Key Insights

The Japan Batteries Market, valued at approximately ¥3.29 billion in 2025, is projected for substantial expansion, with an estimated Compound Annual Growth Rate (CAGR) of 15.75% from 2025 to 2033. This growth is propelled by the rapidly expanding electric vehicle (EV) sector, increasing demand for energy storage systems (ESS) across telecommunications and industrial applications, and the widespread adoption of portable electronics. Lithium-ion batteries currently lead the market due to their superior energy density and performance. However, significant growth is also anticipated in emerging battery technologies focusing on enhanced energy density, extended lifespan, and improved safety, supporting Japan's commitment to sustainability and technological innovation. Major industry players such as Panasonic, Toshiba, and GS Yuasa are strategically investing in research and development (R&D) and production capacity expansion to address escalating demand. The Kanto and Kansai regions are principal markets, driven by concentrated manufacturing bases and consumer demand.

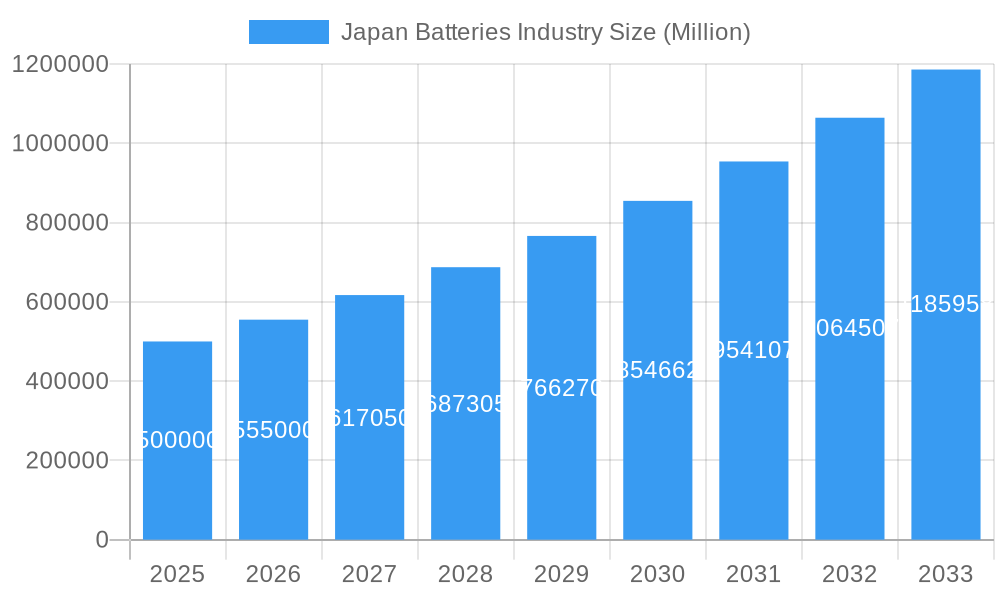

Japan Batteries Industry Market Size (In Billion)

Despite a positive trajectory, the market encounters challenges, including fluctuations in raw material costs, particularly for lithium, cobalt, and nickel, impacting production expenses. Environmental considerations concerning battery recycling and disposal necessitate sustainable practices and robust regulatory frameworks for managing end-of-life batteries. Government initiatives promoting environmentally friendly battery development and adoption, alongside advancements in recycling technologies, are expected to alleviate these concerns. The Japan Batteries Market presents a highly promising long-term outlook, fueled by continuous technological advancements and strong governmental support for achieving national energy and environmental objectives.

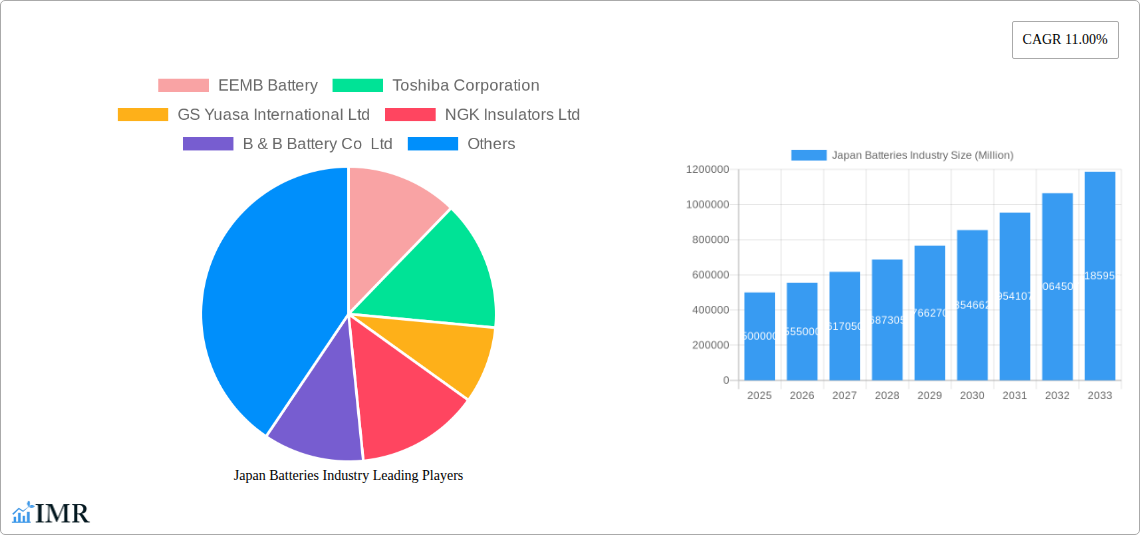

Japan Batteries Industry Company Market Share

Japan Batteries Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Japan batteries industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The report segments the market by battery type (primary and secondary), technology (lithium-ion, lead-acid, others), and application (automotive, industrial, portable, SLI, others).

Japan Batteries Industry Market Dynamics & Structure

The Japan batteries market, valued at xx million units in 2024, is characterized by a moderate level of market concentration. Key players such as Panasonic Corporation, GS Yuasa International Ltd, and Toshiba Corporation hold significant market share, but smaller players contribute substantially to overall market volume. Technological innovation, primarily driven by advancements in lithium-ion battery technology, is a key driver, alongside stringent government regulations promoting renewable energy and electric vehicles. Lead-acid batteries still hold a notable market share, particularly in the SLI segment, but are facing increasing competition from lithium-ion alternatives. The market also experiences competitive pressure from imported batteries, particularly from China and South Korea. M&A activity has been moderate in recent years, with a focus on strengthening supply chains and expanding technological capabilities.

- Market Concentration: Moderately concentrated, with a few major players and a significant number of smaller players.

- Technological Innovation: Lithium-ion battery advancements dominate, impacting various segments.

- Regulatory Framework: Government policies supporting EVs and renewable energy significantly influence market growth.

- Competitive Substitutes: Lead-acid batteries continue to compete with lithium-ion batteries in certain applications.

- End-User Demographics: The automotive and industrial sectors are major end-users, with growing demand from consumer electronics.

- M&A Trends: Moderate M&A activity, focused on supply chain optimization and technological expertise. xx M&A deals were recorded between 2019 and 2024.

Japan Batteries Industry Growth Trends & Insights

The Japan batteries market exhibits a robust growth trajectory, driven by increasing demand from the automotive, industrial, and portable electronics sectors. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The shift towards electric vehicles is a primary growth driver, significantly boosting demand for lithium-ion batteries. Technological advancements, including improved energy density, longer lifespan, and faster charging times, further propel market expansion. Consumer preferences are also shifting towards environmentally friendly and high-performance battery solutions, contributing to growth. Market penetration of lithium-ion batteries continues to increase across various applications, gradually replacing lead-acid batteries in several segments.

(Note: This section requires XXX data to be fully populated with specific CAGR and market penetration figures. Placeholders are used until that data is provided.)

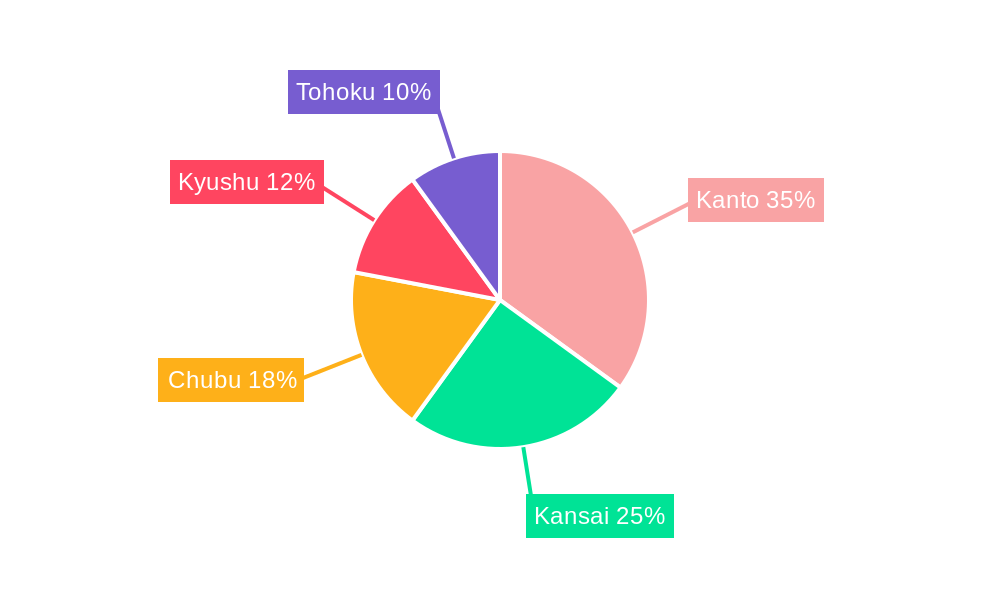

Dominant Regions, Countries, or Segments in Japan Batteries Industry

The Kanto region, including Tokyo and surrounding prefectures, dominates the Japan batteries market due to its high concentration of manufacturing facilities, automotive production hubs, and research and development activities. Within battery types, secondary batteries, especially lithium-ion batteries, are driving market expansion, fueled by the rise of electric vehicles and energy storage systems. In terms of applications, the automotive sector (HEV, PHEV, EV) exhibits the highest growth potential, significantly outpacing other segments.

- Key Drivers:

- Strong automotive sector growth, particularly in electric vehicles.

- Government policies supporting renewable energy and electric vehicles.

- Technological advancements in lithium-ion battery technology.

- Increasing demand from industrial and portable electronics sectors.

- Dominance Factors:

- High concentration of manufacturing facilities in the Kanto region.

- Strong presence of major battery manufacturers.

- High adoption rate of lithium-ion batteries in the automotive sector.

Japan Batteries Industry Product Landscape

The Japanese battery market showcases a wide range of products, from traditional lead-acid batteries to cutting-edge lithium-ion batteries with diverse energy densities, sizes, and chemistries. Innovation focuses on improving energy density, cycle life, safety features, and reducing costs. Unique selling propositions often involve specific technological advancements or tailored solutions for particular applications (e.g., high-temperature performance batteries for automotive use). The market increasingly features solid-state batteries and other advanced battery technologies in research and development phases, aiming for improved energy density and safety.

Key Drivers, Barriers & Challenges in Japan Batteries Industry

Key Drivers: The burgeoning electric vehicle market, government incentives promoting renewable energy, and technological advancements in battery technology are primary growth drivers. Increased demand for energy storage solutions (ESS) in the industrial and utility sectors also fuels expansion.

Key Challenges: The dependence on imported raw materials creates supply chain vulnerabilities. Stringent environmental regulations increase manufacturing costs. Intense competition from global players, including those from China, poses a significant challenge. xx% of raw materials are currently imported.

Emerging Opportunities in Japan Batteries Industry

Emerging opportunities include the expansion of energy storage systems (ESS) in the grid-scale and commercial sectors, the growth of hybrid and electric vehicles, and the development of next-generation battery technologies, such as solid-state batteries. Untapped markets lie in the integration of smart energy solutions with battery storage and increased adoption of portable power solutions for various applications.

Growth Accelerators in the Japan Batteries Industry Industry

Technological advancements, particularly in solid-state battery technology and high-energy-density lithium-ion batteries, are key growth catalysts. Strategic partnerships between battery manufacturers, automotive companies, and energy providers will accelerate market expansion. Government policies supporting the development and adoption of renewable energy and electric vehicles will significantly influence long-term growth.

Key Players Shaping the Japan Batteries Industry Market

- EEMB Battery

- Toshiba Corporation

- GS Yuasa International Ltd

- NGK Insulators Ltd

- B & B Battery Co Ltd

- Furukawa Battery Co Ltd

- Maxell Ltd

- Contemporary Amperex Technology Co Ltd

- LG Energy Solution

- Panasonic Corporation

Notable Milestones in Japan Batteries Industry Sector

- February 2022: Panasonic announces plans to produce 4680-type cylindrical lithium-ion batteries in Japan, expanding its global business.

- November 2022: Eurus Energy Holdings Corp establishes a grid storage battery business and begins construction of a 1.5-MW/4.58-MWh project.

In-Depth Japan Batteries Industry Market Outlook

The Japan batteries market is poised for sustained growth, driven by the accelerating adoption of electric vehicles, expanding renewable energy infrastructure, and continuous advancements in battery technology. Strategic partnerships and government support will further accelerate market expansion. The focus on developing next-generation battery technologies will unlock new opportunities and enhance market competitiveness. The market is expected to see continued consolidation, with larger players acquiring smaller companies to strengthen their position.

Japan Batteries Industry Segmentation

-

1. Battery Type

- 1.1. Primary Battery

- 1.2. Secondary Battery

-

2. Technology

- 2.1. Lithium-ion Battery

- 2.2. Lead-Acid Battery

- 2.3. Others

-

3. Application

- 3.1. Automotive Batteries (HEV, PHEV, EV)

- 3.2. Industri

- 3.3. Portable Batteries (Consumer Electronics, etc.)

- 3.4. SLI Batteries

- 3.5. Others

Japan Batteries Industry Segmentation By Geography

- 1. Japan

Japan Batteries Industry Regional Market Share

Geographic Coverage of Japan Batteries Industry

Japan Batteries Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Adoption of Healthcare Wearable Devices4.; Growing Penetration of Internet of Things (IoT) Applications

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Alternate Battery Technologies Existing for Various Applications

- 3.4. Market Trends

- 3.4.1. Secondary Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Primary Battery

- 5.1.2. Secondary Battery

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Lithium-ion Battery

- 5.2.2. Lead-Acid Battery

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive Batteries (HEV, PHEV, EV)

- 5.3.2. Industri

- 5.3.3. Portable Batteries (Consumer Electronics, etc.)

- 5.3.4. SLI Batteries

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EEMB Battery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GS Yuasa International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NGK Insulators Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 B & B Battery Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Furukawa Battery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxell Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Contemporary Amperex Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LG Energy Solution

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EEMB Battery

List of Figures

- Figure 1: Japan Batteries Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Batteries Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Batteries Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 2: Japan Batteries Industry Volume K Unit Forecast, by Battery Type 2020 & 2033

- Table 3: Japan Batteries Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Japan Batteries Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Japan Batteries Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Japan Batteries Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Japan Batteries Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Japan Batteries Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Japan Batteries Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 10: Japan Batteries Industry Volume K Unit Forecast, by Battery Type 2020 & 2033

- Table 11: Japan Batteries Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Japan Batteries Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Japan Batteries Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Japan Batteries Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Japan Batteries Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Batteries Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Batteries Industry?

The projected CAGR is approximately 15.75%.

2. Which companies are prominent players in the Japan Batteries Industry?

Key companies in the market include EEMB Battery, Toshiba Corporation, GS Yuasa International Ltd, NGK Insulators Ltd, B & B Battery Co Ltd, Furukawa Battery Co Ltd, Maxell Ltd, Contemporary Amperex Technology Co Ltd, LG Energy Solution, Panasonic Corporation.

3. What are the main segments of the Japan Batteries Industry?

The market segments include Battery Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.29 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Adoption of Healthcare Wearable Devices4.; Growing Penetration of Internet of Things (IoT) Applications.

6. What are the notable trends driving market growth?

Secondary Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Availability of Alternate Battery Technologies Existing for Various Applications.

8. Can you provide examples of recent developments in the market?

February 2022: Panasonic announced that its Energy Company is likely to produce 4680 type cylindrical lithium-ion batteries in Japan in order to expand its business globally. The company is likely to establish a production facility at its Wakayama Factory in western Japan to manufacture 4680-type battery cells.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Batteries Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Batteries Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Batteries Industry?

To stay informed about further developments, trends, and reports in the Japan Batteries Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence