Key Insights

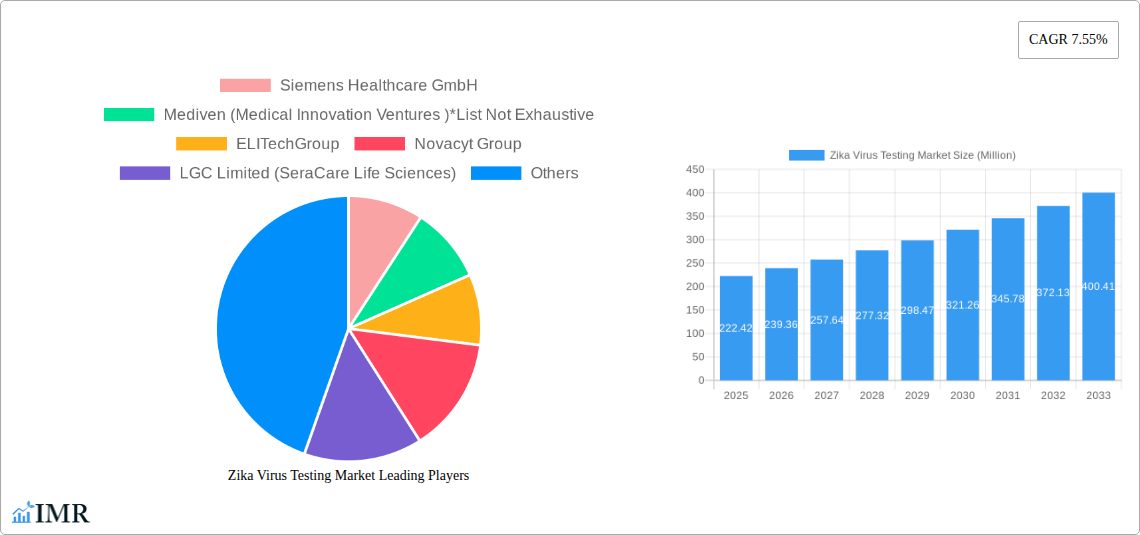

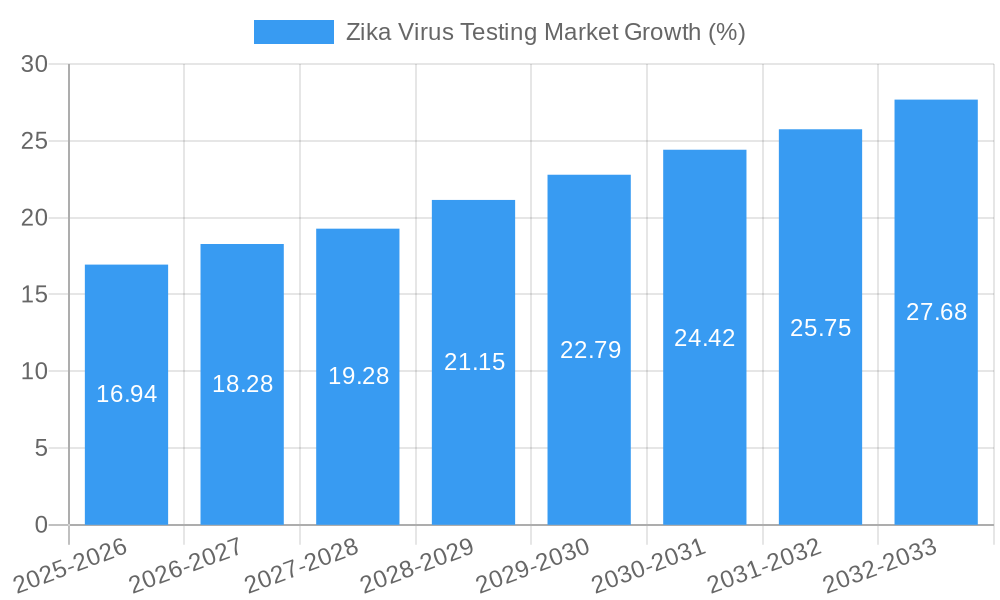

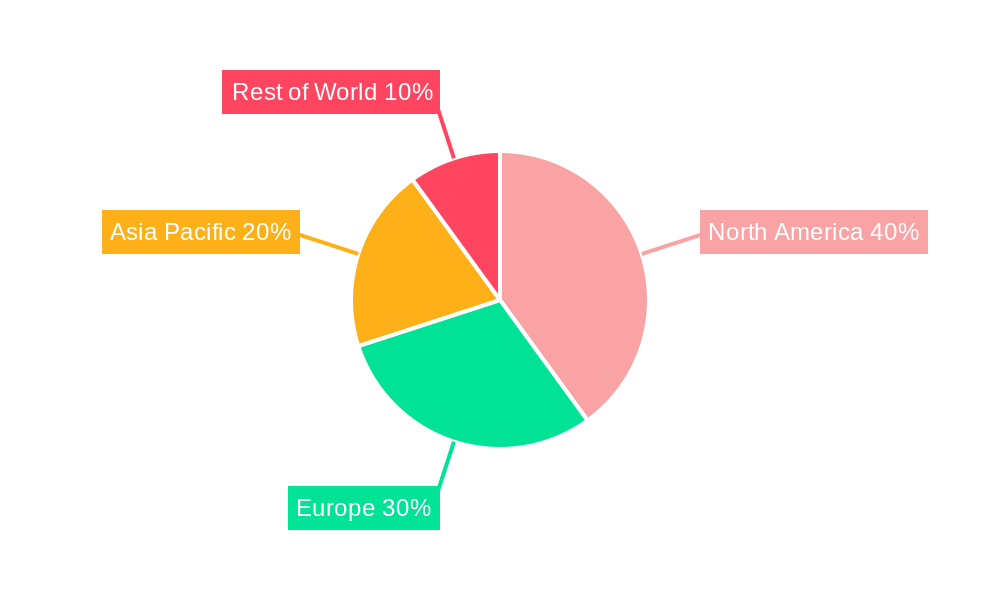

The Zika virus testing market, valued at $222.42 million in 2025, is projected to experience robust growth, driven by factors such as increasing prevalence of Zika virus infections in endemic regions, rising awareness about the virus's potential complications (like microcephaly), and advancements in diagnostic technologies. The market's compound annual growth rate (CAGR) of 7.55% from 2019 to 2024 indicates a consistent upward trajectory, a trend expected to continue through 2033. Molecular tests currently dominate the test type segment due to their high sensitivity and specificity, offering accurate and timely diagnosis. However, serologic tests are also gaining traction as they are cost-effective and provide information about past infections. Hospitals and clinics represent the largest end-user segment, owing to their crucial role in managing infected patients. The geographical distribution of the market is significantly influenced by the prevalence rates in different regions. North America and Europe currently hold substantial market shares, but significant growth potential exists in the Asia-Pacific region and other developing countries with high Zika virus prevalence and limited access to diagnostic resources. Competition is intense, with major players like Siemens Healthcare, Roche, and Abbott alongside smaller specialized companies constantly innovating to improve diagnostic accuracy, speed, and accessibility. This competitive landscape ensures continuous market evolution and refinement of diagnostic strategies.

Ongoing research and development efforts focus on developing faster, more portable, and point-of-care diagnostic tools for improved accessibility, especially in remote areas. This will further propel market expansion. Despite this positive growth outlook, market expansion may face certain challenges. These include the cyclical nature of outbreaks, cost constraints associated with advanced diagnostic techniques, and the need for continuous education and awareness campaigns to increase testing rates. Government initiatives promoting disease surveillance and public health programs play a crucial role in mitigating these challenges and driving further market growth. The market's future hinges on successful collaboration between public health organizations, research institutions, and diagnostic companies to effectively manage Zika outbreaks and improve access to testing for affected populations.

Zika Virus Testing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Zika Virus Testing Market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by Test Type (Molecular Test, Serologic Test) and End User (Hospital/Clinic, Diagnostics Laboratory, Others), offering granular insights into this critical sector of the infectious disease diagnostics market. The market value is presented in Million units.

Zika Virus Testing Market Dynamics & Structure

The Zika Virus Testing market is characterized by a moderately concentrated landscape, with key players like Siemens Healthcare GmbH, Abbott, and Roche holding significant market share. However, the market also exhibits a dynamic competitive environment, with smaller companies and new entrants constantly innovating and vying for market share. Technological advancements, particularly in molecular diagnostics, are a significant driver of growth, improving test accuracy, speed, and affordability.

Regulatory frameworks play a crucial role, influencing market access and product approval timelines. Stringent regulatory requirements, while crucial for patient safety, can present barriers to entry for smaller companies. The market also witnesses competitive pressure from substitute technologies and evolving diagnostic techniques. Mergers and acquisitions (M&A) activity remains moderate but is expected to increase as larger players look to consolidate market share and expand their product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Rapid advancements in molecular diagnostics (PCR, RT-PCR) and serological assays are driving market growth.

- Regulatory Landscape: Stringent regulatory requirements (e.g., FDA approval in the US) impact market entry and product lifecycle.

- Competitive Substitutes: Competition exists from other diagnostic methods for arboviruses.

- M&A Activity: Moderate activity expected to increase in the forecast period, driven by consolidation and expansion strategies. The number of M&A deals in the last five years is estimated at xx.

Zika Virus Testing Market Growth Trends & Insights

The Zika Virus Testing market witnessed substantial growth during the historical period (2019-2024) driven primarily by outbreaks in various regions. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Adoption rates have increased significantly owing to enhanced diagnostic capabilities and greater awareness of Zika virus infection.

Technological disruptions, particularly the introduction of rapid and point-of-care diagnostic tests, are fueling market expansion. Shifts in consumer behavior, with greater emphasis on quick and reliable diagnostics, are also contributing factors. Increased government funding for research and development, coupled with improved healthcare infrastructure in developing countries, are likely to further bolster market expansion. Market penetration in underdeveloped regions remains comparatively low offering future growth potential.

Dominant Regions, Countries, or Segments in Zika Virus Testing Market

The Zika Virus Testing market is geographically diverse, with significant variations in market size and growth rates across different regions. While xx (predicted) remains the leading region due to factors such as high disease prevalence and robust healthcare infrastructure, other regions, including xx and xx, are expected to witness significant growth in the coming years.

Within the segments, the Molecular Test segment holds a larger market share than the Serologic Test segment due to its higher accuracy and sensitivity. Similarly, Hospitals/Clinics constitute the largest end-user segment due to higher testing volumes and advanced diagnostic facilities.

- Key Regional Drivers:

- xx: High disease prevalence, robust healthcare infrastructure, and government initiatives.

- xx: Rising healthcare expenditure, improving diagnostic capabilities, and increased disease awareness.

- xx: Growing public health concerns and increased investments in healthcare infrastructure.

- Segment Dominance: Molecular tests, due to superior accuracy, and Hospital/Clinic segment due to high testing volumes.

Zika Virus Testing Market Product Landscape

The Zika Virus Testing market offers a range of products, including molecular tests (RT-PCR, nucleic acid amplification tests) and serological tests (ELISA, immunofluorescence assays). These tests vary in terms of sensitivity, specificity, turnaround time, and cost. Recent innovations focus on developing rapid, point-of-care diagnostic tools for quicker results and improved accessibility. The unique selling proposition of many tests centers around speed, accuracy, and ease of use. Technological advancements are constantly pushing toward higher sensitivity, lower cost, and faster results.

Key Drivers, Barriers & Challenges in Zika Virus Testing Market

Key Drivers:

- Increased prevalence of Zika virus infections in endemic regions.

- Technological advancements in diagnostic methods.

- Growing awareness of Zika virus and its potential complications.

- Government initiatives and funding for disease control programs.

Key Barriers & Challenges:

- High cost of sophisticated diagnostic equipment and tests.

- Limited access to diagnostic facilities in resource-constrained settings.

- Challenges in developing rapid and point-of-care diagnostics with high sensitivity and specificity.

- Regulatory hurdles and approval processes for new diagnostic products. The regulatory approval process adds an estimated xx% to the total cost of bringing a new test to market.

Emerging Opportunities in Zika Virus Testing Market

Emerging opportunities lie in the development of affordable and point-of-care diagnostic tests suitable for resource-limited settings. This will greatly improve accessibility and early detection rates. Innovative applications, such as incorporating Zika virus testing into broader infectious disease panels, present another avenue for growth. Expanding into untapped markets, particularly in regions with high disease prevalence but limited access to diagnostic capabilities, holds significant potential.

Growth Accelerators in the Zika Virus Testing Market Industry

Long-term growth will be fueled by continued technological advancements, leading to more sensitive, specific, and cost-effective tests. Strategic partnerships between diagnostic companies and public health organizations will be crucial for wider market penetration and improved access to diagnostic services. Expansion into emerging markets and investment in R&D for new diagnostic platforms will be key growth drivers.

Key Players Shaping the Zika Virus Testing Market Market

- Siemens Healthcare GmbH

- Mediven (Medical Innovation Ventures)

- ELITechGroup

- Novacyt Group

- LGC Limited (SeraCare Life Sciences)

- F Hoffmann-La Roche Ltd

- Chembio Diagnostics Inc

- Genekam

- altona Diagnostics GmbH

- Quest Diagnostics

- Abbott

- DiaSorin (Luminex Corporation)

- Co-Diagnostics Inc

Notable Milestones in Zika Virus Testing Market Sector

- July 2022: Mylab launched an RT-PCR test kit for the Zika virus, enabling faster results and mass testing capabilities.

- February 2022: The Indian Council of Medical Research (ICMR) and Klenzaids launched India's first Mobile BSL-3 enhanced laboratory, improving diagnostic capacity.

In-Depth Zika Virus Testing Market Market Outlook

The Zika Virus Testing market exhibits strong growth potential, driven by technological advancements and increasing awareness of the disease. Strategic investments in R&D, partnerships to expand market access, and continued development of rapid and point-of-care diagnostics will be instrumental in shaping future market dynamics and maximizing the market's potential. The increasing prevalence of the disease combined with growing investments in research and development are major factors driving future growth.

Zika Virus Testing Market Segmentation

-

1. Test Type

- 1.1. Molecular Test

- 1.2. Serologic Test

-

2. End User

- 2.1. Hospital/Clinic

- 2.2. Diagnostics Laboratory

- 2.3. Others

Zika Virus Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Zika Virus Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Zika Virus Infection; Increasing R&D by Biopharmaceutical Companies; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Excessive Cost of Testing Kits

- 3.4. Market Trends

- 3.4.1. Molecular Test Segment is Expected to Show Better Growth Over the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Molecular Test

- 5.1.2. Serologic Test

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinic

- 5.2.2. Diagnostics Laboratory

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. North America Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Molecular Test

- 6.1.2. Serologic Test

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinic

- 6.2.2. Diagnostics Laboratory

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. Europe Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Molecular Test

- 7.1.2. Serologic Test

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinic

- 7.2.2. Diagnostics Laboratory

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. Asia Pacific Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Molecular Test

- 8.1.2. Serologic Test

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinic

- 8.2.2. Diagnostics Laboratory

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Middle East and Africa Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Molecular Test

- 9.1.2. Serologic Test

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinic

- 9.2.2. Diagnostics Laboratory

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. South America Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Molecular Test

- 10.1.2. Serologic Test

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinic

- 10.2.2. Diagnostics Laboratory

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. North America Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Zika Virus Testing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Siemens Healthcare GmbH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Mediven (Medical Innovation Ventures )*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ELITechGroup

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Novacyt Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LGC Limited (SeraCare Life Sciences)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 F Hoffmann-La Roche Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Chembio Diagnostics Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Genekam

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 altona Diagnostics GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Quest Diagnostics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Abbott

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 DiaSorin (Luminex Corporation)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Co-Diagnostics Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Global Zika Virus Testing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: South America Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Zika Virus Testing Market Revenue (Million), by Test Type 2024 & 2032

- Figure 13: North America Zika Virus Testing Market Revenue Share (%), by Test Type 2024 & 2032

- Figure 14: North America Zika Virus Testing Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Zika Virus Testing Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Zika Virus Testing Market Revenue (Million), by Test Type 2024 & 2032

- Figure 19: Europe Zika Virus Testing Market Revenue Share (%), by Test Type 2024 & 2032

- Figure 20: Europe Zika Virus Testing Market Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Zika Virus Testing Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Zika Virus Testing Market Revenue (Million), by Test Type 2024 & 2032

- Figure 25: Asia Pacific Zika Virus Testing Market Revenue Share (%), by Test Type 2024 & 2032

- Figure 26: Asia Pacific Zika Virus Testing Market Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Zika Virus Testing Market Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Zika Virus Testing Market Revenue (Million), by Test Type 2024 & 2032

- Figure 31: Middle East and Africa Zika Virus Testing Market Revenue Share (%), by Test Type 2024 & 2032

- Figure 32: Middle East and Africa Zika Virus Testing Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East and Africa Zika Virus Testing Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Zika Virus Testing Market Revenue (Million), by Test Type 2024 & 2032

- Figure 37: South America Zika Virus Testing Market Revenue Share (%), by Test Type 2024 & 2032

- Figure 38: South America Zika Virus Testing Market Revenue (Million), by End User 2024 & 2032

- Figure 39: South America Zika Virus Testing Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Zika Virus Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Zika Virus Testing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Zika Virus Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Zika Virus Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of South America Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Russia Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Africa Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 33: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 39: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: France Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Italy Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Spain Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 48: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 49: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: China Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Australia Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 57: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 58: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: GCC Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Middle East and Africa Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Zika Virus Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 63: Global Zika Virus Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 64: Global Zika Virus Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Brazil Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Argentina Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Rest of South America Zika Virus Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zika Virus Testing Market?

The projected CAGR is approximately 7.55%.

2. Which companies are prominent players in the Zika Virus Testing Market?

Key companies in the market include Siemens Healthcare GmbH, Mediven (Medical Innovation Ventures )*List Not Exhaustive, ELITechGroup, Novacyt Group, LGC Limited (SeraCare Life Sciences), F Hoffmann-La Roche Ltd, Chembio Diagnostics Inc, Genekam, altona Diagnostics GmbH, Quest Diagnostics, Abbott, DiaSorin (Luminex Corporation), Co-Diagnostics Inc.

3. What are the main segments of the Zika Virus Testing Market?

The market segments include Test Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 222.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Zika Virus Infection; Increasing R&D by Biopharmaceutical Companies; Technological Advancements.

6. What are the notable trends driving market growth?

Molecular Test Segment is Expected to Show Better Growth Over the Forecast Years.

7. Are there any restraints impacting market growth?

Excessive Cost of Testing Kits.

8. Can you provide examples of recent developments in the market?

July 2022: Mylab launched an RT-PCR test kit for the Zika virus. The combined kit can process samples to give results in two hours and can be used for mass testing as well.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Zika Virus Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Zika Virus Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Zika Virus Testing Market?

To stay informed about further developments, trends, and reports in the Zika Virus Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence