Key Insights

The United States pharmacy management system market is experiencing robust growth, driven by the increasing need for efficient medication management, rising healthcare costs, and the expanding adoption of electronic health records (EHRs). The market's compound annual growth rate (CAGR) of 9.38% from 2019 to 2024 suggests a significant upward trajectory, projected to continue into the forecast period of 2025-2033. Key drivers include the rising prevalence of chronic diseases necessitating complex medication regimens, the increasing demand for improved patient safety and reduced medication errors, and the government's push towards interoperability and data exchange within the healthcare ecosystem. The shift towards cloud-based solutions offers scalability and cost-effectiveness, fueling market expansion. While the on-premise segment still holds a significant share, the cloud segment is rapidly gaining traction due to its flexibility and accessibility. Market segmentation reveals a strong presence across retail, hospital, and specialty pharmacies, with each segment contributing uniquely to the overall market size. Leading vendors such as Omnicell, McKesson, and Cerner are leveraging technological advancements in artificial intelligence (AI) and machine learning (ML) to enhance system capabilities, optimize workflows, and provide advanced analytics to pharmacies. Competition is intense, with established players and emerging tech companies striving for market share.

The market's growth is, however, subject to certain restraints. High initial investment costs for implementing pharmacy management systems, particularly in smaller pharmacies, can hinder adoption. Concerns regarding data security and privacy, along with the need for extensive staff training and integration with existing systems, pose challenges. Furthermore, regulatory compliance and the evolving landscape of healthcare reimbursement models influence market dynamics. Despite these restraints, the long-term outlook remains positive, fueled by increasing government regulations promoting technological advancements in pharmacy management and the growing emphasis on value-based care, driving demand for systems that improve efficiency and reduce costs. The ongoing focus on improving patient outcomes and streamlining medication management will continue to be a significant catalyst for market growth throughout the forecast period. To illustrate, assuming a 2025 market size of $X billion (a realistic estimation considering the 9.38% CAGR and industry reports would be needed to give a specific figure here), the market is likely to surpass $Y billion by 2033, representing a substantial expansion.

United States Pharmacy Management System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Pharmacy Management System market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. The report utilizes a combination of quantitative and qualitative data to offer a holistic view of this rapidly evolving market. The total market size in 2025 is estimated at XX Million.

United States Pharmacy Management System Market Dynamics & Structure

The US pharmacy management system market is characterized by a moderately concentrated landscape, with key players like McKesson Corporation, Cerner Corporation, and Omnicell Inc. holding significant market share. The market's growth is fueled by technological advancements, including cloud-based solutions and AI-powered analytics, alongside increasing regulatory pressures demanding improved medication safety and efficiency. The market is segmented into Retail Pharmacy, Hospital Pharmacy, and Other Types (Assisted Living and Specialty Pharmacies).

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: The adoption of cloud-based systems, AI, and machine learning is driving efficiency and improving patient outcomes. However, integration complexities and data security concerns pose challenges.

- Regulatory Framework: Stringent regulations from FDA and HIPAA influence system design and data security protocols, impacting market growth.

- Competitive Substitutes: While there are limited direct substitutes, alternative workflows and manual processes pose some competition.

- End-User Demographics: The increasing aging population and the growing prevalence of chronic diseases drive demand for efficient pharmacy management systems.

- M&A Trends: Consolidation is expected to continue, with larger players acquiring smaller companies to enhance their product portfolios and market reach. An estimated xx M&A deals occurred between 2019 and 2024.

United States Pharmacy Management System Market Growth Trends & Insights

The US pharmacy management system market is experiencing robust growth, driven by the increasing adoption of advanced technologies and a rising demand for improved medication safety and efficiency. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by factors such as the rising prevalence of chronic diseases, the increasing number of elderly people, and the growing adoption of electronic health records (EHRs). The shift towards value-based care models further incentivizes the use of technology to optimize medication management and improve patient outcomes. The market penetration rate is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in United States Pharmacy Management System Market

The hospital pharmacy segment currently dominates the US market, driven by higher investment in advanced technologies and the need for robust medication management systems within hospitals. The cloud-based deployment model is witnessing faster growth than on-premise solutions, due to its scalability, cost-effectiveness, and ease of access. Geographically, the market is broadly spread across the US, with higher concentrations in densely populated states with larger healthcare infrastructure.

- Hospital Pharmacy Segment: High volume of prescriptions and stringent regulatory requirements drive adoption. Market share: xx% in 2025.

- Cloud-Based Deployment: Scalability and cost-effectiveness are primary drivers. Market share: xx% in 2025.

- Key Growth Drivers: Increasing healthcare spending, government initiatives promoting electronic health records (EHRs), and a rising number of patients with chronic conditions.

United States Pharmacy Management System Market Product Landscape

The market offers a wide range of solutions, from standalone systems to integrated platforms. These systems manage inventory, track prescriptions, automate dispensing processes, and ensure accurate medication administration. Recent innovations include the integration of AI for predictive analytics, improving medication adherence and reducing errors. The focus is shifting towards user-friendly interfaces and seamless integration with other healthcare IT systems.

Key Drivers, Barriers & Challenges in United States Pharmacy Management System Market

Key Drivers:

- Rising adoption of EHRs and interoperability standards.

- Growing demand for enhanced medication safety and adherence.

- Increased focus on cost reduction and efficiency improvements.

- Government regulations pushing for electronic prescriptions and automation.

Challenges and Restraints:

- High initial investment costs for implementing new systems.

- Concerns about data security and patient privacy.

- Complex integration with existing healthcare IT infrastructure.

- Resistance to change among healthcare professionals. The impact of these challenges is estimated to reduce overall market growth by approximately xx% in 2025.

Emerging Opportunities in United States Pharmacy Management System Market

- Expansion into underserved markets, such as rural areas.

- Integration of telehealth platforms for remote medication management.

- Development of specialized solutions for specific patient populations (e.g., geriatrics).

- Focus on personalized medicine and improved patient engagement.

Growth Accelerators in the United States Pharmacy Management System Market Industry

The market's long-term growth is fueled by continuous technological innovation, strategic partnerships between technology providers and healthcare organizations, and government initiatives promoting the adoption of advanced pharmacy management systems. The increasing focus on data analytics and predictive modeling will further accelerate market growth.

Key Players Shaping the United States Pharmacy Management System Market Market

- Omnicell Inc

- Clanwilliam Health Ltd

- Epicor Software Corporation

- ACG Infotech Ltd

- Cerner Corporation

- Idhasoft Ltd

- Talyst LLC

- DATASCAN (DCS Pharmacy Inc )

- GE Healthcare Inc

- Becton Dickinson and Co

- McKesson Corporation

- MedHOK Inc

- Health Business Systems Inc

- GlobeMed Ltd

- Allscripts Healthcare Solution Inc

- List Not Exhaustive

Notable Milestones in United States Pharmacy Management System Market Sector

- June 2022: CerTest Biotec and BD collaborated on a molecular diagnostic test for Monkeypox, leveraging BD's MAX System, demonstrating advancements in integrated diagnostic capabilities.

- May 2022: ValGenesis Inc. and Zenovative partnered to offer compliance-focused digital validation solutions for pharmaceutical companies, highlighting the growing focus on regulatory compliance.

In-Depth United States Pharmacy Management System Market Market Outlook

The future of the US pharmacy management system market is promising, with continued growth driven by technological advancements, increasing regulatory pressures, and the growing need for efficient and safe medication management. Strategic partnerships, investments in R&D, and the adoption of innovative solutions will shape the market's future landscape. The market is poised for significant expansion, driven by unmet needs and a focus on improving patient outcomes.

United States Pharmacy Management System Market Segmentation

-

1. Component

-

1.1. Solutions

- 1.1.1. Inventory Management

- 1.1.2. Purchase Orders Management

- 1.1.3. Supply Chain Management

- 1.1.4. Regulatory and Compliance Information

- 1.1.5. Clinical and Administrative Performance

- 1.1.6. Other Solutions

- 1.2. Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud-based

- 2.2. On-premise

-

3. Type

- 3.1. Retail Pharmacy

- 3.2. Hospital Pharmacy

- 3.3. Other Ty

United States Pharmacy Management System Market Segmentation By Geography

- 1. United States

United States Pharmacy Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Burden on Pharmacists due to the Increasing Number of Prescriptions; Recent Innovations and the Launch of Automated Dispensing Systems

- 3.3. Market Restrains

- 3.3.1. Vendor Lock-in is a Major Barrier to the Adoption of Pharmacy Management Systems

- 3.4. Market Trends

- 3.4.1. Solution Segment to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmacy Management System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.1.1. Inventory Management

- 5.1.1.2. Purchase Orders Management

- 5.1.1.3. Supply Chain Management

- 5.1.1.4. Regulatory and Compliance Information

- 5.1.1.5. Clinical and Administrative Performance

- 5.1.1.6. Other Solutions

- 5.1.2. Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Retail Pharmacy

- 5.3.2. Hospital Pharmacy

- 5.3.3. Other Ty

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

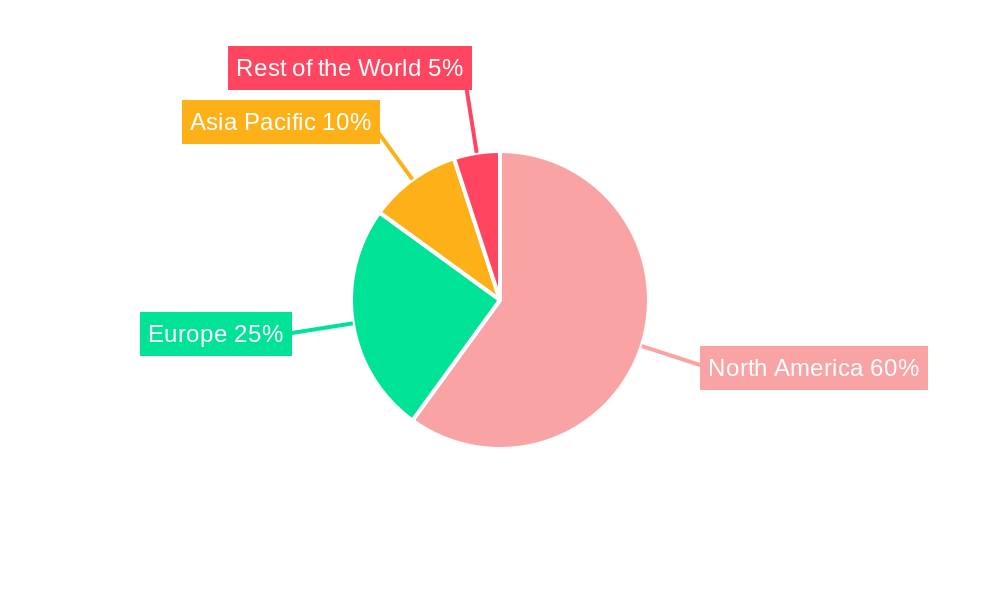

- 6. North America United States Pharmacy Management System Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Pharmacy Management System Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Pharmacy Management System Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United States Pharmacy Management System Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Omnicell Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Clanwilliam Health Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Epicor Software Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ACG Infotech Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cerner Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Idhasoft Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Talyst LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DATASCAN (DCS Pharmacy Inc )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Healthcare Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Becton Dickinson and Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 McKesson Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 MedHOK Inc *List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Health Business Systems Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 GlobeMed Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Allscripts Healthcare Solution Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Omnicell Inc

List of Figures

- Figure 1: United States Pharmacy Management System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Pharmacy Management System Market Share (%) by Company 2024

List of Tables

- Table 1: United States Pharmacy Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Pharmacy Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: United States Pharmacy Management System Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: United States Pharmacy Management System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 5: United States Pharmacy Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Pharmacy Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Pharmacy Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Pharmacy Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Pharmacy Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Pharmacy Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Pharmacy Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Pharmacy Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Pharmacy Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Pharmacy Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 15: United States Pharmacy Management System Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: United States Pharmacy Management System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: United States Pharmacy Management System Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmacy Management System Market?

The projected CAGR is approximately 9.38%.

2. Which companies are prominent players in the United States Pharmacy Management System Market?

Key companies in the market include Omnicell Inc, Clanwilliam Health Ltd, Epicor Software Corporation, ACG Infotech Ltd, Cerner Corporation, Idhasoft Ltd, Talyst LLC, DATASCAN (DCS Pharmacy Inc ), GE Healthcare Inc, Becton Dickinson and Co, McKesson Corporation, MedHOK Inc *List Not Exhaustive, Health Business Systems Inc, GlobeMed Ltd, Allscripts Healthcare Solution Inc.

3. What are the main segments of the United States Pharmacy Management System Market?

The market segments include Component, Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Burden on Pharmacists due to the Increasing Number of Prescriptions; Recent Innovations and the Launch of Automated Dispensing Systems.

6. What are the notable trends driving market growth?

Solution Segment to Hold a Major Share.

7. Are there any restraints impacting market growth?

Vendor Lock-in is a Major Barrier to the Adoption of Pharmacy Management Systems.

8. Can you provide examples of recent developments in the market?

Jun 2022: CerTest Biotec collaborated with BD on the Molecular Diagnostic Test for Monkeypox. As part of the collaboration, the assay will leverage the BD MAX open system reagent suite to validate the CerTest VIASURE Monkeypox CE/IVD molecular test on the BD MAX System. The BD MAX System is a fully integrated, automated platform that performs nucleic acid extraction and real-time PCR, providing results for up to 24 samples across multiple syndromes in less than three hours.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmacy Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmacy Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmacy Management System Market?

To stay informed about further developments, trends, and reports in the United States Pharmacy Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence