Key Insights

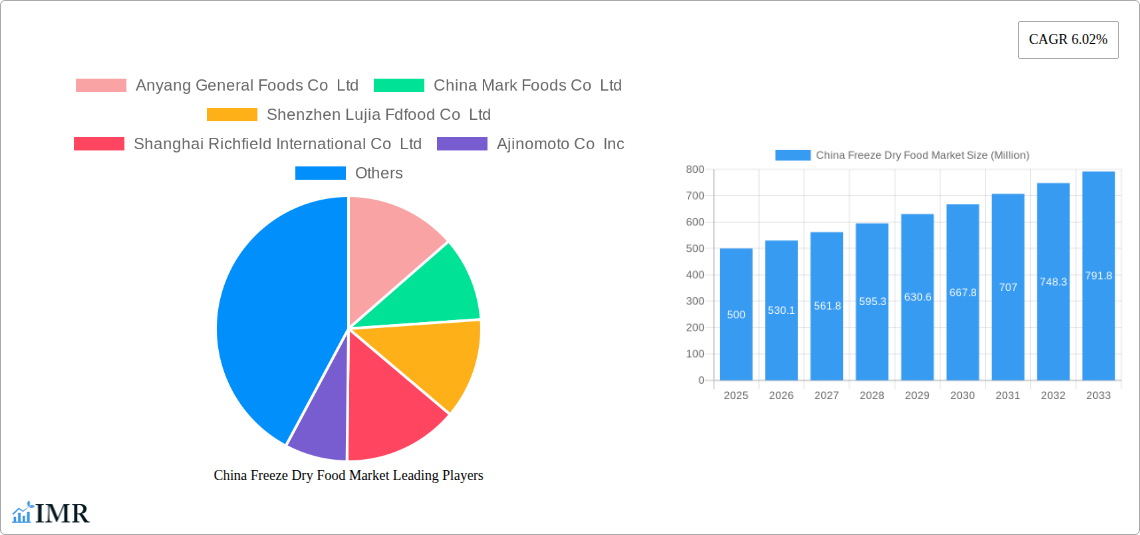

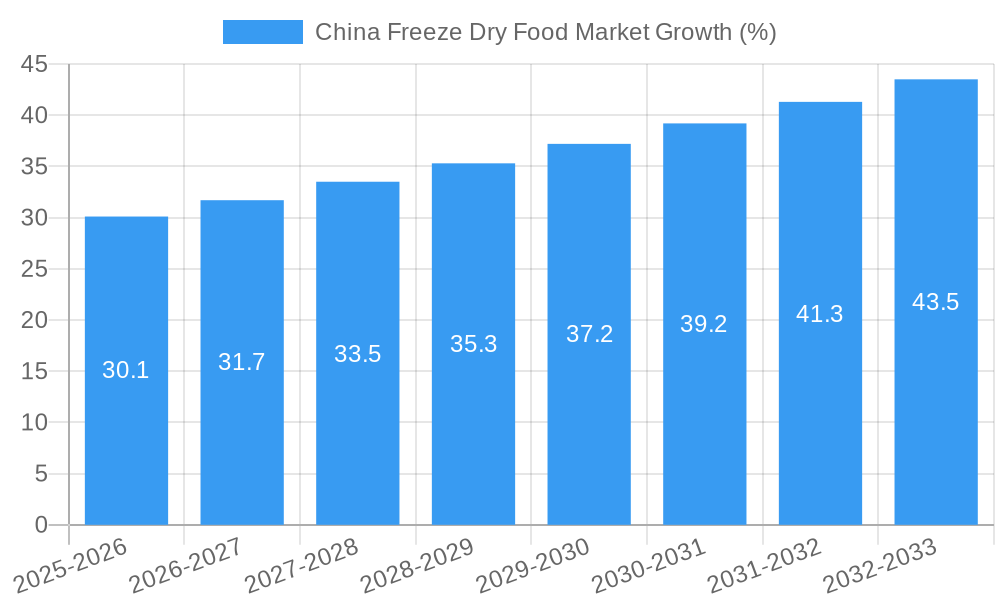

The China freeze-dried food market, currently experiencing robust growth, is projected to reach a substantial size by 2033. Driven by increasing consumer demand for convenient, healthy, and long-shelf-life food products, the market is witnessing a surge in popularity across diverse segments. The rising prevalence of busy lifestyles, coupled with growing awareness of the nutritional benefits of freeze-dried foods, particularly in urban areas, fuels this market expansion. Key product segments like freeze-dried fruits, vegetables, and meat products are experiencing significant traction, propelled by their use in convenient meal solutions and the expanding food processing industry. The food service sector and processed food manufacturers are major end-users, contributing significantly to market volume. While the market faces challenges like fluctuating raw material prices and the need for advanced preservation technologies, innovative product development and strategic partnerships are mitigating these restraints. The presence of established domestic players like Anyang General Foods and international companies such as Kerry Group PLC highlights the competitive landscape and points towards future consolidation and growth. The sustained CAGR of 6.02% further indicates a positive outlook for the market's future expansion.

Based on the provided 2025 market size (let's assume it's $500 million for illustrative purposes, this is an estimation) and the CAGR of 6.02%, the market is poised for significant growth throughout the forecast period (2025-2033). The strong growth is underpinned by factors such as rising disposable incomes, increasing urbanization, and the evolving preferences for convenient and healthy food options. The ongoing investments in research and development of novel freeze-drying technologies, alongside expanding distribution networks, are further facilitating market growth. The government's focus on promoting the food processing industry and supporting the adoption of advanced preservation methods will also contribute positively to the market's trajectory. China’s substantial population and evolving consumer preferences create a fertile ground for the continued growth of this market segment. Further market segmentation analysis, based on specific regional variations within China and detailed consumer purchasing patterns, would provide even more refined insights.

China Freeze-Dried Food Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China freeze-dried food market, offering invaluable insights for industry professionals, investors, and strategic planners. With a detailed examination of market dynamics, growth trends, key players, and future projections, this report serves as an essential resource for navigating this rapidly expanding sector. The report covers the parent market of processed food and the child market of freeze-dried food within China, providing a granular view of the market's structure and potential.

China Freeze Dry Food Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the China freeze-dried food market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

Market Concentration: The market exhibits a moderately concentrated structure, with key players like Ajinomoto Co Inc and Kerry Group PLC holding significant market share (estimated at xx% and xx% respectively in 2025). However, smaller domestic players like Anyang General Foods Co Ltd and Zhengzhou Donsen Foods Co Ltd are also contributing to market growth. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive environment.

Technological Innovation: Advancements in freeze-drying technology, including improved energy efficiency and automation, are driving production capacity and reducing costs. However, barriers to innovation include high initial investment costs for advanced equipment and the need for skilled labor.

Regulatory Framework: Chinese government regulations concerning food safety and labeling are stringent. Compliance requirements impact operational costs and potentially limit smaller players.

Competitive Product Substitutes: Canned and frozen foods pose competition, but freeze-dried foods offer advantages in terms of extended shelf life and nutritional retention.

End-User Demographics: The growing middle class in China, coupled with increasing health consciousness and demand for convenient foods, is boosting the consumption of freeze-dried products. The Foodservice segment is expected to maintain the largest market share in 2025 (xx million units).

M&A Trends: The recent acquisition of Jining Natural Group by Kerry Group (April 2021) highlights the consolidation trend in the industry. The number of M&A deals in the sector is estimated to have been xx in the period 2019-2024.

China Freeze Dry Food Market Growth Trends & Insights

The China freeze-dried food market witnessed significant growth during the historical period (2019-2024), driven by increasing consumer preference for convenient and nutritious food options. Market size expanded from xx million units in 2019 to xx million units in 2024, registering a Compound Annual Growth Rate (CAGR) of xx%. This upward trajectory is anticipated to continue throughout the forecast period (2025-2033), with the market size expected to reach xx million units by 2033. The adoption rate of freeze-dried foods is increasing across all end-user segments, particularly in the retail and foodservice sectors. Technological advancements in freeze-drying technology are improving product quality and efficiency, which further stimulates growth. Consumer behaviour shifts towards health-conscious eating habits, convenience, and longer shelf-life products are key drivers for this expanding market.

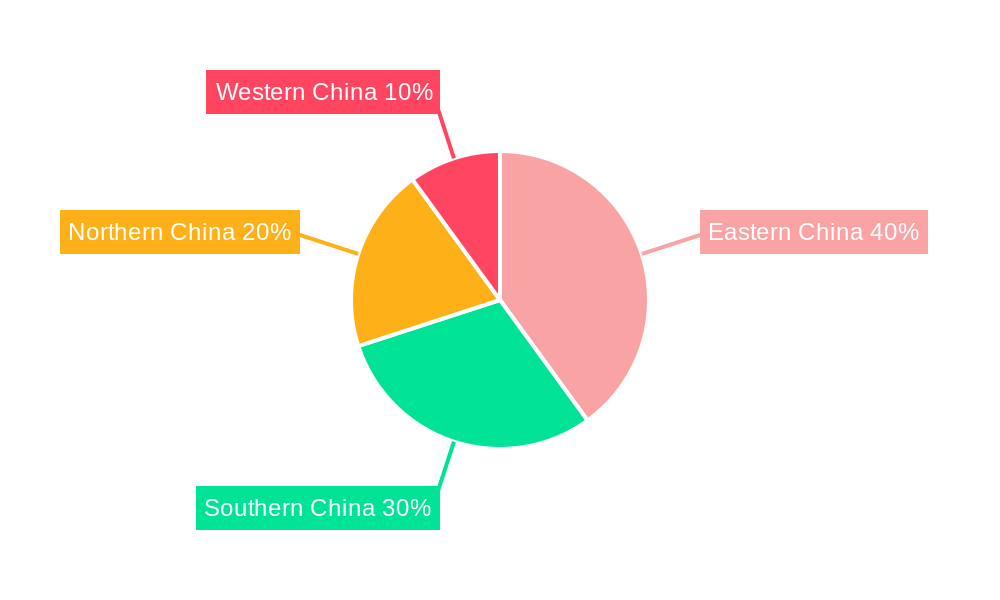

Dominant Regions, Countries, or Segments in China Freeze Dry Food Market

The coastal regions of China, including Guangdong, Jiangsu, and Zhejiang provinces, are expected to dominate the freeze-dried food market in 2025, accounting for approximately xx% of the total market. This dominance is attributed to higher consumer purchasing power, greater availability of advanced food processing facilities, and proximity to major urban centers.

Product Type: Freeze-dried fruits and vegetables will maintain the largest segment share by 2025 (xx million units), driven by the rising demand for healthy and convenient snacking options. Freeze-dried dairy products, however, are predicted to show the highest CAGR (xx%) owing to growing awareness of the benefits of convenient dairy consumption.

End Users: The foodservice sector is anticipated to be the largest end-user segment (xx million units), benefiting from the increasing popularity of freeze-dried ingredients in restaurants and catering services. The growth of the processed food manufacturers segment is fueled by the incorporation of freeze-dried ingredients to enhance product quality and extend shelf-life. The Retail sector is another significant segment showcasing substantial growth as demand for convenient and ready-to-eat meals increases.

Key Drivers: Growing disposable incomes, urbanization, rising health consciousness, and government support for the food processing industry are major drivers of regional dominance.

China Freeze Dry Food Market Product Landscape

The China freeze-dried food market showcases a diverse range of products, encompassing fruits, vegetables, herbs, tea, coffee, dairy products, meat, seafood, and other specialized items. Recent innovations focus on enhancing product texture, flavor, and nutritional content through advanced freeze-drying techniques and ingredient combinations. Many products emphasize natural ingredients and reduced added sugars, aligning with evolving consumer preferences. Freeze-dried foods are increasingly incorporated into ready-to-eat meals, snacks, and functional food products, expanding application scope. Performance metrics, such as shelf life (typically exceeding 2 years), moisture content (typically less than 5%), and nutrient retention, are crucial aspects of product development and market positioning.

Key Drivers, Barriers & Challenges in China Freeze Dry Food Market

Key Drivers: The rising demand for convenient and healthy food options, coupled with increased disposable incomes and urbanization, are primary drivers of market expansion. Government support for the food processing industry and technological advancements in freeze-drying techniques further accelerate growth.

Key Challenges: High initial investment costs associated with freeze-drying equipment pose a significant barrier for small and medium-sized enterprises (SMEs). Stringent food safety regulations and quality control requirements add to operational expenses. Intense competition from existing food preservation methods, like canning and freezing, also presents a hurdle. Supply chain disruptions and fluctuating raw material prices can impact production costs and profitability. The estimated impact of these challenges on market growth is projected at xx% reduction in 2025.

Emerging Opportunities in China Freeze Dry Food Market

Untapped opportunities exist in expanding the market penetration of freeze-dried foods in rural areas and smaller cities. Developing innovative products targeting niche consumer segments, such as elderly individuals or athletes with specific nutritional needs, presents significant potential. Strategic partnerships with food retailers and e-commerce platforms can help broaden distribution channels and improve market access. Furthermore, exploring novel applications in pet food and specialized dietary products will further enhance growth prospects.

Growth Accelerators in the China Freeze Dry Food Market Industry

Technological breakthroughs in freeze-drying technology, leading to improved efficiency and reduced energy consumption, will continue to fuel market expansion. Strategic partnerships between freeze-drying equipment manufacturers and food processors can enhance innovation and product development. Government incentives and support for the food processing industry, coupled with expanding export opportunities, will further stimulate long-term growth.

Key Players Shaping the China Freeze Dry Food Market Market

- Anyang General Foods Co Ltd

- China Mark Foods Co Ltd

- Shenzhen Lujia Fdfood Co Ltd

- Shanghai Richfield International Co Ltd

- Ajinomoto Co Inc

- Zhengzhou Donsen Foods Co Ltd

- Fonterra Co-operative Group Limited

- Tianjin Sai Yu Food Co Ltd

- Lixing Group (Fujian Lixing Foods Co Ltd)

- Kerry Group PLC

- Chaucer Foods Ltd

Notable Milestones in China Freeze Dry Food Market Sector

- May 2022: Fonterra launched an online platform for dairy ingredients across Asia, including freeze-dried products, boosting accessibility for customers.

- December 2021: Fujian Lixing completed its Phase IV Freeze-Dried Production Workshop, significantly increasing production capacity.

- April 2021: Kerry Group acquired Jining Natural Group, expanding its presence and market share within China.

In-Depth China Freeze Dry Food Market Market Outlook

The China freeze-dried food market is poised for sustained growth, driven by factors such as evolving consumer preferences, technological advancements, and supportive government policies. Strategic opportunities abound in product diversification, expanding into new market segments, and leveraging e-commerce channels for enhanced market reach. The market's long-term potential is significant, with substantial opportunities for both established players and new entrants to capitalize on the growing demand for convenient and nutritious food solutions.

China Freeze Dry Food Market Segmentation

-

1. Product Type

- 1.1. Freeze-dried Fruits

- 1.2. Freeze-dried Vegetables and Herbs

- 1.3. Freeze-dried Tea and Coffee

- 1.4. Freeze-dried Dairy Products

- 1.5. Freeze-dried Meat and Seafood

- 1.6. Other Freeze-dried Food

-

2. End Users

- 2.1. Foodservice

- 2.2. Processed Food Manufacturers

- 2.3. Retail

- 2.4. Institutions

China Freeze Dry Food Market Segmentation By Geography

- 1. China

China Freeze Dry Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Foods

- 3.3. Market Restrains

- 3.3.1. High Production Costs

- 3.4. Market Trends

- 3.4.1. Rise of online shopping has made freeze-dried foods more accessible to consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Freeze Dry Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried Fruits

- 5.1.2. Freeze-dried Vegetables and Herbs

- 5.1.3. Freeze-dried Tea and Coffee

- 5.1.4. Freeze-dried Dairy Products

- 5.1.5. Freeze-dried Meat and Seafood

- 5.1.6. Other Freeze-dried Food

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Foodservice

- 5.2.2. Processed Food Manufacturers

- 5.2.3. Retail

- 5.2.4. Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anyang General Foods Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Mark Foods Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shenzhen Lujia Fdfood Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai Richfield International Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zhengzhou Donsen Foods Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fonterra Co-operative Group Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tianjin Sai Yu Food Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lixing Group (Fujian Lixing Foods Co Ltd)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Chaucer Foods Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Anyang General Foods Co Ltd

List of Figures

- Figure 1: China Freeze Dry Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Freeze Dry Food Market Share (%) by Company 2024

List of Tables

- Table 1: China Freeze Dry Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Freeze Dry Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Freeze Dry Food Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: China Freeze Dry Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Freeze Dry Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Freeze Dry Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: China Freeze Dry Food Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: China Freeze Dry Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Freeze Dry Food Market?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the China Freeze Dry Food Market?

Key companies in the market include Anyang General Foods Co Ltd, China Mark Foods Co Ltd, Shenzhen Lujia Fdfood Co Ltd, Shanghai Richfield International Co Ltd, Ajinomoto Co Inc, Zhengzhou Donsen Foods Co Ltd, Fonterra Co-operative Group Limited, Tianjin Sai Yu Food Co Ltd, Lixing Group (Fujian Lixing Foods Co Ltd), Kerry Group PLC, Chaucer Foods Ltd.

3. What are the main segments of the China Freeze Dry Food Market?

The market segments include Product Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Foods.

6. What are the notable trends driving market growth?

Rise of online shopping has made freeze-dried foods more accessible to consumers.

7. Are there any restraints impacting market growth?

High Production Costs.

8. Can you provide examples of recent developments in the market?

In May 2022: Fonterra announced the launch of an online platform for dairy ingredients across Asia and a few other regions for the convenience of their ingredients customers to purchase the products, from milk powder to specialty dairy proteins including its freeze dried-products such as SureStart BifidoB HN019.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Freeze Dry Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Freeze Dry Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Freeze Dry Food Market?

To stay informed about further developments, trends, and reports in the China Freeze Dry Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence