Key Insights

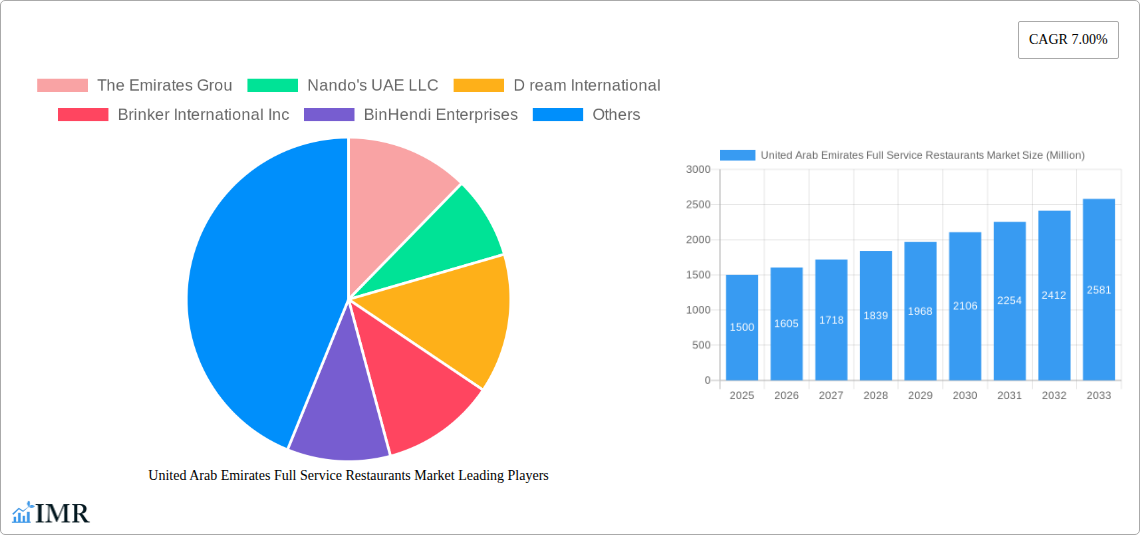

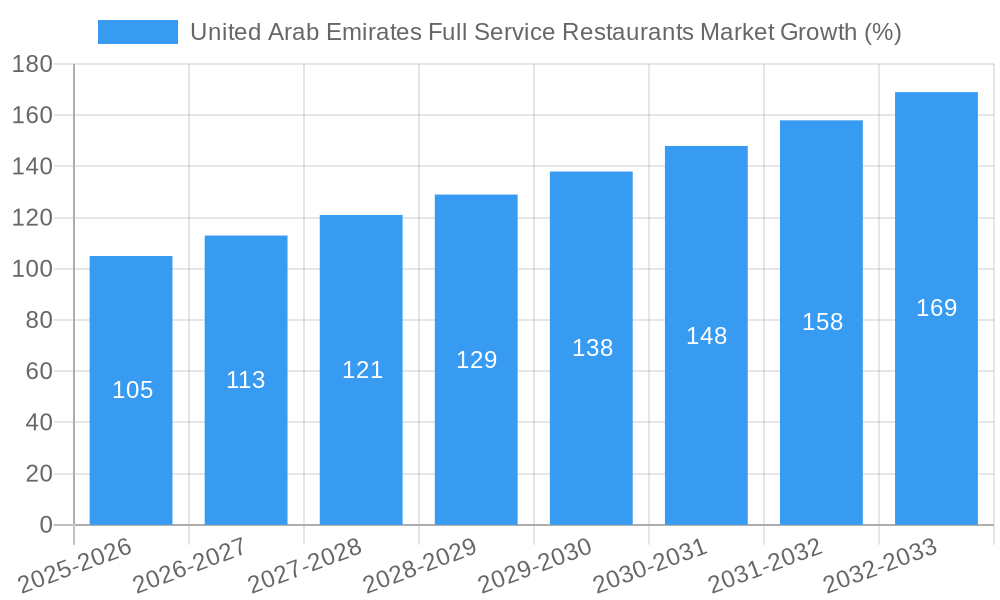

The United Arab Emirates (UAE) full-service restaurant (FSR) market exhibits robust growth potential, driven by a thriving tourism sector, a large expatriate population with diverse culinary preferences, and rising disposable incomes. The market's 7.00% CAGR indicates a consistent expansion, projecting significant market value increase over the forecast period (2025-2033). Several factors contribute to this growth. The UAE's strategic location and its appeal as a global hub for business and leisure attract a constant influx of tourists, fueling demand for diverse dining experiences. The significant presence of multinational corporations and a high concentration of affluent individuals further bolster the market. Segment analysis reveals strong performance across various cuisines, with Asian, European, and Middle Eastern cuisines holding significant market share. Chained outlets dominate the market, demonstrating the success of established brands in catering to diverse consumer preferences. Location-wise, leisure and lodging segments represent considerable market portions, indicating a strong connection between tourism and FSR demand. Competition is fierce, with both international and local players vying for market share. However, the market’s resilience suggests that continued investment in innovative concepts, superior service quality, and strategic location choices are crucial for success.

The success of key players like The Emirates Group, Nando's UAE LLC, and Americana Restaurants International PLC highlights the importance of brand recognition and effective operational strategies. While challenges such as fluctuating food prices and intense competition exist, the long-term outlook for the UAE FSR market remains optimistic. Future growth will likely be shaped by evolving consumer preferences, the rise of online food ordering and delivery platforms, and an increasing focus on sustainable and healthy dining options. Expansion into underserved areas and adapting to shifting consumer demands will be essential for players seeking to capitalize on the market's continuing expansion. The market’s segmentation offers various opportunities for specialized FSR businesses to cater to niche customer needs and preferences, leading to further market diversification.

United Arab Emirates Full Service Restaurants (FSR) Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United Arab Emirates (UAE) Full Service Restaurants market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by cuisine (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

United Arab Emirates Full Service Restaurants Market Market Dynamics & Structure

The UAE FSR market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few large players alongside numerous smaller independent operators. Technological innovation, particularly in areas like online ordering, delivery platforms, and kitchen automation, is a key driver. The regulatory framework, including food safety regulations and licensing requirements, significantly impacts market operations. Competitive substitutes, such as quick-service restaurants (QSRs) and food delivery services, exert pressure on FSRs. The UAE's diverse demographics, with a significant expatriate population, influence culinary preferences and dining habits. Mergers and acquisitions (M&A) activity is relatively frequent, with larger chains consolidating market share.

- Market Concentration: Moderate, with a few dominant players and numerous smaller businesses.

- Technological Innovation: High adoption of online ordering, delivery apps, and kitchen technology.

- Regulatory Framework: Stringent food safety and licensing regulations.

- Competitive Substitutes: QSRs and food delivery services pose significant competition.

- End-User Demographics: Diverse population with varied culinary preferences.

- M&A Activity: Moderate level of consolidation through acquisitions. xx M&A deals recorded between 2019-2024.

United Arab Emirates Full Service Restaurants Market Growth Trends & Insights

The UAE FSR market experienced robust growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, a burgeoning tourism sector, and a preference for diverse dining experiences. The market size evolution demonstrates a consistent upward trend, with a CAGR of xx% between 2019 and 2024. Technological disruptions, particularly the rise of online food delivery platforms, have significantly altered consumer behavior, leading to increased convenience and accessibility. Market penetration of online ordering continues to increase, currently estimated at xx% and projected to reach xx% by 2033. Changing consumer preferences toward healthier options and unique culinary experiences are shaping the market landscape. The adoption of innovative technologies in restaurant operations, such as AI-powered point-of-sale systems and inventory management tools, is also contributing to market growth.

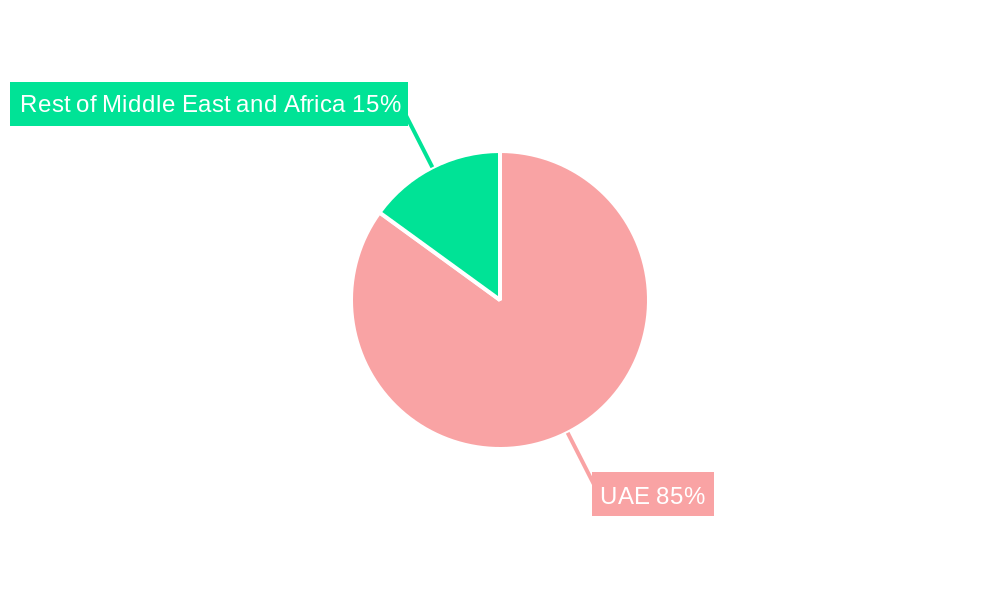

Dominant Regions, Countries, or Segments in United Arab Emirates Full Service Restaurants Market

Dubai and Abu Dhabi are the dominant regions in the UAE FSR market, accounting for the largest market share due to high population density, significant tourist influx, and well-developed infrastructure. The Middle Eastern cuisine segment enjoys strong demand, reflecting local preferences and cultural heritage. Chained outlets dominate the market, leveraging brand recognition, consistent quality, and economies of scale. Retail and leisure locations witness the highest concentration of FSRs, catering to large consumer bases in shopping malls and entertainment centers.

- Key Drivers in Dubai & Abu Dhabi: High population density, strong tourism, and robust infrastructure.

- Dominant Cuisine Segment: Middle Eastern cuisine, reflecting local preferences.

- Dominant Outlet Type: Chained outlets, benefitting from brand recognition and scale.

- Dominant Location Type: Retail and leisure locations, targeting high consumer traffic areas.

- Growth Potential: Expansion in less saturated regions and exploration of niche cuisines.

United Arab Emirates Full Service Restaurants Market Product Landscape

The UAE FSR market showcases a diverse range of culinary offerings, reflecting global trends and local preferences. Restaurant chains are increasingly focusing on unique selling propositions (USPs), such as farm-to-table ingredients, specialized dietary options, and themed dining experiences. Technological advancements, including smart kitchen technologies, online ordering systems, and customer relationship management (CRM) tools, are enhancing operational efficiency and customer satisfaction. The market is witnessing the introduction of personalized dining experiences and the integration of virtual and augmented reality (VR/AR) to enhance customer engagement.

Key Drivers, Barriers & Challenges in United Arab Emirates Full Service Restaurants Market

Key Drivers:

- Rising disposable incomes and a growing middle class.

- Increasing tourism and a preference for diverse culinary experiences.

- Technological advancements improving operational efficiency and customer experience.

- Government support for the hospitality sector.

Key Challenges:

- High operating costs, including rent and labor expenses.

- Intense competition from both established and new entrants.

- Fluctuations in tourism and economic conditions.

- Maintaining consistent food quality and hygiene standards. The impact of these challenges is estimated to reduce market growth by xx% in the forecast period.

Emerging Opportunities in United Arab Emirates Full Service Restaurants Market

Emerging trends in the UAE FSR market include increasing demand for healthy and sustainable food options, the rise of ghost kitchens and cloud kitchens, and the growing popularity of personalized dining experiences. Untapped markets include catering to specific dietary needs (vegan, gluten-free) and exploring unique culinary concepts. The integration of technology for seamless ordering and delivery, personalized recommendations, and loyalty programs will also contribute to market growth.

Growth Accelerators in the United Arab Emirates Full Service Restaurants Market Industry

Long-term growth will be driven by strategic partnerships between FSRs and technology providers, enabling innovative solutions and improved efficiency. Expansion into new markets, leveraging franchise models and strategic locations, will accelerate market growth. Investment in technological advancements, such as AI-powered kitchen automation, will increase productivity and reduce operational costs. Focus on sustainability and ethical sourcing of ingredients will attract environmentally conscious consumers.

Key Players Shaping the United Arab Emirates Full Service Restaurants Market Market

- The Emirates Group

- Nando's UAE LLC

- Dream International

- Brinker International Inc

- BinHendi Enterprises

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Apparel Group

- Al Khaja Group Of Companies

- Kerzner International Limited

Notable Milestones in United Arab Emirates Full Service Restaurants Market Sector

- January 2022: Tim Hortons expanded its presence by opening six outlets across Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, Ras Al Khaimah, and Al Ain. This expansion significantly increased market competition and broadened the range of available FSR options in the UAE.

In-Depth United Arab Emirates Full Service Restaurants Market Market Outlook

The UAE FSR market presents significant growth potential in the coming years. Continued economic growth, sustained tourism, and technological advancements will fuel market expansion. Strategic opportunities lie in focusing on niche segments, leveraging technology for improved efficiency, and offering unique and personalized dining experiences. The market is expected to witness consolidation through M&A activities, with larger players expanding their market share. The emphasis on sustainability and health-conscious options will shape future trends.

United Arab Emirates Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Arab Emirates Full Service Restaurants Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. High demand for traditional cuisines has led to the growth of Middle Eastern Cuisines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. South Africa United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7. United Arab Emirates United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 The Emirates Grou

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nando's UAE LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 D ream International

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Brinker International Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BinHendi Enterprises

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Americana Restaurants International PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 M H Alshaya Co WLL

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Apparel Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Al Khaja Group Of Companies

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kerzner International Limited

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 The Emirates Grou

List of Figures

- Figure 1: United Arab Emirates Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 4: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 5: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: United Arab Emirates United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Middle East and Africa United Arab Emirates Full Service Restaurants Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 20: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 21: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 22: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 23: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 24: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 25: United Arab Emirates Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Arab Emirates Full Service Restaurants Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Full Service Restaurants Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the United Arab Emirates Full Service Restaurants Market?

Key companies in the market include The Emirates Grou, Nando's UAE LLC, D ream International, Brinker International Inc, BinHendi Enterprises, Americana Restaurants International PLC, M H Alshaya Co WLL, Apparel Group, Al Khaja Group Of Companies, Kerzner International Limited.

3. What are the main segments of the United Arab Emirates Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

High demand for traditional cuisines has led to the growth of Middle Eastern Cuisines.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2022: Tim Hortons expanded its presence by opening six outlets across Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, Ras Al Khaimah, and Al Ain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence