Key Insights

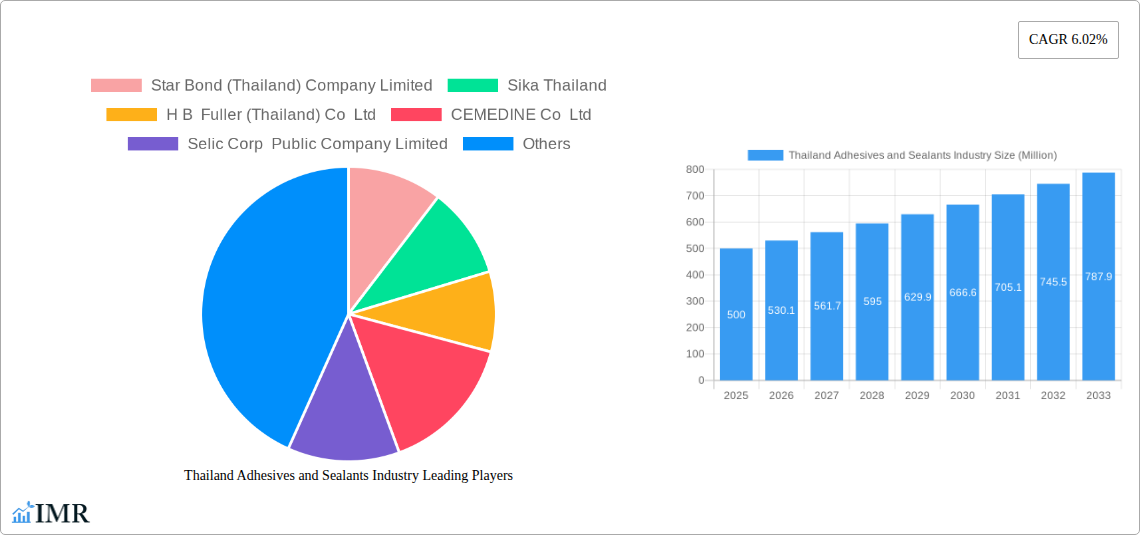

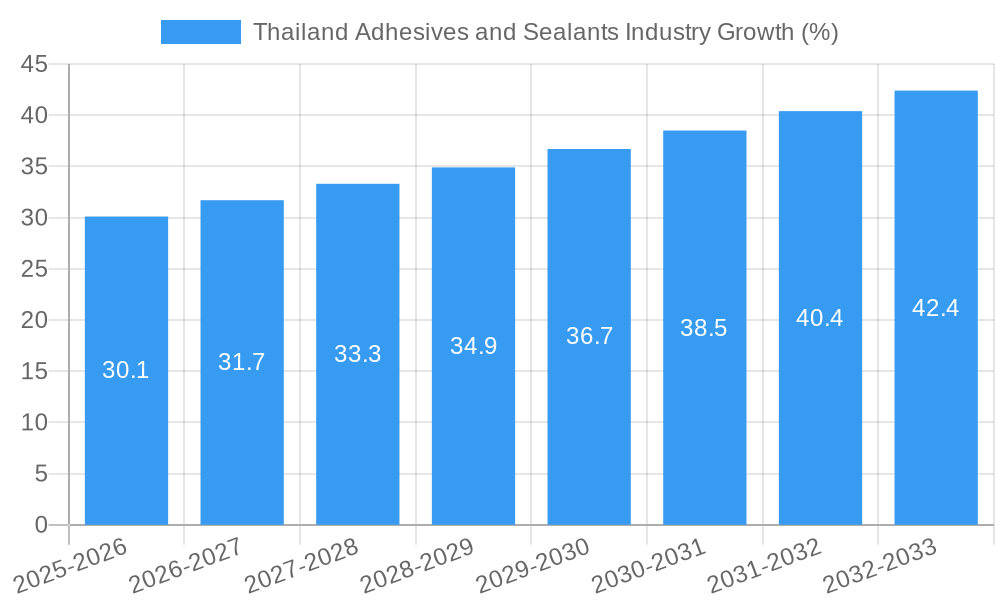

The Thailand adhesives and sealants market, valued at approximately 500 million USD in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 6.02% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning construction industry in Thailand, fueled by infrastructure development and urbanization, constitutes a significant demand driver for adhesives and sealants. Simultaneously, the rising popularity of DIY home improvement projects and increasing consumer disposable incomes contribute to market growth. Furthermore, advancements in adhesive technology, such as the development of eco-friendly water-borne adhesives and high-performance reactive adhesives, are creating new opportunities. The automotive and packaging sectors also play a considerable role, requiring specialized adhesives for diverse applications. Competition among established players like 3M, Sika, and Henkel, alongside local manufacturers, fosters innovation and competitive pricing, benefiting consumers.

However, certain challenges hinder market growth. Fluctuations in raw material prices, particularly for petroleum-based adhesives, impact production costs and profitability. Stringent environmental regulations regarding volatile organic compound (VOC) emissions necessitate the adoption of greener alternatives, requiring investments in research and development. Moreover, the market’s sensitivity to economic downturns poses a potential risk, influencing demand across various end-user industries. Despite these restraints, the long-term outlook remains positive, underpinned by Thailand's ongoing economic development and the continuous innovation within the adhesives and sealants sector. The market segmentation by adhesive type (water-borne, solvent-borne, reactive, hot-melt) and by end-user industry (construction, automotive, packaging) provides crucial insights into specific growth areas and opportunities for market players. Analysis of these segments reveals opportunities for specialized product development catering to specific needs and preferences within each sector.

Thailand Adhesives and Sealants Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Thailand adhesives and sealants industry, offering invaluable insights for industry professionals, investors, and strategic planners. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this analysis is 2025. Market values are presented in Million units.

Thailand Adhesives and Sealants Industry Market Dynamics & Structure

The Thailand adhesives and sealants market is characterized by a moderately concentrated landscape, with key players such as 3M, Sika Thailand, and H.B. Fuller (Thailand) Co Ltd holding significant market share. Technological innovation, driven by the demand for high-performance, eco-friendly products, is a key dynamic. Stringent environmental regulations are influencing the adoption of water-based and low-VOC adhesives and sealants. Competitive pressures from substitute materials, like welding and mechanical fasteners, are also present. The construction and automotive industries are major end-users, while the packaging and consumer goods sectors contribute significantly as well. M&A activity has been moderate, with several strategic acquisitions aimed at expanding product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on water-based, low-VOC, and high-performance adhesives and sealants.

- Regulatory Framework: Increasing emphasis on environmental regulations influencing product formulation.

- Competitive Substitutes: Welding, mechanical fasteners, and other bonding technologies pose competitive challenges.

- End-User Demographics: Construction, automotive, packaging, and consumer goods are primary end-use segments.

- M&A Trends: Moderate activity focused on portfolio expansion and market penetration.

Thailand Adhesives and Sealants Industry Growth Trends & Insights

The Thailand adhesives and sealants market witnessed steady growth during the historical period (2019-2024), driven by robust construction activity and expanding manufacturing sectors. The estimated market size in 2025 is xx Million units. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), fueled by increasing demand from various end-use industries and ongoing infrastructure development. Technological advancements, such as the introduction of bio-based adhesives and improved sealant formulations, are further contributing to market growth. Consumer preference for sustainable and eco-friendly products is also influencing market trends. Market penetration of high-performance adhesives is gradually increasing across various segments.

Dominant Regions, Countries, or Segments in Thailand Adhesives and Sealants Industry

The Bangkok Metropolitan Region and surrounding provinces dominate the Thailand adhesives and sealants market, driven by high construction activity and industrial concentration. Within product segments, the water-borne adhesives (Acrylics, PVA Emulsion, EVA Emulsion) segment holds the largest market share, fueled by its versatility, cost-effectiveness, and environmental friendliness. The construction sector represents the largest end-use market for both adhesives and sealants. Other rapidly growing segments include reactive adhesives (epoxy, polyurethane) for specialized industrial applications and hot-melt adhesives for packaging and consumer goods.

Key Drivers:

- Robust construction activity and infrastructure development.

- Growth of the manufacturing and automotive sectors.

- Increasing demand for high-performance and eco-friendly products.

- Government initiatives promoting sustainable construction practices.

Dominant Segments:

- Water-borne adhesives (Acrylics, PVA, EVA): xx% market share in 2025

- Reactive adhesives (Epoxy, Polyurethane): xx% market share in 2025

- Construction sector: xx% of total adhesives and sealants consumption.

Thailand Adhesives and Sealants Industry Product Landscape

The Thailand adhesives and sealants market offers a diverse range of products, from conventional solvent-borne adhesives to advanced reactive and hot-melt systems. Recent innovations include the introduction of bio-based adhesives, high-performance sealants with enhanced durability and weather resistance, and specialized adhesives for specific applications like electronics and medical devices. The focus is on improving product performance, reducing environmental impact, and enhancing application efficiency. Unique selling propositions include superior bonding strength, faster curing times, and improved ease of application.

Key Drivers, Barriers & Challenges in Thailand Adhesives and Sealants Industry

Key Drivers: Rising construction activities, expanding automotive industry, growth in packaging and consumer goods sectors, and increasing demand for high-performance materials. Government initiatives promoting infrastructure development further accelerate growth.

Key Challenges: Fluctuations in raw material prices, intense competition from both domestic and international players, and stringent environmental regulations requiring formulation adjustments and increased production costs. Supply chain disruptions due to global events can impact availability and pricing. The projected impact on market growth from these factors is a reduction of xx% in CAGR.

Emerging Opportunities in Thailand Adhesives and Sealants Industry

Untapped opportunities exist in specialized applications like renewable energy, medical devices, and advanced electronics. Growing demand for sustainable products presents an opportunity for bio-based and eco-friendly adhesives and sealants. The rising popularity of DIY home improvement also creates potential for innovative consumer-friendly products. Expanding into rural markets offers further growth prospects.

Growth Accelerators in the Thailand Adhesives and Sealants Industry

Technological advancements, such as the development of high-performance, eco-friendly adhesives and sealants, are key growth catalysts. Strategic partnerships and collaborations among industry players are fostering innovation and market expansion. Government initiatives promoting sustainable construction and manufacturing practices are also driving growth. Increased focus on improving product performance and expanding product applications will propel market expansion in the coming years.

Key Players Shaping the Thailand Adhesives and Sealants Industry Market

- 3M

- Sika Thailand

- H B Fuller (Thailand) Co Ltd

- CEMEDINE Co Ltd

- Selic Corp Public Company Limited

- Siam Industry Adhesive Tapes Co Ltd

- Anabond Limited

- Thai Mitsui Specialty Chemicals Co Ltd

- Huntsman International LLC

- MORESCO (THAILAND) CO LTD

- Beardow Adams

- Dow

- Lord Corporation (Parker Hannifin Corp)

- Bond Chemicals Company Limited

- Henkel (Thailand) Ltd

- DUNLOP ADHESIVES (THAILAND) CO LTD

- Covestro AG

- TOAGOSEI (THAILAND) CO LTD

- AVERY DENNISON CORPORATION

- Wacker Chemie AG

- Bostik

- Jowat (Thailand) Co Ltd

- Star Bond (Thailand) Company Limited

Notable Milestones in Thailand Adhesives and Sealants Industry Sector

- August 2020: WACKER partnered with H.M. Royal company to expand its SILPURAN silicone portfolio for medical applications (wound dressings, medical adhesives, gels).

- August 2020: Momentive Performance Materials sold its Consumer Sealants division to Henkel.

In-Depth Thailand Adhesives and Sealants Industry Market Outlook

The Thailand adhesives and sealants market is poised for strong growth in the coming years, driven by sustained infrastructure development, industrial expansion, and rising demand for high-performance and eco-friendly products. Strategic investments in research and development, coupled with strategic partnerships and acquisitions, will further enhance market dynamics. Focus on developing innovative solutions tailored to specific end-use industries will unlock significant growth opportunities. The market presents attractive prospects for both established players and new entrants, offering substantial potential for market expansion and profitability.

Thailand Adhesives and Sealants Industry Segmentation

-

1. Adhesives

-

1.1. Technology

-

1.1.1. Water-borne

- 1.1.1.1. Acrylics

- 1.1.1.2. Polyvinyl Acetate (PVA) Emulsion

- 1.1.1.3. Ethylene Vinyl Acetate (EVA) Emulsion

- 1.1.1.4. Other Water-borne Adhesives

-

1.1.2. Solvent-borne

- 1.1.2.1. Styrene-butadiene Rubber (SBR)

- 1.1.2.2. Chloroprene Rubber

- 1.1.2.3. Poly Acrylate (PA)

- 1.1.2.4. Other Solvent-borne Adhesives

-

1.1.3. Reactive

- 1.1.3.1. Epoxy

- 1.1.3.2. Cyanoacrylate

- 1.1.3.3. Silicone

- 1.1.3.4. Polyurethane

- 1.1.3.5. Other Reactive Adhesives

-

1.1.4. Hot-Melt

- 1.1.4.1. Thermoplastic Polyurethane

- 1.1.4.2. Styrenic-butadiene Copolymers

- 1.1.4.3. Other Hot-melt Adhesives

- 1.1.5. Other Adhesive Technologies

-

1.1.1. Water-borne

-

1.2. End-user Industry

- 1.2.1. Buildings and Construction

- 1.2.2. Paper, Board, and Packaging

- 1.2.3. Transportation

- 1.2.4. Footwear and Leather

- 1.2.5. Healthcare

- 1.2.6. Electrical and Electronics

- 1.2.7. Other End-user Industries

-

1.1. Technology

-

2. Sealants

-

2.1. Product Type

- 2.1.1. Silicone

- 2.1.2. Polyurethane

- 2.1.3. Acrylic

- 2.1.4. Other Sealant Product Types

-

2.2. End-user Industry

- 2.2.1. Buildings and Construction

- 2.2.2. Transportation

- 2.2.3. Healthcare

- 2.2.4. Electrical and Electronics

- 2.2.5. Other End-user Industries

-

2.1. Product Type

Thailand Adhesives and Sealants Industry Segmentation By Geography

- 1. Thailand

Thailand Adhesives and Sealants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Packaging Industry; Shifting Focus Towards Adhesive Bonding for Composite Materials

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations Regarding VOC Emissions; COVID-19 Impact

- 3.4. Market Trends

- 3.4.1 Paper

- 3.4.2 Board

- 3.4.3 and Packaging Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Adhesives and Sealants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Adhesives

- 5.1.1. Technology

- 5.1.1.1. Water-borne

- 5.1.1.1.1. Acrylics

- 5.1.1.1.2. Polyvinyl Acetate (PVA) Emulsion

- 5.1.1.1.3. Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.1.1.4. Other Water-borne Adhesives

- 5.1.1.2. Solvent-borne

- 5.1.1.2.1. Styrene-butadiene Rubber (SBR)

- 5.1.1.2.2. Chloroprene Rubber

- 5.1.1.2.3. Poly Acrylate (PA)

- 5.1.1.2.4. Other Solvent-borne Adhesives

- 5.1.1.3. Reactive

- 5.1.1.3.1. Epoxy

- 5.1.1.3.2. Cyanoacrylate

- 5.1.1.3.3. Silicone

- 5.1.1.3.4. Polyurethane

- 5.1.1.3.5. Other Reactive Adhesives

- 5.1.1.4. Hot-Melt

- 5.1.1.4.1. Thermoplastic Polyurethane

- 5.1.1.4.2. Styrenic-butadiene Copolymers

- 5.1.1.4.3. Other Hot-melt Adhesives

- 5.1.1.5. Other Adhesive Technologies

- 5.1.1.1. Water-borne

- 5.1.2. End-user Industry

- 5.1.2.1. Buildings and Construction

- 5.1.2.2. Paper, Board, and Packaging

- 5.1.2.3. Transportation

- 5.1.2.4. Footwear and Leather

- 5.1.2.5. Healthcare

- 5.1.2.6. Electrical and Electronics

- 5.1.2.7. Other End-user Industries

- 5.1.1. Technology

- 5.2. Market Analysis, Insights and Forecast - by Sealants

- 5.2.1. Product Type

- 5.2.1.1. Silicone

- 5.2.1.2. Polyurethane

- 5.2.1.3. Acrylic

- 5.2.1.4. Other Sealant Product Types

- 5.2.2. End-user Industry

- 5.2.2.1. Buildings and Construction

- 5.2.2.2. Transportation

- 5.2.2.3. Healthcare

- 5.2.2.4. Electrical and Electronics

- 5.2.2.5. Other End-user Industries

- 5.2.1. Product Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Adhesives

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Star Bond (Thailand) Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sika Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 H B Fuller (Thailand) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEMEDINE Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Selic Corp Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siam Industry Adhesive Tapes Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3M

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anabond Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thai Mitsui Specialty Chemicals Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huntsman International LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MORESCO (THAILAND) CO LTD

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Beardow Adams

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dow

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Lord Corporation (Parker Hannifin Corp)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bond Chemicals Company Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Henkel (Thailand) Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 DUNLOP ADHESIVES (THAILAND) CO LTD

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Covestro AG

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 TOAGOSEI (THAILAND) CO LTD

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AVERY DENNISON CORPORATION

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Wacker Chemie AG*List Not Exhaustive

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Bostik

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Jowat (Thailand) Co Ltd

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 Star Bond (Thailand) Company Limited

List of Figures

- Figure 1: Thailand Adhesives and Sealants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Adhesives and Sealants Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Adhesives 2019 & 2032

- Table 3: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Sealants 2019 & 2032

- Table 4: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Adhesives 2019 & 2032

- Table 7: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Sealants 2019 & 2032

- Table 8: Thailand Adhesives and Sealants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Adhesives and Sealants Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Thailand Adhesives and Sealants Industry?

Key companies in the market include Star Bond (Thailand) Company Limited, Sika Thailand, H B Fuller (Thailand) Co Ltd, CEMEDINE Co Ltd, Selic Corp Public Company Limited, Siam Industry Adhesive Tapes Co Ltd, 3M, Anabond Limited, Thai Mitsui Specialty Chemicals Co Ltd, Huntsman International LLC, MORESCO (THAILAND) CO LTD, Beardow Adams, Dow, Lord Corporation (Parker Hannifin Corp), Bond Chemicals Company Limited, Henkel (Thailand) Ltd, DUNLOP ADHESIVES (THAILAND) CO LTD, Covestro AG, TOAGOSEI (THAILAND) CO LTD, AVERY DENNISON CORPORATION, Wacker Chemie AG*List Not Exhaustive, Bostik, Jowat (Thailand) Co Ltd.

3. What are the main segments of the Thailand Adhesives and Sealants Industry?

The market segments include Adhesives, Sealants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Packaging Industry; Shifting Focus Towards Adhesive Bonding for Composite Materials.

6. What are the notable trends driving market growth?

Paper. Board. and Packaging Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations Regarding VOC Emissions; COVID-19 Impact.

8. Can you provide examples of recent developments in the market?

In August 2020, WACKER started a partnership with H.M. Royal company to include silicones for medical applications. SILPURAN portfolio consists of specifically designed applications, such as wound dressings, medical adhesives, gels, and others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Adhesives and Sealants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Adhesives and Sealants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Adhesives and Sealants Industry?

To stay informed about further developments, trends, and reports in the Thailand Adhesives and Sealants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence