Key Insights

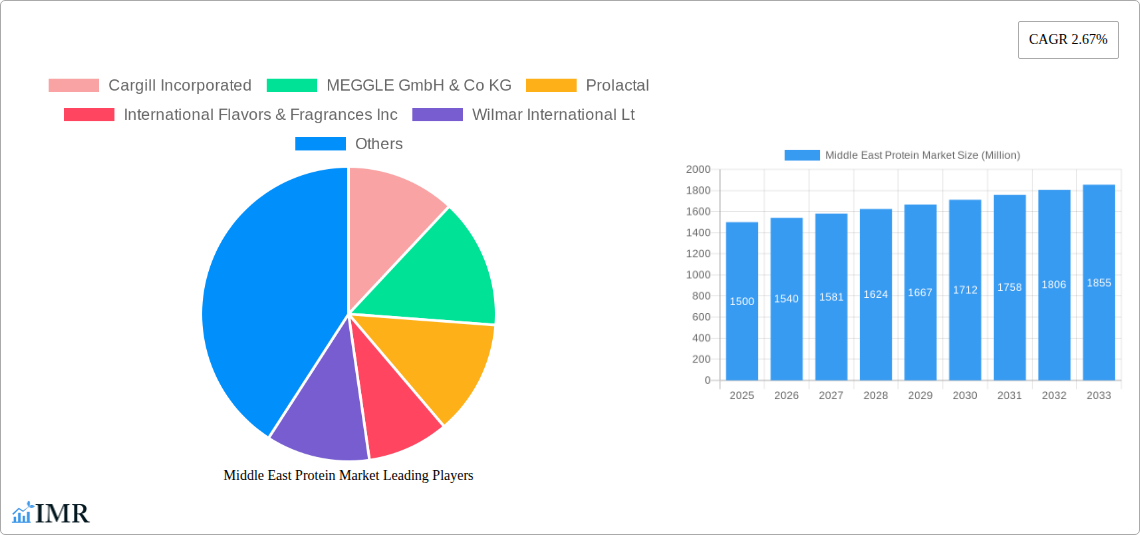

The Middle East protein market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by several key factors. The region's burgeoning population, coupled with increasing disposable incomes and a rising preference for health-conscious diets rich in protein, are fueling demand. Growth in the animal feed sector, particularly within poultry and livestock farming, significantly contributes to this market expansion. The increasing popularity of sports and performance nutrition products further enhances market prospects. While the market is segmented by source (animal, plant-based alternatives like soy and pea protein) and end-user (animal feed, food and beverage industries), the animal-sourced protein segment currently dominates. Major players like Cargill, MEGGLE, and Fonterra are strategically positioning themselves to capture the expanding market share. However, challenges remain, including fluctuating raw material prices and potential regulatory hurdles related to food safety and labeling.

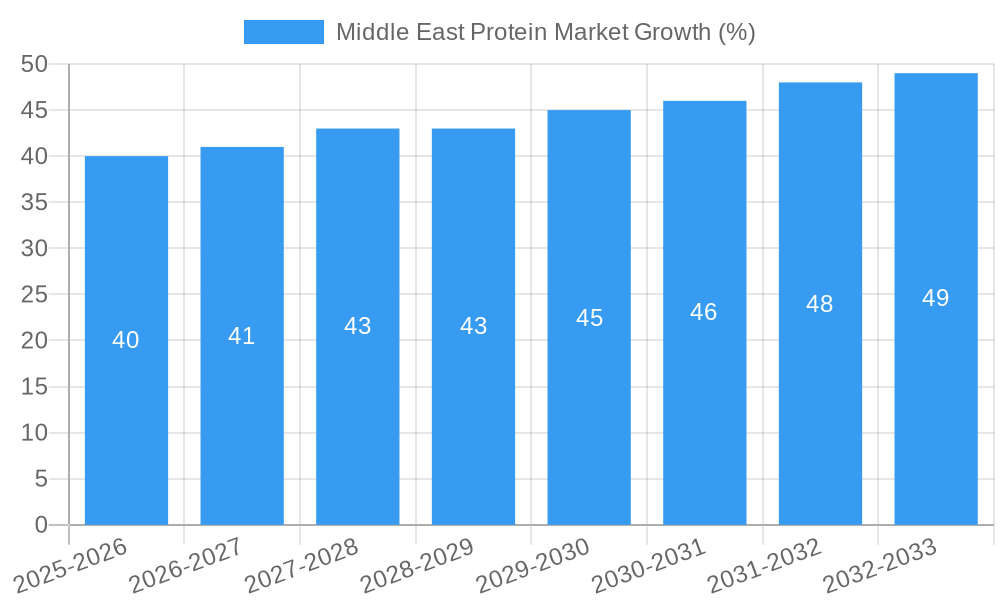

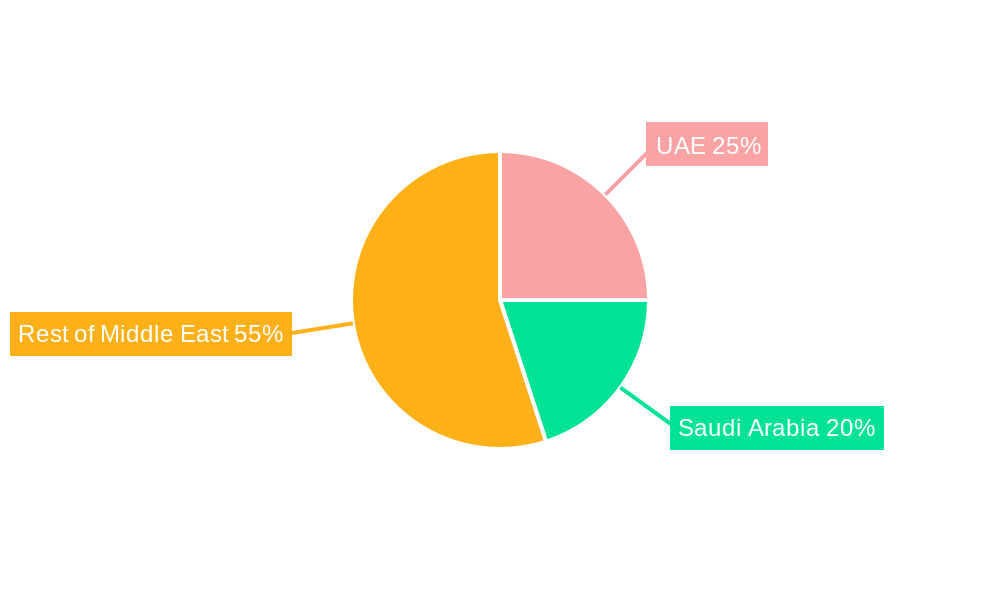

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 2.67%. This growth trajectory is likely to be influenced by government initiatives promoting food security and diversification, as well as increasing investments in the food processing and manufacturing sectors within the region. Specific countries like the UAE and Saudi Arabia are expected to lead the market due to their strong economies and higher per capita consumption of protein-rich foods. While challenges exist, the long-term outlook for the Middle East protein market remains positive, presenting substantial opportunities for established and emerging players alike. Further growth is expected through innovations in protein fortification, sustainable sourcing practices, and the development of new product formats catering to evolving consumer preferences.

Middle East Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East protein market, encompassing market dynamics, growth trends, regional performance, and key players. With a detailed study period from 2019 to 2033, including a base year of 2025 and forecast period of 2025-2033, this report is an essential resource for industry professionals seeking to navigate this dynamic market. The market is segmented by source (animal), end-user (animal feed, food and beverages, sport/performance nutrition), and key countries (Iran, Saudi Arabia, UAE, Rest of Middle East). The total market size in 2025 is estimated at xx Million.

Middle East Protein Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Middle East protein market. We delve into market concentration, identifying the dominant players and their respective market shares. The report also examines the impact of technological innovations, such as novel protein extraction and processing techniques, on market growth. Further analysis includes a detailed examination of the regulatory landscape, exploring its influence on market access and product development. The role of competitive substitutes, consumer demographics and M&A activities (with an estimated xx number of deals between 2019-2024) are also incorporated into the analysis.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable protein sources and improved processing efficiency.

- Regulatory Framework: Impact of food safety regulations and labeling requirements.

- Competitive Substitutes: Plant-based protein alternatives and their market penetration.

- End-User Demographics: Growing health consciousness and its effect on protein consumption patterns.

- M&A Trends: Consolidation among major players, driving market integration.

Middle East Protein Market Growth Trends & Insights

This section provides a detailed analysis of the Middle East protein market's growth trajectory. We examine historical data (2019-2024), analyzing market size evolution, adoption rates across different segments, and the impact of technological disruptions. The analysis incorporates consumer behavior shifts, including increasing demand for convenient and functional protein products. Key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates are presented to illustrate market trends and provide a clear picture of future prospects. The projected CAGR for the forecast period (2025-2033) is estimated at xx%.

Dominant Regions, Countries, or Segments in Middle East Protein Market

This section identifies the leading regions, countries, and segments within the Middle East protein market based on market size, growth rate, and key drivers. The analysis encompasses market share data for each segment (Source: Animal, Sport/Performance Nutrition, End User: Animal Feed, Food and Beverages) and country (Iran, Saudi Arabia, UAE, Rest of Middle East). It identifies factors driving the dominance of specific regions and segments, including economic policies, infrastructure development, and consumer preferences.

- Leading Segment: Food and Beverages segment expected to maintain dominance through 2033, with a projected xx Million market value.

- Fastest-Growing Country: Saudi Arabia exhibits strong growth potential due to (explain specific reasons, e.g. rising disposable incomes, government initiatives).

- Key Drivers: Population growth, rising disposable incomes, and increasing health awareness.

Middle East Protein Market Product Landscape

This section details the product innovations and technological advancements shaping the Middle East protein market. The focus lies on product applications, performance metrics, and the unique selling propositions of different protein products. We highlight advancements in protein extraction, processing, and formulation, along with the emergence of specialized protein products targeting specific dietary needs and health benefits. The market is witnessing an increase in the demand for products like functional protein bars and protein supplements tailored for sport/performance nutrition, leading to the development of novel formulations.

Key Drivers, Barriers & Challenges in Middle East Protein Market

This section outlines the key factors propelling market growth, including technological advancements, economic growth, and supportive government policies. It also analyzes significant challenges and restraints, such as supply chain disruptions, regulatory hurdles, and intense competition, quantifying their impacts where possible.

Key Drivers:

- Increasing demand for convenient protein sources.

- Technological innovations in protein extraction and processing.

- Growing awareness of health and fitness.

Challenges:

- Volatility in raw material prices.

- Stringent food safety regulations.

- Intense competition from international and local players.

Emerging Opportunities in Middle East Protein Market

This section explores emerging opportunities in the Middle East protein market, identifying untapped markets, innovative applications, and evolving consumer preferences. It focuses on areas with high growth potential and suggests strategies for capitalizing on these opportunities. The rise of plant-based protein alternatives, the growing demand for sustainable protein sources, and increasing interest in personalized nutrition present significant opportunities.

Growth Accelerators in the Middle East Protein Market Industry

This section highlights factors driving long-term market growth, emphasizing the role of technological breakthroughs, strategic partnerships, and market expansion strategies. The development of novel protein sources, efficient processing techniques, and innovative product formulations will significantly contribute to market expansion. The increased focus on sustainable and ethical sourcing practices offers further growth avenues.

Key Players Shaping the Middle East Protein Market Market

- Cargill Incorporated

- MEGGLE GmbH & Co KG

- Prolactal

- International Flavors & Fragrances Inc

- Wilmar International Ltd

- Croda International Plc

- Lactoprot Deutschland GmbH

- Royal FrieslandCampina NV

- Kerry Group PLC

- Fonterra Co-operative Group Limited

- Hilmar Cheese Company Inc

Notable Milestones in Middle East Protein Market Sector

- February 2021: NZMP (Fonterra) launched a new whey protein ingredient with 10% higher protein content.

- February 2021: DuPont's Nutrition & Biosciences merged with IFF, creating a larger player in the protein ingredients market.

- April 2021: FrieslandCampina Ingredients launched a new portfolio of protein ingredients addressing the hardening problem in protein bar production.

In-Depth Middle East Protein Market Market Outlook

The Middle East protein market exhibits robust growth potential driven by several factors, including population growth, rising disposable incomes, and increased health consciousness. Technological advancements and strategic partnerships are further accelerating market expansion. Opportunities exist in developing innovative protein products tailored to specific consumer preferences and dietary needs, and companies focusing on sustainable and ethical sourcing practices are well-positioned for success. The market is expected to continue its strong growth trajectory over the forecast period, presenting lucrative opportunities for both established players and new entrants.

Middle East Protein Market Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Middle East Protein Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative protein sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United Arab Emirates Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MEGGLE GmbH & Co KG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Prolactal

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 International Flavors & Fragrances Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Wilmar International Lt

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Croda International Plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lactoprot Deutschland GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Royal FrieslandCampina NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kerry Group PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Fonterra Co-operative Group Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Hilmar Cheese Company Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Middle East Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Middle East Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Middle East Protein Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 5: Middle East Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Middle East Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: Middle East Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Middle East Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Middle East Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Arab Emirates Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Saudi Arabia Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Saudi Arabia Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Qatar Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Qatar Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Egypt Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Egypt Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Middle East Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Middle East Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Middle East Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 26: Middle East Protein Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 27: Middle East Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Middle East Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 29: Middle East Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: Saudi Arabia Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: United Arab Emirates Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Arab Emirates Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Israel Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Qatar Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Qatar Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Kuwait Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Kuwait Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Oman Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Oman Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Bahrain Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Bahrain Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Jordan Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Jordan Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Lebanon Middle East Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Lebanon Middle East Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Protein Market?

The projected CAGR is approximately 2.67%.

2. Which companies are prominent players in the Middle East Protein Market?

Key companies in the market include Cargill Incorporated, MEGGLE GmbH & Co KG, Prolactal, International Flavors & Fragrances Inc, Wilmar International Lt, Croda International Plc, Lactoprot Deutschland GmbH, Royal FrieslandCampina NV, Kerry Group PLC, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc.

3. What are the main segments of the Middle East Protein Market?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Alternative protein sources.

8. Can you provide examples of recent developments in the market?

April 2021: FrieslandCampina Ingredients launched a new portfolio, including Excellion Calcium Caseinate S, to aid in the production of softer protein bars. Other products launched included Nutri Whey 800F, Nutri Whey Isolate, Biotis GOS, and Excellion EM9, as well as the new Excellion Textpro. The portfolio was made as a key solution to address the hardening problem that many formulators currently face.February 2021: NZMP, Fonterra's dairy ingredients business, launched a new protein ingredient that delivers 10% more protein than other standard whey protein offerings.February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Protein Market?

To stay informed about further developments, trends, and reports in the Middle East Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence