Key Insights

The Africa Engineering Plastics Market is poised for significant growth, driven by expanding industrialization, burgeoning automotive and construction sectors, and increasing demand for lightweight and high-performance materials across various applications. Over the forecast period (2025-2033), the market is projected to experience robust expansion, fueled by substantial investments in infrastructure development and the adoption of advanced manufacturing techniques. Factors such as rising disposable incomes, growing urbanization, and government initiatives promoting industrial diversification will further contribute to market expansion. While challenges such as volatile raw material prices and supply chain disruptions persist, the overall outlook remains positive, with several market segments demonstrating impressive growth trajectories. The automotive segment is expected to be a key driver, given the increasing adoption of plastics in vehicle components to improve fuel efficiency and reduce weight. The construction industry, too, presents considerable opportunities due to the widespread use of engineering plastics in pipes, fittings, and other infrastructure components.

Specific growth within sub-segments will vary. For instance, the demand for high-performance plastics, such as polyamides and polycarbonates, is likely to increase faster than that for commodity plastics, driven by their superior properties and ability to meet stringent performance requirements. The market landscape is fairly competitive, with both global and regional players vying for market share. Key players leverage their extensive product portfolios, technological advancements, and established distribution networks to maintain a competitive edge. Strategic partnerships, mergers, and acquisitions are anticipated to shape the market dynamics in the coming years, further accelerating market consolidation. This growth is expected to be geographically diverse, with substantial contributions from various regions of Africa depending on infrastructural development and industrial activities within those specific areas.

Africa Engineering Plastics Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Engineering Plastics market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory through 2033. This in-depth study is essential for industry professionals, investors, and anyone seeking a thorough understanding of this burgeoning market. The market is segmented by various types of engineering plastics, end-use applications, and geographic regions within Africa.

Africa Engineering Plastics Market Market Dynamics & Structure

This section delves into the intricate dynamics shaping the African engineering plastics market. We analyze market concentration, revealing the dominance of key players and identifying potential areas for new entrants. The report explores technological innovation drivers, such as the shift towards sustainable materials and the adoption of advanced manufacturing techniques. Regulatory frameworks and their impact on market growth are also thoroughly examined. Competitive product substitutes, such as bioplastics and other advanced materials, are assessed to understand their potential influence. Furthermore, the report examines end-user demographics, focusing on key sectors driving demand, and analyzes M&A trends within the industry. This comprehensive analysis helps in understanding the market structure and competitive landscape.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable materials and lightweighting solutions.

- Regulatory Landscape: Analysis of relevant environmental and safety regulations across African nations.

- Competitive Substitutes: Emerging bioplastics and other sustainable alternatives.

- M&A Activity: xx major mergers and acquisitions recorded between 2019 and 2024.

Africa Engineering Plastics Market Growth Trends & Insights

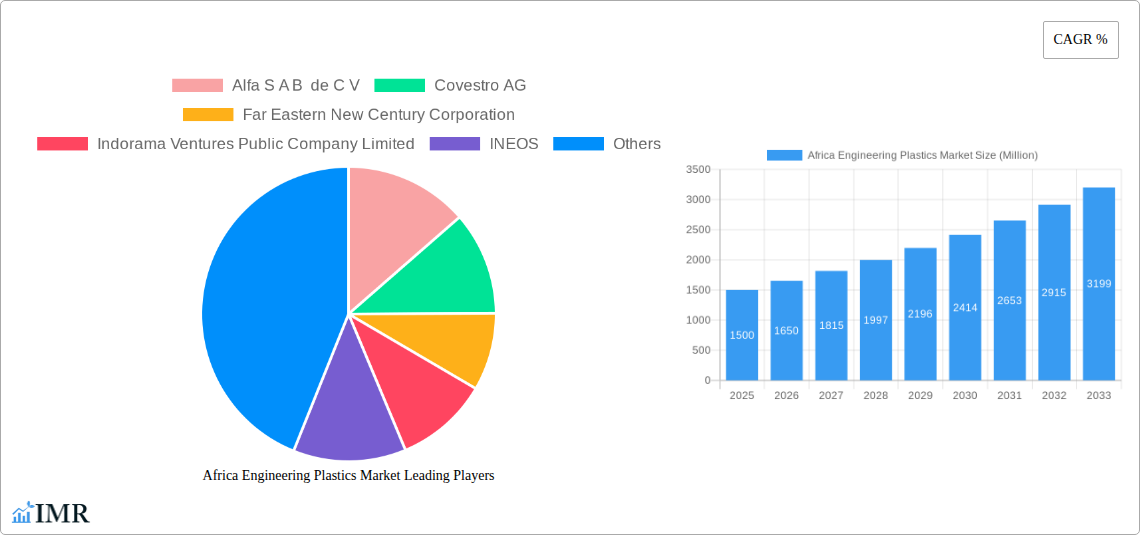

This section presents a detailed analysis of the Africa Engineering Plastics market's growth trajectory. Using robust data and analytical methodologies, the report illuminates the market's size evolution from 2019 to 2024 and projects its expansion until 2033. It provides insights into adoption rates across various sectors, identifying leading applications and regions. The influence of technological disruptions, such as advancements in material science and additive manufacturing, is meticulously examined. Shifts in consumer behavior, encompassing growing environmental consciousness and demand for sustainable solutions, are also thoroughly considered. Key metrics like CAGR and market penetration are used to provide concrete evidence for predicted growth.

- Market Size: Market value projected to reach xx Million units by 2033.

- CAGR: Estimated CAGR of xx% during the forecast period (2025-2033).

- Adoption Rates: Analysis of growth across key industry segments.

- Technological Disruptions: Impact of 3D printing and other innovative technologies.

- Consumer Behavior: Growing preference for sustainable and recyclable engineering plastics.

Dominant Regions, Countries, or Segments in Africa Engineering Plastics Market

This section pinpoints the leading regions, countries, and segments within the African engineering plastics market, driving its growth. It dissects the dominance factors of these regions and segments, including market share, growth potential, and future projections. A detailed analysis of relevant economic policies, infrastructure development, and other key drivers further enhances the understanding of this market segment.

- Leading Region: [Name of Region] exhibiting the highest growth potential due to [Specific reason].

- Key Country Drivers: [List countries] demonstrating strong growth based on [Specific factors].

- Dominant Segments: [List dominant segments and factors of dominance].

- Market Share: Breakdown of market share by region/country/segment.

- Growth Potential: Analysis of future expansion opportunities across various regions.

Africa Engineering Plastics Market Product Landscape

The report provides an overview of the product landscape, detailing product innovations, applications, and performance metrics for engineering plastics within the African market. Unique selling propositions (USPs) of leading products are highlighted, along with discussion of recent technological advancements that have impacted the market. This section is concise yet comprehensive, offering a clear picture of the market's product diversity and innovation levels.

Key Drivers, Barriers & Challenges in Africa Engineering Plastics Market

This section identifies the key factors driving market growth. The analysis includes technological advancements, economic growth, and supportive government policies. Specific examples of these drivers will be provided to support the analysis. Subsequently, it explores challenges and restraints impacting the market, such as supply chain disruptions, regulatory hurdles, and competitive pressures. Quantifiable impacts of these challenges will be presented to provide perspective.

- Key Drivers: Technological advancements, infrastructure development, increasing demand from automotive and construction sectors.

- Challenges: Raw material price volatility, infrastructural limitations in some regions, competition from cheaper alternatives.

Emerging Opportunities in Africa Engineering Plastics Market

This section explores emerging trends and opportunities in the Africa Engineering Plastics market. This analysis focuses on potential opportunities in untapped markets, the development of innovative applications, and shifts in consumer preferences.

- Untapped Markets: Expansion into rural areas and underserved sectors.

- Innovative Applications: Development of specialized plastics for unique African needs.

- Evolving Consumer Preferences: Increased demand for sustainable and recyclable materials.

Growth Accelerators in the Africa Engineering Plastics Market Industry

This section examines factors likely to drive long-term growth within the Africa Engineering Plastics market. These include technological breakthroughs, strategic partnerships, and market expansion strategies, and their individual impacts on market development.

Key Players Shaping the Africa Engineering Plastics Market Market

- Alfa S A B de C V

- Covestro AG

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- INEOS

- JBF Industries Ltd

- Reliance Industries Limited

- Röhm GmbH

- SABIC

- Safripol division of KAP Diversified Industrial (Pty) Lt

Notable Milestones in Africa Engineering Plastics Market Sector

- August 2022: INEOS launched its sustainable Novodur ECO range of ABS products, reducing the product carbon footprint by up to -71%.

- August 2022: INEOS introduced Novodur E3TZ, a high-performance extrusion grade ABS for food trays, sanitary applications, and suitcases.

- February 2023: Covestro AG launched Makrolon 3638 polycarbonate for healthcare and life science applications.

In-Depth Africa Engineering Plastics Market Market Outlook

The Africa Engineering Plastics market shows significant promise for future growth, driven by robust economic expansion across several African nations, increasing industrialization, and a growing demand for durable and versatile materials in various sectors. Strategic partnerships between international and local players, coupled with advancements in material science and manufacturing, are poised to further accelerate market expansion. The focus on sustainable and recyclable materials presents a compelling opportunity for both established players and new entrants. The market is predicted to experience consistent growth throughout the forecast period, fueled by a combination of ongoing infrastructural development and rising consumer spending.

Africa Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Africa Engineering Plastics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Alfa S A B de C V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Covestro AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Far Eastern New Century Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indorama Ventures Public Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBF Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reliance Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Röhm GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SABIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safripol division of KAP Diversified Industrial (Pty) Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alfa S A B de C V

List of Figures

- Figure 1: Africa Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 7: Africa Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Ethiopia Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Morocco Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ghana Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Algeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ivory Coast Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Engineering Plastics Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Africa Engineering Plastics Market?

Key companies in the market include Alfa S A B de C V, Covestro AG, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, INEOS, JBF Industries Ltd, Reliance Industries Limited, Röhm GmbH, SABIC, Safripol division of KAP Diversified Industrial (Pty) Lt.

3. What are the main segments of the Africa Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.August 2022: INEOS announced the introduction of an extension to its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ is an extrusion grade that is suitable for a variety of applications, including food trays, sanitary applications, and suitcases.August 2022: INEOS announced the introduction of a comprehensive range of sustainable solutions for its specialty ABS product group Novodur addressing applications in a range of industries, including automotive, electronics, and household. The individual grades come with a significant product carbon footprint (PCF) saving of up to -71% as compared to the respective non-ECO product reference.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Africa Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence