Key Insights

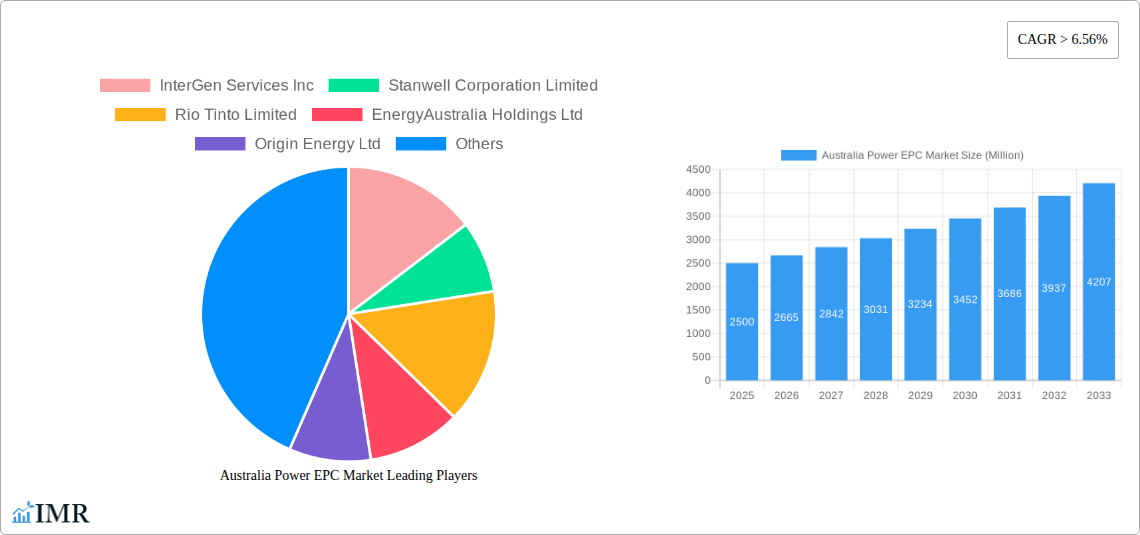

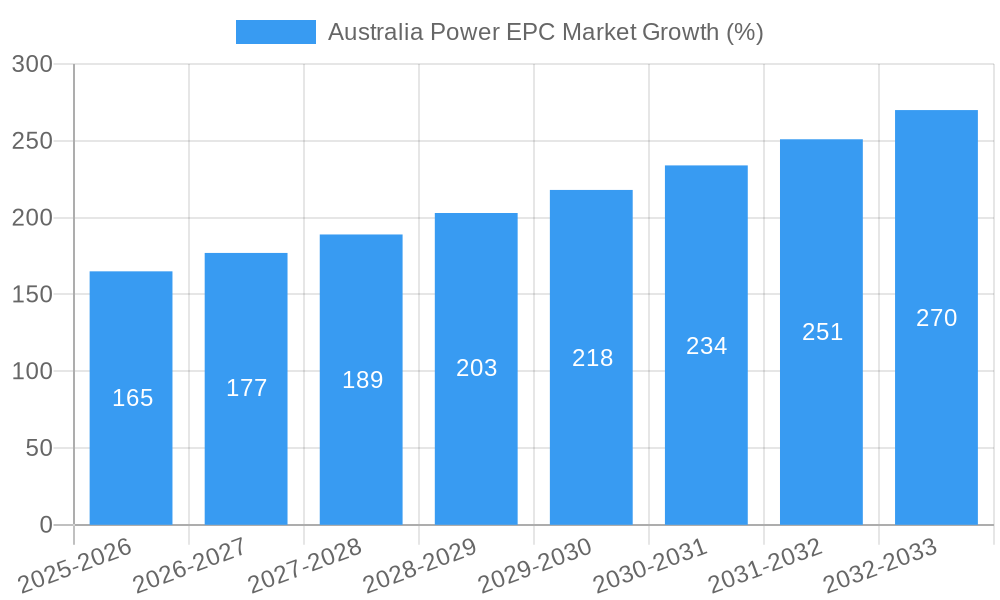

The Australian power engineering, procurement, and construction (EPC) market is experiencing robust growth, driven by increasing energy demand and a significant push towards renewable energy sources. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on comparable international markets and the provided CAGR), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6.56% from 2025 to 2033. This expansion is fueled by substantial investments in both thermal and renewable power generation projects, responding to the nation's commitment to reducing carbon emissions and ensuring energy security. Key drivers include government policies supporting renewable energy integration, the modernization of existing power infrastructure, and growing industrial activity requiring reliable power supplies. While some constraints such as fluctuating commodity prices and potential workforce shortages may temper growth, the overall outlook remains positive. The market is segmented into thermal, renewable, and other power generation projects, with renewable energy EPC projects increasingly dominating the market share due to substantial government incentives and private sector investment. Leading companies such as InterGen Services Inc., Stanwell Corporation Limited, and Origin Energy Ltd are actively shaping the market landscape through large-scale project development and technological advancements.

The dominance of renewable energy projects within the Australian power EPC market is expected to continue throughout the forecast period. This trend is further strengthened by the Australian government's commitment to achieving ambitious renewable energy targets and the decreasing cost of renewable energy technologies. Competition among EPC companies is intensifying, leading to innovation in project delivery methods, cost optimization strategies, and the adoption of sustainable practices. Furthermore, the increasing demand for grid modernization and integration of distributed generation sources presents significant opportunities for EPC companies specializing in smart grid technologies and energy storage solutions. Growth in the non-renewable segment will be primarily driven by the continued need for baseload power generation in the near term, with a gradual shift towards cleaner thermal power generation technologies. Geographic concentration of projects within Australia will also influence market dynamics, with key regions experiencing higher growth rates than others.

Australia Power EPC Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian Power Engineering, Procurement, and Construction (EPC) market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It offers crucial insights for industry professionals, investors, and strategic decision-makers seeking to understand this dynamic sector. The report segments the market into Power Generation (Thermal, Renewables, Others) providing a granular view of market dynamics and growth potential. Key players like InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, and AGL Energy Limited are profiled, alongside an analysis of the competitive landscape.

Keywords: Australia Power EPC Market, Power Generation EPC, Renewable Energy EPC, Thermal Power EPC, Australian Energy Market, EPC Contracts, Australian Infrastructure, Power Generation Australia, EnergyAustralia, AGL Energy, Origin Energy, CIMIC Group, Elecnor, Mergers and Acquisitions, Market Growth, Market Size, Market Share, Market Forecast.

Australia Power EPC Market Dynamics & Structure

The Australian Power EPC market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, driven by the increasing adoption of renewable energy sources and the need for grid modernization, is a key dynamic. Stringent regulatory frameworks, aiming for carbon reduction targets and grid stability, heavily influence market activity. The market also faces competition from alternative energy solutions and faces continuous pressure from cost optimisation. Mergers and acquisitions (M&A) activity are shaping the competitive landscape, with larger companies consolidating their positions.

- Market Concentration: xx% held by top 5 players in 2025.

- Technological Innovation: Focus on smart grids, renewable energy integration, and digitalization.

- Regulatory Framework: Stringent environmental regulations and grid connection policies.

- Competitive Substitutes: Growing competition from distributed generation and energy storage solutions.

- M&A Trends: Consolidation among major players to increase market share and operational efficiency. xx number of M&A deals were recorded between 2019 and 2024.

Australia Power EPC Market Growth Trends & Insights

The Australian Power EPC market experienced robust growth during the historical period (2019-2024), driven by increased investment in power generation capacity and infrastructure upgrades. The market size reached xx million in 2024, registering a CAGR of xx% during this period. This growth is projected to continue, albeit at a slightly moderated pace, throughout the forecast period (2025-2033). The increasing adoption of renewable energy technologies, government initiatives supporting clean energy transition, and modernization of the existing power grid infrastructure are key growth drivers. Furthermore, technological advancements and changes in consumer behaviour are significantly influencing market growth. The market is expected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Australia Power EPC Market

The Renewable energy segment is currently the fastest-growing segment within the Australian Power EPC market, driven by government incentives and the rising demand for sustainable energy solutions. New South Wales and Queensland are leading regions in terms of project development and investment, benefiting from favorable renewable energy resources and supportive policy environments.

- Key Drivers for Renewable Energy Segment:

- Government incentives and subsidies for renewable energy projects.

- Increasing demand for clean energy from consumers and businesses.

- Abundant renewable energy resources (solar, wind) in certain regions.

- Policy support for renewable energy integration into the national grid.

- Dominance Factors:

- Higher investment in renewable energy projects compared to thermal power.

- Technological advancements reducing the cost of renewable energy technologies.

- Growing consumer awareness and preference for sustainable energy sources.

- Strong government support and policy framework for renewable energy transition.

Australia Power EPC Market Product Landscape

The Australian Power EPC market showcases a diverse product landscape, encompassing conventional thermal power plants, along with increasingly sophisticated renewable energy solutions such as large-scale solar farms, wind farms, and hybrid projects. Technological advancements such as AI-driven predictive maintenance and smart grid technologies are increasingly integrated into EPC projects, leading to improved efficiency, reliability, and reduced operational costs. The emphasis is now on optimizing energy performance, minimizing environmental impact, and streamlining project delivery.

Key Drivers, Barriers & Challenges in Australia Power EPC Market

Key Drivers:

- Increased investment in renewable energy infrastructure.

- Government policies promoting clean energy transition.

- Modernization of the existing power grid.

- Technological advancements reducing the cost of renewable energy technologies.

Challenges:

- Supply chain disruptions affecting project timelines and costs. (e.g., xx% increase in component costs in 2023).

- Regulatory complexities and permitting delays slowing down project development.

- Intense competition among EPC contractors leading to price pressures.

Emerging Opportunities in Australia Power EPC Market

- Growing demand for energy storage solutions to address the intermittency of renewable energy.

- Expansion of microgrids and distributed generation systems.

- Increasing adoption of smart grid technologies to improve grid efficiency and reliability.

- Opportunities in emerging technologies like green hydrogen production and offshore wind.

Growth Accelerators in the Australia Power EPC Market Industry

Long-term growth in the Australian Power EPC market will be propelled by ongoing investment in renewable energy, coupled with smart grid development and the integration of energy storage solutions. Strategic partnerships between EPC contractors and technology providers, together with the development of innovative financing models, will accelerate market expansion and drive efficiency improvements across the sector.

Key Players Shaping the Australia Power EPC Market Market

- InterGen Services Inc

- Stanwell Corporation Limited

- Rio Tinto Limited

- EnergyAustralia Holdings Ltd

- Origin Energy Ltd

- Sumitomo Corporation

- NRG Energy Inc

- AGL Energy Limited

Notable Milestones in Australia Power EPC Market Sector

- June 2021: Elecnor and Clough secure a EUR 917 million contract for the Energy Connect project.

- January 2022: UGL wins three contracts worth over AUD 296 million for renewable energy and transmission projects.

In-Depth Australia Power EPC Market Market Outlook

The future of the Australian Power EPC market is bright, driven by the nation's commitment to renewable energy targets and grid modernization. Strategic investments in renewable energy infrastructure, coupled with technological innovations, will continue to fuel market growth. Opportunities exist for EPC contractors who can demonstrate expertise in integrating renewable energy sources, managing complex grid infrastructure projects, and adopting digital technologies to improve project efficiency and reduce costs. The market is poised for significant expansion, presenting lucrative opportunities for both established and emerging players.

Australia Power EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Others

- 2. Power Transmission and Distribution (T&D)

Australia Power EPC Market Segmentation By Geography

- 1. Australia

Australia Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Increasing Renewable Energy Installations are Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 InterGen Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stanwell Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rio Tinto Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergyAustralia Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Origin Energy Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NRG Energy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGL Energy Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 InterGen Services Inc

List of Figures

- Figure 1: Australia Power EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Power EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Australia Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 4: Australia Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 7: Australia Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 8: Australia Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Power EPC Market?

The projected CAGR is approximately > 6.56%.

2. Which companies are prominent players in the Australia Power EPC Market?

Key companies in the market include InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, AGL Energy Limited.

3. What are the main segments of the Australia Power EPC Market?

The market segments include Power Generation, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Increasing Renewable Energy Installations are Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In January 2022, Australia's UGL, part of CIMIC Group Ltd, secured three contracts worth over AUD 296 million for renewable energy and transmission projects in Queensland and South Australia. One of the orders is Vena Energy to cover the engineering, procurement, and construction (EPC) of an 87-MW solar farm and substation upgrade at Tailem Bend in South Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Power EPC Market?

To stay informed about further developments, trends, and reports in the Australia Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence