Key Insights

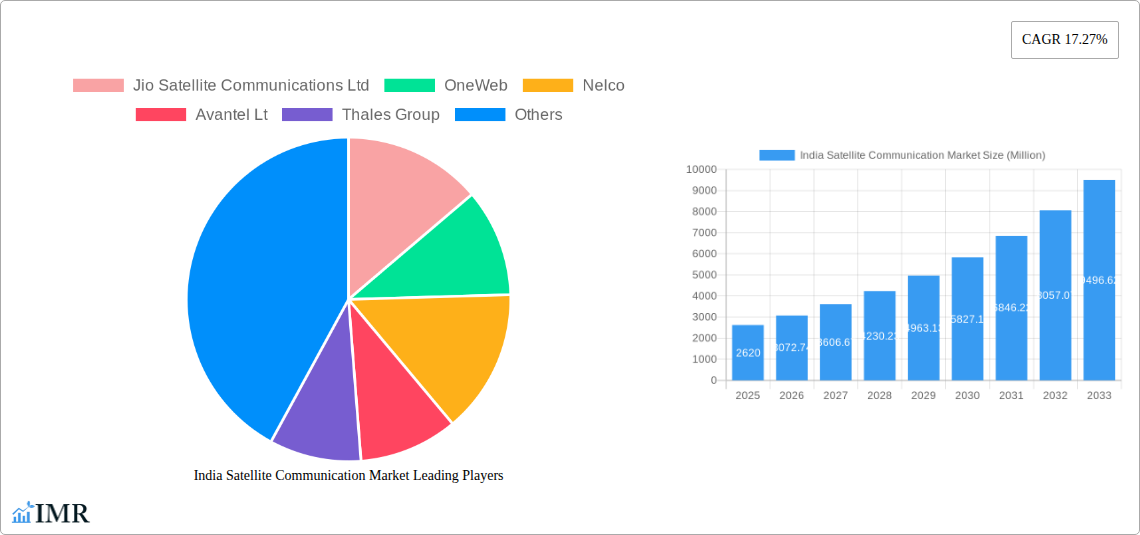

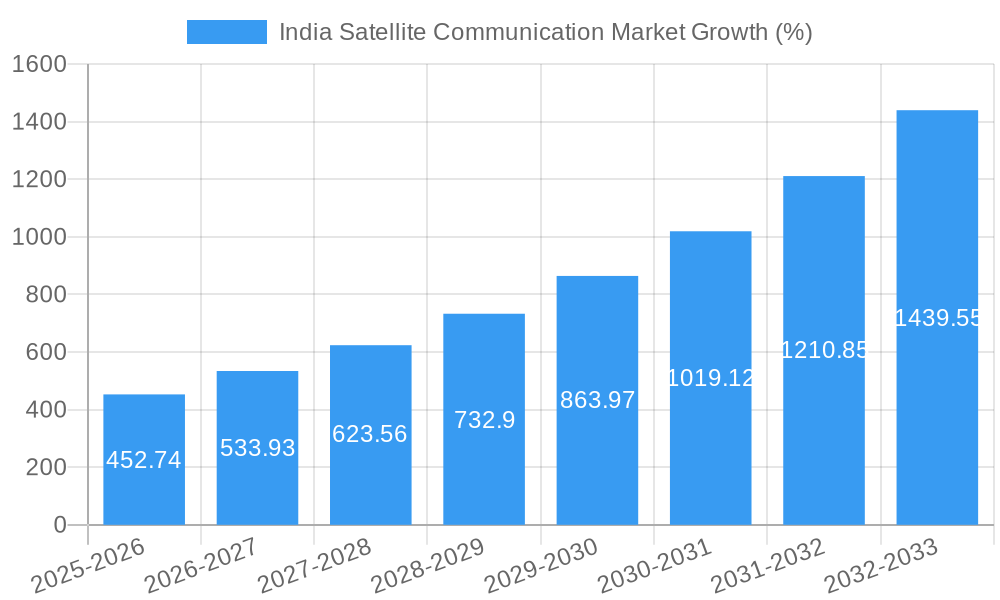

The India satellite communication market is experiencing robust growth, projected to reach \$2.62 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.27% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for high-speed internet access in remote and underserved areas is fueling the adoption of satellite communication technologies. The government's push for digitalization and infrastructure development, particularly in rural India, further stimulates market growth. The rising popularity of satellite-based services in sectors like maritime, defense, and media & entertainment is also contributing significantly. Furthermore, advancements in satellite technology, such as the deployment of high-throughput satellites (HTS), are enabling the delivery of broader bandwidth and improved service quality, thus attracting more users and businesses. The market is segmented by type (ground equipment and SNG services), platform (portable, land, maritime, airborne), and end-user vertical (maritime, defense & government, enterprises, media & entertainment, and others). Competition in this rapidly evolving market is intense, with both domestic and international players vying for market share.

The dominance of specific segments within the Indian satellite communication market will likely shift over the forecast period. The growth of the SNG services segment will be fueled by increasing media consumption and the need for reliable live news broadcasting. The maritime segment is projected to witness substantial growth due to increased demand for connectivity in shipping and offshore operations. The government's strategic investments in defense and national security will drive growth in the defense and government segment. While the market faces challenges such as high initial investment costs and regulatory hurdles, the overall outlook remains positive, with substantial opportunities for expansion throughout the forecast period. The competitive landscape will continue to evolve with mergers, acquisitions, and strategic partnerships among key players further shaping the market dynamics.

India Satellite Communication Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Satellite Communication market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by type (Ground Equipment, Satellite News Gathering (SNG) Services), platform (Portable, Land, Maritime, Airborne), and end-user vertical (Maritime, Defense & Government, Enterprises, Media & Entertainment, Other). This detailed analysis is invaluable for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The total market size is projected to reach xx Million units by 2033.

India Satellite Communication Market Dynamics & Structure

The Indian satellite communication market is characterized by a moderately concentrated landscape with key players such as Jio Satellite Communications Ltd, OneWeb, and Tata Communications holding significant market share. Technological innovation, driven by advancements in satellite technology and increasing demand for high-bandwidth applications, is a major driver. The regulatory framework, while evolving, plays a crucial role in shaping market access and competition. The market witnesses competitive pressures from terrestrial communication technologies like fiber optics, while M&A activities remain relatively moderate, with xx deals recorded between 2019 and 2024, contributing to approximately xx% market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Advancements in High Throughput Satellites (HTS), Low Earth Orbit (LEO) constellations, and 5G integration are key drivers.

- Regulatory Framework: Government policies and spectrum allocation influence market growth and accessibility.

- Competitive Substitutes: Terrestrial communication technologies (fiber optics) pose a significant competitive challenge.

- End-User Demographics: Growth is fueled by increasing internet penetration, particularly in rural areas, and the expanding demand across diverse verticals.

- M&A Trends: Moderate M&A activity observed, with xx deals in the historical period, primarily focused on strategic partnerships and technology acquisitions. This is expected to increase to xx deals during the forecast period.

India Satellite Communication Market Growth Trends & Insights

The Indian satellite communication market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to the increasing demand for broadband services in underserved regions, the rising adoption of satellite-based solutions across various sectors, and government initiatives promoting digital connectivity. The market size in 2025 is estimated at xx Million units, and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as the launch of LEO constellations and the integration of 5G, are expected to further accelerate market growth. Consumer behavior is shifting towards higher bandwidth and more reliable communication services, driving the demand for advanced satellite technologies. Market penetration is expected to increase from xx% in 2025 to xx% in 2033.

Dominant Regions, Countries, or Segments in India Satellite Communication Market

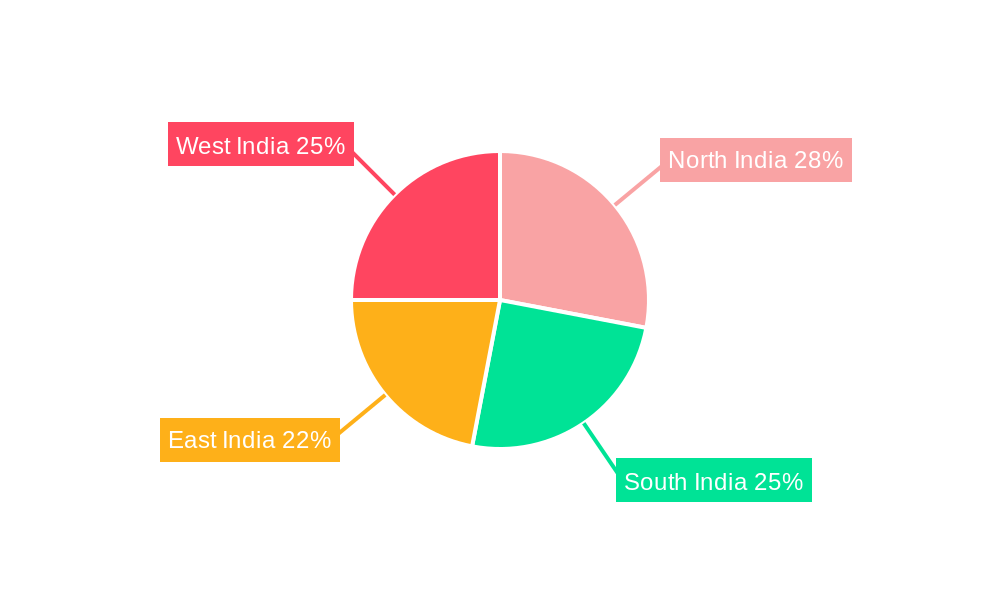

The India Satellite Communication Market is witnessing significant growth across multiple segments and regions. The Ground Equipment segment holds a dominant position, accounting for approximately xx% of the market share in 2025, due to the widespread adoption of VSAT systems across diverse sectors. The Maritime end-user vertical is experiencing the fastest growth, driven by increasing demand for reliable communication solutions in the maritime industry. Geographically, the growth is relatively evenly distributed across India with urban centers experiencing faster growth due to increased demand for higher bandwidth services. Key drivers include government initiatives promoting digital inclusion, expansion of infrastructure, and growing adoption of satellite-based solutions across various sectors, especially in remote and rural areas.

- Ground Equipment: Dominant segment driven by VSAT adoption.

- Maritime: Fastest-growing end-user vertical due to demand for reliable connectivity at sea.

- Urban Centers: Witnessing fastest growth due to high demand for high-bandwidth services.

- Government Initiatives: Digital inclusion programs are boosting market expansion.

- Infrastructure Development: Expansion of infrastructure facilitates wider adoption.

India Satellite Communication Market Product Landscape

The Indian satellite communication market showcases a diverse product landscape, featuring advanced ground equipment, high-throughput satellite systems, and sophisticated SNG solutions. Innovations focus on enhancing bandwidth, improving signal quality, and reducing latency. New products incorporate features like advanced encryption and network management capabilities. Technological advancements, including the use of Software-Defined Networks (SDNs) and Artificial Intelligence (AI), are improving operational efficiency and customer experience. The unique selling propositions lie in providing reliable, high-bandwidth connectivity to remote areas with limited or no terrestrial infrastructure.

Key Drivers, Barriers & Challenges in India Satellite Communication Market

Key Drivers:

- Increasing demand for broadband connectivity in underserved regions.

- Government initiatives to promote digital inclusion and infrastructure development.

- Growing adoption of satellite-based solutions across various sectors.

- Technological advancements in satellite technology.

Challenges & Restraints:

- High initial investment costs associated with satellite communication systems.

- Dependence on spectrum allocation and regulatory approvals.

- Competition from terrestrial communication technologies.

- Weather-related disruptions impacting signal quality. This has resulted in a xx% downtime in certain regions during the past 5 years.

Emerging Opportunities in India Satellite Communication Market

Emerging opportunities lie in expanding satellite broadband services to rural areas, leveraging IoT applications, and providing satellite-based solutions for disaster management and remote sensing. The increasing demand for high-speed internet in remote locations presents significant growth potential for satellite communication providers. Innovations in satellite technology and partnerships with local telecom companies will create new avenues for market expansion.

Growth Accelerators in the India Satellite Communication Market Industry

Strategic partnerships between satellite operators and telecom providers, coupled with government support for infrastructure development and the expansion of satellite-based broadband services to rural and remote areas, are key growth catalysts. Technological breakthroughs, such as the introduction of HTS and LEO constellations, will further enhance the capabilities and affordability of satellite communication services. Market expansion through targeted initiatives focusing on specific verticals will also accelerate growth.

Key Players Shaping the India Satellite Communication Market Market

- Jio Satellite Communications Ltd

- OneWeb

- Nelco

- Avantel Lt

- Thales Group

- Tata Communications

- Bharti Airtel Limited

- Precision Electronics Limited (PEL)

- Orbcomm Inc

- ViaSat Inc

- Hughes Communications India Ltd

Notable Milestones in India Satellite Communication Market Sector

- April 2024: SIA-India and ABRASAT formalized a partnership to enhance space industry cooperation between India and Brazil.

- April 2024: Tata Advanced Systems Ltd launched India's first private sector sub-meter resolution earth observation satellite, TSAT-1A.

In-Depth India Satellite Communication Market Market Outlook

The future of the Indian satellite communication market is bright, fueled by technological advancements, increasing demand for connectivity, and government support. Strategic investments in infrastructure and partnerships will unlock significant growth opportunities. The market is poised for expansion in underserved regions, driving significant market penetration and growth in the coming years. The focus will be on offering affordable, high-bandwidth solutions, leveraging emerging technologies to cater to the diverse needs of various sectors.

India Satellite Communication Market Segmentation

-

1. Type

-

1.1. Ground Equipment

- 1.1.1. Gateway

- 1.1.2. Very Small Aperture Terminal (VSAT)

- 1.1.3. Network Operation Center (NOC)

- 1.1.4. Satellite News Gathering (SNG)

-

1.2. Services

- 1.2.1. Mobile Satellite Services (MSS)

- 1.2.2. Earth Observation Services

-

1.1. Ground Equipment

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

India Satellite Communication Market Segmentation By Geography

- 1. India

India Satellite Communication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Growth of Internet of Things (IoT) and Autonomous Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Satellite Communication Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.1.1. Gateway

- 5.1.1.2. Very Small Aperture Terminal (VSAT)

- 5.1.1.3. Network Operation Center (NOC)

- 5.1.1.4. Satellite News Gathering (SNG)

- 5.1.2. Services

- 5.1.2.1. Mobile Satellite Services (MSS)

- 5.1.2.2. Earth Observation Services

- 5.1.1. Ground Equipment

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Satellite Communication Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Satellite Communication Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Satellite Communication Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Satellite Communication Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Jio Satellite Communications Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OneWeb

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nelco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Avantel Lt

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tata Communications

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bharti Airtel Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Precision Electronics Limited (PEL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Orbcomm Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ViaSat Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hughes Communications India Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Jio Satellite Communications Ltd

List of Figures

- Figure 1: India Satellite Communication Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Satellite Communication Market Share (%) by Company 2024

List of Tables

- Table 1: India Satellite Communication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Satellite Communication Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Satellite Communication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: India Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: India Satellite Communication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Satellite Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Satellite Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Satellite Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Satellite Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Satellite Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Satellite Communication Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Satellite Communication Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 13: India Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 14: India Satellite Communication Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Satellite Communication Market?

The projected CAGR is approximately 17.27%.

2. Which companies are prominent players in the India Satellite Communication Market?

Key companies in the market include Jio Satellite Communications Ltd, OneWeb, Nelco, Avantel Lt, Thales Group, Tata Communications, Bharti Airtel Limited, Precision Electronics Limited (PEL), Orbcomm Inc, ViaSat Inc, Hughes Communications India Ltd.

3. What are the main segments of the India Satellite Communication Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.62 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Growth of Internet of Things (IoT) and Autonomous Systems.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

April 2024 - SIA-India, the premier space association in India, and ABRASAT, a key player in Brazil's Satellite Communications sector, have formalized a partnership via a Memorandum of Understanding (MoU). The primary goal of this collaboration is to bolster cooperation and drive advancements in the space industries of both nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Satellite Communication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Satellite Communication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Satellite Communication Market?

To stay informed about further developments, trends, and reports in the India Satellite Communication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence