Key Insights

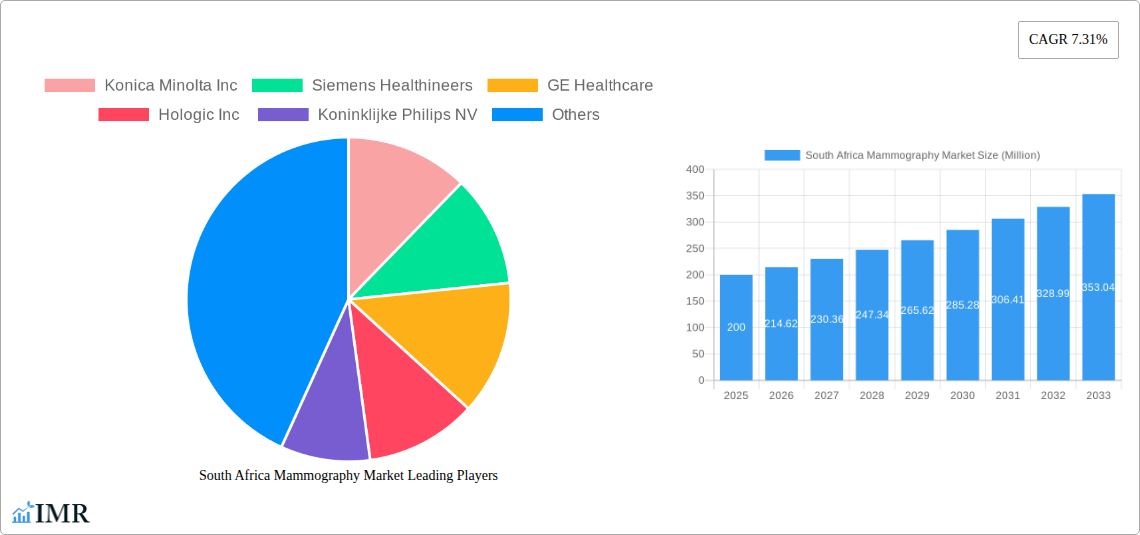

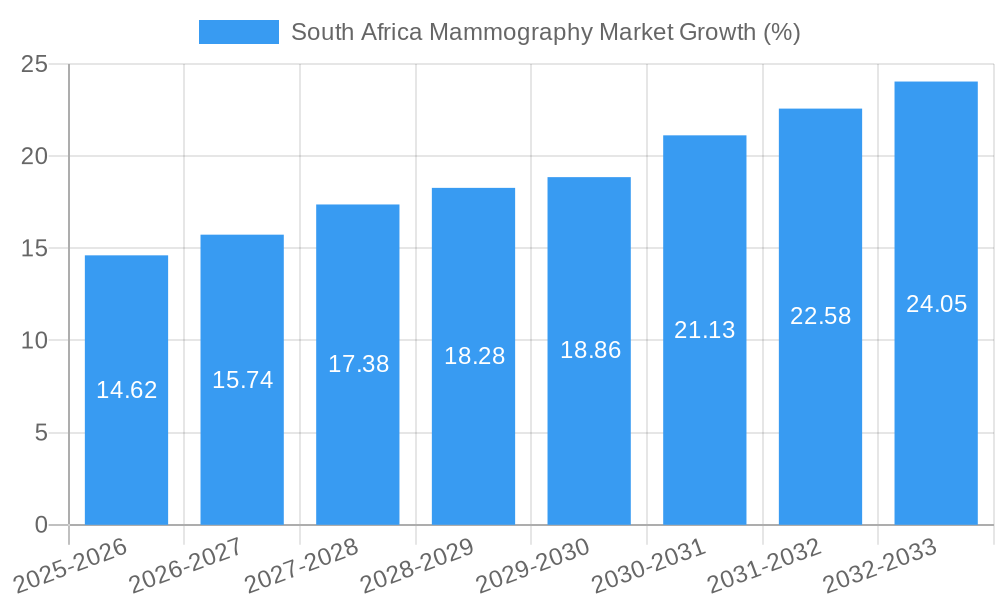

The South African mammography market, valued at approximately $200 million in 2025, is poised for robust growth, driven by increasing breast cancer incidence rates, rising healthcare expenditure, and a growing awareness of preventive healthcare. The market's Compound Annual Growth Rate (CAGR) of 7.31% from 2019 to 2024 suggests a continued upward trajectory, projecting a market size exceeding $350 million by 2033. Key growth drivers include the increasing adoption of advanced digital mammography systems, offering superior image quality and reduced radiation exposure, and the expansion of healthcare infrastructure in both urban and rural areas. Furthermore, government initiatives promoting early detection and screening programs are significantly boosting market demand. The segment comprising digital mammography systems is expected to dominate the market due to technological advancements and improved diagnostic capabilities. Hospitals and specialty clinics represent the largest end-user segment, accounting for a significant share of the market revenue. However, challenges remain, including the high cost of advanced equipment, limited access to healthcare in underserved regions, and a shortage of trained radiologists. Despite these restraints, the long-term outlook for the South African mammography market remains positive, driven by continuous technological innovation and increasing investment in healthcare infrastructure.

The competitive landscape is characterized by a mix of global and regional players, including Konica Minolta, Siemens Healthineers, GE Healthcare, and Hologic. These companies are actively engaged in strategic initiatives like product launches, partnerships, and technological advancements to consolidate their market positions. The market's growth is expected to be largely influenced by the ongoing expansion of private healthcare facilities and the increasing affordability of mammography services. A key factor for success will be the ability of companies to adapt to the evolving regulatory landscape and to offer comprehensive solutions encompassing equipment, service, and training to meet the growing demand for high-quality mammography services across the diverse South African population.

South Africa Mammography Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa mammography market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and healthcare policymakers seeking to understand this vital sector of the South African healthcare landscape. The market is segmented by end-user (Hospitals, Specialty Clinics, Diagnostic Centers) and product type (Digital Systems, Analog Systems, Breast Tomosynthesis, Other Product Types). Key players analyzed include Konica Minolta Inc, Siemens Healthineers, GE Healthcare, Hologic Inc, Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, and Fujifilm Holdings Corporation. The report projects a market size of xx Million units by 2033.

South Africa Mammography Market Dynamics & Structure

The South African mammography market is characterized by a moderate level of market concentration, with key players vying for market share. Technological innovation, particularly in digital mammography and breast tomosynthesis, is a key driver. Regulatory frameworks governing medical devices and healthcare practices significantly influence market operations. Competitive pressures from substitute technologies and increasing awareness of breast cancer are shaping the market. The demographics of the South African population, particularly the growing number of women in the high-risk age groups, are fueling demand.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Strong emphasis on digital mammography and AI-driven image analysis; however, affordability remains a barrier in certain segments.

- Regulatory Framework: Compliance with South African Health Products Regulatory Authority (SAHPRA) guidelines is crucial; potential for increased regulatory scrutiny impacting market dynamics.

- Competitive Substitutes: Limited direct substitutes; however, alternative screening methods influence market growth.

- M&A Trends: Moderate level of M&A activity observed in the past five years, with xx deals recorded (2019-2024). Consolidation is expected to continue driving market dynamics.

- End-User Demographics: A growing aging population and increased awareness of breast cancer screening are positive contributors.

South Africa Mammography Market Growth Trends & Insights

The South African mammography market is experiencing steady growth driven by factors such as rising breast cancer incidence, increased healthcare expenditure, and government initiatives promoting preventative healthcare. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is being driven by technological advancements that increase accuracy and efficiency of screening, along with increased government investment in public healthcare infrastructure. The adoption rate of digital mammography systems is increasing, while the market for analog systems is gradually declining. Changes in consumer behavior, including increased awareness and demand for advanced screening technologies, are influencing market trends. Market penetration is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in South Africa Mammography Market

The Gauteng province is expected to dominate the South African mammography market owing to its higher concentration of hospitals, diagnostic centers, and specialized clinics. Within the product segment, digital mammography systems hold the largest market share, driven by their superior image quality and diagnostic capabilities. Among the end-users, hospitals constitute the largest segment, followed by specialty clinics and diagnostic centers.

- Key Drivers: Government initiatives to improve healthcare infrastructure, rising disposable incomes, and increased awareness of breast cancer.

- Dominance Factors: Concentration of healthcare facilities in Gauteng and higher adoption of digital systems in urban areas.

- Growth Potential: Significant growth potential exists in rural areas through mobile screening units and public-private partnerships.

South Africa Mammography Market Product Landscape

The South African mammography market features a range of digital and analog systems, with a clear trend toward the adoption of advanced digital technologies, including breast tomosynthesis. Digital systems offer enhanced image clarity, reducing the need for recall examinations and improving diagnostic accuracy. Breast tomosynthesis provides three-dimensional imaging, further improving detection rates and reducing false positives. Manufacturers are continuously innovating to improve image quality, reduce radiation dose, and enhance user experience. The unique selling propositions include improved diagnostic accuracy, reduced radiation exposure, and streamlined workflows for healthcare providers.

Key Drivers, Barriers & Challenges in South Africa Mammography Market

Key Drivers:

- Increasing prevalence of breast cancer in South Africa.

- Government initiatives to improve healthcare infrastructure and access to screening.

- Technological advancements in mammography systems.

- Rising awareness among women regarding the importance of breast cancer screening.

Key Barriers & Challenges:

- High cost of advanced mammography systems, particularly in resource-limited settings.

- Shortage of trained radiologists and technicians, especially in rural areas.

- Inadequate healthcare infrastructure in certain regions.

- Competition from alternative screening methods. This leads to a xx% reduction in market growth in specific regions.

Emerging Opportunities in South Africa Mammography Market

- Expansion of mammography services in underserved rural areas through mobile screening units.

- Increased adoption of AI-powered image analysis tools to improve diagnostic accuracy and efficiency.

- Development of cost-effective mammography solutions tailored to the needs of resource-constrained settings.

- Public-private partnerships to improve access to mammography services.

Growth Accelerators in the South Africa Mammography Market Industry

Technological advancements, particularly in digital mammography and AI-powered image analysis, are key growth accelerators. Strategic partnerships between healthcare providers and technology companies are driving innovation and market expansion. Government investments in healthcare infrastructure and initiatives to improve access to screening are further enhancing market growth.

Key Players Shaping the South Africa Mammography Market Market

- Konica Minolta Inc

- Siemens Healthineers

- GE Healthcare

- Hologic Inc

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Planmed Oy

- Carestream Health Inc

- Fujifilm Holdings Corporation

Notable Milestones in South Africa Mammography Market Sector

- September 2021: Keystone Medical launched a mobile breast cancer screening unit, improving access to screening throughout South Africa.

- April 2022: The IAEA launched a plan to address the shortage of cancer care capacity in Africa, potentially increasing mammography access.

In-Depth South Africa Mammography Market Market Outlook

The South Africa mammography market is poised for continued growth, driven by technological innovation, increased awareness of breast cancer, and government support for healthcare infrastructure development. Strategic partnerships, expansion into underserved areas, and adoption of cost-effective solutions will be crucial for unlocking the market's full potential. The focus on improving access to screening, particularly in rural communities, presents significant opportunities for market expansion and positive health outcomes.

South Africa Mammography Market Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Other Product Types

-

2. End User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

South Africa Mammography Market Segmentation By Geography

- 1. South Africa

South Africa Mammography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Digital Systems are Expected to Hold Significant Share in Product Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Konica Minolta Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens Healthineers

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GE Healthcare

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hologic Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Koninklijke Philips NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Canon Medical Systems Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Planmed Oy

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Carestream Health Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fujifilm Holdings Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Konica Minolta Inc

List of Figures

- Figure 1: South Africa Mammography Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Mammography Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Mammography Market Volume Piece Forecast, by Region 2019 & 2032

- Table 3: South Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South Africa Mammography Market Volume Piece Forecast, by Product Type 2019 & 2032

- Table 5: South Africa Mammography Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: South Africa Mammography Market Volume Piece Forecast, by End User 2019 & 2032

- Table 7: South Africa Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Mammography Market Volume Piece Forecast, by Region 2019 & 2032

- Table 9: South Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Africa Mammography Market Volume Piece Forecast, by Country 2019 & 2032

- Table 11: South Africa South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 13: Sudan South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 15: Uganda South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 17: Tanzania South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 19: Kenya South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa South Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa South Africa Mammography Market Volume (Piece) Forecast, by Application 2019 & 2032

- Table 23: South Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: South Africa Mammography Market Volume Piece Forecast, by Product Type 2019 & 2032

- Table 25: South Africa Mammography Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: South Africa Mammography Market Volume Piece Forecast, by End User 2019 & 2032

- Table 27: South Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Mammography Market Volume Piece Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Mammography Market?

The projected CAGR is approximately 7.31%.

2. Which companies are prominent players in the South Africa Mammography Market?

Key companies in the market include Konica Minolta Inc, Siemens Healthineers, GE Healthcare, Hologic Inc , Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, Fujifilm Holdings Corporation.

3. What are the main segments of the South Africa Mammography Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

Digital Systems are Expected to Hold Significant Share in Product Type Segment.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

In April 2022, the International Atomic Energy Agency (IAEA) launched a plan to tackle a severe shortage of cancer care capacity in many poorer countries, with an initial focus on Africa where people often die from the disease because they lack access to potentially life-saving nuclear medicine and radiotherapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Mammography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Mammography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Mammography Market?

To stay informed about further developments, trends, and reports in the South Africa Mammography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence