Key Insights

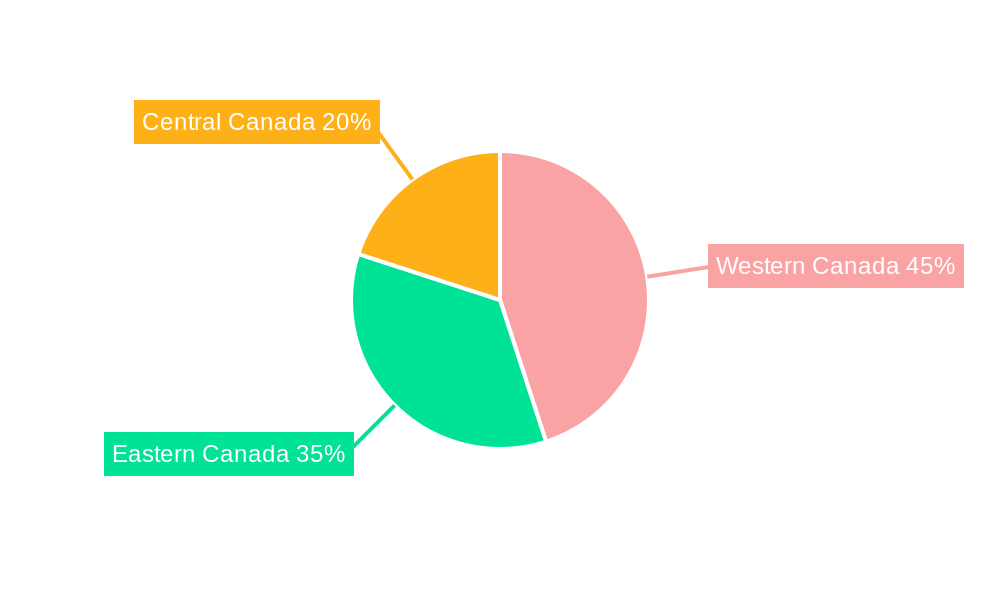

The Canada commercial vehicle market, valued at approximately $XX million in 2025 (based on provided CAGR and market size data), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.55% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning e-commerce sector fuels demand for efficient delivery solutions, necessitating a larger fleet of commercial vehicles. Secondly, infrastructure development projects across Canada, particularly in Western Canada (where growth is expected to outpace other regions), require heavy-duty trucks and specialized commercial vehicles. Furthermore, government initiatives promoting sustainable transportation and stricter emission regulations are pushing the adoption of hybrid and electric commercial vehicles, presenting significant opportunities for manufacturers like Hino Motors, Navistar, and Rivian. The increasing focus on fuel efficiency and reduced operational costs also contributes to market growth.

However, the market faces certain challenges. Fluctuations in fuel prices significantly impact operational expenses, potentially hindering market expansion. The high initial cost of electric and hybrid vehicles remains a barrier to widespread adoption, although government subsidies and incentives are gradually mitigating this issue. Moreover, the availability of charging infrastructure for electric commercial vehicles is still developing, posing a constraint, particularly in less populated areas of Canada. Segmentation analysis reveals strong growth in the LPG (Liquefied Petroleum Gas) fueled commercial vehicle segment, driven by cost-effectiveness, while the hybrid and electric segment is experiencing rapid but currently smaller market share, promising significant future growth. The market's performance is closely tied to the overall economic health of Canada and the construction and logistics industries. Regional disparities exist, with Western Canada projected to lead the market due to its robust economy and extensive infrastructure projects. The forecast period, 2025-2033, indicates a substantial market expansion, driven by technological advancements and evolving transportation needs.

Canada Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Commercial Vehicles Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The market is segmented by Vehicle Type (Commercial Vehicles), Propulsion Type (Hybrid and Electric Vehicles), and Fuel Type (LPG). The total market size is projected to reach xx Million units by 2033.

Canada Commercial Vehicles Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the Canada Commercial Vehicles Market. The market is moderately consolidated, with key players holding significant shares, though the emergence of new entrants and disruptive technologies is altering the dynamics. Government regulations regarding emissions and safety standards are significant drivers, pushing the adoption of cleaner and safer vehicles.

- Market Concentration: The market exhibits moderate concentration, with the top five players holding approximately xx% of the market share in 2024.

- Technological Innovation: The adoption of hybrid and electric vehicles, along with advancements in autonomous driving technologies, are key innovation drivers. However, high initial investment costs and charging infrastructure limitations remain significant barriers.

- Regulatory Framework: Stringent emission regulations and safety standards are compelling manufacturers to invest in cleaner and safer commercial vehicles. Government incentives for electric vehicles further accelerate this trend.

- Competitive Product Substitutes: The rise of alternative transportation solutions, such as rail and waterways, presents competitive pressure on the road transport sector.

- End-User Demographics: The growth of e-commerce and logistics sectors is driving demand for commercial vehicles, especially delivery vans and trucks.

- M&A Trends: The past five years have witnessed xx M&A deals in the Canadian commercial vehicle sector, primarily focused on technology integration and market expansion.

Canada Commercial Vehicles Market Growth Trends & Insights

The Canada Commercial Vehicles Market experienced significant growth during the historical period (2019-2024), primarily driven by economic expansion, infrastructure development, and increasing e-commerce activity. The market is expected to maintain a steady growth trajectory throughout the forecast period (2025-2033), though the pace of growth may fluctuate depending on economic conditions and technological adoption rates. The market is projected to achieve a CAGR of xx% during the forecast period. The increasing adoption of hybrid and electric vehicles is a significant growth driver, propelled by government incentives and environmental concerns. Consumer behavior is shifting toward fuel-efficient and environmentally friendly options, further stimulating market growth.

Dominant Regions, Countries, or Segments in Canada Commercial Vehicles Market

Ontario and British Columbia are the leading regions for the commercial vehicle market in Canada, driven by robust industrial activity, significant logistics operations, and supportive government policies. The hybrid and electric vehicle segment is experiencing the fastest growth, reflecting growing environmental consciousness and government support for green initiatives. Within vehicle types, heavy-duty trucks currently dominate the market, but medium-duty and light-duty trucks are also showcasing substantial growth potential.

- Key Drivers in Ontario and British Columbia:

- Strong industrial and manufacturing bases.

- Extensive logistics and transportation networks.

- Government incentives for green transportation.

- Well-developed infrastructure.

- Growth Potential in Other Regions: Growth opportunities exist in other provinces, especially those experiencing rapid economic development or expansion of infrastructure projects. The LPG segment, while smaller, offers potential growth as a transition fuel.

Canada Commercial Vehicles Market Product Landscape

The Canadian commercial vehicle market offers a diverse range of products, encompassing various vehicle types, propulsion systems, and fuel options. Technological advancements are focused on enhancing fuel efficiency, safety features, and driver assistance systems. Manufacturers are increasingly incorporating telematics and connected vehicle technologies to improve fleet management and optimize operational efficiency. Unique selling propositions often include enhanced payload capacity, superior fuel economy, and advanced safety features.

Key Drivers, Barriers & Challenges in Canada Commercial Vehicles Market

Key Drivers:

- Growing e-commerce and logistics sectors driving demand.

- Government incentives for green vehicles.

- Advancements in hybrid and electric vehicle technology.

- Infrastructure development projects boosting demand.

Key Barriers and Challenges:

- High initial cost of electric and hybrid vehicles.

- Limited charging infrastructure for electric vehicles.

- Supply chain disruptions impacting vehicle production.

- Stringent emission regulations increasing production costs.

Emerging Opportunities in Canada Commercial Vehicles Market

- Growth in last-mile delivery solutions.

- Increasing adoption of autonomous driving technologies.

- Expansion of electric vehicle charging infrastructure.

- Development of sustainable and alternative fuel vehicles.

Growth Accelerators in the Canada Commercial Vehicles Market Industry

Long-term growth in the Canadian commercial vehicle market will be fueled by continued infrastructure investment, the expansion of the e-commerce sector, and technological breakthroughs in alternative fuels and autonomous driving. Strategic partnerships between manufacturers and technology providers will play a vital role in accelerating innovation and market penetration. Government policies supporting sustainable transportation will also be crucial in driving market expansion.

Key Players Shaping the Canada Commercial Vehicles Market

- Hino Motors Ltd

- Navistar International Transportation Corporation

- Ram Trucking Inc

- Nissan Motor Co Ltd

- Isuzu Motors Limited

- General Motors Company

- Rivian Automotive Inc

- Honda Motor Co Ltd

- Ford Motor Company

- Toyota Motor Corporation

Notable Milestones in Canada Commercial Vehicles Market Sector

- August 2023: General Motors announces the launch of an all-electric Cadillac Escalade in late 2024. This signifies a major commitment to electric vehicles in the luxury segment.

- August 2023: General Motors reinforces its commitment to electric vehicles in the Middle East, indicating expansion plans in a key global market.

- August 2023: Toyota Kirloskar Motor launches the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) in India. While not directly in Canada, this highlights the global trend towards hybrid and electric vehicles.

In-Depth Canada Commercial Vehicles Market Outlook

The Canada Commercial Vehicles Market is poised for robust growth over the next decade, driven by technological advancements, supportive government policies, and the expansion of key end-user sectors. Strategic investments in electric vehicle infrastructure, coupled with increasing demand for fuel-efficient and sustainable transportation solutions, will unlock significant market opportunities for innovative players. The market offers compelling prospects for companies focused on developing and deploying advanced technologies, such as autonomous driving and connected vehicle systems.

Canada Commercial Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Canada Commercial Vehicles Market Segmentation By Geography

- 1. Canada

Canada Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Eastern Canada Canada Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Hino Motors Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Navistar International Transportation Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Ram Trucking Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nissan Motor Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Isuzu Motors Limited

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 General Motors Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Rivian Automotive Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Honda Motor Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ford Motor Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Toyota Motor Corporatio

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Canada Commercial Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Commercial Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Commercial Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Canada Commercial Vehicles Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Canada Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: Canada Commercial Vehicles Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 11: Canada Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Vehicles Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the Canada Commercial Vehicles Market?

Key companies in the market include Hino Motors Ltd, Navistar International Transportation Corporation, Ram Trucking Inc, Nissan Motor Co Ltd, Isuzu Motors Limited, General Motors Company, Rivian Automotive Inc, Honda Motor Co Ltd, Ford Motor Company, Toyota Motor Corporatio.

3. What are the main segments of the Canada Commercial Vehicles Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024August 2023: General Motors doubles down on plans for an electric future in the Middle East.August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) for a starting price of INR 11.99 million and going to INR 12.99 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence