Key Insights

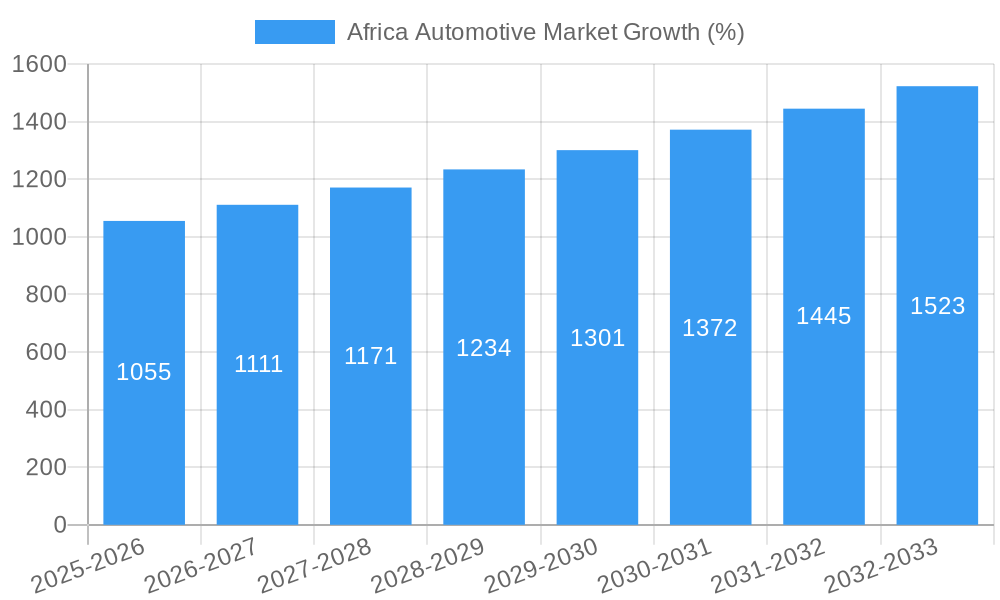

The African automotive market, valued at $20.5 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class, increasing urbanization, and rising disposable incomes across key nations like South Africa, Nigeria, and Kenya. A Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033 indicates a significant expansion of this market. Key growth drivers include government initiatives promoting local manufacturing and infrastructure development, coupled with increasing demand for passenger vehicles and commercial vehicles to support logistics and transportation needs within a rapidly developing continent. The market is segmented by vehicle type (passenger cars and commercial vehicles) and geographically across major African nations. Leading players like Volkswagen, Toyota, and Hyundai are strategically investing in the region, leveraging their established global presence and adapting their offerings to the specific needs of African consumers. However, challenges remain, including limited automotive infrastructure in certain regions, fluctuating fuel prices, and the need for improved road networks to support the growth of the automotive sector. The presence of both established global players and local manufacturers like Innoson Vehicle Manufacturing Company highlights a dynamic market with opportunities for both foreign direct investment and local entrepreneurial growth. While challenges exist, the long-term outlook for the African automotive market remains positive, fueled by sustained economic growth and evolving consumer preferences. The market will likely see a gradual shift towards more fuel-efficient and technologically advanced vehicles in line with global trends, further driving innovation and competition.

The continued expansion of the African automotive market hinges on several factors, including consistent macroeconomic stability across various African nations, improvements in financing options for vehicle purchases, and a concerted effort to address challenges related to infrastructure and supply chains. The successful navigation of these factors will significantly influence the market's trajectory and overall growth potential over the coming decade. Significant investments in electric vehicle (EV) infrastructure and the wider adoption of sustainable automotive solutions will also shape the future landscape. Further market segmentation based on vehicle segments (e.g., SUVs, sedans) and further analysis of regional market penetration will provide a more granular view of growth opportunities for various stakeholders within this dynamic market.

Africa Automotive Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa automotive market, encompassing market dynamics, growth trends, regional performance, and key player strategies. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Automotive) and its child markets (Passenger Cars and Commercial Vehicles) across key African nations. Market size is presented in million units.

Africa Automotive Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the African automotive market. We delve into market concentration, identifying key players and their market shares. The report explores technological innovation drivers, including electrification and automation, while examining the impact of regulatory frameworks on market growth. Furthermore, we assess the role of competitive substitutes, end-user demographics, and the frequency of mergers and acquisitions (M&A) activity.

- Market Concentration: The market exhibits a moderately concentrated structure, with xx% market share held by the top five players in 2024.

- Technological Innovation: Electrification and the adoption of alternative fuels are major drivers, but high initial costs and inadequate infrastructure pose challenges.

- Regulatory Frameworks: Varying regulations across African nations impact market entry and operations, creating both opportunities and complexities.

- Competitive Substitutes: The rise of ride-hailing services and public transport poses a competitive challenge to car ownership.

- M&A Activity: The number of M&A deals in the African automotive sector averaged xx per year during the historical period (2019-2024). This reflects a growing interest in market consolidation and expansion.

- End-User Demographics: The growing middle class and urbanization in several African countries are driving demand for personal vehicles.

Africa Automotive Market Growth Trends & Insights

This section presents a detailed analysis of the Africa automotive market's growth trajectory, leveraging robust data and analytical models. We examine market size evolution, adoption rates of various vehicle types, the influence of technological disruptions (e.g., autonomous driving, connected cars), and shifts in consumer behavior. Key performance indicators such as Compound Annual Growth Rate (CAGR) and market penetration are employed to provide a nuanced understanding of the market's growth dynamics. We project xx Million units total market size by 2033.

Dominant Regions, Countries, or Segments in Africa Automotive Market

This section identifies the leading regions, countries, and segments within the African automotive market, focusing on the drivers behind their dominance. South Africa, with its established automotive industry, is analyzed as a leading market, alongside other key markets such as Morocco, Algeria, Egypt, Nigeria, and Kenya. The report dissects the performance of both passenger cars and commercial vehicles.

- South Africa: Benefits from established infrastructure, a skilled workforce, and government support. Its CAGR for passenger cars during 2025-2033 is projected at xx%.

- Nigeria: Strong population growth and increasing urbanization fuel demand despite infrastructural challenges. Its CAGR for commercial vehicles during 2025-2033 is estimated at xx%.

- Passenger Cars: Growth driven by rising middle class and improved road infrastructure in certain areas.

- Commercial Vehicles: Demand is fueled by the need for goods transportation and infrastructure development, particularly in urban and developing areas.

Africa Automotive Market Product Landscape

The African automotive market exhibits a diverse product landscape, encompassing various vehicle types, fuel technologies, and price points catering to different consumer needs and preferences. Innovations focus on fuel efficiency, durability, and affordability. Technological advancements are evident in the integration of safety features and infotainment systems, although at varying levels of adoption depending on the market segment.

Key Drivers, Barriers & Challenges in Africa Automotive Market

Key Drivers:

- Rising Disposable Incomes: A growing middle class fuels demand for personal vehicles.

- Infrastructure Development: Investments in road networks are boosting mobility and transport needs.

- Government Initiatives: Policies aimed at boosting local manufacturing and infrastructure are positive drivers.

Key Challenges & Restraints:

- High Import Tariffs: These increase the cost of vehicles, limiting accessibility.

- Inadequate Infrastructure: Poor roads and limited charging infrastructure hinder market development.

- Economic Volatility: Fluctuations in currency values and economic downturns impact consumer spending.

Emerging Opportunities in Africa Automotive Market

- Growth of Ride-Hailing Services: Creates opportunities for vehicle financing and fleet management solutions.

- Expansion of Electric Vehicle (EV) Market: Despite challenges, the potential for EV adoption holds significant opportunities.

- Demand for Affordable and Durable Vehicles: Focus on developing vehicles tailored to the specific needs and budget constraints of African consumers.

Growth Accelerators in the Africa Automotive Market Industry

The long-term growth of the African automotive market hinges on significant infrastructure developments, the continued rise of the middle class, and the embrace of innovative technological solutions. Strategic partnerships between international and local manufacturers are also key, facilitating technology transfer and localized production.

Key Players Shaping the Africa Automotive Market Market

- Innoson Vehicle Manufacturing Company

- Volkswagen AG

- Daimler AG

- Tata Motors Limited

- Volvo Group

- Hyundai Motor Company

- Ashok Leyland

- Groupe Renault

- Isuzu Motors Ltd

- Toyota Motor Corporation

- Ford Motor Company

Notable Milestones in Africa Automotive Market Sector

- October 2023: BMW AG and Sasol Ltd. announced a partnership to develop hydrogen-powered vehicle infrastructure in South Africa.

- February 2024: Tata Motors launched its Ultra T.9 and Ultra T.14 heavy-duty trucks in South Africa.

In-Depth Africa Automotive Market Market Outlook

The African automotive market holds substantial long-term growth potential, driven by demographic shifts, infrastructure investments, and technological advancements. Strategic opportunities exist for companies that can adapt to the unique challenges and needs of this diverse market, focusing on affordability, durability, and localization strategies. The projected growth rates suggest a significant expansion in the coming decade, presenting promising prospects for both local and international players.

Africa Automotive Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

Africa Automotive Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in The Passenger Car Sales Across the Region

- 3.3. Market Restrains

- 3.3.1. Transportation Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Passenger Car holds Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. South Africa Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Innoson Vehicle Manufacturing Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Volkswagen AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Daimler AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tata Motors Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Volvo Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hyundai Motor Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ashok Leylan

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Groupe Renault

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Isuzu Motors Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Toyota Motor Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Ford Motor Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Innoson Vehicle Manufacturing Company

List of Figures

- Figure 1: Africa Automotive Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Automotive Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Africa Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: Africa Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Automotive Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Africa Automotive Market?

Key companies in the market include Innoson Vehicle Manufacturing Company, Volkswagen AG, Daimler AG, Tata Motors Limited, Volvo Group, Hyundai Motor Company, Ashok Leylan, Groupe Renault, Isuzu Motors Ltd, Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the Africa Automotive Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in The Passenger Car Sales Across the Region.

6. What are the notable trends driving market growth?

Passenger Car holds Highest Share in the Market.

7. Are there any restraints impacting market growth?

Transportation Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2023: Th BMW AG and Sasol Ltd planned to work together to develop infrastructure to encourage the production and use of hydrogen-powered vehicles in South Africa. According to the companies, BMW will provide its fuel-cell iX5 sport utility vehicle, while Sasol will supply green hydrogen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Automotive Market?

To stay informed about further developments, trends, and reports in the Africa Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence