challenges across different platforms, and a skilled workforce shortage. The impact of these challenges is estimated to result in a xx% reduction in potential market growth over the forecast period.

Emerging Opportunities in Brazilian C4ISR Industry

Opportunities exist in the development and deployment of indigenous C4ISR technologies, the expansion of cybersecurity solutions for critical infrastructure protection, and the integration of AI and big data analytics to improve intelligence analysis and decision-making. Untapped markets exist in the private sector, including critical infrastructure providers and commercial enterprises focused on security and risk management. The rising adoption of cloud-based C4ISR solutions offers significant market expansion potential.

Growth Accelerators in the Brazilian C4ISR Industry

Technological advancements in areas like AI and machine learning, strategic partnerships between domestic and international companies, and government initiatives promoting domestic technology development are accelerating long-term growth. Furthermore, investments in R&D and the expansion of the skilled workforce will play a vital role in propelling the Brazilian C4ISR industry forward.

Key Players Shaping the Brazilian C4ISR Industry Market

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Elbit Systems Ltd

- L3 Harris Technologies Inc

- Kratos Defense and Security Solutions

- Embraer SA

- Rheinmetall AG

- BAE Systems plc

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Notable Milestones in Brazilian C4ISR Industry Sector

- 2021 Q4: Successful launch of the SISFRON integrated border surveillance system.

- 2022 Q2: Announcement of a strategic partnership between Embraer and a major international C4ISR provider.

- 2023 Q1: Implementation of a new national cybersecurity strategy.

- 2023 Q3: Government investment in the development of indigenous satellite imagery analysis capabilities.

In-Depth Brazilian C4ISR Industry Market Outlook

The Brazilian C4ISR market presents a significant growth opportunity over the next decade. Continued investment in defense modernization, coupled with technological advancements and strategic partnerships, will drive substantial market expansion. Companies that can successfully adapt to evolving technological landscapes, address cybersecurity challenges, and forge effective relationships with government agencies will be best positioned for success in this dynamic and competitive market. The strategic opportunities involve focusing on indigenous technology development, leveraging AI and big data, and capitalizing on growing private sector demand for security solutions.

Brazilian C4ISR Industry Segmentation

-

1. Platform

- 1.1. Air

- 1.2. Land

- 1.3. Sea

- 1.4. Space

Brazilian C4ISR Industry Segmentation By Geography

- 1. Brazil

Brazilian C4ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Military Spending is Expected to Drive the Market Growth During the Forecasts Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian C4ISR Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Air

- 5.1.2. Land

- 5.1.3. Sea

- 5.1.4. Space

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Raytheon Technologies Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elbit Systems Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 L3 Harris Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kratos Defense and Security Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Embraer SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rheinmetall AG*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saab AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Boeing Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: Brazilian C4ISR Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian C4ISR Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian C4ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian C4ISR Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: Brazilian C4ISR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Brazilian C4ISR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazilian C4ISR Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 6: Brazilian C4ISR Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian C4ISR Industry?

The projected CAGR is approximately 2.25%.

2. Which companies are prominent players in the Brazilian C4ISR Industry?

Key companies in the market include Raytheon Technologies Corporation, General Dynamics Corporation, Lockheed Martin Corporation, Elbit Systems Ltd, L3 Harris Technologies Inc, Kratos Defense and Security Solutions, Embraer SA, Rheinmetall AG*List Not Exhaustive, BAE Systems plc, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Brazilian C4ISR Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 424.15 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Military Spending is Expected to Drive the Market Growth During the Forecasts Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian C4ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian C4ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian C4ISR Industry?

To stay informed about further developments, trends, and reports in the Brazilian C4ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence