Key Insights

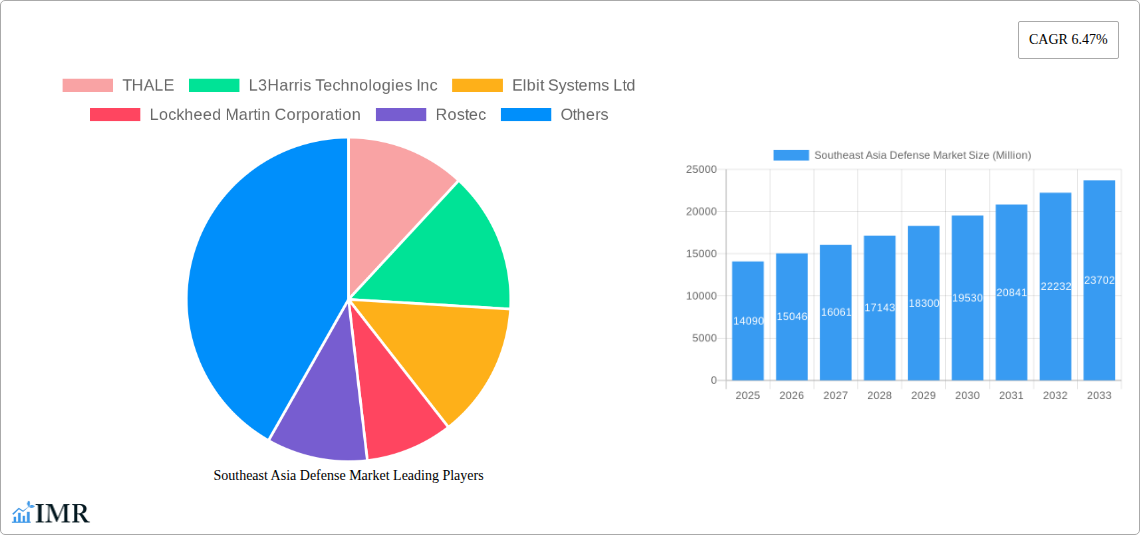

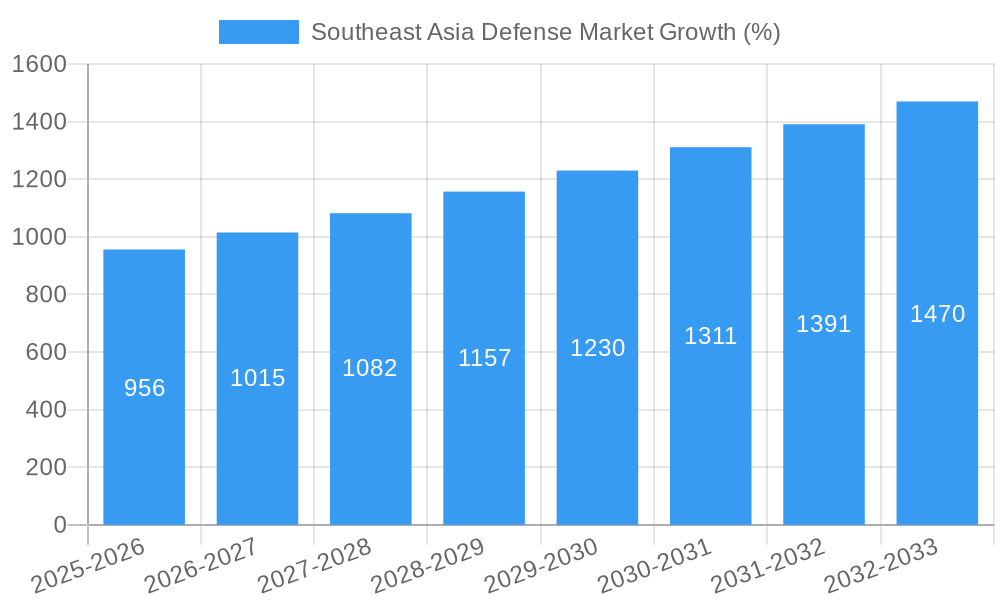

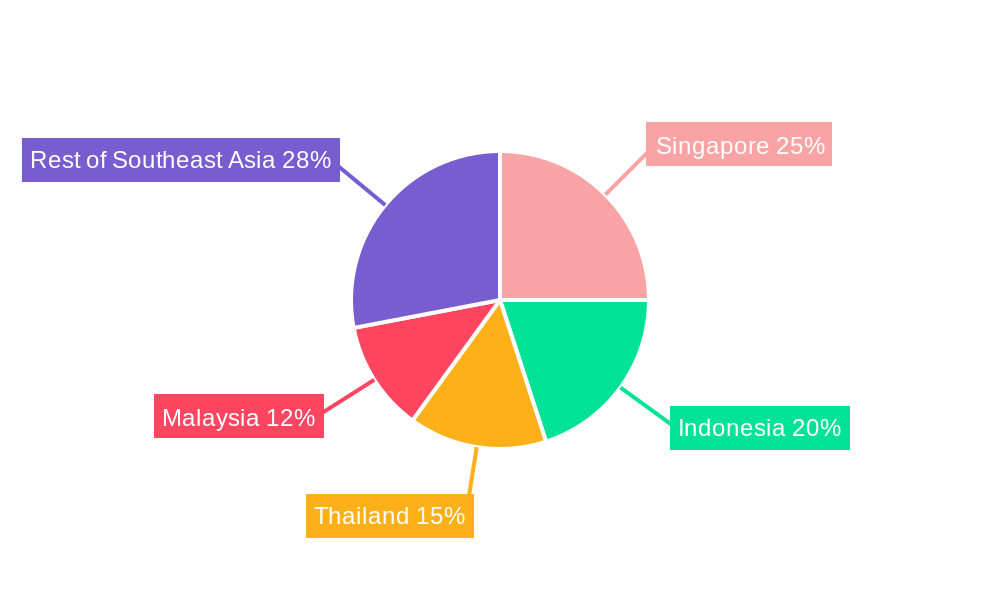

The Southeast Asia defense market, valued at $14.09 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization efforts by regional armed forces, and increasing cross-border threats. The 6.47% CAGR indicates a significant expansion over the forecast period (2025-2033). Key market drivers include the need for enhanced cybersecurity and intelligence capabilities (C4ISR and EW), modernization of aging military equipment across various segments (vehicles, weapons, and ammunition), and a rising focus on personnel training and protection programs. This growth is particularly noticeable in countries like Singapore, Indonesia, Malaysia, and Thailand, where substantial investments are being made to bolster national defense capabilities. The air force, army, and navy segments all contribute significantly to market demand, with varied focuses depending on specific national security priorities. While the market faces certain restraints, such as budget constraints in some nations and potential supply chain disruptions, the overall outlook remains positive, supported by consistent government spending and regional collaboration on defense initiatives.

The competitive landscape is marked by a mix of international and regional players, including major defense contractors like Thales, Lockheed Martin, and Boeing, alongside significant regional players like Singapore Technologies Engineering. These companies are vying for contracts across the various segments. Future growth will likely be shaped by technological advancements in areas like autonomous weapons systems, cyber warfare defense, and advanced surveillance technologies. The continued focus on regional stability, coupled with evolving threat landscapes, ensures the Southeast Asia defense market will remain a focal point for significant investment and growth throughout the forecast period. Further expansion is anticipated in areas such as advanced training programs, specialized equipment procurement, and collaborative defense initiatives. The market's growth trajectory suggests a promising investment opportunity for businesses involved in defense manufacturing, technology development, and services.

Southeast Asia Defense Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Southeast Asia defense market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033, including a base year of 2025, this report is an invaluable resource for industry professionals, investors, and policymakers seeking to understand this dynamic and strategically important market. The report segments the market by type (Personnel Training and Protection, C4ISR and EW, Vehicles, Weapons and Ammunition), country (Singapore, Indonesia, Thailand, Malaysia, Rest of Southeast Asia), and armed forces (Air Force, Army, Navy), offering granular insights into market size, growth drivers, and competitive landscapes. The market size is projected in Million USD.

Southeast Asia Defense Market Dynamics & Structure

The Southeast Asia defense market is characterized by a complex interplay of factors impacting its structure and growth. Market concentration is moderate, with several major international players and strong domestic companies vying for market share. Technological innovation, particularly in areas like unmanned aerial systems (UAS) and advanced sensors, is a key driver. Stringent regulatory frameworks, varying across nations, influence procurement processes and investment decisions. The market also faces the challenge of competitive product substitutes, driving innovation and efficiency. End-user demographics, shaped by evolving geopolitical concerns and rising defense budgets, play a critical role. Finally, mergers and acquisitions (M&A) activity is relatively frequent, reshaping the competitive landscape and driving consolidation.

- Market Concentration: Moderate, with a mix of international and regional players.

- Technological Innovation: Significant driver, particularly in UAS, AI, and cyber warfare.

- Regulatory Frameworks: Varied across nations, influencing procurement and investment.

- Competitive Substitutes: Drive innovation and efficiency improvements.

- End-User Demographics: Shaped by geopolitical concerns and defense spending.

- M&A Activity: Relatively frequent, leading to market consolidation (xx deals in the past 5 years, resulting in xx% market share change).

Southeast Asia Defense Market Growth Trends & Insights

The Southeast Asia defense market experienced robust growth during the historical period (2019-2024), driven by increased defense spending, regional geopolitical tensions, and modernization efforts across armed forces. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. Adoption rates of advanced technologies are increasing, but challenges remain in terms of budget constraints and technological integration. Consumer behavior shifts are evident in a growing focus on cost-effectiveness, interoperability, and indigenous technological capabilities. Market penetration of advanced weapon systems remains relatively low but is gradually increasing.

Dominant Regions, Countries, or Segments in Southeast Asia Defense Market

Singapore consistently dominates the Southeast Asia defense market due to its high defense spending, strategic location, and focus on advanced technology adoption. Indonesia and Thailand also represent significant market segments, characterized by substantial defense budgets and ongoing modernization programs. Within the segments, the C4ISR and EW segment is experiencing the fastest growth, driven by the increasing demand for improved situational awareness and communication systems.

- Singapore: High defense spending, advanced technology adoption, and strategic location drive dominance.

- Indonesia & Thailand: Significant defense budgets and modernization programs fuel growth.

- C4ISR and EW: Fastest-growing segment due to demand for improved situational awareness.

- Vehicles Segment: Significant market due to the need for modernizing existing fleets.

- Weapons and Ammunition Segment: Large market share, with consistent demand for modern weapons.

- Personnel Training and Protection: Steady growth driven by a focus on personnel readiness.

Southeast Asia Defense Market Product Landscape

The Southeast Asia defense market is witnessing significant product innovation, with a focus on enhanced capabilities, improved performance, and cost-effectiveness. Unmanned aerial systems (UAS), advanced sensors, and cyber warfare technologies are experiencing strong growth. Products are characterized by unique selling propositions such as extended operational ranges, improved situational awareness, and enhanced survivability. Technological advancements in materials science, artificial intelligence, and data analytics are driving the development of more sophisticated and effective defense systems.

Key Drivers, Barriers & Challenges in Southeast Asia Defense Market

Key Drivers: Rising geopolitical tensions, increasing defense budgets, modernization of armed forces, and technological advancements are the main growth drivers. Specific examples include regional security concerns, increased cross-border conflicts and the adoption of advanced technologies like AI and UAS.

Key Barriers & Challenges: Budget constraints, complex procurement processes, technological integration challenges, and supply chain vulnerabilities present major obstacles. For example, delays in procurement due to bureaucratic hurdles, the high cost of advanced weapon systems, and reliance on foreign suppliers can impede market growth.

Emerging Opportunities in Southeast Asia Defense Market

Emerging opportunities exist in the development and deployment of advanced technologies such as AI-powered systems, cyber warfare solutions, and advanced sensors. Untapped markets exist in areas such as cybersecurity and homeland security. Evolving consumer preferences are focused on cost-effectiveness, interoperability, and indigenous technological capabilities, creating opportunities for locally produced defense equipment.

Growth Accelerators in the Southeast Asia Defense Market Industry

Technological breakthroughs in areas like AI, UAS, and cyber security are driving rapid growth. Strategic partnerships between international and regional companies are fostering technology transfer and indigenous capability development. Expansion strategies focusing on regional cooperation and export markets are also contributing to the expansion of the defense market.

Key Players Shaping the Southeast Asia Defense Market Market

- THALES

- L3Harris Technologies Inc

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Rostec

- Airbus SE

- IAI

- Leonardo S p A

- Singapore Technologies Engineering Ltd

- Saab AB

- The Boeing Company

Notable Milestones in Southeast Asia Defense Market Sector

- March 2023: Singapore’s Ministry of Defense exercised an option to acquire eight F-35B Lightning II Fighter multirole combat aircraft from Lockheed Martin Corporation.

- September 2023: Elbit Systems announced the presentation of Skylark 3 Hybrid STUAS at the Singapore Airshow.

In-Depth Southeast Asia Defense Market Market Outlook

The Southeast Asia defense market is poised for continued strong growth, driven by persistent geopolitical uncertainties, modernization efforts, and technological advancements. Strategic partnerships, investments in R&D, and a focus on indigenous capabilities will shape future market dynamics. Opportunities exist for companies that can offer cost-effective, interoperable, and technologically advanced solutions. The market is expected to witness a significant influx of new technologies, which will create new avenues for growth and open up lucrative opportunities for key players.

Southeast Asia Defense Market Segmentation

-

1. Armed Forces

- 1.1. Air Force

- 1.2. Army

- 1.3. Navy

-

2. Type

- 2.1. Personnel Training and Protection

- 2.2. C4ISR and EW

- 2.3. Vehicles

- 2.4. Weapons and Ammunition

Southeast Asia Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Navy Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Air Force

- 5.1.2. Army

- 5.1.3. Navy

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Personnel Training and Protection

- 5.2.2. C4ISR and EW

- 5.2.3. Vehicles

- 5.2.4. Weapons and Ammunition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Air Force

- 6.1.2. Army

- 6.1.3. Navy

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Personnel Training and Protection

- 6.2.2. C4ISR and EW

- 6.2.3. Vehicles

- 6.2.4. Weapons and Ammunition

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Air Force

- 7.1.2. Army

- 7.1.3. Navy

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Personnel Training and Protection

- 7.2.2. C4ISR and EW

- 7.2.3. Vehicles

- 7.2.4. Weapons and Ammunition

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Air Force

- 8.1.2. Army

- 8.1.3. Navy

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Personnel Training and Protection

- 8.2.2. C4ISR and EW

- 8.2.3. Vehicles

- 8.2.4. Weapons and Ammunition

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Air Force

- 9.1.2. Army

- 9.1.3. Navy

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Personnel Training and Protection

- 9.2.2. C4ISR and EW

- 9.2.3. Vehicles

- 9.2.4. Weapons and Ammunition

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Air Force

- 10.1.2. Army

- 10.1.3. Navy

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Personnel Training and Protection

- 10.2.2. C4ISR and EW

- 10.2.3. Vehicles

- 10.2.4. Weapons and Ammunition

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. China Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 13. India Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Southeast Asia Defense Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 THALE

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 L3Harris Technologies Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Elbit Systems Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Lockheed Martin Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Rostec

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Airbus SE

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 IAI

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Leonardo S p A

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Singapore Technologies Engineering Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Saab AB

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 The Boeing Company

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 THALE

List of Figures

- Figure 1: Global Southeast Asia Defense Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Southeast Asia Defense Market Revenue (Million), by Armed Forces 2024 & 2032

- Figure 5: North America Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 6: North America Southeast Asia Defense Market Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Southeast Asia Defense Market Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Southeast Asia Defense Market Revenue (Million), by Armed Forces 2024 & 2032

- Figure 11: South America Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 12: South America Southeast Asia Defense Market Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Southeast Asia Defense Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Southeast Asia Defense Market Revenue (Million), by Armed Forces 2024 & 2032

- Figure 17: Europe Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 18: Europe Southeast Asia Defense Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Southeast Asia Defense Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Armed Forces 2024 & 2032

- Figure 23: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 24: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Armed Forces 2024 & 2032

- Figure 29: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 30: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Southeast Asia Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Southeast Asia Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 14: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 20: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 26: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 38: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 47: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Defense Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the Southeast Asia Defense Market?

Key companies in the market include THALE, L3Harris Technologies Inc, Elbit Systems Ltd, Lockheed Martin Corporation, Rostec, Airbus SE, IAI, Leonardo S p A, Singapore Technologies Engineering Ltd, Saab AB, The Boeing Company.

3. What are the main segments of the Southeast Asia Defense Market?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Navy Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

September 2023: Elbit Systems announced that it would present Skylark 3 Hybrid Small Tactical Unmanned Aerial Systems (STUAS) for the first time at the Singapore Airshow. The Skylark 3 Hybrid system is equipped with a hybrid propulsion system that offers 18 hours of operations and improves mission effectiveness and cost efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Defense Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence