Key Insights

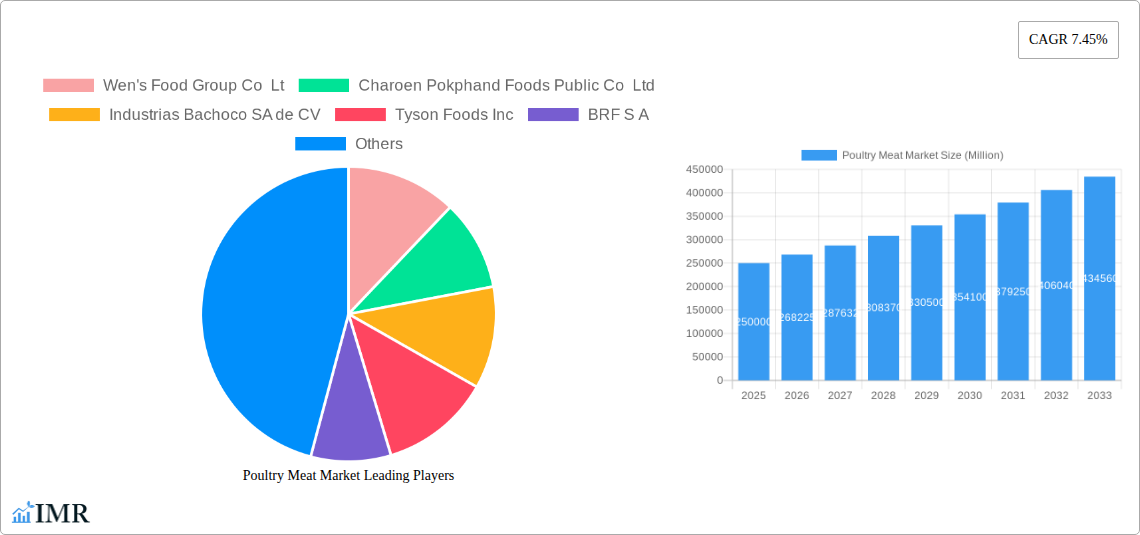

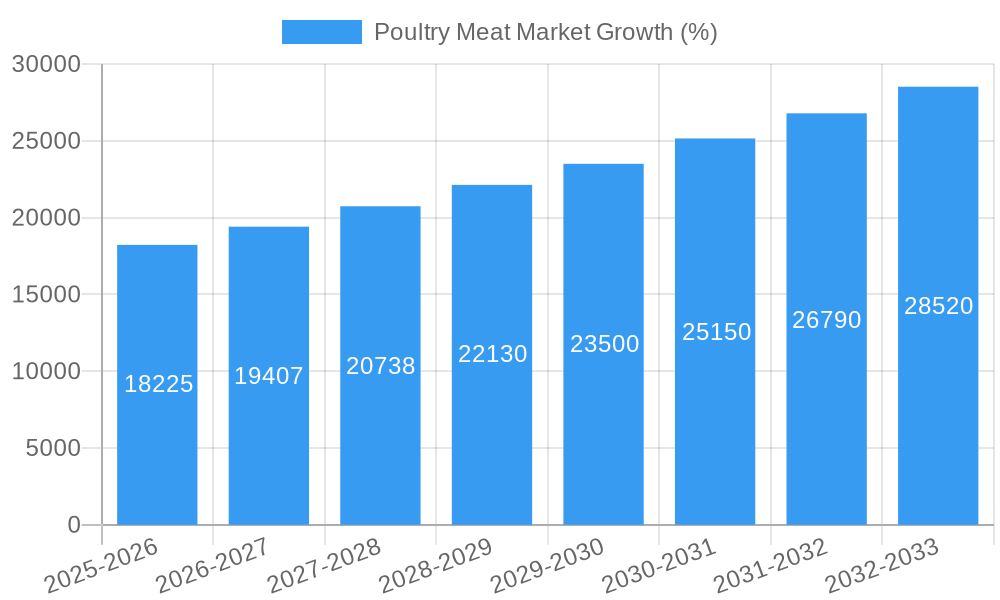

The global poultry meat market is experiencing robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 7.45% from 2019 to 2024 indicates a consistently expanding market driven by several factors. Increasing global population and rising per capita consumption, particularly in developing economies, fuel significant demand. The growing preference for affordable and readily available protein sources further contributes to market expansion. Convenience is a key driver, with processed and canned poultry products experiencing strong growth alongside fresh and chilled options. Major players like Tyson Foods, BRF, and Charoen Pokphand Foods are capitalizing on this trend through strategic expansion, product diversification, and innovative processing techniques. While factors such as fluctuating feed prices and potential disease outbreaks pose challenges, the market's resilience is evident in its sustained growth trajectory. The segmentation by distribution channel (off-trade and on-trade) and form (canned, fresh/chilled, frozen, processed) provides valuable insights into consumer preferences and evolving market dynamics. Regional variations in consumption patterns and market penetration further contribute to the complexity and opportunities within this dynamic sector. The market's projected value in 2025 serves as a crucial benchmark for future growth projections. This data provides a solid foundation for strategic decision-making by industry stakeholders.

The ongoing shift towards healthier eating habits and the growing demand for sustainable and ethically sourced poultry also influences market trends. Innovations in poultry processing and packaging enhance product shelf life and convenience. This is complemented by the expansion of retail channels and online grocery platforms, making poultry products more accessible to consumers. The market is also witnessing increased investment in research and development, focusing on improving poultry breeds for higher yields and disease resistance. This continuous innovation, along with effective supply chain management, ensures the consistent availability of high-quality poultry meat to meet the global demand. However, challenges remain, including concerns about food safety and environmental sustainability, prompting companies to adopt eco-friendly practices and transparent labeling strategies. Understanding these dynamics is crucial for stakeholders navigating this thriving yet complex marketplace. The future of the poultry meat market hinges on the ability of companies to adapt to changing consumer preferences, address sustainability concerns, and effectively manage risks within the value chain.

Poultry Meat Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global poultry meat market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report meticulously examines the parent market (Meat Market) and the child market (Poultry Meat Market) to provide a holistic understanding of this dynamic industry. Valuations are presented in million units.

Poultry Meat Market Dynamics & Structure

The global poultry meat market is characterized by moderate concentration, with several large multinational players holding significant market share. Market leaders such as Tyson Foods Inc., BRF S.A., and JBS S.A. compete intensely, driving innovation and efficiency gains. Technological advancements, including automation in processing and improved breeding techniques, are key drivers. Stringent regulatory frameworks concerning food safety and animal welfare significantly impact operations. Competitive substitutes, such as beef and pork, exert pressure, especially in price-sensitive markets. The market exhibits diverse end-user demographics, ranging from individual consumers to food service providers and industrial processors. M&A activity has been moderate in recent years, with a focus on consolidating production and distribution capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share (2024).

- Technological Innovation: Automation, improved breeding, and sustainable farming practices are key drivers.

- Regulatory Framework: Stringent food safety and animal welfare regulations influence market dynamics.

- Competitive Substitutes: Beef, pork, and other protein sources pose competitive pressure.

- End-User Demographics: Diverse, including individual consumers, food service providers, and industrial users.

- M&A Activity: Moderate activity focused on consolidation of production and distribution (xx deals in 2024).

Poultry Meat Market Growth Trends & Insights

The poultry meat market experienced steady growth between 2019 and 2024, driven by factors such as rising global population, increasing disposable incomes in developing economies, and growing demand for affordable and readily available protein sources. Technological disruptions, such as precision farming and improved processing techniques, enhanced efficiency and product quality. Consumer behavior shifts, reflecting a preference for convenience and health-conscious options, have influenced market segmentation. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Market penetration of processed poultry products is increasing, particularly in urban areas.

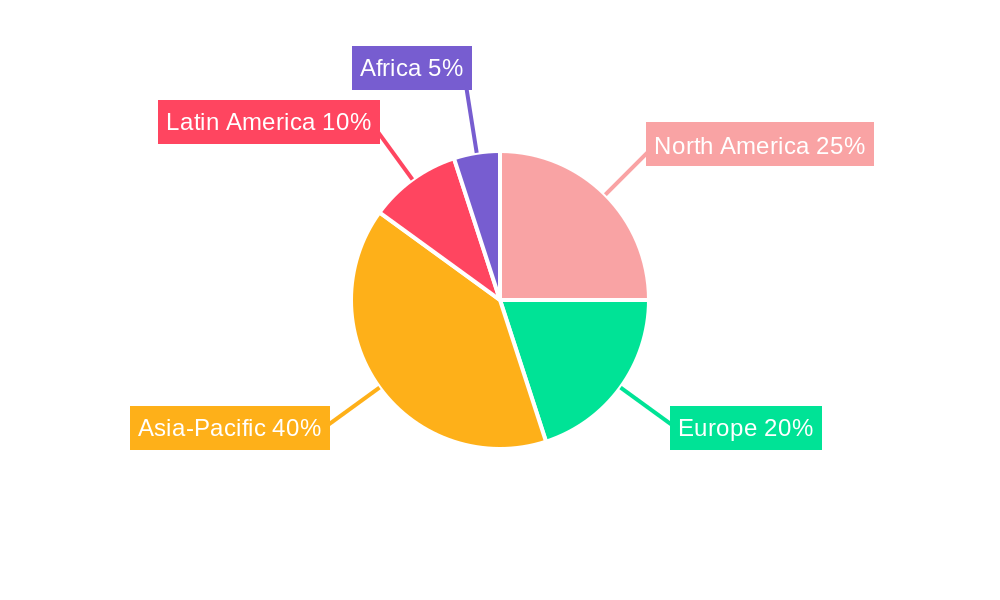

Dominant Regions, Countries, or Segments in Poultry Meat Market

The Asia-Pacific region currently dominates the poultry meat market, driven by a burgeoning population, robust economic growth, and increasing consumption of poultry products. China and India are key growth drivers within this region. Within the segments, the 'Fresh/Chilled' form holds the largest market share, followed by 'Frozen'. The 'Off-Trade' distribution channel dominates, reflecting the prevalence of retail sales.

- Key Drivers in Asia-Pacific: High population density, rising disposable incomes, and increasing urbanization.

- Dominant Form: Fresh/Chilled (xx% market share in 2024)

- Dominant Distribution Channel: Off-Trade (xx% market share in 2024)

- Growth Potential: Significant untapped potential in Africa and Latin America.

Poultry Meat Market Product Landscape

Poultry meat products are evolving, with an emphasis on value-added offerings such as marinated, ready-to-cook, and organic options. Technological advancements in processing and packaging enhance shelf life and product quality. Unique selling propositions include convenience, health benefits (lean protein), and diverse flavors.

Key Drivers, Barriers & Challenges in Poultry Meat Market

Key Drivers:

- Growing global population and rising demand for protein.

- Increasing disposable incomes in developing economies.

- Technological advancements improving efficiency and product quality.

- Government initiatives promoting poultry farming.

Key Challenges:

- Fluctuations in feed prices impacting production costs.

- Avian influenza outbreaks causing production disruptions.

- Stringent regulatory compliance and food safety concerns.

- Intense competition from other protein sources.

Emerging Opportunities in Poultry Meat Market

- Expansion into untapped markets in Africa and Latin America.

- Growing demand for organic and sustainable poultry products.

- Development of value-added products catering to specific dietary needs.

- Innovative packaging solutions extending shelf life and enhancing convenience.

Growth Accelerators in the Poultry Meat Market Industry

Long-term growth in the poultry meat market will be fueled by technological breakthroughs in breeding, farming, and processing; strategic partnerships to enhance supply chain efficiency; and targeted market expansion strategies focusing on emerging economies and evolving consumer preferences. The focus on sustainability and health-conscious options will also drive growth.

Key Players Shaping the Poultry Meat Market Market

- Wen's Food Group Co Lt

- Charoen Pokphand Foods Public Co Ltd

- Industrias Bachoco SA de CV

- Tyson Foods Inc

- BRF S A

- Sysco Corporation

- The Kraft Heinz Company

- Fujian Sunner Development Co Ltd

- Continental Grain Company

- Hormel Foods Corporation

- Cargill Inc

- New Hope Liuhe Co Ltd

- Koch Foods Inc

- JBS SA

Notable Milestones in Poultry Meat Market Sector

- November 2023: Tyson Foods announces plans to build new production facilities in China (creating over 1000 jobs) and Thailand (creating over 700 jobs), and expand its Netherlands facility (adding over 150 jobs), adding over 100,000 tonnes of fully cooked poultry capacity.

- March 2023: Tyson Foods opens a new IT hub in Lisbon, Portugal, focusing on human and food safety.

- March 2023: Kraft Heinz Company and BEES expand their partnership to unlock 1 million potential new points of sale across LATAM.

In-Depth Poultry Meat Market Market Outlook

The poultry meat market is poised for continued growth, driven by the factors previously mentioned. Strategic opportunities lie in leveraging technological advancements to enhance efficiency and sustainability, expanding into high-growth markets, and developing innovative products tailored to evolving consumer demands. The market's future success hinges on addressing challenges related to feed prices, disease outbreaks, and regulatory compliance while capitalizing on opportunities presented by rising global demand for protein.

Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Poultry Meat Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Affordability of poultry meat and growing investments in the market will propel the market’s growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Canned

- 6.1.2. Fresh / Chilled

- 6.1.3. Frozen

- 6.1.4. Processed

- 6.1.4.1. By Processed Types

- 6.1.4.1.1. Deli Meats

- 6.1.4.1.2. Marinated/ Tenders

- 6.1.4.1.3. Meatballs

- 6.1.4.1.4. Nuggets

- 6.1.4.1.5. Sausages

- 6.1.4.1.6. Other Processed Poultry

- 6.1.4.1. By Processed Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Channel

- 6.2.1.3. Supermarkets and Hypermarkets

- 6.2.1.4. Others

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. South America Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Canned

- 7.1.2. Fresh / Chilled

- 7.1.3. Frozen

- 7.1.4. Processed

- 7.1.4.1. By Processed Types

- 7.1.4.1.1. Deli Meats

- 7.1.4.1.2. Marinated/ Tenders

- 7.1.4.1.3. Meatballs

- 7.1.4.1.4. Nuggets

- 7.1.4.1.5. Sausages

- 7.1.4.1.6. Other Processed Poultry

- 7.1.4.1. By Processed Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Channel

- 7.2.1.3. Supermarkets and Hypermarkets

- 7.2.1.4. Others

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Canned

- 8.1.2. Fresh / Chilled

- 8.1.3. Frozen

- 8.1.4. Processed

- 8.1.4.1. By Processed Types

- 8.1.4.1.1. Deli Meats

- 8.1.4.1.2. Marinated/ Tenders

- 8.1.4.1.3. Meatballs

- 8.1.4.1.4. Nuggets

- 8.1.4.1.5. Sausages

- 8.1.4.1.6. Other Processed Poultry

- 8.1.4.1. By Processed Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Channel

- 8.2.1.3. Supermarkets and Hypermarkets

- 8.2.1.4. Others

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Middle East & Africa Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Canned

- 9.1.2. Fresh / Chilled

- 9.1.3. Frozen

- 9.1.4. Processed

- 9.1.4.1. By Processed Types

- 9.1.4.1.1. Deli Meats

- 9.1.4.1.2. Marinated/ Tenders

- 9.1.4.1.3. Meatballs

- 9.1.4.1.4. Nuggets

- 9.1.4.1.5. Sausages

- 9.1.4.1.6. Other Processed Poultry

- 9.1.4.1. By Processed Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Channel

- 9.2.1.3. Supermarkets and Hypermarkets

- 9.2.1.4. Others

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Asia Pacific Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Canned

- 10.1.2. Fresh / Chilled

- 10.1.3. Frozen

- 10.1.4. Processed

- 10.1.4.1. By Processed Types

- 10.1.4.1.1. Deli Meats

- 10.1.4.1.2. Marinated/ Tenders

- 10.1.4.1.3. Meatballs

- 10.1.4.1.4. Nuggets

- 10.1.4.1.5. Sausages

- 10.1.4.1.6. Other Processed Poultry

- 10.1.4.1. By Processed Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Channel

- 10.2.1.3. Supermarkets and Hypermarkets

- 10.2.1.4. Others

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wen's Food Group Co Lt

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Charoen Pokphand Foods Public Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Industrias Bachoco SA de CV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tyson Foods Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BRF S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sysco Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Kraft Heinz Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fujian Sunner Development Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Continental Grain Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hormel Foods Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cargill Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 New Hope Liuhe Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Koch Foods Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 JBS SA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Wen's Food Group Co Lt

List of Figures

- Figure 1: Global Poultry Meat Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Poultry Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 3: North America Poultry Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 4: North America Poultry Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Poultry Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Poultry Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Poultry Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Poultry Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 9: South America Poultry Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 10: South America Poultry Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Poultry Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Poultry Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Poultry Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Poultry Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 15: Europe Poultry Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 16: Europe Poultry Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Poultry Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Poultry Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Poultry Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Poultry Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 21: Middle East & Africa Poultry Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 22: Middle East & Africa Poultry Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Poultry Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Poultry Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Poultry Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Poultry Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 27: Asia Pacific Poultry Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 28: Asia Pacific Poultry Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Poultry Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Poultry Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Poultry Meat Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 6: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 12: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 18: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 30: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 39: Global Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poultry Meat Market?

The projected CAGR is approximately 7.45%.

2. Which companies are prominent players in the Poultry Meat Market?

Key companies in the market include Wen's Food Group Co Lt, Charoen Pokphand Foods Public Co Ltd, Industrias Bachoco SA de CV, Tyson Foods Inc, BRF S A, Sysco Corporation, The Kraft Heinz Company, Fujian Sunner Development Co Ltd, Continental Grain Company, Hormel Foods Corporation, Cargill Inc, New Hope Liuhe Co Ltd, Koch Foods Inc, JBS SA.

3. What are the main segments of the Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Affordability of poultry meat and growing investments in the market will propel the market’s growth.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

November 2023: Tyson Foods announced plans to build new production facilities in China and Thailand, and expand its facility in the Netherlands. The latest expansions, adds over 100,000 tonnes of fully cooked poultry capacity. The new plant in China and Thailand is expected to create more than 700, 1000 jobs respectively and the European expansion will add more than 150 jobs.March 2023: Tyson Foods has announced the opening of a new Information Technology (IT hub) in Lisbon, Portugal within our international practice to leverage quality talent to help deliver the latest ideas for human and food safety.March 2023: Kraft Heinz Company and BEES announced an expanded partnership to propel the B2B marketplace, with the ambition to unlock 1 million potential new points of sale across LATAM for the Company, specifically to enhance its footprint in Mexico, Colombia and Peru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence