Key Insights

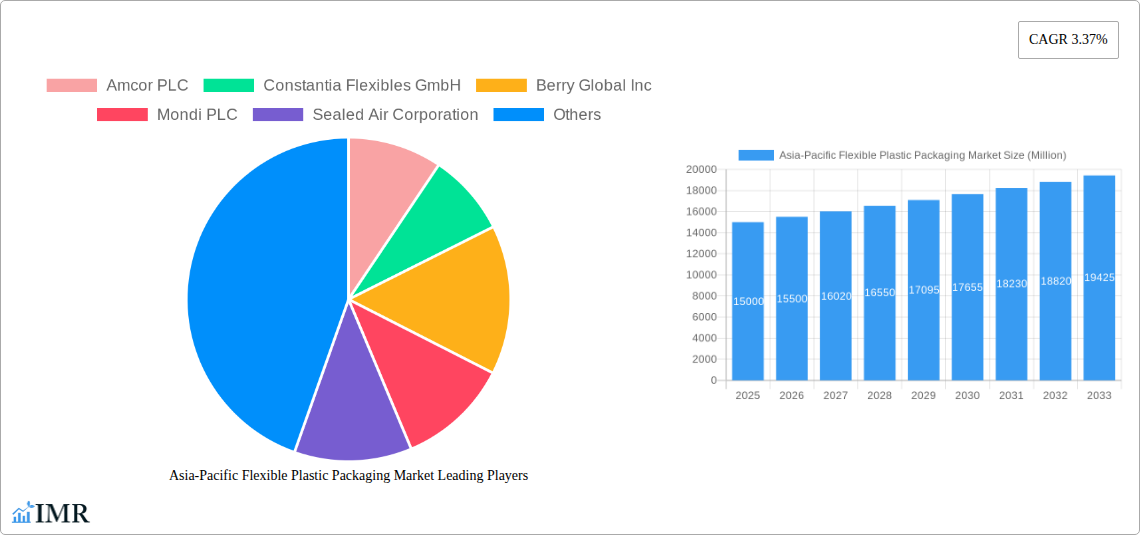

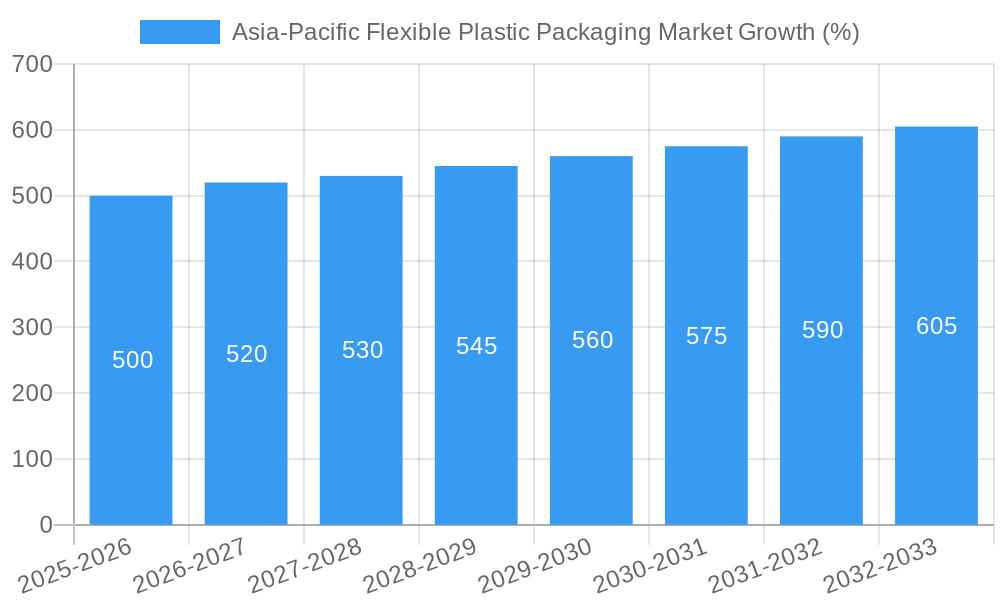

The Asia-Pacific flexible plastic packaging market is experiencing robust growth, driven by the region's burgeoning food and beverage, healthcare, and consumer goods sectors. A compound annual growth rate (CAGR) of 3.37% from 2019 to 2024 suggests a consistently expanding market, and this upward trajectory is projected to continue through 2033. Factors such as increasing disposable incomes, changing consumer lifestyles favoring convenience and ready-to-eat meals, and the rising demand for lightweight and cost-effective packaging solutions are key drivers. E-commerce growth significantly boosts demand for flexible packaging, while advancements in materials science are leading to more sustainable and innovative options, such as biodegradable and recyclable films. However, environmental concerns regarding plastic waste and stringent regulations aimed at reducing plastic pollution present significant challenges. The market is segmented by material type (polyethylene, polypropylene, etc.), packaging type (pouches, bags, films), and end-use industry, with significant opportunities arising in emerging economies within the region due to expanding middle classes and infrastructure development.

Competition within the Asia-Pacific flexible plastic packaging market is intense, with both established multinational corporations and regional players vying for market share. Established players like Amcor PLC, Constantia Flexibles GmbH, and Berry Global Inc leverage their extensive experience, technological prowess, and global distribution networks. Emerging players are focusing on niche applications, leveraging local market knowledge, and offering competitive pricing. The market landscape is further characterized by strategic partnerships, mergers and acquisitions, and a continuous focus on innovation to meet evolving consumer demands and regulatory requirements. Given the projected growth and market dynamics, companies focusing on sustainability and offering differentiated products tailored to specific regional preferences will likely gain a competitive edge in this dynamic market. While precise market sizing data is absent, estimations based on industry reports suggest a market value well in excess of several billion dollars (with appropriate assumptions regarding the current market value and growth rate).

Asia-Pacific Flexible Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific flexible plastic packaging market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this dynamic market. The market size is projected to reach xx Million units by 2033.

Asia-Pacific Flexible Plastic Packaging Market Dynamics & Structure

This section delves into the intricate structure of the Asia-Pacific flexible plastic packaging market, examining market concentration, technological advancements, regulatory landscapes, competitive dynamics, and end-user demographics. We analyze the influence of mergers and acquisitions (M&A) activities on market consolidation. The report quantifies market share percentages and M&A deal volumes while also exploring qualitative factors such as innovation barriers.

- Market Concentration: The Asia-Pacific flexible plastic packaging market exhibits a moderately concentrated structure, with the top five players holding approximately xx% market share in 2024.

- Technological Innovation: Significant investments in sustainable packaging solutions are driving innovation, with a focus on recyclable and biodegradable materials. However, high R&D costs and complex regulatory approvals pose significant barriers to entry.

- Regulatory Frameworks: Stringent environmental regulations in several countries are shaping the market, promoting the adoption of eco-friendly packaging options. Varying standards across nations present challenges for manufacturers.

- Competitive Product Substitutes: Growth of alternative packaging materials (e.g., paper-based, compostable) presents competitive pressure. Market share of these substitutes is currently estimated at xx%.

- End-User Demographics: The burgeoning food and beverage, consumer goods, and healthcare sectors are driving market demand, with a particular emphasis on e-commerce growth influencing packaging needs.

- M&A Trends: Consolidation through M&A activities continues to reshape the market landscape. We've identified approximately xx M&A deals in the historical period (2019-2024), reflecting increasing competitive pressure and a drive for scale.

Asia-Pacific Flexible Plastic Packaging Market Growth Trends & Insights

This section provides a detailed analysis of the Asia-Pacific flexible plastic packaging market's growth trajectory. We examine market size evolution, adoption rates of new technologies, technological disruptions, and shifting consumer preferences. Key performance indicators (KPIs) such as CAGR and market penetration are provided to offer deeper insight. Data from various credible sources and statistical models (XXX) was used to formulate this analysis.

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Include specific metrics (e.g., CAGR, market penetration) for deeper insights.]

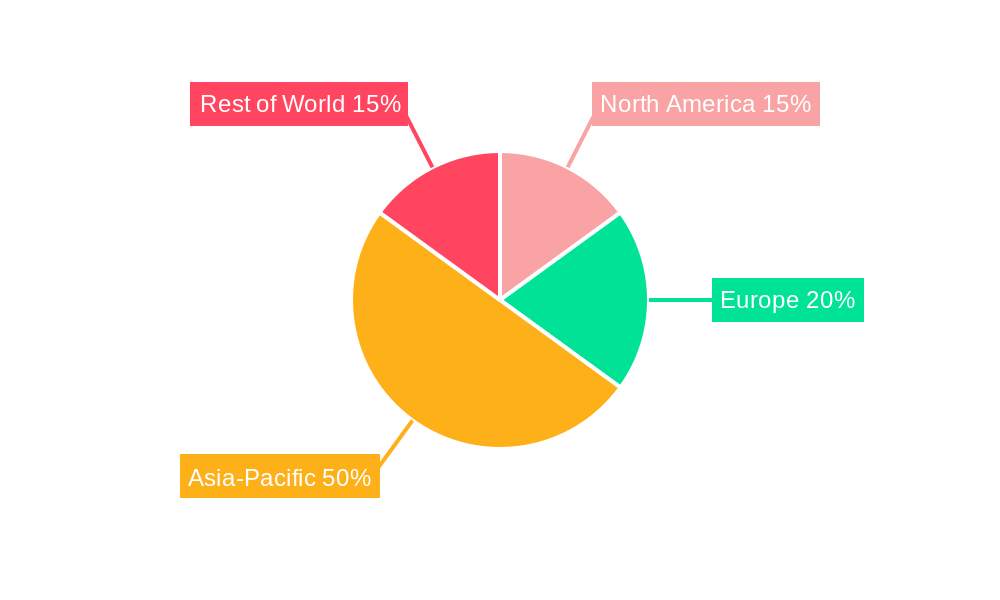

Dominant Regions, Countries, or Segments in Asia-Pacific Flexible Plastic Packaging Market

This section identifies the leading regions, countries, and segments driving growth within the Asia-Pacific flexible plastic packaging market. We detail dominance factors, market share, and future growth potential, highlighting key economic policies and infrastructure developments that fuel this dominance.

[Insert 600-word analysis of leading regions, countries, or segments, using bullet points to highlight key drivers and paragraphs to analyze dominance factors. Include market share and growth potential data.]

Asia-Pacific Flexible Plastic Packaging Market Product Landscape

This section describes the current product landscape, focusing on product innovations, applications, and performance metrics. It emphasizes the unique selling propositions and technological advancements driving market evolution.

[Insert 100-150 word paragraph detailing product innovations, applications, and performance metrics.]

Key Drivers, Barriers & Challenges in Asia-Pacific Flexible Plastic Packaging Market

This section identifies the primary forces driving market growth, including technological, economic, and policy-driven factors, along with key challenges and restraints.

Key Drivers:

- Increasing demand from food & beverage, consumer goods, and healthcare industries.

- Advancements in flexible packaging materials (e.g., barrier films).

- Growing e-commerce and online retail.

Key Challenges:

- Fluctuations in raw material prices (e.g., resins).

- Environmental concerns and regulations on plastic waste.

- Intense competition among established and emerging players.

Emerging Opportunities in Asia-Pacific Flexible Plastic Packaging Market

This section highlights the exciting possibilities within the market, covering untapped markets, innovative applications, and evolving consumer preferences.

[Insert 150 words highlighting emerging trends and opportunities.]

Growth Accelerators in the Asia-Pacific Flexible Packaging Market Industry

This section discusses the primary catalysts for long-term growth, including technological breakthroughs, strategic partnerships, and market expansion strategies.

[Insert 150-word paragraph emphasizing technological breakthroughs, strategic partnerships, or market expansion strategies.]

Key Players Shaping the Asia-Pacific Flexible Plastic Packaging Market Market

- Amcor PLC

- Constantia Flexibles GmbH

- Berry Global Inc

- Mondi PLC

- Sealed Air Corporation

- Sonoco Products Company

- Wapo Cirporation

- Rengo Co Ltd

- Uflex Limited

- Swisspac Pvt Ltd

Notable Milestones in Asia-Pacific Flexible Plastic Packaging Market Sector

- April 2024: UFlex Limited commences commercial production of poly-condensed polyester chips in Panipat, India, signifying a major expansion in its manufacturing capabilities.

- August 2023: Dow and Mengniu collaborate to launch a fully recyclable all-PE yogurt pouch in China, promoting sustainable packaging solutions and circular economy principles.

In-Depth Asia-Pacific Flexible Plastic Packaging Market Outlook

The Asia-Pacific flexible plastic packaging market is poised for sustained growth, driven by increasing consumer demand, technological innovations, and strategic partnerships. Opportunities abound in sustainable packaging solutions, e-commerce packaging, and specialized applications. Companies focusing on innovation and sustainability will be best positioned to capitalize on this market's considerable potential.

Asia-Pacific Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Asia-Pacific Flexible Plastic Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in Pack Sizes Coupled With Move Toward Convenience; Advancements in Packaging Technology have Led to the Extension of Shelf Life

- 3.3. Market Restrains

- 3.3.1. Reduction in Pack Sizes Coupled With Move Toward Convenience; Advancements in Packaging Technology have Led to the Extension of Shelf Life

- 3.4. Market Trends

- 3.4.1. The Food Industry is Expected to Witness Growth in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Constantia Flexibles GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sealed Air Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sonoco Products Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wapo Cirporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rengo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Uflex Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Swisspac Pvt Ltd7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: Asia-Pacific Flexible Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Flexible Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Asia-Pacific Flexible Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: New Zealand Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Indonesia Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Malaysia Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Singapore Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Thailand Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Vietnam Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Philippines Asia-Pacific Flexible Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Flexible Plastic Packaging Market?

The projected CAGR is approximately 3.37%.

2. Which companies are prominent players in the Asia-Pacific Flexible Plastic Packaging Market?

Key companies in the market include Amcor PLC, Constantia Flexibles GmbH, Berry Global Inc, Mondi PLC, Sealed Air Corporation, Sonoco Products Company, Wapo Cirporation, Rengo Co Ltd, Uflex Limited, Swisspac Pvt Ltd7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Asia-Pacific Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Reduction in Pack Sizes Coupled With Move Toward Convenience; Advancements in Packaging Technology have Led to the Extension of Shelf Life.

6. What are the notable trends driving market growth?

The Food Industry is Expected to Witness Growth in the Region.

7. Are there any restraints impacting market growth?

Reduction in Pack Sizes Coupled With Move Toward Convenience; Advancements in Packaging Technology have Led to the Extension of Shelf Life.

8. Can you provide examples of recent developments in the market?

April 2024: UFlex Limited, India’s most extensive multinational flexible packaging and solutions company, announced a significant milestone in its journey of expansion and innovation. Starting March 31, 2024, the company successfully began commercializing poly-condensed polyester chips at its manufacturing facility in Panipat, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence