Key Insights

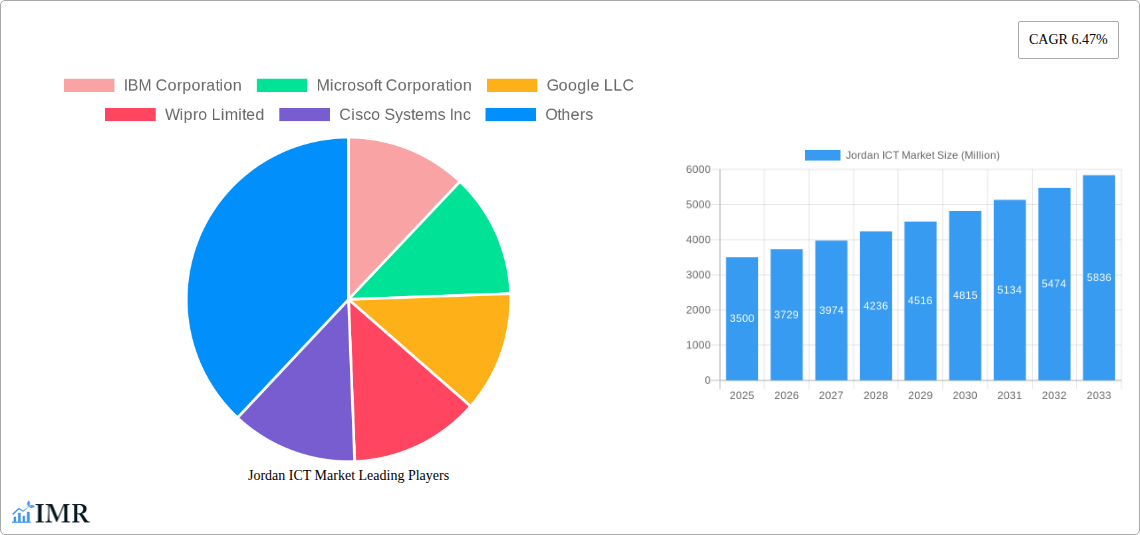

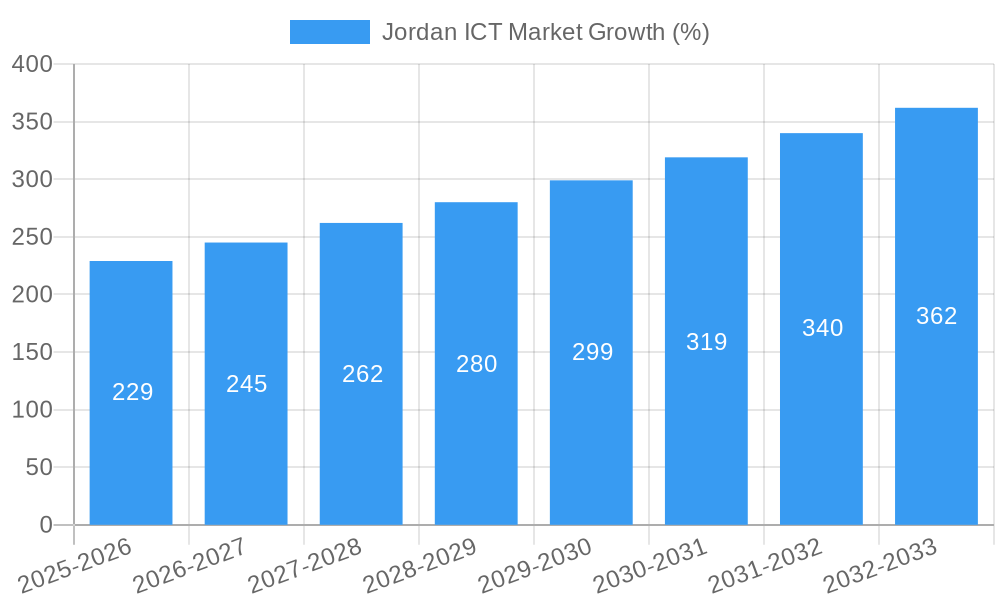

The Jordan ICT market, valued at $3.5 billion in 2025, is projected to experience robust growth, driven by increasing government investments in digital infrastructure, rising smartphone penetration, and the expanding adoption of cloud computing and other digital services across various sectors. The 6.47% CAGR from 2025 to 2033 indicates a significant market expansion, fueled by a young and tech-savvy population eager to embrace technological advancements. Key drivers include the government's digital transformation initiatives aimed at improving public services and economic diversification, the burgeoning e-commerce sector demanding robust ICT infrastructure, and a growing need for cybersecurity solutions to protect sensitive data. While data limitations prevent precise segmentation analysis, it's reasonable to assume significant market shares across segments like software, hardware, telecommunications, and IT services. Leading players such as IBM, Microsoft, Google, and regional companies like Wipro and Datos Solution are actively competing within this dynamic market, vying for a slice of the expanding pie.

The market's growth trajectory is projected to remain positive throughout the forecast period, although challenges exist. These include limited skilled ICT professionals, potential infrastructural bottlenecks, and the need for continuous investment in digital literacy programs. However, the government's commitment to developing the digital economy, coupled with ongoing private sector investments, mitigates these risks. The market's future depends heavily on successful implementation of ongoing digital transformation strategies, fostering a supportive regulatory environment for innovation, and addressing the skills gap. The projected growth offers considerable potential for both established players and new entrants looking to capitalize on the expanding opportunities within the Jordan ICT sector.

Jordan ICT Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Jordan ICT market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report analyzes both parent and child markets within the Jordanian ICT sector, offering granular insights into market segments and growth potential. The total market size for 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Jordan ICT Market Dynamics & Structure

The Jordanian ICT market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, particularly in areas like 5G deployment and cloud computing, is a key driver of growth. The regulatory framework, while evolving, presents both opportunities and challenges for market participants. The presence of competitive product substitutes and the increasing adoption of digital technologies across various sectors are shaping market dynamics. M&A activity, while not at a high volume, is present and signifies consolidation within the market.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: 5G rollout and cloud adoption are key drivers, although infrastructure limitations remain a barrier.

- Regulatory Framework: Government initiatives promoting digital transformation create opportunities but require navigation of bureaucratic processes.

- Competitive Substitutes: The emergence of open-source technologies and alternative solutions pressures incumbents.

- End-User Demographics: A growing young population and increasing internet penetration fuels demand for ICT services.

- M&A Trends: Consolidation is expected, with an estimated xx M&A deals anticipated between 2025 and 2033.

Jordan ICT Market Growth Trends & Insights

The Jordan ICT market experienced significant growth during the historical period (2019-2024), driven by increasing government investment in digital infrastructure and rising internet penetration. The market is projected to continue its expansion, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by factors such as increasing mobile phone penetration, the proliferation of smart devices, and the growing adoption of cloud-based services. Consumer behavior is shifting towards digital solutions, creating opportunities for innovative ICT products and services. Technological disruptions, such as the deployment of 5G networks, are further accelerating market growth. Market penetration of key ICT products and services shows steady increase.

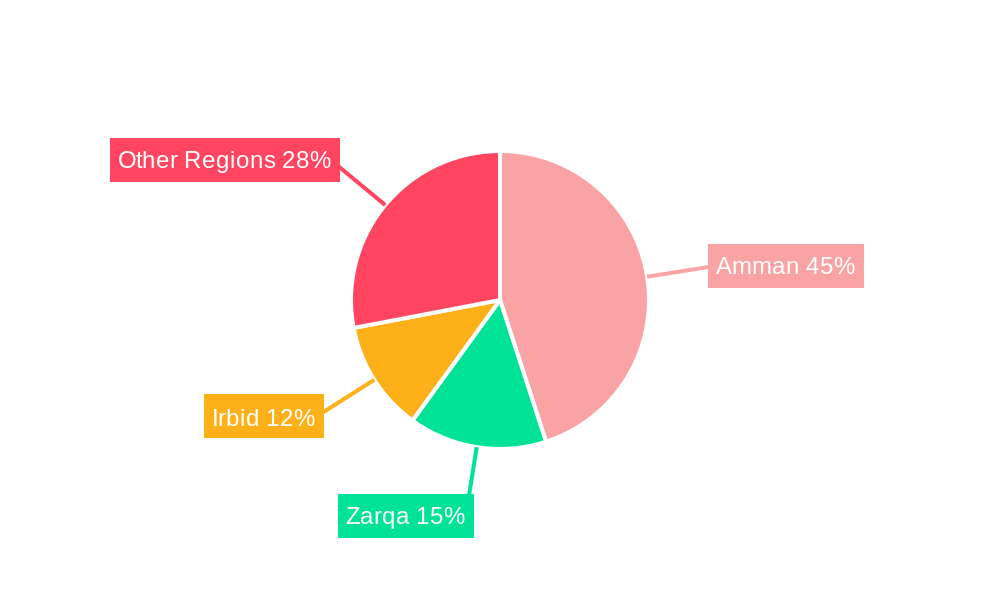

Dominant Regions, Countries, or Segments in Jordan ICT Market

Amman, being the capital city and economic hub, is the dominant region in the Jordanian ICT market, accounting for approximately xx% of the total market value in 2025. This dominance is driven by several factors:

- High Concentration of Businesses and IT Professionals: Amman houses the majority of the country's major corporations and a skilled IT workforce.

- Advanced Infrastructure: The city possesses relatively better infrastructure compared to other regions, supporting higher internet speeds and reliable connectivity.

- Government Initiatives: Government investments in infrastructure development, digital transformation programs, and technology-related educational initiatives primarily focus on Amman.

- Foreign Investments: Amman attracts a significant amount of foreign investment in ICT, contributing to market growth.

While Amman dominates, the report also identifies other regions with potential for future growth. The expansion of internet infrastructure and governmental initiatives in other areas will influence market growth.

Jordan ICT Market Product Landscape

The Jordan ICT market offers a diverse range of products and services, including hardware, software, telecommunications, and IT services. Product innovation is driven by increasing demand for cloud-based solutions, cybersecurity measures, and data analytics capabilities. Key technological advancements include the adoption of artificial intelligence, machine learning, and the Internet of Things (IoT). Products offering enhanced security features and user-friendly interfaces are gaining market traction.

Key Drivers, Barriers & Challenges in Jordan ICT Market

Key Drivers:

- Government initiatives to boost digital transformation are driving demand for ICT solutions.

- Rising internet and smartphone penetration among consumers increases the market's addressable space.

- Growing adoption of cloud services and data analytics creates demand for related products and services.

Key Challenges:

- Limited access to funding for startups and SMEs hinders innovation.

- Cybersecurity threats and data privacy concerns pose significant challenges.

- The skills gap in the ICT workforce is a constraint to market growth, potentially limiting expansion.

Emerging Opportunities in Jordan ICT Market

- The growing adoption of fintech solutions presents a significant opportunity for ICT companies.

- Increased demand for e-government services offers growth opportunities in the public sector.

- The healthcare sector presents opportunities for telemedicine and digital health solutions.

Growth Accelerators in the Jordan ICT Market Industry

Strategic partnerships between local and international ICT companies, along with investments in R&D and infrastructure development, are key catalysts driving the long-term growth of the Jordanian ICT market. Technological breakthroughs in areas such as 5G and AI will create further opportunities. Government support for digital transformation initiatives serves as a key factor in long-term growth.

Key Players Shaping the Jordan ICT Market Market

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Wipro Limited

- Cisco Systems Inc

- Expedia Group Inc

- Oracle Corporation

- Telefonaktiebolaget LM Ericsson

- Devoteam

- Datos Solution LLC

- List Not Exhaustive

Notable Milestones in Jordan ICT Market Sector

- October 2023: Launch of the Aqaba Digital Hub's 6-megawatt data center, boosting connectivity and data exchange capabilities.

- March 2024: Zain Group's USD 994 million infrastructure investment demonstrates significant confidence in the market and its future.

In-Depth Jordan ICT Market Market Outlook

The Jordan ICT market is poised for sustained growth, driven by continued investments in digital infrastructure, increasing adoption of new technologies, and government support for digital transformation initiatives. The market presents significant opportunities for both established players and new entrants, particularly in emerging areas such as fintech, e-government, and digital healthcare. Strategic partnerships and technological innovation will be critical for success in this dynamic market.

Jordan ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprises

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Jordan ICT Market Segmentation By Geography

- 1. Jordan

Jordan ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation

- 3.3. Market Restrains

- 3.3.1. Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation

- 3.4. Market Trends

- 3.4.1. Consistent Digital Transformation Initiatives are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Jordan ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Jordan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wipro Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Expedia Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telefonaktiebolaget LM Ericsson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Devoteam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Datos Solution LLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Jordan ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Jordan ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Jordan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Jordan ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Jordan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Jordan ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Jordan ICT Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 6: Jordan ICT Market Volume Billion Forecast, by Size of Enterprises 2019 & 2032

- Table 7: Jordan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Jordan ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Jordan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Jordan ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Jordan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Jordan ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Jordan ICT Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 14: Jordan ICT Market Volume Billion Forecast, by Size of Enterprises 2019 & 2032

- Table 15: Jordan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Jordan ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Jordan ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Jordan ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Jordan ICT Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the Jordan ICT Market?

Key companies in the market include IBM Corporation, Microsoft Corporation, Google LLC, Wipro Limited, Cisco Systems Inc, Expedia Group Inc, Oracle Corporation, Telefonaktiebolaget LM Ericsson, Devoteam, Datos Solution LLC*List Not Exhaustive.

3. What are the main segments of the Jordan ICT Market?

The market segments include Type, Size of Enterprises, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation.

6. What are the notable trends driving market growth?

Consistent Digital Transformation Initiatives are Driving the Market.

7. Are there any restraints impacting market growth?

Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation.

8. Can you provide examples of recent developments in the market?

March 2024: Zain Group, a prominent telecommunications operator in the Middle East and North Africa, disclosed a significant infrastructure investment, with its capital expenditure (Capex) hitting USD 994 million. The company's strategic moves, like selling towers and engaging in leaseback agreements in pivotal markets like Saudi Arabia, Kuwait, Jordan, and Iraq, bolstered operational efficiencies, leading to a surge in net profits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Jordan ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Jordan ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Jordan ICT Market?

To stay informed about further developments, trends, and reports in the Jordan ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence