Key Insights

The North American bioethanol industry is experiencing robust growth, driven by increasing demand for renewable fuels and the expanding applications of ethanol beyond the automotive sector. The market, valued at approximately $X billion in 2025 (assuming a logical market size based on the provided CAGR of >5% and a substantial global market), is projected to maintain a compound annual growth rate (CAGR) exceeding 5% through 2033. This growth is fueled by several key factors. Government regulations promoting the use of biofuels to reduce greenhouse gas emissions are a significant driver, along with increasing consumer preference for sustainable and environmentally friendly products. The diversification of ethanol applications into food and beverage, pharmaceuticals, cosmetics, and personal care is further expanding the market. Sugarcane, corn, and wheat remain the dominant feedstocks, although research and development into alternative feedstocks are gradually increasing their market share. The United States, as the largest producer and consumer of bioethanol within North America, represents a significant portion of the regional market. While the industry faces challenges such as fluctuating feedstock prices and competition from other renewable energy sources, the strong regulatory support and increasing consumer demand are likely to outweigh these headwinds in the forecast period.

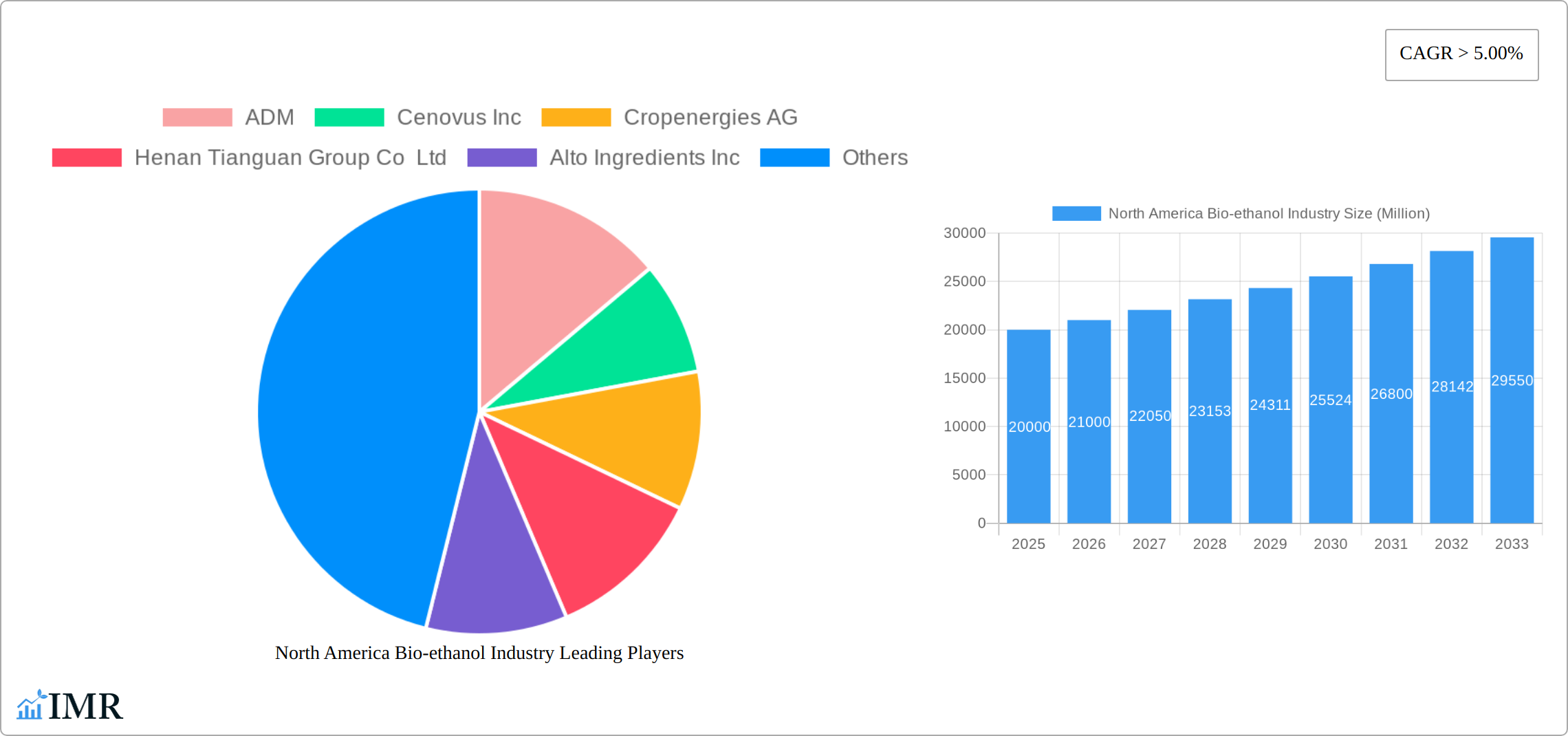

The major players in the North American bioethanol market include established companies like ADM, Poet LLC, and Green Plains Inc., along with several other regional and international producers. These companies are investing heavily in research and development to improve ethanol production efficiency and explore new applications. Competition is expected to remain intense, driving innovation and potentially leading to mergers and acquisitions within the sector. The market’s geographic distribution is concentrated in the United States, with Canada and Mexico holding smaller shares. However, future growth may see expansion into less-developed biofuel markets within North America, driven by increasing governmental incentives and the establishment of new production facilities. The ongoing shift toward sustainable practices and the need for reduced carbon emissions is likely to ensure continued, healthy growth within the North American bioethanol industry throughout the forecast period.

North America Bio-ethanol Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America bio-ethanol industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market.

North America Bio-ethanol Industry Market Dynamics & Structure

The North American bio-ethanol market, valued at xx million in 2024, exhibits a moderately concentrated structure with several major players holding significant market share. Technological innovation, particularly in cellulosic ethanol production and improved fermentation processes, is a key driver. Stringent environmental regulations promoting renewable fuels and government incentives significantly influence market growth. Corn remains the dominant feedstock, but competition from sugarcane and other feedstocks is emerging. The market faces competition from traditional gasoline and other alternative fuels. M&A activity, as evidenced by ADM's sale of its Peoria facility in 2021, reflects industry consolidation and strategic repositioning.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on cellulosic ethanol and advanced fermentation technologies.

- Regulatory Framework: Stringent environmental regulations and government incentives favor bio-ethanol.

- Competitive Substitutes: Gasoline, other biofuels (e.g., biodiesel), and electric vehicles.

- End-User Demographics: Primarily automotive and transportation, but expanding into food & beverage and other applications.

- M&A Trends: Increasing consolidation through acquisitions and divestitures. Deal volume in 2023 estimated at xx.

North America Bio-ethanol Industry Growth Trends & Insights

The North American bio-ethanol market experienced robust growth between 2019 and 2024, fueled by surging demand from the transportation sector, supportive government regulations (such as the Renewable Fuel Standard), and continuous technological advancements. While precise figures for market size and CAGR require up-to-date market research reports, projections indicate substantial expansion through 2033. Adoption is accelerating, especially in regions with strong renewable fuel mandates. The emergence of cellulosic ethanol and other next-generation biofuels is reshaping the production landscape, offering the potential for even greater sustainability and reduced reliance on corn-based feedstocks. Consumer preference, increasingly driven by environmental awareness and volatile fossil fuel prices, is further bolstering bio-ethanol's appeal as a cleaner, more sustainable alternative. Market penetration is expected to significantly increase in the coming years, driven by a wider adoption of flex-fuel vehicles and stricter environmental regulations. The overall shift towards sustainable and eco-friendly transportation fuels will be a key factor influencing future demand.

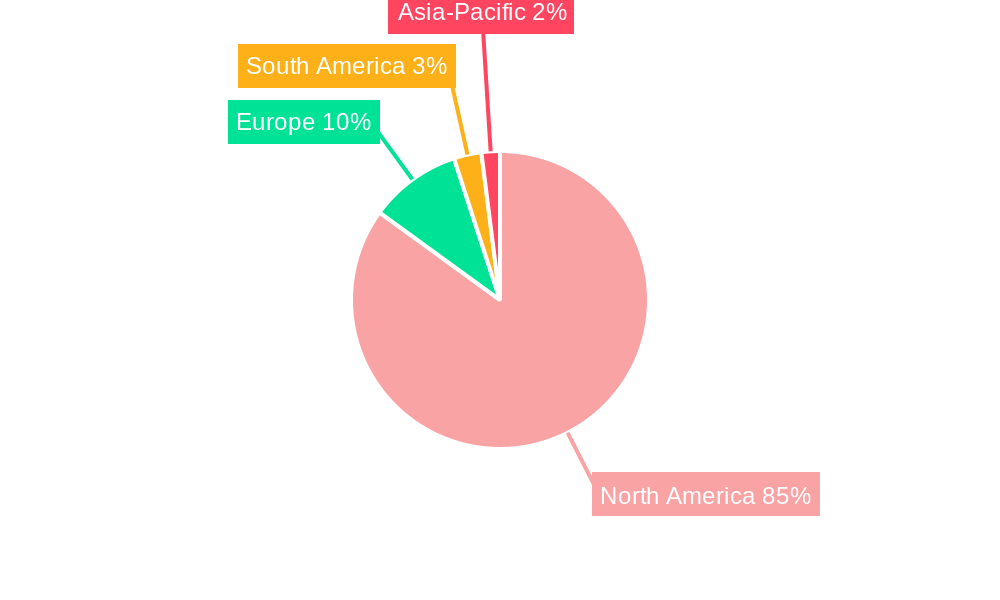

Dominant Regions, Countries, or Segments in North America Bio-ethanol Industry

The Midwest region of the United States dominates the North American bio-ethanol market due to its extensive corn production and established biorefinery infrastructure. Corn remains the leading feedstock, accounting for xx% of total production in 2024. The automotive and transportation segment represents the largest application, driven by increasing mandates for renewable fuels.

- Leading Region: Midwest US

- Leading Feedstock: Corn

- Leading Application: Automotive and Transportation

- Key Drivers: Strong corn production, established infrastructure, government incentives (e.g., RFS), and growing demand for renewable fuels.

Brazil, with its significant sugarcane production, contributes considerably to the overall North American market through imports. Growth potential exists in expanding the use of bio-ethanol in other applications, such as food and beverage, and utilizing alternative feedstocks to diversify the supply chain.

North America Bio-ethanol Industry Product Landscape

The bio-ethanol product landscape is characterized by continuous innovation, focusing on improving ethanol yield, reducing production costs, and broadening applications. Next-generation bio-ethanol production from cellulosic feedstocks is gaining traction, offering enhanced sustainability and reducing reliance on food crops. Advancements in fermentation technologies are improving efficiency and reducing energy consumption. The unique selling propositions of bio-ethanol include its renewability, reduced greenhouse gas emissions, and domestic production capabilities.

Key Drivers, Barriers & Challenges in North America Bio-ethanol Industry

Key Drivers: The expanding demand for renewable fuels remains a primary driver, complemented by supportive government policies like the Renewable Fuel Standard (RFS), which incentivizes biofuel blending. Technological progress, particularly in enzyme development and process optimization, is enhancing efficiency and reducing production costs. Growing environmental concerns and the increasing pressure to reduce greenhouse gas emissions are also significant factors propelling market growth. Further fueling this growth is the expansion of the flex-fuel vehicle market and ever-tightening carbon emission reduction targets.

Challenges & Restraints: The bio-ethanol industry faces several challenges, including the inherent volatility of corn prices (the primary feedstock), competition from other alternative fuels (such as biodiesel and electricity), and concerns surrounding land use and water consumption associated with feedstock production. Achieving cost-competitiveness with conventional gasoline remains a hurdle, particularly for cellulosic ethanol, which requires further technological advancements to reach commercial viability at scale. These factors can introduce supply chain vulnerabilities and potentially impact overall market growth. Furthermore, policy uncertainty and changes in government support can also create instability.

Emerging Opportunities in North America Bio-ethanol Industry

Emerging opportunities include the expansion into cellulosic ethanol production, exploring new feedstocks like switchgrass and algae, developing advanced biofuel blends, and penetrating emerging markets for bio-ethanol in other industries. There is also a growing opportunity in producing bio-based chemicals and materials from ethanol, creating a more circular bioeconomy.

Growth Accelerators in the North America Bio-ethanol Industry

Technological innovation remains a crucial growth accelerator. Breakthroughs in cellulosic ethanol production, the utilization of diverse feedstocks (beyond corn), and the development of advanced biorefinery technologies that integrate multiple bioproducts are key areas of focus. Strategic collaborations between biofuel producers, automotive manufacturers, and technology developers are fostering market penetration and accelerating the wider adoption of bio-ethanol. Diversification into new markets and applications, including the chemical and industrial sectors, is creating new revenue streams and fostering overall industry expansion.

Key Players Shaping the North America Bio-ethanol Industry Market

- ADM

- Cenovus Inc

- Cropenergies AG

- Henan Tianguan Group Co Ltd

- Alto Ingredients Inc

- Green Plains Inc

- Suncor Energy Inc

- Valero

- Ethanol Technologies

- Verbio Vereinigte Bioenergie AG

- Abengoa

- Granbio Investimentos SA

- Sekab

- Blue Bio Fuels Inc

- Lantmannen

- Cristalco

- Poet LLC

- Jilin Fuel Ethanol Co Ltd

- Raizen

- KWST

Notable Milestones in North America Bio-ethanol Industry Sector

- May 2022: VERBIO AG's commissioning of the first cellulosic RNG plant in the US marked a significant step forward in sustainable biofuel production, with projected annual output of 7 million MMBtu of RNG and substantial ethanol production capacity. This highlights the growing potential of next-generation biofuels.

- October 2021: ADM's divestment of its Peoria ethanol plant to BioUrja Group exemplifies the ongoing consolidation and strategic repositioning within the industry.

- [Add other recent significant milestones here, with dates and brief descriptions. Include mergers, acquisitions, technological breakthroughs, policy changes etc.]

In-Depth North America Bio-ethanol Industry Market Outlook

The North American bio-ethanol industry is projected to experience continued growth, driven by a confluence of factors: the escalating demand for renewable fuels, ongoing technological advancements (especially in cellulosic ethanol and advanced biorefinery technologies), and supportive government policies. The industry's future success hinges on addressing the existing challenges while capitalizing on emerging opportunities. Strategic partnerships, expansion into new applications, and continued innovation will be critical for realizing the industry's full potential. The long-term outlook remains optimistic, with bio-ethanol poised to play a progressively significant role in a more sustainable energy future.

North America Bio-ethanol Industry Segmentation

-

1. Feedstock Type

- 1.1. Sugarcane

- 1.2. Corn

- 1.3. Wheat

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Bio-ethanol Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Bio-ethanol Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels

- 3.3. Market Restrains

- 3.3.1. Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 5.1.1. Sugarcane

- 5.1.2. Corn

- 5.1.3. Wheat

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6. United States North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6.1.1. Sugarcane

- 6.1.2. Corn

- 6.1.3. Wheat

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7. Canada North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7.1.1. Sugarcane

- 7.1.2. Corn

- 7.1.3. Wheat

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8. Mexico North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8.1.1. Sugarcane

- 8.1.2. Corn

- 8.1.3. Wheat

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9. United States North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ADM

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cenovus Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cropenergies AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Henan Tianguan Group Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Alto Ingredients Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Green Plains Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Suncor Energy Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Valero

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ethanol Technologies

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Verbio Vereinigte Bioenergie AG*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Abengoa

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Granbio Investimentos SA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Sekab

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Blue Bio Fuels Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Lantmannen

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Cristalco

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Poet LLC

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Jilin Fuel Ethanol Co Ltd

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Raizen

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 KWST

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 ADM

List of Figures

- Figure 1: North America Bio-ethanol Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Bio-ethanol Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Bio-ethanol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 3: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Bio-ethanol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 12: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 16: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 20: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bio-ethanol Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the North America Bio-ethanol Industry?

Key companies in the market include ADM, Cenovus Inc, Cropenergies AG, Henan Tianguan Group Co Ltd, Alto Ingredients Inc, Green Plains Inc, Suncor Energy Inc, Valero, Ethanol Technologies, Verbio Vereinigte Bioenergie AG*List Not Exhaustive, Abengoa, Granbio Investimentos SA, Sekab, Blue Bio Fuels Inc, Lantmannen, Cristalco, Poet LLC, Jilin Fuel Ethanol Co Ltd, Raizen, KWST.

3. What are the main segments of the North America Bio-ethanol Industry?

The market segments include Feedstock Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels.

6. What are the notable trends driving market growth?

Automotive and Transportation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol.

8. Can you provide examples of recent developments in the market?

May 2022: VERBIO AG opened the first cellulosic RNG plant in the United States, achieving full-scale production of 7 million ethanol gallons equivalent (EGE) of RNG annually by mid-summer 2022. In 2023, this project is expected to start functioning as a biorefinery, producing 60 million gallons of corn-based ethanol annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bio-ethanol Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bio-ethanol Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bio-ethanol Industry?

To stay informed about further developments, trends, and reports in the North America Bio-ethanol Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence