Key Insights

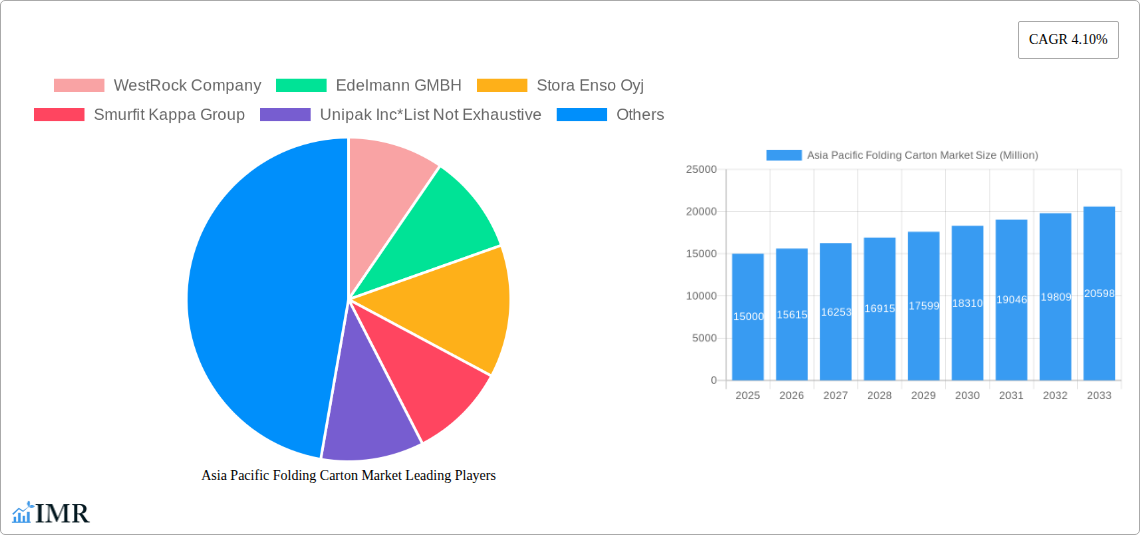

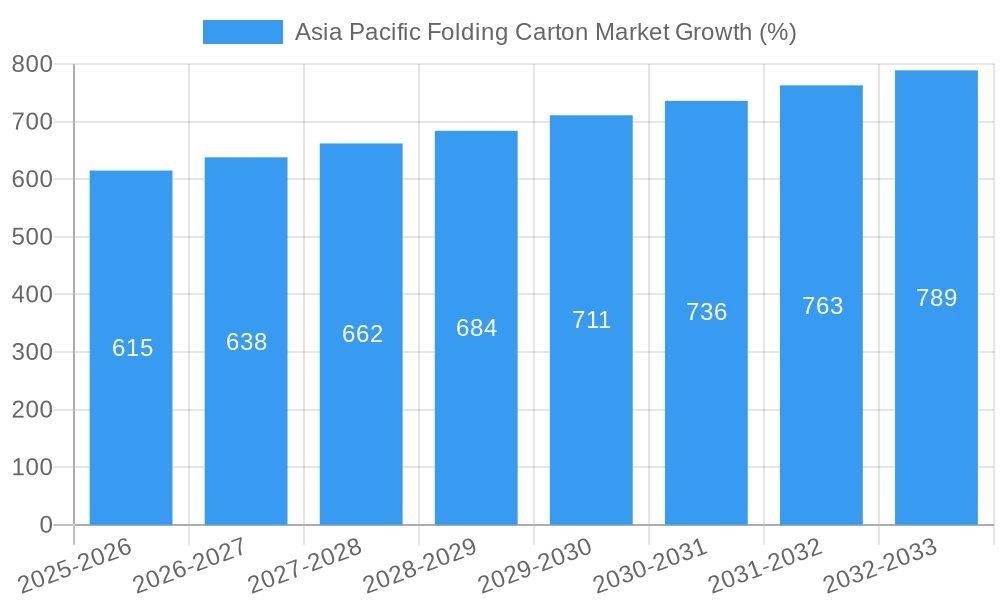

The Asia Pacific folding carton market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, particularly in rapidly developing economies like India and China, is a major driver, demanding increased packaging solutions for processed foods, beverages, and confectionery. The rise of e-commerce and the consequent need for secure and attractive packaging further boosts demand. Growth in the household and personal care sectors, alongside the increasing adoption of pharmaceutical and healthcare products, contribute significantly to market expansion. Furthermore, innovative packaging designs incorporating sustainability features, such as recyclable and biodegradable materials, are gaining traction, reflecting consumer preference for eco-friendly options. While fluctuating raw material prices and potential supply chain disruptions could pose challenges, the overall market outlook remains positive, indicating significant opportunities for established players and new entrants.

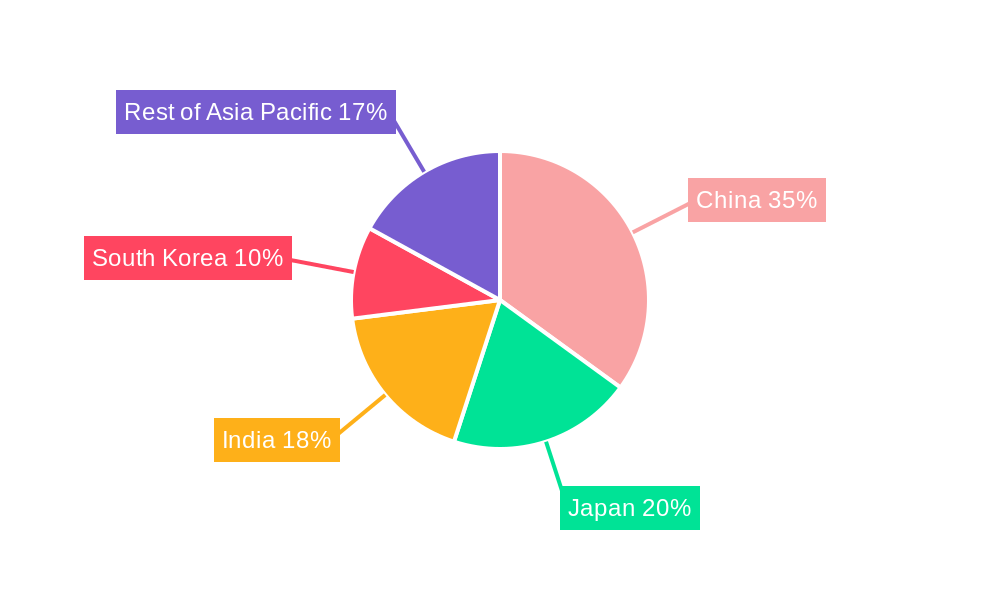

Regional variations within the Asia Pacific market are expected. China, Japan, and India are anticipated to be the leading consumers of folding cartons, owing to their large populations, expanding middle classes, and robust manufacturing sectors. However, other countries in the region, including South Korea and Taiwan, are also poised for considerable growth as their economies continue to develop and consumer spending rises. The competitive landscape is characterized by both multinational corporations and regional players. Companies like WestRock, Smurfit Kappa, and Stora Enso are leveraging their global presence and expertise to maintain their market share. Simultaneously, local companies are capitalizing on regional market knowledge and adapting to specific customer demands. The strategic focus on sustainable packaging, coupled with technological advancements in printing and design, promises to shape the market's trajectory in the coming years, promoting continued growth and innovation.

Asia Pacific Folding Carton Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Folding Carton Market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market by end-user industry (Food and Beverage, Household and Personal Care, Healthcare, Other End-User Industries) and country (China, Japan, India, South Korea, Rest of Asia Pacific). The market size is presented in million units.

Asia Pacific Folding Carton Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and market trends impacting the Asia Pacific Folding Carton market. We delve into market concentration, examining the market share held by key players like WestRock Company, Edelmann GMBH, Stora Enso Oyj, Smurfit Kappa Group, Unipak Inc, Mayr Melnhof Packaging International GmbH, Bell Inc, Graphic Packaging International LLC, Essentra PLC, and DS Smith (list not exhaustive). The analysis includes:

- Market Concentration: The market exhibits a [xx]% concentration ratio, with the top 5 players holding approximately [xx]% of the market share in 2024.

- Technological Innovation: Advancements in printing technologies (e.g., digital printing) and sustainable materials are driving innovation. Barriers to innovation include high initial investment costs and the need for skilled labor.

- Regulatory Frameworks: Government regulations regarding sustainable packaging and waste management are influencing market trends.

- Competitive Product Substitutes: Alternatives like plastic packaging present competitive pressure; however, growing consumer preference for eco-friendly options is driving demand for folding cartons.

- End-User Demographics: Growing populations and rising disposable incomes in several Asian countries fuel demand for packaged goods, boosting the market.

- M&A Trends: The number of M&A deals in the Asia Pacific folding carton market averaged [xx] per year between 2019 and 2024, driven by consolidation efforts and expansion strategies among key players.

Asia Pacific Folding Carton Market Growth Trends & Insights

This section analyzes the historical and projected growth trajectory of the Asia Pacific Folding Carton market. The analysis employs a combination of quantitative data and qualitative insights to provide a comprehensive understanding of market evolution. Key trends explored include:

- Market Size Evolution: The market size grew from [xx] million units in 2019 to [xx] million units in 2024, exhibiting a CAGR of [xx]% during the historical period. The market is projected to reach [xx] million units by 2033.

- Adoption Rates: The adoption rate of sustainable and innovative folding carton solutions is increasing steadily, driven by consumer demand and stringent environmental regulations.

- Technological Disruptions: Advancements in printing and packaging technologies are impacting production efficiency, product design, and customization.

- Consumer Behavior Shifts: The growing preference for eco-friendly and convenient packaging solutions is reshaping the market dynamics.

Dominant Regions, Countries, or Segments in Asia Pacific Folding Carton Market

This section identifies the key regions, countries, and segments driving the growth of the Asia Pacific Folding Carton market. China is expected to remain the largest market, followed by Japan and India. The Food and Beverage sector represents the largest end-user industry segment.

- China: Rapid economic growth, large population, and increasing demand for packaged goods contribute to China's dominance.

- Japan: High per capita consumption, advanced packaging technology, and stringent quality standards drive market growth.

- India: A rapidly expanding middle class and increasing urbanization fuel demand for packaged consumer goods.

- South Korea: High technological advancement and strong consumer preference for innovative packaging solutions.

- Rest of Asia Pacific: Growth is driven by the increasing demand for packaged products in Southeast Asian countries.

- End-User Industry: The Food and Beverage segment holds the largest market share, driven by the high demand for packaged food and beverages.

Asia Pacific Folding Carton Market Product Landscape

The Asia Pacific folding carton market offers a diverse range of products tailored to various end-user needs. Innovations focus on sustainable materials (e.g., recycled paperboard), improved printability, enhanced barrier properties, and customized designs. These advancements enable better product protection, extended shelf life, and enhanced brand appeal. Unique selling propositions center on eco-friendliness, cost-effectiveness, and enhanced functionality.

Key Drivers, Barriers & Challenges in Asia Pacific Folding Carton Market

Key Drivers:

- Growing demand for packaged goods due to rising disposable incomes and population growth.

- Increasing consumer preference for sustainable and eco-friendly packaging solutions.

- Technological advancements in printing and packaging technologies.

- Favorable government policies and regulations promoting sustainable packaging.

Key Challenges & Restraints:

- Fluctuations in raw material prices (e.g., paper pulp) impacting production costs.

- Intense competition among existing players and the entry of new players.

- Stringent environmental regulations requiring compliance.

- Supply chain disruptions impacting timely delivery of materials and products.

Emerging Opportunities in Asia Pacific Folding Carton Market

Emerging opportunities exist in several areas:

- Growing demand for customized and personalized packaging solutions.

- Expansion into untapped markets in Southeast Asia and other developing regions.

- Development of innovative packaging solutions with enhanced functionality (e.g., tamper-evident features).

- Increased adoption of sustainable and recyclable packaging materials.

Growth Accelerators in the Asia Pacific Folding Carton Market Industry

Technological advancements, strategic partnerships, and market expansion strategies are pivotal growth accelerators. Focus on sustainable materials and innovative designs, along with efficient supply chains, will further propel market expansion.

Key Players Shaping the Asia Pacific Folding Carton Market Market

- WestRock Company

- Edelmann GMBH

- Stora Enso Oyj

- Smurfit Kappa Group

- Unipak Inc

- Mayr Melnhof Packaging International GmbH

- Bell Inc

- Graphic Packaging International LLC

- Essentra PLC

- DS Smith

Notable Milestones in Asia Pacific Folding Carton Market Sector

- March 2022: Asia Pacific Resources International Limited (APRIL Group) announced a USD 2.3 billion investment in a sustainable paperboard production facility in Indonesia, with an annual capacity of 1.2 million tonnes. This significantly boosts the supply of sustainable folding carton materials.

- March 2022: APRIL Group commenced construction of the aforementioned paperboard facility in Indonesia. This signifies a significant commitment to expanding production capacity within the region.

In-Depth Asia Pacific Folding Carton Market Market Outlook

The Asia Pacific folding carton market is poised for robust growth driven by sustainable packaging trends, economic expansion in several countries, and technological innovations. Strategic partnerships, investments in sustainable infrastructure, and expansion into niche markets present significant opportunities for industry players. The focus on sustainability and innovation will shape the future of this market, presenting lucrative opportunities for companies that adapt and innovate.

Asia Pacific Folding Carton Market Segmentation

-

1. End-User Industry

- 1.1. Food and Beverage

- 1.2. Household and Personalcare

- 1.3. Healthcare

- 1.4. Other End-User Industries

Asia Pacific Folding Carton Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Folding Carton Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco Friendly Solutions and Scope for Printing Innovations Propelling the Growth in the End-user Segments; Potential Growth in Packaged Food Sales

- 3.3. Market Restrains

- 3.3.1. Concerns over Material Availability and Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Healthcare Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Food and Beverage

- 5.1.2. Household and Personalcare

- 5.1.3. Healthcare

- 5.1.4. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. China Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Folding Carton Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 WestRock Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Edelmann GMBH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Stora Enso Oyj

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Smurfit Kappa Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unipak Inc*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mayr Melnhof Packaging International GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bell Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Graphic Packaging International LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Essentra PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DS Smith

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 WestRock Company

List of Figures

- Figure 1: Asia Pacific Folding Carton Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Folding Carton Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Folding Carton Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Folding Carton Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: Asia Pacific Folding Carton Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia Pacific Folding Carton Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia Pacific Folding Carton Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 13: Asia Pacific Folding Carton Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Pacific Folding Carton Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Folding Carton Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Asia Pacific Folding Carton Market?

Key companies in the market include WestRock Company, Edelmann GMBH, Stora Enso Oyj, Smurfit Kappa Group, Unipak Inc*List Not Exhaustive, Mayr Melnhof Packaging International GmbH, Bell Inc, Graphic Packaging International LLC, Essentra PLC, DS Smith.

3. What are the main segments of the Asia Pacific Folding Carton Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco Friendly Solutions and Scope for Printing Innovations Propelling the Growth in the End-user Segments; Potential Growth in Packaged Food Sales.

6. What are the notable trends driving market growth?

Healthcare Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

Concerns over Material Availability and Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

March 2022 - Sustainable fiber and product producer Asia Pacific Resources International Limited (APRIL Group) has announced that will invest IDR 33.4 trillion (USD 2.3 billion) in a sustainable paperboard production facility in Indonesia. Through the investment, Singapore-based APRIL Group aims to expand its product portfolio in the downstream sector along with supporting the growth of the green economy in Indonesia. The new facility that is being built can produce 1.2 million tonnes of fully recyclable and biodegradable folding boxboard annually to meet the demand for sustainable packaging products in the domestic and international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Folding Carton Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Folding Carton Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Folding Carton Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Folding Carton Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence