Key Insights

The India Optic Fiber Cable and Accessories Market is experiencing robust growth, driven by the increasing demand for high-speed internet and digital infrastructure development across the country. Government initiatives promoting digitalization, coupled with rising smartphone penetration and expanding 5G network deployments, are significantly fueling market expansion. The burgeoning telecommunications sector, coupled with the growing adoption of cloud computing and data centers, necessitates substantial investments in optic fiber cable infrastructure. This demand is further amplified by the ongoing expansion of smart cities projects and the government's push for broadband connectivity in rural areas. Competitive pricing strategies employed by major players, alongside advancements in fiber optic technology leading to improved bandwidth and efficiency, are contributing to market expansion. However, challenges such as the high initial investment cost associated with fiber optic network infrastructure and the potential for damage to cables during installation or maintenance could act as restraints.

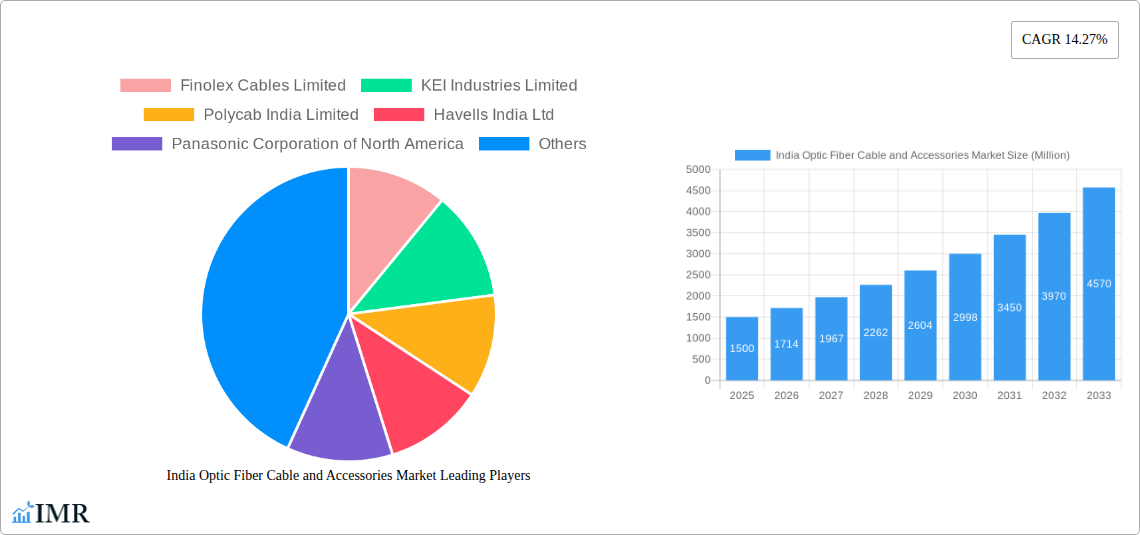

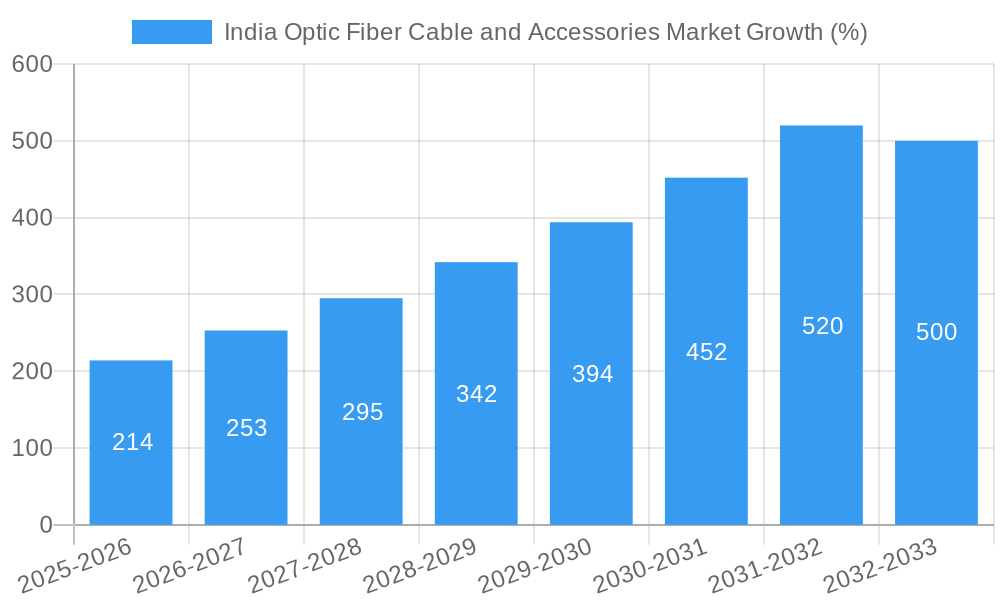

Despite these restraints, the market outlook remains positive, projected to maintain a Compound Annual Growth Rate (CAGR) of 14.27% from 2025 to 2033. Key players like Finolex Cables Limited, KEI Industries Limited, and Polycab India Limited are investing heavily in research and development to enhance product quality and expand their market share. The market is segmented by type (single-mode, multi-mode), application (telecommunications, data centers, broadband), and region. While precise regional data is unavailable, it is expected that urban areas and key economic hubs will demonstrate higher growth rates compared to rural regions. The market's expansion is further supported by ongoing infrastructure development in sectors such as transportation, energy, and healthcare, all of which rely increasingly on high-bandwidth communication networks.

India Optic Fiber Cable and Accessories Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Optic Fiber Cable and Accessories Market, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving market. The market is segmented by type (e.g., single-mode, multi-mode fiber optic cables) and application (e.g., telecommunications, broadband internet access, enterprise networks), with detailed analysis provided for each segment. The total market size is projected to reach xx Million units by 2033.

India Optic Fiber Cable and Accessories Market Market Dynamics & Structure

The Indian optic fiber cable and accessories market is experiencing robust growth, driven by increasing demand for high-speed internet and digital infrastructure development. Market concentration is moderate, with several major players and numerous smaller regional players. Technological innovation, particularly in fiber optic cable technology and related accessories, is a significant driver, enabling higher bandwidth, improved signal transmission, and cost-effectiveness. Government regulations and policies, such as the BharatNet project, play a crucial role in shaping market growth. Competitive product substitutes, such as wireless technologies, pose some challenges but are limited in their capacity to fully replace fiber optic infrastructure for high-bandwidth applications. End-user demographics show a clear shift towards higher adoption rates in urban areas, with rural penetration steadily increasing. M&A activity within the sector is moderate, with strategic acquisitions primarily aimed at expanding product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on higher fiber count cables, improved durability, and reduced installation costs.

- Regulatory Framework: Government initiatives like BharatNet significantly boost demand.

- Competitive Substitutes: Wireless technologies pose a partial threat, but fiber optics remain dominant for high-bandwidth needs.

- End-User Demographics: Strong growth in urban areas, with increasing penetration in rural regions.

- M&A Trends: Moderate activity, with strategic acquisitions driving expansion and diversification.

India Optic Fiber Cable and Accessories Market Growth Trends & Insights

The Indian optic fiber cable and accessories market has witnessed significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth trajectory is projected to continue throughout the forecast period (2025-2033), driven by increasing government investments in digital infrastructure, rising internet and mobile penetration, and the growing adoption of cloud services and 5G technology. The market size is estimated to be xx Million units in 2025 and is projected to reach xx Million units by 2033. Technological advancements such as the development of higher-density fiber cables, and improved fiber optic materials are further fueling market expansion. The increasing adoption of fiber-to-the-home (FTTH) technology is contributing significantly to the growth of the optic fiber cable market. Consumer behavior shifts towards greater reliance on high-speed internet for both personal and professional use continue to underpin market demand.

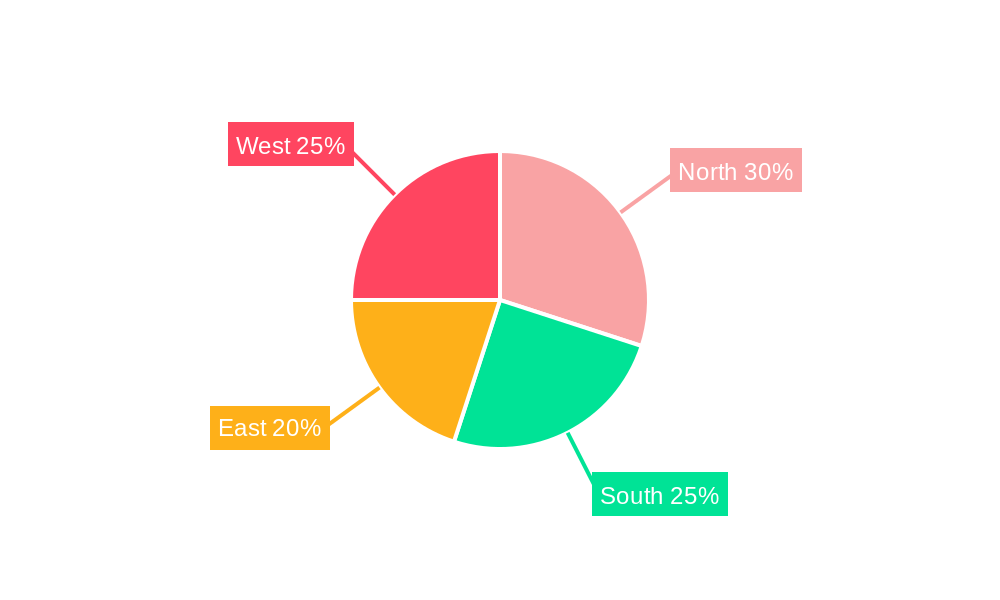

Dominant Regions, Countries, or Segments in India Optic Fiber Cable and Accessories Market

The market is characterized by uneven regional development. Urban centers and states with robust digital infrastructure initiatives experience the strongest growth. Maharashtra, Gujarat, and Karnataka are currently leading in terms of market share and growth potential, primarily driven by strong economic activity and proactive government policies supporting digital infrastructure development. The telecommunications segment dominates the market, reflecting the substantial investments made by telecom operators in expanding their fiber optic networks.

- Key Drivers:

- Government initiatives (BharatNet).

- Investments in digital infrastructure.

- High internet penetration growth in urban areas.

- Expanding telecommunication networks.

- Dominance Factors:

- Strong economic activity in leading states.

- Proactive government support for digital infrastructure.

- High concentration of telecom operators and data centers.

- Established supply chains and manufacturing capabilities.

India Optic Fiber Cable and Accessories Market Product Landscape

The market offers a diverse range of fiber optic cables, including single-mode and multi-mode options, each tailored to specific bandwidth and distance requirements. Recent innovations focus on increased fiber density within smaller cable diameters, improving installation efficiency and reducing costs. Performance metrics are increasingly focused on minimizing signal attenuation and maximizing transmission speed, aligning with the demands of high-bandwidth applications. Unique selling propositions include enhanced durability, improved bend resistance, and compatibility with next-generation network technologies.

Key Drivers, Barriers & Challenges in India Optic Fiber Cable and Accessories Market

Key Drivers:

- Government Initiatives: Projects like BharatNet are significantly boosting demand.

- 5G Rollout: Demand for high-bandwidth infrastructure is escalating.

- Increasing Internet Penetration: Growth in both urban and rural areas fuels demand.

Key Challenges:

- Supply Chain Disruptions: Global events can impact raw material availability and pricing.

- Regulatory Hurdles: Navigating complex regulatory processes can slow deployment.

- Competitive Intensity: Pricing pressures from numerous players create challenges for profitability.

Emerging Opportunities in India Optic Fiber Cable and Accessories Market

- Rural Broadband Expansion: Untapped potential exists in extending fiber optic networks to underserved rural areas.

- Smart City Initiatives: The development of smart cities creates significant demand for advanced networking infrastructure.

- Data Center Growth: The increasing number of data centers requires substantial fiber optic connectivity.

Growth Accelerators in the India Optic Fiber Cable and Accessories Market Industry

Technological advancements, particularly in fiber optic cable design and manufacturing, are crucial for long-term growth. Strategic partnerships between cable manufacturers, telecom operators, and infrastructure developers are accelerating market expansion. Government initiatives and favorable regulatory environments will continue to provide impetus for market growth.

Key Players Shaping the India Optic Fiber Cable and Accessories Market Market

- Finolex Cables Limited

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd

- Panasonic Corporation of North America

- Sterlite Technologies Limited (STL Tech)

- Birla Cable Limited

- Vindhya Telelinks Ltd

- HFCL Limited

- Aksh Optifibre Limited

Notable Milestones in India Optic Fiber Cable and Accessories Market Sector

- May 2024: Runaya plans to double capacity and reach INR 500 crore (~USD 60 million) revenue in 3-4 years, driven by 5G, tower fiberization, broadband expansion, and BharatNet. INR 60 crore (~USD 7 million) invested since 2019 in FRP rod manufacturing.

- July 2024: STL launches 864F Micro Cables, boasting industry-leading fiber density (864 fibers in 11.4 mm diameter) for efficient compact network connectivity.

In-Depth India Optic Fiber Cable and Accessories Market Market Outlook

The future outlook for the Indian optic fiber cable and accessories market is exceptionally positive. Continued government support, expanding digital infrastructure, and technological advancements will fuel sustained growth. Strategic partnerships and investments in manufacturing capacity will ensure the market continues to meet the rising demand for high-speed internet connectivity across the country. Opportunities exist for companies to leverage innovation, expand into underserved regions, and establish strong partnerships to capture significant market share.

India Optic Fiber Cable and Accessories Market Segmentation

-

1. Offering

- 1.1. Optical Fiber Cables

- 1.2. Optical Fiber Connectors

- 1.3. Optical Fiber Accessories

-

2. End-user Vertical

- 2.1. Industrial

- 2.2. Telecommunication

- 2.3. Energy and Utilities

- 2.4. Other End-user Verticals

India Optic Fiber Cable and Accessories Market Segmentation By Geography

- 1. India

India Optic Fiber Cable and Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.3. Market Restrains

- 3.3.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and 5G Deployment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Optic Fiber Cable and Accessories Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Optical Fiber Cables

- 5.1.2. Optical Fiber Connectors

- 5.1.3. Optical Fiber Accessories

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Industrial

- 5.2.2. Telecommunication

- 5.2.3. Energy and Utilities

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Finolex Cables Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KEI Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Polycab India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation of North America

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sterlite Technologies Limited (STL Tech)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Birla Cable Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vindhya Telelinks Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFCL Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aksh Optifibre Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Finolex Cables Limited

List of Figures

- Figure 1: India Optic Fiber Cable and Accessories Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Optic Fiber Cable and Accessories Market Share (%) by Company 2024

List of Tables

- Table 1: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 6: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 7: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Optic Fiber Cable and Accessories Market?

The projected CAGR is approximately 14.27%.

2. Which companies are prominent players in the India Optic Fiber Cable and Accessories Market?

Key companies in the market include Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, Havells India Ltd, Panasonic Corporation of North America, Sterlite Technologies Limited (STL Tech), Birla Cable Limited, Vindhya Telelinks Ltd, HFCL Limited, Aksh Optifibre Limite.

3. What are the main segments of the India Optic Fiber Cable and Accessories Market?

The market segments include Offering , End-user Vertical .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

6. What are the notable trends driving market growth?

Rising Internet Penetration and 5G Deployment to Drive the Market.

7. Are there any restraints impacting market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

8. Can you provide examples of recent developments in the market?

May 2024 - Runaya, a manufacturer of optical fiber cable components, aimed to double its capacity and scale its revenues to INR 500 crore (~USD 60 million) within the next 3-4 years. This ambition is driven by the accelerated rollout of 5G, the fiberization of towers, the push for home broadband connectivity, and the government's Bharatnet Project. Since 2019, the company has channeled a capital expenditure of INR 60 crore (~USD 7 million) into manufacturing FRP (fiber-reinforced polymer) rods, essential for optical fibers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Optic Fiber Cable and Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Optic Fiber Cable and Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Optic Fiber Cable and Accessories Market?

To stay informed about further developments, trends, and reports in the India Optic Fiber Cable and Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence