Key Insights

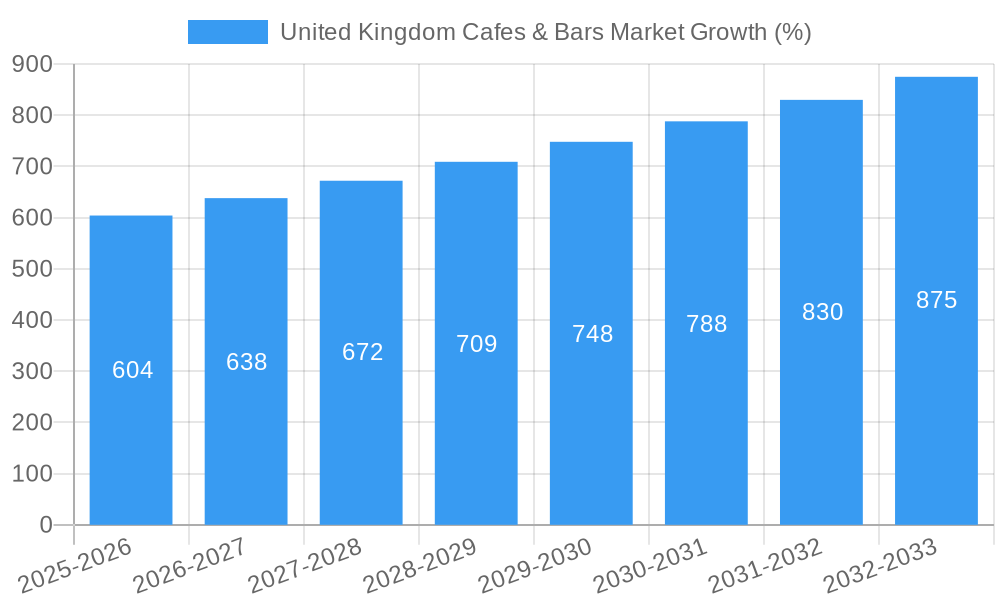

The United Kingdom cafes and bars market, a significant contributor to the UK's hospitality sector, exhibits robust growth potential. Driven by evolving consumer preferences towards experiences and convenience, the market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.04% from 2025 to 2033. This growth is fueled by several key factors. The increasing popularity of specialty coffee and tea shops, along with the rise of experiential dining and the demand for diverse culinary offerings in bars and pubs, are significant drivers. Furthermore, the strategic expansion of chained outlets alongside the continued success of independent establishments catering to local tastes contributes to market dynamism. Location plays a crucial role, with leisure, lodging, and retail locations demonstrating strong growth, alongside standalone and travel-focused outlets. The market is segmented by cuisine type (bars & pubs, cafes, juice/smoothie/dessert bars, specialty coffee & tea shops) and outlet type (chained and independent). This segmentation highlights the diverse landscape within the UK's hospitality sector. While challenges such as fluctuating ingredient costs and economic uncertainties may present some restraints, the overall market outlook remains positive, indicating substantial opportunities for growth and innovation within the coming years.

The UK cafes and bars market’s growth trajectory is further influenced by generational shifts in consumer behavior. Younger demographics demonstrate a strong preference for unique and Instagrammable experiences, influencing the design and offerings of many establishments. The ongoing trend of health-conscious consumers is reflected in the increasing popularity of juice bars and cafes offering healthy options. Technological advancements, such as online ordering and delivery platforms, are also transforming the landscape, providing both challenges and opportunities for businesses to adapt and compete effectively. Key players, including Marston's PLC, Admiral Taverns Ltd, and Costa Coffee, are actively shaping the market through strategic expansions, brand innovations, and targeted marketing campaigns. The competitive landscape is diverse, ranging from large multinational corporations to smaller, independent businesses, reflecting the market's varied offerings and customer preferences. Understanding these dynamics is crucial for businesses seeking to thrive in this dynamic and evolving sector.

United Kingdom Cafes & Bars Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom's dynamic cafes and bars market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market segments, key players, growth trends, and future opportunities. The report is meticulously structured to provide clear, actionable intelligence, maximizing its value for decision-making. The market size is valued in Million units.

United Kingdom Cafes & Bars Market Market Dynamics & Structure

The UK cafes and bars market is a highly competitive landscape characterized by both large multinational chains and numerous independent operators. Market concentration is moderate, with several key players holding significant market share, but ample room for smaller businesses to thrive in niche segments. Technological innovation, particularly in areas like mobile ordering, loyalty programs, and personalized experiences, is a key driver of growth. Stringent regulatory frameworks concerning food safety, licensing, and alcohol sales significantly impact operations. Competitive product substitutes, such as home-delivered meals and entertainment alternatives, exert pressure on market growth. End-user demographics show increasing demand from millennials and Gen Z, influencing trends towards healthier options, sustainability, and unique experiences. M&A activity in the sector has been significant in recent years, with larger companies acquiring smaller chains to expand their market reach.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Mobile ordering, loyalty programs, personalized offers driving efficiency and customer engagement.

- Regulatory Framework: Stringent food safety and alcohol licensing regulations impacting operational costs.

- Competitive Substitutes: Home delivery services, streaming entertainment posing challenges to dine-in experiences.

- End-User Demographics: Millennials and Gen Z driving demand for healthier, sustainable, and unique offerings.

- M&A Activity: xx major deals in the last 5 years, indicating consolidation within the market.

United Kingdom Cafes & Bars Market Growth Trends & Insights

The UK cafes and bars market exhibits robust growth, driven by evolving consumer preferences, increasing disposable incomes, and urbanization. The market experienced a xx% CAGR between 2019 and 2024, reaching a value of xx million units in 2024. Adoption rates for innovative technologies, like contactless payment systems and online reservations, have increased significantly. Technological disruptions, such as the rise of delivery platforms and the impact of the pandemic, have forced businesses to adapt rapidly. Consumer behavior has shifted towards experiences, personalization, and healthier choices. The market is expected to continue its growth trajectory, with a projected CAGR of xx% from 2025 to 2033, reaching an estimated value of xx million units by 2033. This growth is fueled by ongoing innovation, changing consumer preferences and investments by major players. Market penetration of various segments will be further analysed in the report.

Dominant Regions, Countries, or Segments in United Kingdom Cafes & Bars Market

London and other major cities dominate the UK cafes and bars market due to higher population density, tourism, and business activity. The Bars & Pubs segment holds the largest market share, followed by Cafes and Specialist Coffee & Tea Shops. Chained outlets command a substantial portion, leveraging brand recognition and economies of scale. Standalone locations are prevalent across various segments, offering unique and tailored experiences.

- Leading Regions: London, major metropolitan areas exhibit highest concentration of cafes and bars.

- Dominant Segments: Bars & Pubs (xx% market share), Cafes (xx%), Specialist Coffee & Tea Shops (xx%).

- Outlet Type: Chained outlets (xx%) benefit from economies of scale, while Independent Outlets (xx%) provide niche options.

- Location Type: Standalone locations (xx%) and locations integrated into Leisure, Lodging and Retail locations (xx%) both see significant growth.

- Key Drivers: High population density, tourism, strong business activity, and evolving consumer preferences.

United Kingdom Cafes & Bars Market Product Landscape

The UK cafes and bars market showcases a diverse product landscape, ranging from traditional pub fare to innovative beverage creations and plant-based options. Product innovations are driven by consumer demand for healthier, more sustainable, and unique offerings. Key performance metrics include customer satisfaction, average transaction value, and repeat business rates. The increasing prevalence of bespoke coffee and tea blends reflects the shift towards premiumization and personalized experiences. The introduction of vegan and vegetarian options reflects the increasing consumer focus on dietary choices.

Key Drivers, Barriers & Challenges in United Kingdom Cafes & Bars Market

Key Drivers:

- Evolving consumer preferences: Demand for healthy, sustainable, and personalized offerings.

- Technological advancements: Mobile ordering, loyalty programs, and personalized experiences enhance customer engagement.

- Tourism and urbanization: Higher population density and tourist influx in major cities drive demand.

Key Challenges and Restraints:

- Rising operating costs: Increased rent, labor costs, and ingredient prices impacting profitability.

- Intense competition: Saturation in some areas with numerous establishments vying for customer attention.

- Economic fluctuations: Consumer spending patterns impacted by economic downturns.

Emerging Opportunities in United Kingdom Cafes & Bars Market

- Expansion into underserved areas: Opportunities exist in smaller towns and regions with limited cafe and bar options.

- Focus on sustainability and ethical sourcing: Increasing consumer interest in eco-friendly practices.

- Unique and personalized experiences: Offering niche concepts, events, and tailored offerings to attract customers.

Growth Accelerators in the United Kingdom Cafes & Bars Market Industry

Long-term growth will be driven by continued technological innovation, strategic partnerships between brands and suppliers, and expansion into new markets. A focus on healthier options and sustainability will attract a broader customer base. Furthermore, the diversification of offerings and the creation of unique brand identities will provide a competitive edge in the market.

Key Players Shaping the United Kingdom Cafes & Bars Market Market

- Marston's PLC

- Admiral Taverns Ltd

- The Restaurant Group PLC

- Stonegate Group

- Samworth Brothers Limited

- Whitbread PLC

- Costa Coffee

- Jab Holding Company SÀRL

- Starbucks Corporation

- Mitchells & Butlers PLC

- McDonald's Corporation

- Ben & Jerry's Homemade Holdings Inc

- Greggs PLC

Notable Milestones in United Kingdom Cafes & Bars Market Sector

- August 2023: Starbucks announced a USD 32.78 million investment to open 100 new UK outlets in 2023, indicating strong growth expectations.

- January 2023: Costa Coffee expanded its menu with new food and beverage options, catering to evolving consumer preferences.

- October 2022: McDonald's launched the McPlant vegan burger, responding to the increasing demand for plant-based options.

In-Depth United Kingdom Cafes & Bars Market Market Outlook

The UK cafes and bars market is poised for continued growth, driven by innovation, changing consumer preferences, and strategic investments by major players. Strategic partnerships, technological advancements, and a focus on unique and personalized offerings will be key to success in this dynamic market. The market's future potential is substantial, with ample opportunities for both established players and new entrants to capitalize on evolving trends and consumer demands.

United Kingdom Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Cafes & Bars Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Premium products and special offerings such as organic tea and coffee are gaining popularity in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Rest of Europe

- 8. Asia Pacific United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United Kingdom Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Marston's PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Admiral Taverns Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Restaurant Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stonegate Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samworth Brothers Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Whitbread PL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Costa Coffee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jab Holding Company SÀRL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Starbucks Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitchells & Butlers PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 McDonald's Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ben & Jerry's Homemade Holdings Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Greggs PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Marston's PLC

List of Figures

- Figure 1: United Kingdom Cafes & Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Cafes & Bars Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa United Kingdom Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 33: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 34: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 35: United Kingdom Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Cafes & Bars Market?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the United Kingdom Cafes & Bars Market?

Key companies in the market include Marston's PLC, Admiral Taverns Ltd, The Restaurant Group PLC, Stonegate Group, Samworth Brothers Limited, Whitbread PL, Costa Coffee, Jab Holding Company SÀRL, Starbucks Corporation, Mitchells & Butlers PLC, McDonald's Corporation, Ben & Jerry's Homemade Holdings Inc, Greggs PLC.

3. What are the main segments of the United Kingdom Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Premium products and special offerings such as organic tea and coffee are gaining popularity in the country.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Costa Coffee added new servings to its menu like Cajun Spiced Chicken Pizza Wrap, uzeTea Mellow Mango Superfuzions Tea, FuzeTea Spiced Apple flavor Superfuzions Tea, FuzeTea Citrus Zing Superfuzions Tea, vegan BBQ Chick'n Panini, Burts BBQ Lentil Chips, Poached Egg & Bacon Brioche, M&S Smoked Ham & Coleslaw Sandwich, or the new M&S Minestrone with Bacon Soup, M&S pineapple chunks, and a new range of Chocolate Cornflake Cake and caramel cakes at its outlets in the United Kingdom.October 2022: In 2022, McDonald's launched McPlant across all UK restaurants. McPlant is a vegan burger made with a juicy plant-based patty co-developed with Beyond Meat® with a vegan sandwich, sauce, onion, mustard, and cheese alternative in a sesame seed bun.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the United Kingdom Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence