Key Insights

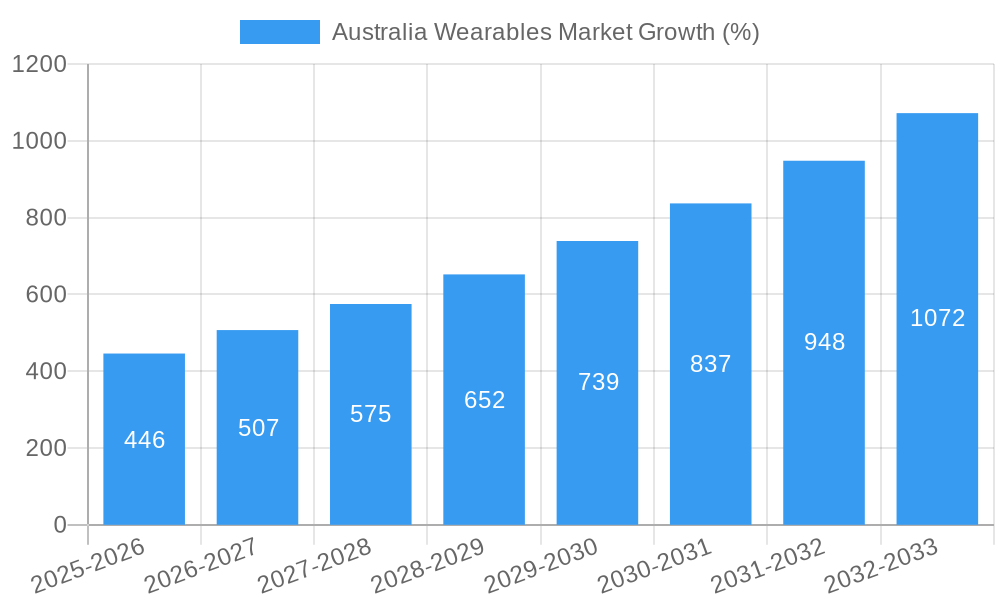

The Australian wearables market, valued at $3.53 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.90% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of smartwatches and fitness trackers, fueled by rising health consciousness and the desire for convenient health monitoring, is a major contributor. Furthermore, technological advancements leading to more sophisticated features, improved battery life, and sleeker designs are boosting consumer interest. The market segmentation reveals a diverse user base, with significant demand across all age groups – babies, kids, adults, and the elderly – each with unique wearable needs and preferences. The popularity of smartwatches, head-mounted displays, and fitness trackers is particularly notable, indicating a preference for devices that integrate seamlessly into daily routines and offer comprehensive health and fitness data. Competitive pressures from established tech giants like Apple, Samsung, and Fitbit, alongside emerging players, ensure continuous innovation and affordability. While challenges like data privacy concerns and potential health risks associated with prolonged device use exist, the overall market outlook remains positive.

The growth trajectory of the Australian wearables market is expected to remain strong throughout the forecast period. Factors such as increasing smartphone penetration, improving internet infrastructure, and rising disposable incomes will continue to fuel market expansion. The continued evolution of wearable technology, encompassing advancements in sensor technology, artificial intelligence, and integration with other smart devices, promises to create new opportunities and drive further market penetration. While the specific segment performance will vary, the overall positive trends suggest a substantial increase in market size by 2033. Strong government support for digital health initiatives and a growing focus on preventative healthcare are also bolstering market growth. The diverse range of applications for wearables, extending beyond fitness and health to encompass entertainment, communication, and personal safety, ensures a broad appeal and further solidifies the market's long-term prospects.

Australia Wearables Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia wearables market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for businesses, investors, and researchers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is segmented by end-user (babies, kids, adults, elderly) and product type (smartwatches, head-mounted displays, ear-worn devices, fitness trackers/activity trackers, other wearables).

Australia Wearables Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory environment shaping the Australian wearables market. The market exhibits a moderately concentrated structure with key players like Apple, Samsung, and Garmin holding significant market share. However, the emergence of niche players and innovative startups is increasing competition. Technological innovations, particularly in sensor technology, battery life, and data analytics, are crucial growth drivers.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Focus on improved sensor accuracy, longer battery life, enhanced health monitoring capabilities, and integration with AI and machine learning.

- Regulatory Framework: Compliance with data privacy regulations (e.g., GDPR, Australian Privacy Principles) is paramount.

- Competitive Substitutes: Traditional fitness equipment and health monitoring devices pose indirect competition.

- End-User Demographics: The adult segment is the largest, driven by health consciousness and technological adoption. The elderly segment shows significant growth potential.

- M&A Trends: xx M&A deals recorded in the Australian wearables sector between 2019-2024, primarily focused on technology acquisition and market expansion.

Australia Wearables Market Growth Trends & Insights

The Australian wearables market experienced significant growth during the historical period (2019-2024), driven by increasing smartphone penetration, rising health awareness, and the affordability of wearable devices. The market is expected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Technological advancements such as improved battery life, advanced health monitoring features, and the integration of wearables with smart home ecosystems are further driving adoption. Consumer behavior is shifting towards more personalized health and fitness management, fueling demand for advanced wearables.

Dominant Regions, Countries, or Segments in Australia Wearables Market

The Australian wearables market is geographically concentrated, with major metropolitan areas like Sydney and Melbourne exhibiting higher adoption rates due to higher disposable income and technological awareness. The adult segment dominates by end-user, driven by increased health consciousness and preference for smartwatches and fitness trackers. Smartwatches currently constitute the largest product segment, followed by fitness trackers.

- Key Drivers: Rising disposable incomes, increasing health awareness, government initiatives promoting digital health, and expanding e-commerce platforms.

- Dominance Factors: High smartphone penetration, strong consumer preference for technologically advanced products, and effective marketing campaigns by major brands.

- Growth Potential: The elderly and kids segments offer significant untapped potential for growth with the development of age-specific wearable devices.

Australia Wearables Market Product Landscape

The Australian wearables market offers a diverse range of products, including smartwatches with advanced health monitoring features, fitness trackers with sophisticated activity tracking capabilities, and head-mounted displays for augmented reality applications. Key features driving product innovation include improved sensor accuracy, extended battery life, enhanced user interfaces, and seamless integration with smartphone ecosystems. The market is witnessing the emergence of specialized wearables catering to specific needs like sleep tracking, stress management, and rehabilitation.

Key Drivers, Barriers & Challenges in Australia Wearables Market

Key Drivers:

- Rising health consciousness and adoption of preventative healthcare measures.

- Growing demand for personalized health and fitness tracking.

- Technological advancements leading to improved accuracy and functionality.

- Increasing smartphone penetration and the proliferation of connected devices.

Key Challenges:

- Data privacy concerns and regulations limiting data collection and usage.

- High initial cost of premium wearables, impacting wider market penetration.

- Dependence on smartphone connectivity and limited functionality in offline modes.

- Intense competition from established players and new entrants.

Emerging Opportunities in Australia Wearables Market

Emerging opportunities exist in areas such as niche market development (wearables for specific health conditions), integration with telehealth platforms, and the development of sophisticated analytics for preventative health management. Expanding into regional areas with lower penetration rates and offering affordable wearables represents significant growth potential.

Growth Accelerators in the Australia Wearables Market Industry

Long-term growth will be driven by advancements in sensor technology, miniaturization, and improved battery life. Strategic partnerships between wearable manufacturers and healthcare providers will expand the market into the healthcare sector. Government initiatives supporting digital health and fitness initiatives will further accelerate adoption rates.

Key Players Shaping the Australia Wearables Market Market

- Microsoft

- Samsung Electronics Co Ltd

- Garmin Ltd

- Oppo

- OnePlus

- Huawei Technologies Co Ltd

- Fitbit Inc

- Wear OS

- Apple Inc

- Nuheara Limited

Notable Milestones in Australia Wearables Market Sector

- August 2022: Samsung Electronics Co., Ltd. announced the Galaxy Watch5 Pro and Galaxy Watch5, featuring advanced health monitoring capabilities.

- May 2022: Huawei launched the Watch GT 3 Pro, Watch D (with blood pressure and ECG monitoring), and Band 7, expanding its wearable product portfolio.

In-Depth Australia Wearables Market Market Outlook

The Australian wearables market is poised for continued growth, driven by increasing health consciousness, technological innovation, and government support for digital health initiatives. Strategic partnerships between technology companies and healthcare providers will unlock new opportunities within the healthcare sector. The market’s future potential lies in personalized health monitoring, preventative care applications, and the integration of wearables into broader smart home ecosystems.

Australia Wearables Market Segmentation

-

1. End-user

- 1.1. Babies

- 1.2. Kids

- 1.3. Adults

- 1.4. Elderly

-

2. Product

- 2.1. Smartwatches

- 2.2. Head Mounted Displays

- 2.3. Ear Worn

- 2.4. Fitness Trackers/Activity Trackesr

- 2.5. Other Wearables

Australia Wearables Market Segmentation By Geography

- 1. Australia

Australia Wearables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Incremental Technological Advancements Aiding the Market Growth; Increase in Health Awareness among the Consumers

- 3.3. Market Restrains

- 3.3.1. ; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure

- 3.4. Market Trends

- 3.4.1. Head-Mounted Display will Drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Wearables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Babies

- 5.1.2. Kids

- 5.1.3. Adults

- 5.1.4. Elderly

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Smartwatches

- 5.2.2. Head Mounted Displays

- 5.2.3. Ear Worn

- 5.2.4. Fitness Trackers/Activity Trackesr

- 5.2.5. Other Wearables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Garmin Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oppo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OnePlus

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fitbit Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wear OS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuheara Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Australia Wearables Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Wearables Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Wearables Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 3: Australia Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Australia Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Wearables Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 7: Australia Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Australia Wearables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Wearables Market?

The projected CAGR is approximately 12.90%.

2. Which companies are prominent players in the Australia Wearables Market?

Key companies in the market include Microsoft, Samsung Electronics Co Ltd, Garmin Ltd, Oppo, OnePlus, Huawei Technologies Co Ltd, Fitbit Inc *List Not Exhaustive, Wear OS, Apple Inc, Nuheara Limited.

3. What are the main segments of the Australia Wearables Market?

The market segments include End-user, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Incremental Technological Advancements Aiding the Market Growth; Increase in Health Awareness among the Consumers.

6. What are the notable trends driving market growth?

Head-Mounted Display will Drive the Growth of this Market.

7. Are there any restraints impacting market growth?

; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure.

8. Can you provide examples of recent developments in the market?

August 2022 - Samsung Electronics Co., Ltd. announced the Galaxy Watch5 Pro and Galaxy Watch5, shaping consumers' wellness and health habits with advanced features, intuitive insights, and even more powerful capabilities. With an increasing desire to better understand and act on consumers' health goals, the company has provided depth monitoring and experimental data, offering the information needed to help users along their health and wellness journey. Galaxy Watch5 is equipped with Samsung's unique BioActive Sensor that drives the next era of digital health monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Wearables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Wearables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Wearables Market?

To stay informed about further developments, trends, and reports in the Australia Wearables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence