Key Insights

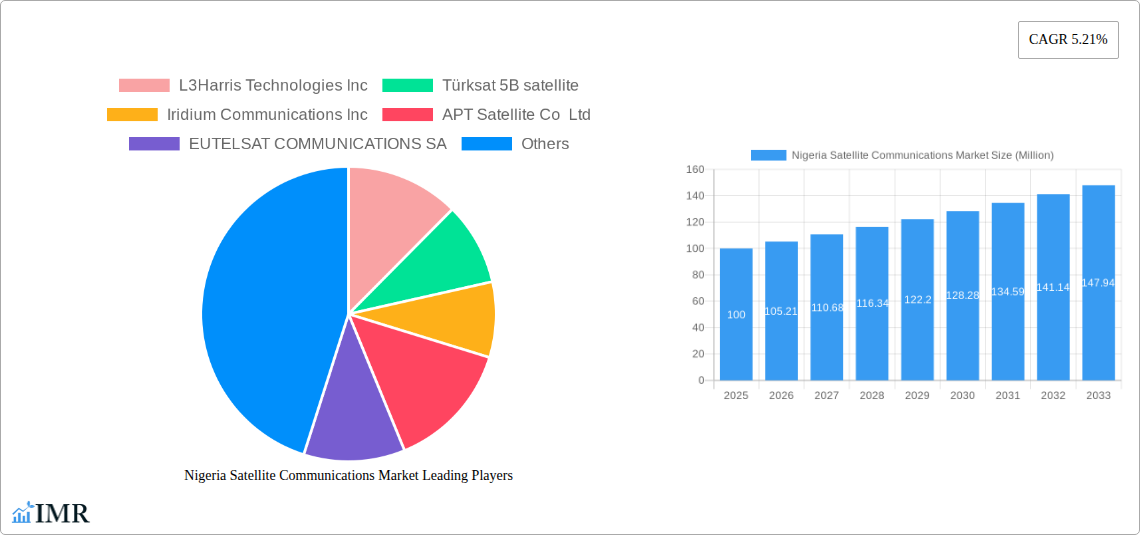

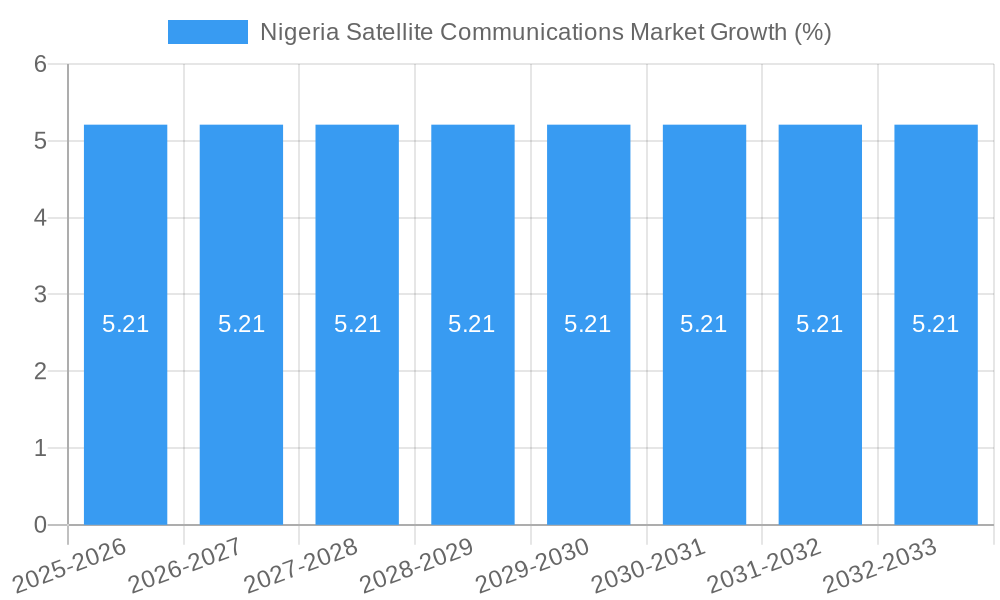

The Nigeria satellite communications market, valued at approximately $X million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.21% from 2025 to 2033. This expansion is driven by increasing demand for broadband internet access in underserved regions, the rising adoption of satellite-based technologies in various sectors, and government initiatives to improve communication infrastructure. Key growth drivers include the expansion of government and defense applications, the increasing need for reliable connectivity in the maritime and oil & gas sectors, and the growing popularity of satellite-based television and media services. The market is segmented by platform (portable, land, maritime, airborne), end-user vertical (maritime, defense & government, enterprises, media & entertainment, others), and type (ground equipment, services). While challenges such as high initial investment costs and regulatory hurdles exist, the long-term potential for satellite communication in Nigeria remains substantial, particularly given the country's vast geography and underdeveloped terrestrial infrastructure. The market’s growth will be fueled by strategic partnerships between international satellite operators and local telecommunications providers, aimed at bridging the digital divide and improving connectivity across the nation.

The Nigerian market demonstrates strong potential for both established players like L3Harris Technologies, Inmarsat, and ViaSat, and regional providers such as Nigcomast. The successful deployment of satellite constellations and advancements in technology, like high-throughput satellites (HTS), will continue to improve bandwidth availability and reduce costs, thereby making satellite communication more accessible to a wider range of users and businesses. The competitive landscape will likely intensify as companies strive to capture market share within various segments. Strategic acquisitions and collaborations will play a crucial role in shaping the market’s future trajectory. The forecast period of 2025-2033 promises robust expansion driven by increasing digitalization across all sectors and the continued demand for reliable and resilient communication solutions in a geographically challenging environment. Further expansion will be boosted by supportive government policies, which may include regulatory frameworks and initiatives to encourage private sector investment in satellite infrastructure.

Nigeria Satellite Communications Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nigeria satellite communications market, covering market dynamics, growth trends, key players, and future opportunities. The report segments the market by platform (Portable, Land, Maritime, Airborne), end-user vertical (Maritime, Defense & Government, Enterprises, Media & Entertainment, Other), and type (Ground Equipment, Services). The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for industry professionals, investors, and anyone seeking to understand the evolving landscape of satellite communications in Nigeria. The market is valued at xx Million units in 2025.

Nigeria Satellite Communications Market Dynamics & Structure

The Nigerian satellite communications market exhibits a moderately concentrated structure, with several key players vying for market share. Technological innovation, driven by the demand for higher bandwidth and improved latency, is a significant driver. However, regulatory frameworks and infrastructure limitations pose challenges. The market faces competition from terrestrial communication technologies, notably fiber optics in urban areas. End-user demographics are diverse, ranging from government agencies to enterprises and individuals. The M&A activity in the sector is moderate, with occasional strategic acquisitions to expand service offerings or geographic reach.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller competitors. The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Driven by demand for higher throughput, lower latency, and improved reliability. Challenges include high initial investment costs and infrastructure limitations.

- Regulatory Framework: The regulatory environment influences market access and investment. Clarity and stability in regulations are vital for growth.

- Competitive Substitutes: Terrestrial communication networks (fiber optics, mobile networks) compete for market share, particularly in urban areas.

- End-User Demographics: Diverse, including government, enterprises, media, maritime, and individuals, requiring varied service offerings.

- M&A Trends: Moderate M&A activity, primarily focused on strategic acquisitions to expand service portfolios or geographic reach. An estimated xx M&A deals occurred between 2019 and 2024.

Nigeria Satellite Communications Market Growth Trends & Insights

The Nigerian satellite communications market is experiencing substantial growth, driven by increasing demand for broadband access, particularly in underserved areas. Adoption rates are rising steadily, fueled by the expansion of satellite internet services and the growing need for reliable connectivity in various sectors. Technological disruptions, such as the introduction of high-throughput satellites (HTS) and the deployment of low earth orbit (LEO) constellations, are transforming the market landscape. Consumer behavior shifts towards greater reliance on data-intensive applications and remote work further stimulate demand. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx Million units by 2033. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Nigeria Satellite Communications Market

The maritime segment currently dominates the Nigerian satellite communications market, driven by the substantial demand for reliable communication and navigation services within the country's extensive coastal areas and offshore oil and gas operations. The Defense and Government sector also displays strong growth due to the need for secure and reliable communication infrastructure for national security and public services. The Land segment is showing significant growth potential, especially in rural and underserved areas with limited terrestrial infrastructure.

- Key Drivers:

- Maritime Sector: High demand for reliable communication and navigation systems in maritime operations.

- Defense & Government: Need for secure communication infrastructure for national security and public services.

- Economic Policies: Government initiatives promoting digital inclusion and infrastructure development.

- Infrastructure Gaps: Limited terrestrial infrastructure in many areas drives demand for satellite solutions.

Nigeria Satellite Communications Market Product Landscape

The Nigerian satellite communications market offers a diverse range of products, including ground equipment (antennas, modems, receivers), and services (satellite internet, VSAT, and satellite-based navigation). Recent innovations focus on enhancing bandwidth, reducing latency, and improving user experience. Products emphasize mobility, affordability, and ease of installation, targeting a broad spectrum of users.

Key Drivers, Barriers & Challenges in Nigeria Satellite Communications Market

Key Drivers:

- Increasing demand for broadband access in underserved areas.

- Growth of data-intensive applications and remote work.

- Government initiatives promoting digital inclusion.

Key Challenges:

- High initial investment costs for satellite infrastructure.

- Regulatory hurdles and licensing complexities.

- Competition from terrestrial networks in urban areas.

- Power supply issues impacting operations in some areas.

Emerging Opportunities in Nigeria Satellite Communications Market

- Expansion of satellite internet services to rural and underserved areas.

- Growth of IoT applications and the need for satellite-based connectivity.

- Adoption of advanced satellite technologies, such as HTS and LEO constellations.

Growth Accelerators in the Nigeria Satellite Communications Market Industry

Technological advancements in satellite technology, strategic partnerships between satellite operators and local telecommunications providers, and expansion into new market segments are key growth catalysts. Government support and investment in infrastructure development further accelerate market expansion.

Key Players Shaping the Nigeria Satellite Communications Market Market

- L3Harris Technologies Inc

- Türksat 5B satellite

- Iridium Communications Inc

- APT Satellite Co Ltd

- EUTELSAT COMMUNICATIONS SA

- Gilat Satellite Networks

- Inmarsat global limited

- AMOS Spacecom

- ViaSat Inc

- Nigcomast

Notable Milestones in Nigeria Satellite Communications Market Sector

- January 2023: SpaceX launched Starlink services in Nigeria, marking its entry into the African market.

- May 2023: Nigcomast Ltd partnered with NAPET (NNPC subsidiary) to provide satellite monitoring services for critical equipment.

In-Depth Nigeria Satellite Communications Market Market Outlook

The Nigerian satellite communications market is poised for significant growth, driven by increasing demand for broadband connectivity and the adoption of advanced satellite technologies. Strategic partnerships, infrastructure investments, and supportive government policies will further propel market expansion, creating lucrative opportunities for both established players and new entrants. The market's future prospects are highly positive, with considerable untapped potential in underserved regions and emerging applications.

Nigeria Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborn3

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Nigeria Satellite Communications Market Segmentation By Geography

- 1. Niger

Nigeria Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defence Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in the Transmission of Data

- 3.4. Market Trends

- 3.4.1. Increase in Internet of Things (IoT) and Autonomous Systems is Driving the Nigeria Satellite Communication Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Satellite Communications Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborn3

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Türksat 5B satellite

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iridium Communications Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 APT Satellite Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EUTELSAT COMMUNICATIONS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gilat Satellite Networks

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inmarsat global limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AMOS Spacecom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ViaSat Inc 7 2 *List Not Exhaustiv

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nigcomast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Nigeria Satellite Communications Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Satellite Communications Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Satellite Communications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Nigeria Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Nigeria Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Nigeria Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Nigeria Satellite Communications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Nigeria Satellite Communications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Nigeria Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 9: Nigeria Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: Nigeria Satellite Communications Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Satellite Communications Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Nigeria Satellite Communications Market?

Key companies in the market include L3Harris Technologies Inc, Türksat 5B satellite, Iridium Communications Inc, APT Satellite Co Ltd, EUTELSAT COMMUNICATIONS SA, Gilat Satellite Networks, Inmarsat global limited, AMOS Spacecom, ViaSat Inc 7 2 *List Not Exhaustiv, Nigcomast.

3. What are the main segments of the Nigeria Satellite Communications Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defence Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Increase in Internet of Things (IoT) and Autonomous Systems is Driving the Nigeria Satellite Communication Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in the Transmission of Data.

8. Can you provide examples of recent developments in the market?

May 2023 - Nigcomast Ltd has announced a collaboration with National Petroleum Telecommunications Limited (NAPET), a subsidiary of the Nigerian National Petroleum Company Limited (NNPC). The collaboration will provide satellite monitoring services for critical equipment and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Nigeria Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence