Key Insights

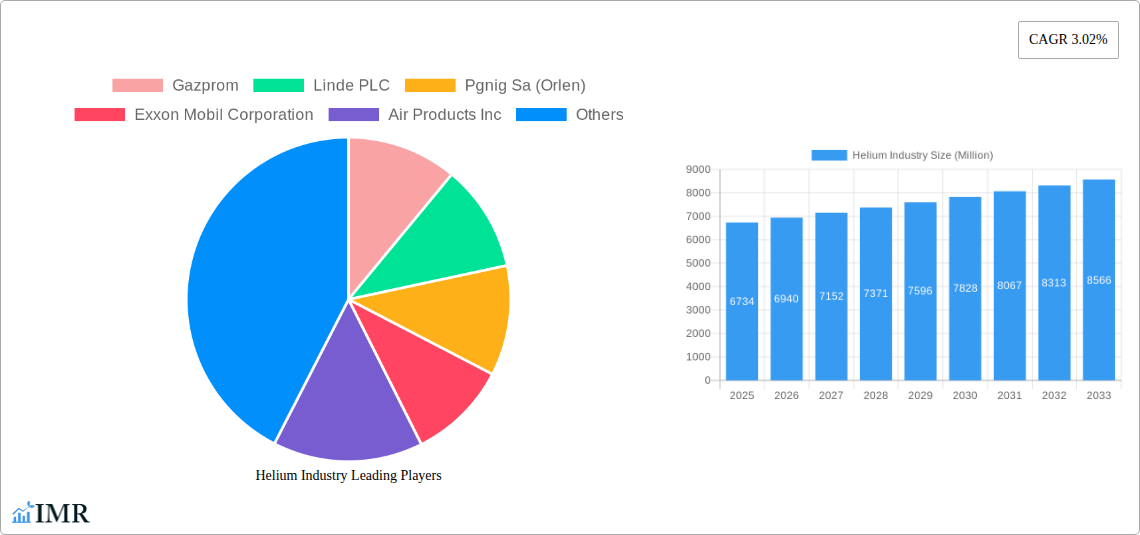

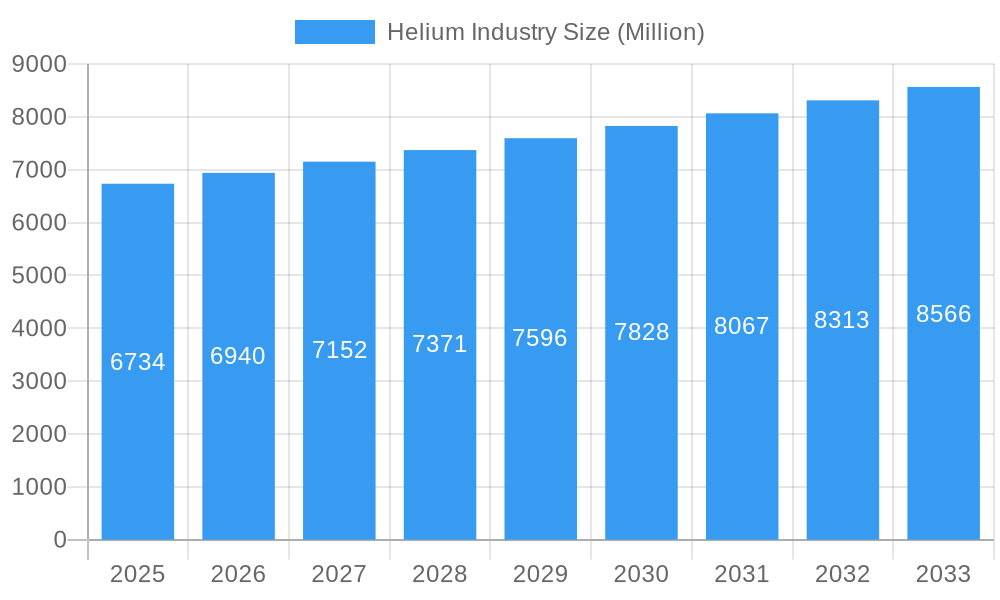

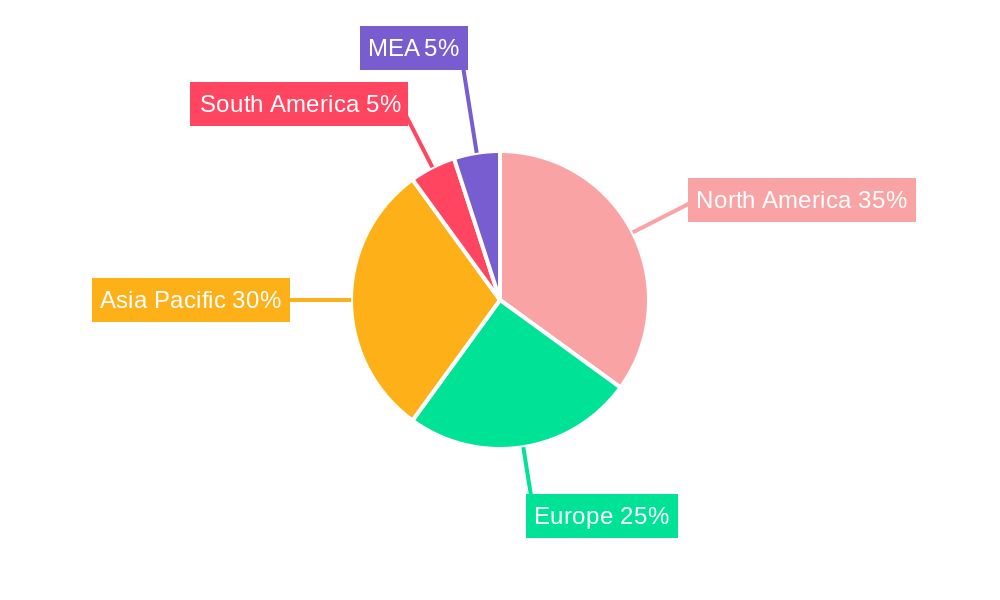

The global helium market, valued at $3.36 billion in 2025, is poised for robust expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.05% from 2025 to 2033, this growth is primarily fueled by escalating demand within the electronics, semiconductor, and healthcare sectors. Key applications include leak detection, specialized manufacturing, and MRI imaging. Advancements in cryogenics and the expanding aerospace industry are also significant growth catalysts. While natural helium supply limitations are a potential constraint, innovations in helium recovery and recycling are actively mitigating these challenges. The market is segmented by phase (liquid and gas), application (including breathing mixes, cryogenics, leak detection, pressurizing/purging, welding, and controlled atmospheres), and end-user industry (aerospace, electronics, nuclear power, healthcare, welding, and others). North America and Asia Pacific currently lead regional markets due to substantial industrial activity and technological progress.

Helium Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, with the market size projected to exceed $4.1 billion by 2033. This growth trajectory is supported by expanding economies and ongoing technological developments. Price volatility, influenced by global supply and demand, remains a consideration. However, the market offers considerable opportunities for companies specializing in efficient helium recovery, recycling technologies, and the development of helium substitutes. The diversification of end-user industries ensures market resilience. Continued research into sustainable helium sourcing and novel applications will bolster long-term market stability and growth.

Helium Industry Company Market Share

Helium Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Helium Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and researchers seeking insights into this vital market. The report segments the market by phase (Liquid, Gas), application (Breathing Mixes, Cryogenics, Leak Detection, Pressurizing and Purging, Welding, Controlled Atmosphere, Other Applications), and end-user industry (Aerospace and Aircraft, Electronics and Semiconductors, Nuclear Power, Healthcare, Welding and Metal Fabrication, Other End-user Industries).

Helium Industry Market Dynamics & Structure

The Helium Industry is characterized by a moderately concentrated market structure, with several major players dominating global supply. Market concentration is influenced by factors such as access to helium sources, processing capabilities, and established distribution networks. Technological innovation is a key driver, with advancements in helium purification and liquefaction technologies constantly improving efficiency and reducing costs. Regulatory frameworks, particularly concerning helium resource management and environmental protection, significantly impact market operations. While there are limited direct substitutes for helium in certain applications, alternative gases and techniques are explored for specific uses, posing a competitive challenge. End-user demographics are diverse, spanning various sectors with distinct helium application needs. M&A activity plays a role in reshaping the market landscape, driving consolidation and enhancing vertical integration.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Technological Innovation: Focus on improving purification and liquefaction efficiency.

- Regulatory Frameworks: Varying regulations impact resource management and environmental compliance.

- Competitive Substitutes: Limited direct substitutes exist, but alternative gases and methods are explored.

- M&A Activity: xx major deals recorded between 2019 and 2024, driving consolidation.

Helium Industry Growth Trends & Insights

The Helium Industry has witnessed significant growth during the historical period (2019-2024), driven by increasing demand across diverse end-user sectors. The market size is projected to reach xx Million units by 2025 and exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly in helium recovery and purification methods, are accelerating market expansion. Consumer behavior shifts toward higher-purity helium and specialized applications further contribute to growth. Market penetration is expected to increase as new applications are developed and existing applications expand across varied industries. The increasing adoption of helium in critical applications such as MRI machines and semiconductor manufacturing reinforces this trajectory.

Dominant Regions, Countries, or Segments in Helium Industry

The North American and Asian markets are currently leading the global Helium Industry, with significant contributions from the United States and China. Within application segments, Cryogenics and Electronics and Semiconductors demonstrate the highest growth potential, driven by the expansion of data centers and advanced semiconductor manufacturing. The Liquid Helium phase holds a larger market share compared to Gas Helium, due to its greater applicability in several industries including cryogenics and healthcare.

- Key Drivers:

- Strong demand from electronics and healthcare sectors.

- Expansion of data centers and semiconductor manufacturing.

- Technological advancements in helium recovery and purification.

- Dominance Factors:

- Abundant helium reserves in specific regions (xx% of global reserves in US).

- Established infrastructure for helium production and distribution.

- Strong economic growth in key end-user industries.

Helium Industry Product Landscape

The Helium Industry offers a range of products, including high-purity helium for specific applications and custom mixtures tailored to customer requirements. Product innovation focuses on improving purity, increasing efficiency, and developing specialized gas mixtures. Advancements in cryogenic technology are driving demand for higher-purity liquid helium. The unique selling propositions are typically centered around purity levels, customized mixtures for specific applications, and reliable supply chains. Furthermore, the industry is exploring environmentally friendly options for helium production and usage.

Key Drivers, Barriers & Challenges in Helium Industry

Key Drivers: The industry is propelled by robust demand from the electronics, healthcare, and scientific research sectors; increasing adoption of helium in cutting-edge technologies such as MRI machines and semiconductor manufacturing; and significant investments in helium recovery and purification technologies.

Key Challenges & Restraints: The industry faces challenges stemming from the finite nature of helium reserves and volatile global pricing; stringent environmental regulations impacting resource extraction and processing; and intense competition among leading producers. These challenges often lead to supply chain disruptions and price fluctuations, significantly impacting profitability and availability. Estimates suggest that supply shortages could constrain growth by xx% by 2030 if no significant mitigation strategies are implemented.

Emerging Opportunities in Helium Industry

Emerging opportunities lie in expanding into untapped markets, such as developing countries with growing industrial sectors. Innovative applications of helium in emerging technologies, like quantum computing and aerospace, also present significant growth potential. Furthermore, evolving consumer preferences toward eco-friendly helium production and sourcing create new opportunities for companies committed to sustainability.

Growth Accelerators in the Helium Industry

Long-term growth is further accelerated by strategic partnerships between helium producers and end-user industries, securing supply chains and ensuring a steady stream of helium to support industry growth. The continued pursuit of technological breakthroughs aimed at lowering the cost and enhancing the efficiency of helium extraction and purification remains a significant accelerator for growth.

Key Players Shaping the Helium Industry Market

- Gazprom

- Linde PLC

- Pgnig Sa (Orlen)

- Exxon Mobil Corporation

- Air Products Inc

- NexAir LLC

- Gulf Cryo

- Matheson Tri-Gas Inc

- Iwatani Corporation

- Messer Group GmbH

- Qatarenergy Lng

- Air Liquide

- Weil Group

- Renergen

Notable Milestones in Helium Industry Sector

- July 2022: Helios Specialty Gases and Iwatani Corporation signed an agreement for Iwatani to supply liquid helium to Helios's facilities in Gujarat, Telangana, and Rajasthan. This expansion strengthens Iwatani’s presence in the Indian market.

- April 2022: Linde signed a long-term helium off-take agreement with Freeport LNG, planning a new helium processing plant in Texas starting in 2024, adding nearly 200 million cubic feet of helium to Linde's supply. This significantly bolsters Linde's position as a major helium supplier.

In-Depth Helium Industry Market Outlook

The Helium Industry is poised for sustained growth, driven by the factors outlined above. Strategic investments in helium recovery technologies, coupled with a diversifying demand landscape, indicate substantial future market potential. Companies that can effectively navigate supply chain challenges and innovate in sustainable helium production are best positioned to capitalize on these opportunities. The forecasted CAGR of xx% suggests a significant market expansion over the coming decade, presenting considerable opportunities for investors and industry players alike.

Helium Industry Segmentation

-

1. Phase

- 1.1. Liquid

- 1.2. Gas

-

2. Application

- 2.1. Breathing Mixes

- 2.2. Cryogenics

- 2.3. Leak Detection

- 2.4. Pressurizing and Purging

- 2.5. Welding

- 2.6. Controlled Atmosphere

- 2.7. Other Applications

-

3. End-user Industry

- 3.1. Aerospace and Aircraft

- 3.2. Electronics and Semiconductors

- 3.3. Nuclear Power

- 3.4. Healthcare

- 3.5. Welding and Metal Fabrication

- 3.6. Other End-user Industries

Helium Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia and New Zealand

-

6. Rest of Asia Pacific

- 6.1. North America

- 7. United States

- 8. Canada

-

9. Mexico

- 9.1. Europe

- 10. Germany

- 11. France

- 12. Italy

- 13. United Kingdom

- 14. Russia

-

15. Rest of Europe

- 15.1. Rest of the World

- 16. South America

- 17. Middle East and Africa

Helium Industry Regional Market Share

Geographic Coverage of Helium Industry

Helium Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Helium Across the Semiconductor Industry; Growing Utilization of Helium Across Aviation Industry

- 3.3. Market Restrains

- 3.3.1. Expensive Extraction Process; Inconsistent Supply of Helium

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Healthcare Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Helium Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Liquid

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Breathing Mixes

- 5.2.2. Cryogenics

- 5.2.3. Leak Detection

- 5.2.4. Pressurizing and Purging

- 5.2.5. Welding

- 5.2.6. Controlled Atmosphere

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Aircraft

- 5.3.2. Electronics and Semiconductors

- 5.3.3. Nuclear Power

- 5.3.4. Healthcare

- 5.3.5. Welding and Metal Fabrication

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Australia and New Zealand

- 5.4.6. Rest of Asia Pacific

- 5.4.7. United States

- 5.4.8. Canada

- 5.4.9. Mexico

- 5.4.10. Germany

- 5.4.11. France

- 5.4.12. Italy

- 5.4.13. United Kingdom

- 5.4.14. Russia

- 5.4.15. Rest of Europe

- 5.4.16. South America

- 5.4.17. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. China Helium Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Liquid

- 6.1.2. Gas

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Breathing Mixes

- 6.2.2. Cryogenics

- 6.2.3. Leak Detection

- 6.2.4. Pressurizing and Purging

- 6.2.5. Welding

- 6.2.6. Controlled Atmosphere

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Aircraft

- 6.3.2. Electronics and Semiconductors

- 6.3.3. Nuclear Power

- 6.3.4. Healthcare

- 6.3.5. Welding and Metal Fabrication

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. India Helium Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Liquid

- 7.1.2. Gas

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Breathing Mixes

- 7.2.2. Cryogenics

- 7.2.3. Leak Detection

- 7.2.4. Pressurizing and Purging

- 7.2.5. Welding

- 7.2.6. Controlled Atmosphere

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Aircraft

- 7.3.2. Electronics and Semiconductors

- 7.3.3. Nuclear Power

- 7.3.4. Healthcare

- 7.3.5. Welding and Metal Fabrication

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. Japan Helium Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Liquid

- 8.1.2. Gas

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Breathing Mixes

- 8.2.2. Cryogenics

- 8.2.3. Leak Detection

- 8.2.4. Pressurizing and Purging

- 8.2.5. Welding

- 8.2.6. Controlled Atmosphere

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Aircraft

- 8.3.2. Electronics and Semiconductors

- 8.3.3. Nuclear Power

- 8.3.4. Healthcare

- 8.3.5. Welding and Metal Fabrication

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. South Korea Helium Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 9.1.1. Liquid

- 9.1.2. Gas

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Breathing Mixes

- 9.2.2. Cryogenics

- 9.2.3. Leak Detection

- 9.2.4. Pressurizing and Purging

- 9.2.5. Welding

- 9.2.6. Controlled Atmosphere

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Aircraft

- 9.3.2. Electronics and Semiconductors

- 9.3.3. Nuclear Power

- 9.3.4. Healthcare

- 9.3.5. Welding and Metal Fabrication

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 10. Australia and New Zealand Helium Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 10.1.1. Liquid

- 10.1.2. Gas

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Breathing Mixes

- 10.2.2. Cryogenics

- 10.2.3. Leak Detection

- 10.2.4. Pressurizing and Purging

- 10.2.5. Welding

- 10.2.6. Controlled Atmosphere

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace and Aircraft

- 10.3.2. Electronics and Semiconductors

- 10.3.3. Nuclear Power

- 10.3.4. Healthcare

- 10.3.5. Welding and Metal Fabrication

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 11. Rest of Asia Pacific Helium Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 11.1.1. Liquid

- 11.1.2. Gas

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Breathing Mixes

- 11.2.2. Cryogenics

- 11.2.3. Leak Detection

- 11.2.4. Pressurizing and Purging

- 11.2.5. Welding

- 11.2.6. Controlled Atmosphere

- 11.2.7. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Aerospace and Aircraft

- 11.3.2. Electronics and Semiconductors

- 11.3.3. Nuclear Power

- 11.3.4. Healthcare

- 11.3.5. Welding and Metal Fabrication

- 11.3.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 12. United States Helium Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Phase

- 12.1.1. Liquid

- 12.1.2. Gas

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Breathing Mixes

- 12.2.2. Cryogenics

- 12.2.3. Leak Detection

- 12.2.4. Pressurizing and Purging

- 12.2.5. Welding

- 12.2.6. Controlled Atmosphere

- 12.2.7. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by End-user Industry

- 12.3.1. Aerospace and Aircraft

- 12.3.2. Electronics and Semiconductors

- 12.3.3. Nuclear Power

- 12.3.4. Healthcare

- 12.3.5. Welding and Metal Fabrication

- 12.3.6. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by Phase

- 13. Canada Helium Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Phase

- 13.1.1. Liquid

- 13.1.2. Gas

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Breathing Mixes

- 13.2.2. Cryogenics

- 13.2.3. Leak Detection

- 13.2.4. Pressurizing and Purging

- 13.2.5. Welding

- 13.2.6. Controlled Atmosphere

- 13.2.7. Other Applications

- 13.3. Market Analysis, Insights and Forecast - by End-user Industry

- 13.3.1. Aerospace and Aircraft

- 13.3.2. Electronics and Semiconductors

- 13.3.3. Nuclear Power

- 13.3.4. Healthcare

- 13.3.5. Welding and Metal Fabrication

- 13.3.6. Other End-user Industries

- 13.1. Market Analysis, Insights and Forecast - by Phase

- 14. Mexico Helium Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Phase

- 14.1.1. Liquid

- 14.1.2. Gas

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Breathing Mixes

- 14.2.2. Cryogenics

- 14.2.3. Leak Detection

- 14.2.4. Pressurizing and Purging

- 14.2.5. Welding

- 14.2.6. Controlled Atmosphere

- 14.2.7. Other Applications

- 14.3. Market Analysis, Insights and Forecast - by End-user Industry

- 14.3.1. Aerospace and Aircraft

- 14.3.2. Electronics and Semiconductors

- 14.3.3. Nuclear Power

- 14.3.4. Healthcare

- 14.3.5. Welding and Metal Fabrication

- 14.3.6. Other End-user Industries

- 14.1. Market Analysis, Insights and Forecast - by Phase

- 15. Germany Helium Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Phase

- 15.1.1. Liquid

- 15.1.2. Gas

- 15.2. Market Analysis, Insights and Forecast - by Application

- 15.2.1. Breathing Mixes

- 15.2.2. Cryogenics

- 15.2.3. Leak Detection

- 15.2.4. Pressurizing and Purging

- 15.2.5. Welding

- 15.2.6. Controlled Atmosphere

- 15.2.7. Other Applications

- 15.3. Market Analysis, Insights and Forecast - by End-user Industry

- 15.3.1. Aerospace and Aircraft

- 15.3.2. Electronics and Semiconductors

- 15.3.3. Nuclear Power

- 15.3.4. Healthcare

- 15.3.5. Welding and Metal Fabrication

- 15.3.6. Other End-user Industries

- 15.1. Market Analysis, Insights and Forecast - by Phase

- 16. France Helium Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Phase

- 16.1.1. Liquid

- 16.1.2. Gas

- 16.2. Market Analysis, Insights and Forecast - by Application

- 16.2.1. Breathing Mixes

- 16.2.2. Cryogenics

- 16.2.3. Leak Detection

- 16.2.4. Pressurizing and Purging

- 16.2.5. Welding

- 16.2.6. Controlled Atmosphere

- 16.2.7. Other Applications

- 16.3. Market Analysis, Insights and Forecast - by End-user Industry

- 16.3.1. Aerospace and Aircraft

- 16.3.2. Electronics and Semiconductors

- 16.3.3. Nuclear Power

- 16.3.4. Healthcare

- 16.3.5. Welding and Metal Fabrication

- 16.3.6. Other End-user Industries

- 16.1. Market Analysis, Insights and Forecast - by Phase

- 17. Italy Helium Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - by Phase

- 17.1.1. Liquid

- 17.1.2. Gas

- 17.2. Market Analysis, Insights and Forecast - by Application

- 17.2.1. Breathing Mixes

- 17.2.2. Cryogenics

- 17.2.3. Leak Detection

- 17.2.4. Pressurizing and Purging

- 17.2.5. Welding

- 17.2.6. Controlled Atmosphere

- 17.2.7. Other Applications

- 17.3. Market Analysis, Insights and Forecast - by End-user Industry

- 17.3.1. Aerospace and Aircraft

- 17.3.2. Electronics and Semiconductors

- 17.3.3. Nuclear Power

- 17.3.4. Healthcare

- 17.3.5. Welding and Metal Fabrication

- 17.3.6. Other End-user Industries

- 17.1. Market Analysis, Insights and Forecast - by Phase

- 18. United Kingdom Helium Industry Analysis, Insights and Forecast, 2020-2032

- 18.1. Market Analysis, Insights and Forecast - by Phase

- 18.1.1. Liquid

- 18.1.2. Gas

- 18.2. Market Analysis, Insights and Forecast - by Application

- 18.2.1. Breathing Mixes

- 18.2.2. Cryogenics

- 18.2.3. Leak Detection

- 18.2.4. Pressurizing and Purging

- 18.2.5. Welding

- 18.2.6. Controlled Atmosphere

- 18.2.7. Other Applications

- 18.3. Market Analysis, Insights and Forecast - by End-user Industry

- 18.3.1. Aerospace and Aircraft

- 18.3.2. Electronics and Semiconductors

- 18.3.3. Nuclear Power

- 18.3.4. Healthcare

- 18.3.5. Welding and Metal Fabrication

- 18.3.6. Other End-user Industries

- 18.1. Market Analysis, Insights and Forecast - by Phase

- 19. Russia Helium Industry Analysis, Insights and Forecast, 2020-2032

- 19.1. Market Analysis, Insights and Forecast - by Phase

- 19.1.1. Liquid

- 19.1.2. Gas

- 19.2. Market Analysis, Insights and Forecast - by Application

- 19.2.1. Breathing Mixes

- 19.2.2. Cryogenics

- 19.2.3. Leak Detection

- 19.2.4. Pressurizing and Purging

- 19.2.5. Welding

- 19.2.6. Controlled Atmosphere

- 19.2.7. Other Applications

- 19.3. Market Analysis, Insights and Forecast - by End-user Industry

- 19.3.1. Aerospace and Aircraft

- 19.3.2. Electronics and Semiconductors

- 19.3.3. Nuclear Power

- 19.3.4. Healthcare

- 19.3.5. Welding and Metal Fabrication

- 19.3.6. Other End-user Industries

- 19.1. Market Analysis, Insights and Forecast - by Phase

- 20. Rest of Europe Helium Industry Analysis, Insights and Forecast, 2020-2032

- 20.1. Market Analysis, Insights and Forecast - by Phase

- 20.1.1. Liquid

- 20.1.2. Gas

- 20.2. Market Analysis, Insights and Forecast - by Application

- 20.2.1. Breathing Mixes

- 20.2.2. Cryogenics

- 20.2.3. Leak Detection

- 20.2.4. Pressurizing and Purging

- 20.2.5. Welding

- 20.2.6. Controlled Atmosphere

- 20.2.7. Other Applications

- 20.3. Market Analysis, Insights and Forecast - by End-user Industry

- 20.3.1. Aerospace and Aircraft

- 20.3.2. Electronics and Semiconductors

- 20.3.3. Nuclear Power

- 20.3.4. Healthcare

- 20.3.5. Welding and Metal Fabrication

- 20.3.6. Other End-user Industries

- 20.1. Market Analysis, Insights and Forecast - by Phase

- 21. South America Helium Industry Analysis, Insights and Forecast, 2020-2032

- 21.1. Market Analysis, Insights and Forecast - by Phase

- 21.1.1. Liquid

- 21.1.2. Gas

- 21.2. Market Analysis, Insights and Forecast - by Application

- 21.2.1. Breathing Mixes

- 21.2.2. Cryogenics

- 21.2.3. Leak Detection

- 21.2.4. Pressurizing and Purging

- 21.2.5. Welding

- 21.2.6. Controlled Atmosphere

- 21.2.7. Other Applications

- 21.3. Market Analysis, Insights and Forecast - by End-user Industry

- 21.3.1. Aerospace and Aircraft

- 21.3.2. Electronics and Semiconductors

- 21.3.3. Nuclear Power

- 21.3.4. Healthcare

- 21.3.5. Welding and Metal Fabrication

- 21.3.6. Other End-user Industries

- 21.1. Market Analysis, Insights and Forecast - by Phase

- 22. Middle East and Africa Helium Industry Analysis, Insights and Forecast, 2020-2032

- 22.1. Market Analysis, Insights and Forecast - by Phase

- 22.1.1. Liquid

- 22.1.2. Gas

- 22.2. Market Analysis, Insights and Forecast - by Application

- 22.2.1. Breathing Mixes

- 22.2.2. Cryogenics

- 22.2.3. Leak Detection

- 22.2.4. Pressurizing and Purging

- 22.2.5. Welding

- 22.2.6. Controlled Atmosphere

- 22.2.7. Other Applications

- 22.3. Market Analysis, Insights and Forecast - by End-user Industry

- 22.3.1. Aerospace and Aircraft

- 22.3.2. Electronics and Semiconductors

- 22.3.3. Nuclear Power

- 22.3.4. Healthcare

- 22.3.5. Welding and Metal Fabrication

- 22.3.6. Other End-user Industries

- 22.1. Market Analysis, Insights and Forecast - by Phase

- 23. Competitive Analysis

- 23.1. Global Market Share Analysis 2025

- 23.2. Company Profiles

- 23.2.1 Gazprom

- 23.2.1.1. Overview

- 23.2.1.2. Products

- 23.2.1.3. SWOT Analysis

- 23.2.1.4. Recent Developments

- 23.2.1.5. Financials (Based on Availability)

- 23.2.2 Linde PLC

- 23.2.2.1. Overview

- 23.2.2.2. Products

- 23.2.2.3. SWOT Analysis

- 23.2.2.4. Recent Developments

- 23.2.2.5. Financials (Based on Availability)

- 23.2.3 Pgnig Sa (Orlen)

- 23.2.3.1. Overview

- 23.2.3.2. Products

- 23.2.3.3. SWOT Analysis

- 23.2.3.4. Recent Developments

- 23.2.3.5. Financials (Based on Availability)

- 23.2.4 Exxon Mobil Corporation

- 23.2.4.1. Overview

- 23.2.4.2. Products

- 23.2.4.3. SWOT Analysis

- 23.2.4.4. Recent Developments

- 23.2.4.5. Financials (Based on Availability)

- 23.2.5 Air Products Inc

- 23.2.5.1. Overview

- 23.2.5.2. Products

- 23.2.5.3. SWOT Analysis

- 23.2.5.4. Recent Developments

- 23.2.5.5. Financials (Based on Availability)

- 23.2.6 NexAir LLC

- 23.2.6.1. Overview

- 23.2.6.2. Products

- 23.2.6.3. SWOT Analysis

- 23.2.6.4. Recent Developments

- 23.2.6.5. Financials (Based on Availability)

- 23.2.7 Gulf Cryo

- 23.2.7.1. Overview

- 23.2.7.2. Products

- 23.2.7.3. SWOT Analysis

- 23.2.7.4. Recent Developments

- 23.2.7.5. Financials (Based on Availability)

- 23.2.8 Matheson Tri-Gas Inc

- 23.2.8.1. Overview

- 23.2.8.2. Products

- 23.2.8.3. SWOT Analysis

- 23.2.8.4. Recent Developments

- 23.2.8.5. Financials (Based on Availability)

- 23.2.9 Iwatani Corporation

- 23.2.9.1. Overview

- 23.2.9.2. Products

- 23.2.9.3. SWOT Analysis

- 23.2.9.4. Recent Developments

- 23.2.9.5. Financials (Based on Availability)

- 23.2.10 Messer Group GmbH

- 23.2.10.1. Overview

- 23.2.10.2. Products

- 23.2.10.3. SWOT Analysis

- 23.2.10.4. Recent Developments

- 23.2.10.5. Financials (Based on Availability)

- 23.2.11 Qatarenergy Lng

- 23.2.11.1. Overview

- 23.2.11.2. Products

- 23.2.11.3. SWOT Analysis

- 23.2.11.4. Recent Developments

- 23.2.11.5. Financials (Based on Availability)

- 23.2.12 Air Liquide

- 23.2.12.1. Overview

- 23.2.12.2. Products

- 23.2.12.3. SWOT Analysis

- 23.2.12.4. Recent Developments

- 23.2.12.5. Financials (Based on Availability)

- 23.2.13 Weil Group*List Not Exhaustive

- 23.2.13.1. Overview

- 23.2.13.2. Products

- 23.2.13.3. SWOT Analysis

- 23.2.13.4. Recent Developments

- 23.2.13.5. Financials (Based on Availability)

- 23.2.14 Renergen

- 23.2.14.1. Overview

- 23.2.14.2. Products

- 23.2.14.3. SWOT Analysis

- 23.2.14.4. Recent Developments

- 23.2.14.5. Financials (Based on Availability)

- 23.2.1 Gazprom

List of Figures

- Figure 1: Global Helium Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Helium Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: China Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 4: China Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 5: China Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 6: China Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 7: China Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: China Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 9: China Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: China Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: China Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 12: China Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: China Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: China Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: China Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: China Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: China Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: China Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: India Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 20: India Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 21: India Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 22: India Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 23: India Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 24: India Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 25: India Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: India Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: India Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 28: India Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: India Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: India Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: India Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: India Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: India Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: India Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Japan Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 36: Japan Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 37: Japan Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 38: Japan Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 39: Japan Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 40: Japan Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 41: Japan Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Japan Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Japan Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Japan Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Japan Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Japan Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Japan Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Japan Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Japan Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Japan Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South Korea Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 52: South Korea Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 53: South Korea Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 54: South Korea Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 55: South Korea Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: South Korea Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 57: South Korea Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South Korea Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South Korea Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 60: South Korea Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 61: South Korea Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South Korea Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South Korea Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South Korea Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South Korea Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South Korea Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Australia and New Zealand Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 68: Australia and New Zealand Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 69: Australia and New Zealand Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 70: Australia and New Zealand Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 71: Australia and New Zealand Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 72: Australia and New Zealand Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 73: Australia and New Zealand Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: Australia and New Zealand Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: Australia and New Zealand Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Australia and New Zealand Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 77: Australia and New Zealand Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Australia and New Zealand Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Australia and New Zealand Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Australia and New Zealand Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Australia and New Zealand Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia and New Zealand Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Rest of Asia Pacific Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 84: Rest of Asia Pacific Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 85: Rest of Asia Pacific Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 86: Rest of Asia Pacific Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 87: Rest of Asia Pacific Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 88: Rest of Asia Pacific Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 89: Rest of Asia Pacific Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 90: Rest of Asia Pacific Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 91: Rest of Asia Pacific Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 92: Rest of Asia Pacific Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 93: Rest of Asia Pacific Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Rest of Asia Pacific Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Rest of Asia Pacific Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 96: Rest of Asia Pacific Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 97: Rest of Asia Pacific Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Asia Pacific Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: United States Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 100: United States Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 101: United States Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 102: United States Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 103: United States Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 104: United States Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 105: United States Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 106: United States Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 107: United States Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 108: United States Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 109: United States Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 110: United States Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 111: United States Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 112: United States Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 113: United States Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 114: United States Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 115: Canada Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 116: Canada Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 117: Canada Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 118: Canada Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 119: Canada Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 120: Canada Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 121: Canada Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 122: Canada Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 123: Canada Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 124: Canada Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 125: Canada Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 126: Canada Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 127: Canada Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 128: Canada Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 129: Canada Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 130: Canada Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 131: Mexico Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 132: Mexico Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 133: Mexico Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 134: Mexico Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 135: Mexico Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 136: Mexico Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 137: Mexico Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 138: Mexico Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 139: Mexico Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 140: Mexico Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 141: Mexico Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 142: Mexico Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 143: Mexico Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 144: Mexico Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 145: Mexico Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 146: Mexico Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 147: Germany Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 148: Germany Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 149: Germany Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 150: Germany Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 151: Germany Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 152: Germany Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 153: Germany Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 154: Germany Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 155: Germany Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 156: Germany Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 157: Germany Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 158: Germany Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 159: Germany Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 160: Germany Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 161: Germany Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 162: Germany Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 163: France Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 164: France Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 165: France Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 166: France Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 167: France Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 168: France Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 169: France Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 170: France Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 171: France Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 172: France Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 173: France Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 174: France Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 175: France Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 176: France Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 177: France Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 178: France Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 179: Italy Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 180: Italy Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 181: Italy Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 182: Italy Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 183: Italy Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 184: Italy Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 185: Italy Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 186: Italy Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 187: Italy Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 188: Italy Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 189: Italy Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 190: Italy Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 191: Italy Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 192: Italy Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 193: Italy Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 194: Italy Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 195: United Kingdom Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 196: United Kingdom Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 197: United Kingdom Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 198: United Kingdom Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 199: United Kingdom Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 200: United Kingdom Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 201: United Kingdom Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 202: United Kingdom Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 203: United Kingdom Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 204: United Kingdom Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 205: United Kingdom Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 206: United Kingdom Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 207: United Kingdom Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 208: United Kingdom Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 209: United Kingdom Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 210: United Kingdom Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 211: Russia Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 212: Russia Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 213: Russia Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 214: Russia Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 215: Russia Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 216: Russia Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 217: Russia Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 218: Russia Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 219: Russia Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 220: Russia Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 221: Russia Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 222: Russia Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 223: Russia Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 224: Russia Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 225: Russia Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 226: Russia Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 227: Rest of Europe Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 228: Rest of Europe Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 229: Rest of Europe Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 230: Rest of Europe Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 231: Rest of Europe Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 232: Rest of Europe Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 233: Rest of Europe Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 234: Rest of Europe Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 235: Rest of Europe Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 236: Rest of Europe Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 237: Rest of Europe Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 238: Rest of Europe Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 239: Rest of Europe Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 240: Rest of Europe Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 241: Rest of Europe Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 242: Rest of Europe Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 243: South America Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 244: South America Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 245: South America Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 246: South America Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 247: South America Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 248: South America Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 249: South America Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 250: South America Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 251: South America Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 252: South America Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 253: South America Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 254: South America Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 255: South America Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 256: South America Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 257: South America Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 258: South America Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 259: Middle East and Africa Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 260: Middle East and Africa Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 261: Middle East and Africa Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 262: Middle East and Africa Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 263: Middle East and Africa Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 264: Middle East and Africa Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 265: Middle East and Africa Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 266: Middle East and Africa Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 267: Middle East and Africa Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 268: Middle East and Africa Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 269: Middle East and Africa Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 270: Middle East and Africa Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 271: Middle East and Africa Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 272: Middle East and Africa Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 273: Middle East and Africa Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 274: Middle East and Africa Helium Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 2: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 3: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Helium Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Helium Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 10: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 11: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 18: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 19: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 26: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 27: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 34: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 35: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 42: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 43: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 50: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 51: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 52: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 53: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: North America Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North America Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 60: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 61: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 62: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 63: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 64: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 65: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 68: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 69: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 71: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 72: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 73: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 75: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 76: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 77: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 78: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 80: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 81: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 82: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 83: Europe Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Europe Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 86: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 87: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 88: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 89: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 90: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 91: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 92: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 93: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 94: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 95: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 96: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 97: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 98: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 99: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 100: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 101: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 102: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 103: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 104: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 105: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 106: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 107: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 108: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 109: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 110: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 111: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 112: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 113: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 114: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 115: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 116: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 117: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 118: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 119: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 120: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 121: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 122: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 123: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 124: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 125: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 126: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 127: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 128: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 129: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 130: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 131: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 132: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 133: Rest of the World Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 134: Rest of the World Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 135: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 136: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 137: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 138: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 139: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 140: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 141: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 142: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 143: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 144: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 145: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 146: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 147: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 148: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 149: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 150: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Helium Industry?

The projected CAGR is approximately 3.05%.

2. Which companies are prominent players in the Helium Industry?

Key companies in the market include Gazprom, Linde PLC, Pgnig Sa (Orlen), Exxon Mobil Corporation, Air Products Inc, NexAir LLC, Gulf Cryo, Matheson Tri-Gas Inc, Iwatani Corporation, Messer Group GmbH, Qatarenergy Lng, Air Liquide, Weil Group*List Not Exhaustive, Renergen.

3. What are the main segments of the Helium Industry?

The market segments include Phase, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Helium Across the Semiconductor Industry; Growing Utilization of Helium Across Aviation Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Healthcare Industry.

7. Are there any restraints impacting market growth?

Expensive Extraction Process; Inconsistent Supply of Helium.

8. Can you provide examples of recent developments in the market?

July 2022: Helios Specialty Gases and Iwatani Corporation signed an agreement involving Iwatani, supplying liquid helium to Helious’s transfer facilities in Gujarat, Telangana, and Rajasthan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Helium Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Helium Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Helium Industry?

To stay informed about further developments, trends, and reports in the Helium Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence