Key Insights

The United States construction materials market, projected at $145 billion in the 2024 base year, is anticipated to experience significant expansion with a Compound Annual Growth Rate (CAGR) of 4% through 2033. Key growth drivers include substantial infrastructure investments, such as the Bipartisan Infrastructure Law, which boosts demand for essential materials like cement and aggregates. A strong residential construction sector, supported by population dynamics and evolving housing demands, also significantly contributes to market volume. The increasing adoption of sustainable and eco-friendly building practices, including recycled materials and low-carbon alternatives, presents further opportunities. However, the market faces constraints from fluctuating raw material and energy costs, alongside supply chain disruptions and labor shortages, which can impact project timelines and costs. The market is segmented by material type, including cement, aggregates, and asphalt, each with distinct growth patterns influenced by project needs and technological advancements. Leading companies like Cemex, CRH PLC, Heidelberg Materials, and Vulcan Materials Company are focusing on innovation, operational efficiency, and strategic consolidation to maintain their competitive positions.

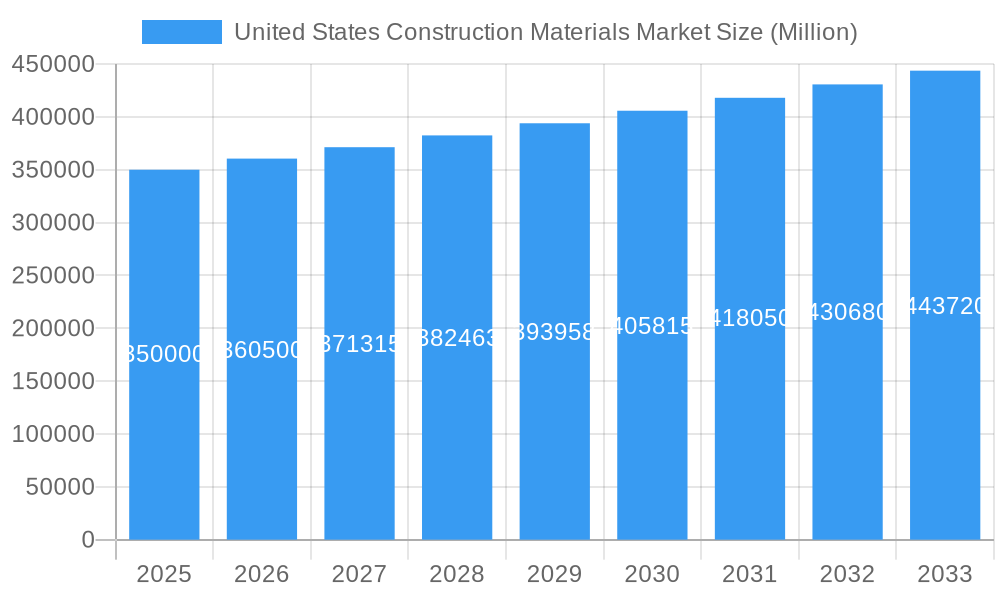

United States Construction Materials Market Market Size (In Billion)

The US construction materials market's outlook through 2033 is positive, contingent upon macroeconomic conditions and government policy. Sustained infrastructure development remains crucial for continued expansion. The market's inherent connection to fundamental construction activities provides a degree of resilience. Navigating price volatility, prioritizing sustainable sourcing, and enhancing operational efficiency are essential for market participants. Strategic collaborations, technology adoption in logistics and predictive modeling, and investments in sustainable practices will be vital for success in this evolving landscape. Market segmentation allows for tailored strategies, enabling companies to target specific material niches or project types for market share growth.

United States Construction Materials Market Company Market Share

United States Construction Materials Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Construction Materials market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base year and the forecast period extending from 2025 to 2033. The report offers valuable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented into various types of construction materials, and parent markets include infrastructure development and real estate. Child markets consist of residential, commercial, and industrial construction. The total market size is estimated to be xx Million in 2025.

United States Construction Materials Market Dynamics & Structure

This section analyzes the market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and mergers & acquisitions (M&A) trends within the US construction materials market. The analysis reveals a moderately consolidated market with several major players holding significant market share.

- Market Concentration: The top 10 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Advancements in materials science, such as high-performance concrete and sustainable building materials, are driving innovation. However, high R&D costs pose a barrier to entry for smaller players.

- Regulatory Landscape: Stringent environmental regulations and building codes significantly influence material choices and production processes. Compliance costs are a major factor for companies.

- Competitive Substitutes: Alternative materials, like recycled aggregates and bio-based composites, are emerging as competitive substitutes, presenting challenges to traditional players.

- End-User Demographics: Growth in residential and non-residential construction, coupled with infrastructure development projects, fuels market demand. Fluctuations in housing starts and government spending directly impact market growth.

- M&A Activity: The market has witnessed a surge in M&A activity in recent years, with deals focused on expanding geographical reach, acquiring specialized technologies, and securing raw material supplies. The number of M&A deals in the past five years is estimated at xx.

United States Construction Materials Market Growth Trends & Insights

This section examines the historical and projected growth trajectory of the US construction materials market. The analysis incorporates data on market size evolution, adoption rates of new technologies, technological disruptions, and shifts in consumer behavior. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, including specific metrics like CAGR and market penetration. This section should leverage external data sources where appropriate.]

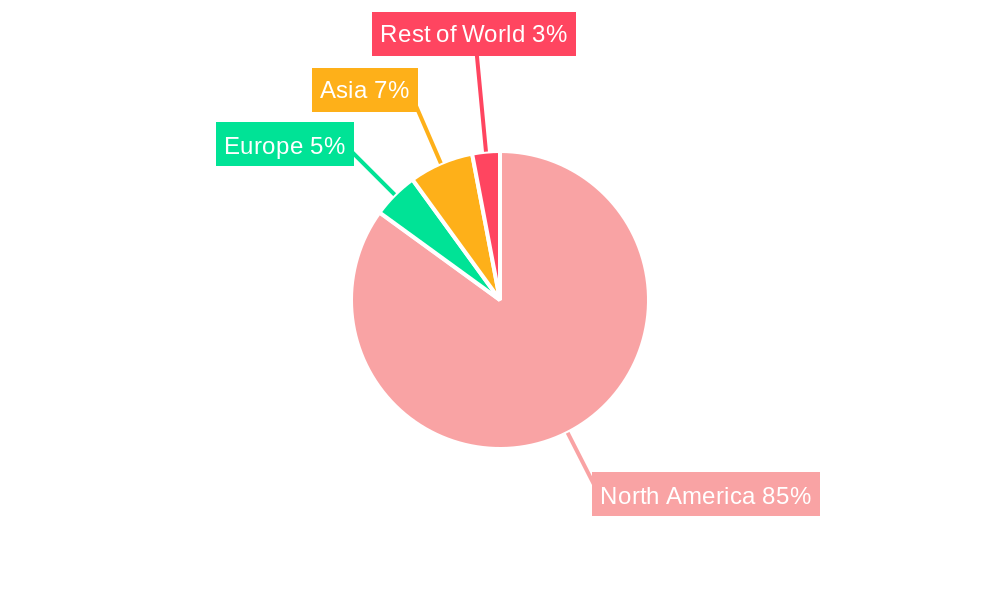

Dominant Regions, Countries, or Segments in United States Construction Materials Market

This section identifies the leading regions and segments driving market growth. The analysis considers factors like economic policies, infrastructure investments, and regional construction activity. The South and West regions of the US are projected to exhibit the highest growth rates due to rapid urbanization and ongoing infrastructure development.

- Key Drivers: Government investment in infrastructure projects like highway expansions and public transportation systems are strong growth drivers. Robust residential and commercial construction also significantly contributes.

- Dominance Factors: High population density, ongoing infrastructure development, and supportive government policies in specific regions contribute to market dominance.

[Insert 600-word analysis of dominance factors, including market share and growth potential for each leading region/segment. This should include detailed analysis of the factors listed above, supported by quantitative data.]

United States Construction Materials Market Product Landscape

The US construction materials market showcases a diverse range of products, including cement, aggregates, asphalt, ready-mix concrete, and specialized materials like high-performance concrete and sustainable building products. Recent innovations focus on enhancing durability, sustainability, and performance characteristics. Product differentiation is achieved through enhanced performance properties, improved sustainability profiles, and streamlined application processes.

Key Drivers, Barriers & Challenges in United States Construction Materials Market

Key Drivers: Strong economic growth, rising infrastructure spending, and a growing population drive market expansion. Government initiatives promoting sustainable construction practices also contribute to market growth.

Challenges & Restraints: Fluctuations in raw material prices, supply chain disruptions, and environmental regulations pose significant challenges. Increased competition and rising labor costs also impact profitability. The impact of supply chain issues on market growth is estimated to be xx% in 2025.

Emerging Opportunities in United States Construction Materials Market

Emerging opportunities include the growing demand for sustainable building materials, the adoption of advanced construction technologies like 3D printing, and the expansion into specialized construction segments like prefabricated structures. The increasing focus on green building practices presents a significant opportunity for eco-friendly construction materials.

Growth Accelerators in the United States Construction Materials Market Industry

Long-term growth will be accelerated by technological advancements, strategic partnerships, and market expansion into new geographical areas. Investments in research and development of innovative materials will also play a crucial role. Government incentives promoting sustainable construction will further stimulate market growth.

Key Players Shaping the United States Construction Materials Market Market

- Cemex Sab De CV

- Colorado Stone Quarries Inc

- Buckman

- CRH PLC

- Heidelberg Materials

- Holcim

- Knife River Corporation

- Martin Marietta Materials

- Summit Materials Inc

- Kemira Oyj

- United States Lime & Minerals Inc

- Vulcan Materials Company *List Not Exhaustive

Notable Milestones in United States Construction Materials Market Sector

- July 2024: CEMEX SAB de CV formed a joint venture with Couch Aggregates and Premier Holdings, expanding its aggregate reserves in the Mid-South US. This significantly strengthens Cemex's market position in the region.

- July 2024: Heidelberg Materials acquired Carver Sand & Gravel, boosting its aggregates production capacity by approximately 3 million metric tons annually. This acquisition enhances Heidelberg Materials' market share and operational efficiency.

In-Depth United States Construction Materials Market Market Outlook

The US construction materials market is poised for continued growth, driven by sustained infrastructure investment, urbanization, and technological advancements. Strategic partnerships, expansion into new markets, and a focus on sustainable materials will be key to success for companies in this sector. The market is expected to reach xx Million by 2033, presenting significant opportunities for both established players and new entrants.

United States Construction Materials Market Segmentation

-

1. Material Type

- 1.1. Marble

- 1.2. Granite

- 1.3. Limestone

- 1.4. Sandstone

- 1.5. Sand and Gravel

- 1.6. Crushed Stone

- 1.7. Clay

- 1.8. Other Material Types

-

2. End-user Industry

- 2.1. Residential

-

2.2. Non-residential

- 2.2.1. Commercial

- 2.2.2. Infrastructure

- 2.2.3. Industrial and Institutional

United States Construction Materials Market Segmentation By Geography

- 1. United States

United States Construction Materials Market Regional Market Share

Geographic Coverage of United States Construction Materials Market

United States Construction Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in the Infrastructure and Industrial Sectors; Growing Mining Activities and Increasing Popularity of Dimension Stones

- 3.3. Market Restrains

- 3.3.1. Rising Investments in the Infrastructure and Industrial Sectors; Growing Mining Activities and Increasing Popularity of Dimension Stones

- 3.4. Market Trends

- 3.4.1. Rising Investments in the Infrastructure and Industrial Sectors Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Marble

- 5.1.2. Granite

- 5.1.3. Limestone

- 5.1.4. Sandstone

- 5.1.5. Sand and Gravel

- 5.1.6. Crushed Stone

- 5.1.7. Clay

- 5.1.8. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.2.2.1. Commercial

- 5.2.2.2. Infrastructure

- 5.2.2.3. Industrial and Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cemex Sab De CV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colorado Stone Quarries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Buckman

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CRH PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Heidelberg Materials

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Holcim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Knife River Corporation�

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Martin Marietta Materials

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Summit Materials Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kemira Oyj

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 United States Lime & Minerals Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Vulcan Materials Company*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Cemex Sab De CV

List of Figures

- Figure 1: United States Construction Materials Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Construction Materials Market Share (%) by Company 2025

List of Tables

- Table 1: United States Construction Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: United States Construction Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: United States Construction Materials Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Construction Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: United States Construction Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: United States Construction Materials Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Construction Materials Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the United States Construction Materials Market?

Key companies in the market include Cemex Sab De CV, Colorado Stone Quarries Inc, Buckman, CRH PLC, Heidelberg Materials, Holcim, Knife River Corporation�, Martin Marietta Materials, Summit Materials Inc, Kemira Oyj, United States Lime & Minerals Inc, Vulcan Materials Company*List Not Exhaustive.

3. What are the main segments of the United States Construction Materials Market?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 145 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in the Infrastructure and Industrial Sectors; Growing Mining Activities and Increasing Popularity of Dimension Stones.

6. What are the notable trends driving market growth?

Rising Investments in the Infrastructure and Industrial Sectors Driving the Market.

7. Are there any restraints impacting market growth?

Rising Investments in the Infrastructure and Industrial Sectors; Growing Mining Activities and Increasing Popularity of Dimension Stones.

8. Can you provide examples of recent developments in the market?

July 2024: CEMEX SAB de CV entered a joint venture with Couch Aggregates, a sand and gravel supplier, and Premier Holdings, a distributor of marine bulk products. This collaboration aims to bolster Cemex's aggregate reserves by focusing on the production, distribution, and sale of sand, gravel, and limestone in the Mid-South United States. As a result, Cemex is set to enhance its presence and offer improved, expedited services to this burgeoning region.July 2024: Heidelberg Materials acquired Carver Sand & Gravel, the largest aggregates producer in Albany, New York. This acquisition boosted the company’s operations, including crushed stone, sand and gravel, asphalt, and logistics, with a combined material capacity of around 3 million metric tons annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Construction Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Construction Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Construction Materials Market?

To stay informed about further developments, trends, and reports in the United States Construction Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence