Key Insights

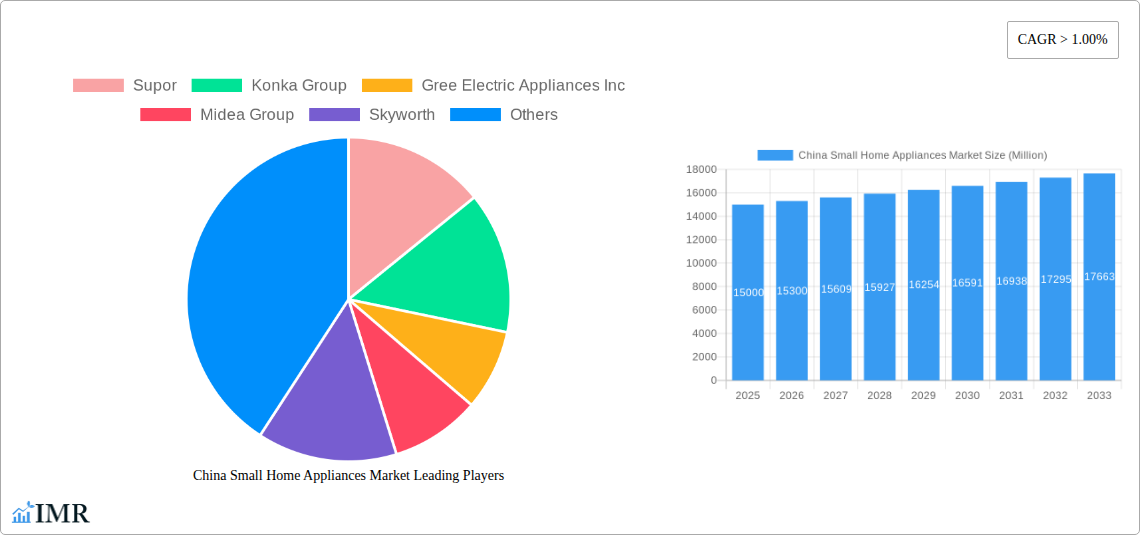

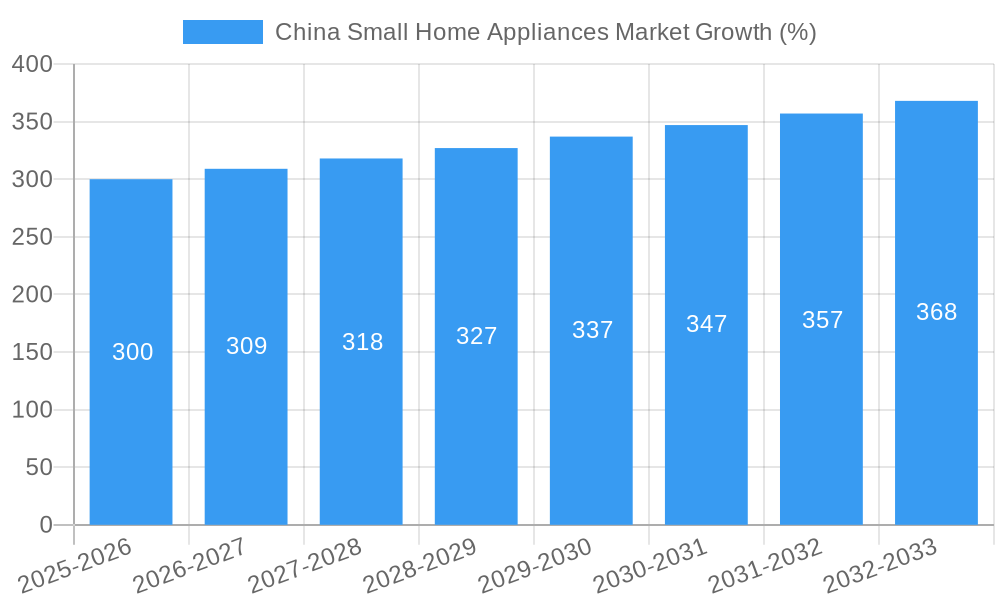

The China small home appliances market, encompassing vacuum cleaners, food processors, coffee machines, irons, toasters, grills and roasters, and other appliances, presents a robust growth opportunity. Driven by rising disposable incomes, urbanization, and a growing preference for convenience, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 1.00%, indicating steady expansion. The market is segmented by distribution channels, with supermarkets/hypermarkets, specialty stores, and online retailers playing significant roles. Key players like Supor, Konka Group, Gree Electric Appliances, Midea Group, Skyworth, TCL Corporation, Haier, Joyoung, Galanz Group, and Changhong dominate the landscape, leveraging brand recognition and technological advancements to cater to evolving consumer demands. The increasing popularity of smart home appliances and the growing emphasis on kitchen innovations are major trends shaping the market's trajectory. While potential restraints could include economic fluctuations and intense competition, the overall market outlook remains positive, fueled by sustained consumer demand and ongoing product innovation. The market size in 2025 is estimated at $XX Billion (assuming a plausible figure based on similar markets and growth rates), expected to significantly increase through 2033. This growth is primarily driven by the expanding middle class's purchasing power and a shift towards improved lifestyles and convenient household solutions.

The competitive landscape is characterized by both domestic and international players vying for market share. Established brands benefit from strong distribution networks and brand loyalty, while newer entrants focus on innovation and niche product offerings. Online sales channels are witnessing rapid growth, reflecting the increasing digital penetration in China and changing consumer behavior. Future market growth hinges on factors such as technological advancements in energy efficiency, smart home integration, and the continuous development of innovative and user-friendly appliances. Strategic partnerships, product diversification, and effective marketing strategies will be crucial for success in this dynamic and rapidly evolving market. Understanding regional variations in consumer preferences and adapting product offerings accordingly will also be important for market penetration and expansion.

China Small Home Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report delivers an in-depth analysis of the dynamic China small home appliances market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). It provides invaluable insights for industry professionals, investors, and strategists seeking to navigate this rapidly evolving landscape. The report segments the market by product (vacuum cleaners, food processors, coffee machines, irons, toasters, grills & roasters, other small appliances) and distribution channels (supermarkets & hypermarkets, specialty stores, online, other channels), offering granular data and analysis for informed decision-making. Key players like Supor, Konka Group, Gree Electric Appliances Inc, Midea Group, Skyworth, TCL Corporation, Haier, Joyoung, Galanz Group, and Changhong are profiled, providing a competitive landscape overview.

China Small Home Appliances Market Market Dynamics & Structure

This section analyzes the market's competitive intensity, technological advancements, regulatory landscape, substitute products, consumer demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of established players and emerging brands, leading to both intense competition and opportunities for innovation.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately concentrated market with potential for further consolidation.

- Technological Innovation: The increasing integration of smart technology, IoT capabilities, and energy efficiency features are driving product differentiation and market growth. Barriers to innovation include high R&D costs and the need for skilled workforce.

- Regulatory Framework: Government regulations related to energy efficiency and safety standards influence product design and manufacturing processes.

- Competitive Product Substitutes: The market faces competition from other household appliances and alternative solutions for specific tasks.

- End-User Demographics: The growing middle class and increasing urbanization are key drivers of market expansion. Shifting consumer preferences towards convenience, premium features, and eco-friendly products are reshaping demand.

- M&A Trends: The acquisition of Wuhan TTIUM Motor Technology CO. LTD by Midea in April 2022 exemplifies the strategic M&A activity aimed at expanding product portfolios and market reach. An estimated xx M&A deals occurred between 2019-2024.

China Small Home Appliances Market Growth Trends & Insights

The China small home appliances market exhibited robust growth from 2019 to 2024, driven by factors such as rising disposable incomes, increasing urbanization, and a shift towards premium products. The market size is expected to reach xx million units in 2025, growing at a CAGR of xx% from 2025 to 2033. The adoption rate of smart home appliances is accelerating. Technological disruptions, such as the introduction of AI-powered features and IoT integration, are creating new market segments and driving demand for advanced products. Consumer behavior shifts towards convenience and sustainability are shaping product development and marketing strategies. The market penetration of high-end small appliances remains relatively low, presenting significant growth opportunities. Furthermore, the preference for online channels is increasing, influencing the distribution strategies adopted by major players.

Dominant Regions, Countries, or Segments in China Small Home Appliances Market

The coastal regions of China, including Guangdong, Jiangsu, and Zhejiang provinces, represent the most significant segments in terms of both market size and growth rate. These areas benefit from higher disposable incomes, well-developed infrastructure, and advanced retail networks.

- Product Segments: Vacuum cleaners and food processors dominate the market in terms of unit sales, with xx million units and xx million units sold in 2025 respectively. However, coffee machines and other small appliances are showing the highest growth potential.

- Distribution Channels: Online sales channels are experiencing rapid growth, outpacing traditional channels. Supermarkets and hypermarkets remain a significant distribution channel, representing approximately xx% of total sales in 2025.

- Key Drivers: Government policies promoting consumer spending, investments in infrastructure development, and favorable economic conditions contribute to the market's robust performance. E-commerce platforms and logistics infrastructure development are particularly crucial for the expansion of the online channel.

China Small Home Appliances Market Product Landscape

The market is witnessing innovation across product categories. Vacuum cleaners are incorporating advanced filtration technologies and smart functionalities. Food processors are becoming more versatile and energy-efficient, while coffee machines are featuring enhanced brewing capabilities and customizable settings. The focus is on improved performance, user experience, and energy efficiency. Unique selling propositions include smart home integration, intuitive interfaces, and innovative designs catering to modern aesthetics.

Key Drivers, Barriers & Challenges in China Small Home Appliances Market

Key Drivers:

Rising disposable incomes, increasing urbanization, technological advancements (e.g., IoT, AI), government support for consumer spending, and strong e-commerce infrastructure drive market expansion.

Challenges:

Intense competition among major brands and emerging players creates downward pressure on pricing. Supply chain disruptions and rising raw material costs impact production efficiency and profitability. Stringent regulatory compliance requirements and concerns regarding the environmental impact of manufacturing contribute to challenges.

Emerging Opportunities in China Small Home Appliances Market

Untapped opportunities lie in expanding into lower-tier cities and rural areas, focusing on value-driven products for budget-conscious consumers. The emergence of new technologies such as AI, IoT, and 5G opens avenues for smart home appliance development. Furthermore, the increasing demand for personalized and specialized small appliances creates niche market opportunities.

Growth Accelerators in the China Small Home Appliances Market Industry

Technological advancements in areas like energy efficiency, connectivity, and automation will continue to propel market growth. Strategic partnerships and collaborations between manufacturers and technology providers will foster innovation. Expanding into new market segments, including niche products and services, will unlock growth potential.

Key Players Shaping the China Small Home Appliances Market Market

- Supor

- Konka Group

- Gree Electric Appliances Inc

- Midea Group

- Skyworth

- TCL Corporation

- Haier

- Joyoung

- Galanz Group

- Changhong

Notable Milestones in China Small Home Appliances Market Sector

- Oct 2022: Changhong showcased 5G eco-friendly appliances at the Canton Fair, highlighting the integration of advanced technologies.

- Apr 2022: Midea's acquisition of Wuhan TTIUM Motor Technology expanded its product portfolio into the two-wheel vehicle market.

In-Depth China Small Home Appliances Market Market Outlook

The China small home appliances market is poised for continued growth, driven by factors including technological innovations, rising consumer spending, and the expansion of e-commerce. Strategic opportunities lie in developing differentiated products, expanding distribution networks, and capitalizing on emerging technologies. The market's long-term potential is substantial, offering lucrative prospects for both established players and new entrants.

China Small Home Appliances Market Segmentation

-

1. Product

- 1.1. Vacuum Cleaners

- 1.2. Food Processors

- 1.3. Coffee Machines

- 1.4. Irons

- 1.5. Toasters

- 1.6. Grills and Roasters

- 1.7. Other Small Appliances

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

China Small Home Appliances Market Segmentation By Geography

- 1. China

China Small Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Generative AI is anticipated to boost the growth of the global theme park market; Growth in the demand for Smart Washing Machines in the market

- 3.3. Market Restrains

- 3.3.1. The growth of the market is likely to be hindered by a high level of electricity consumption

- 3.4. Market Trends

- 3.4.1. Technological Advancements is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Small Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vacuum Cleaners

- 5.1.2. Food Processors

- 5.1.3. Coffee Machines

- 5.1.4. Irons

- 5.1.5. Toasters

- 5.1.6. Grills and Roasters

- 5.1.7. Other Small Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Supor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Konka Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gree Electric Appliances Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Midea Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skyworth

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TCL Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haier

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Joyoung

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Galanz Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Changhong

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Supor

List of Figures

- Figure 1: China Small Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Small Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: China Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Small Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: China Small Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: China Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: China Small Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: China Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Small Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Small Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: China Small Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: China Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: China Small Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: China Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Small Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Small Home Appliances Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the China Small Home Appliances Market?

Key companies in the market include Supor, Konka Group, Gree Electric Appliances Inc, Midea Group, Skyworth, TCL Corporation, Haier, Joyoung, Galanz Group, Changhong.

3. What are the main segments of the China Small Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Generative AI is anticipated to boost the growth of the global theme park market; Growth in the demand for Smart Washing Machines in the market.

6. What are the notable trends driving market growth?

Technological Advancements is Driving the Market.

7. Are there any restraints impacting market growth?

The growth of the market is likely to be hindered by a high level of electricity consumption.

8. Can you provide examples of recent developments in the market?

Oct 2022: At the 132nd China Import and Export Fair (Canton Fair) held online and commence on October 15, 2022, Changhong, one of China's largest consumer electronics and home appliances manufacturers, showcases a full range of products, including 5G eco-friendly household appliances, Mini LED TVs, Eva model air conditioners as well as Space Pro refrigerators and washing machines. With its technological prowess on the Internet of Things (IoT), artificial intelligence (AI), big data, and 5G segments, the company will deliver a superior experience to users by providing them with a full suite of innovative and upgraded smart household appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Small Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Small Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Small Home Appliances Market?

To stay informed about further developments, trends, and reports in the China Small Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence