Key Insights

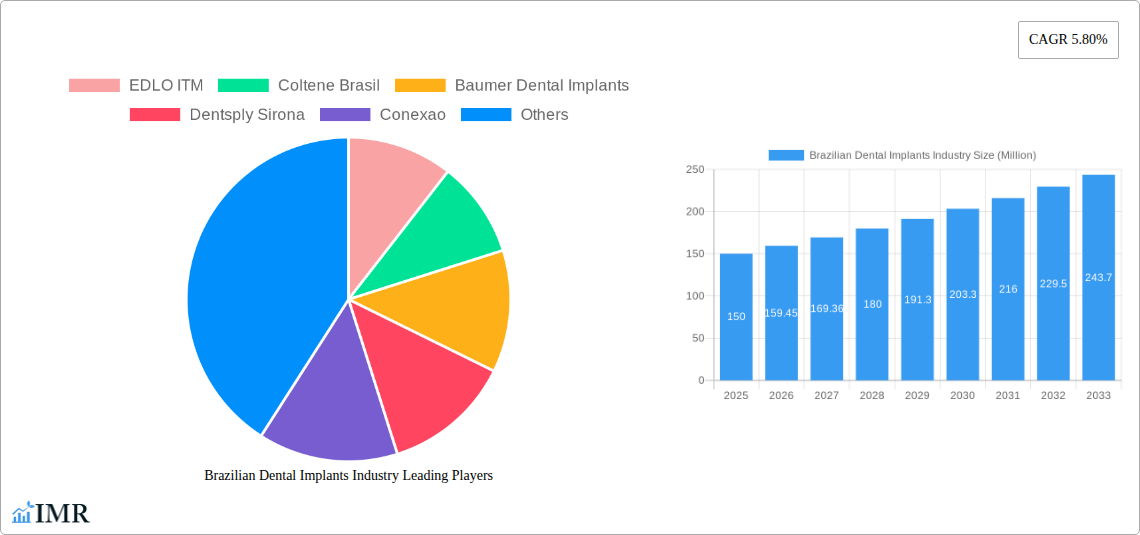

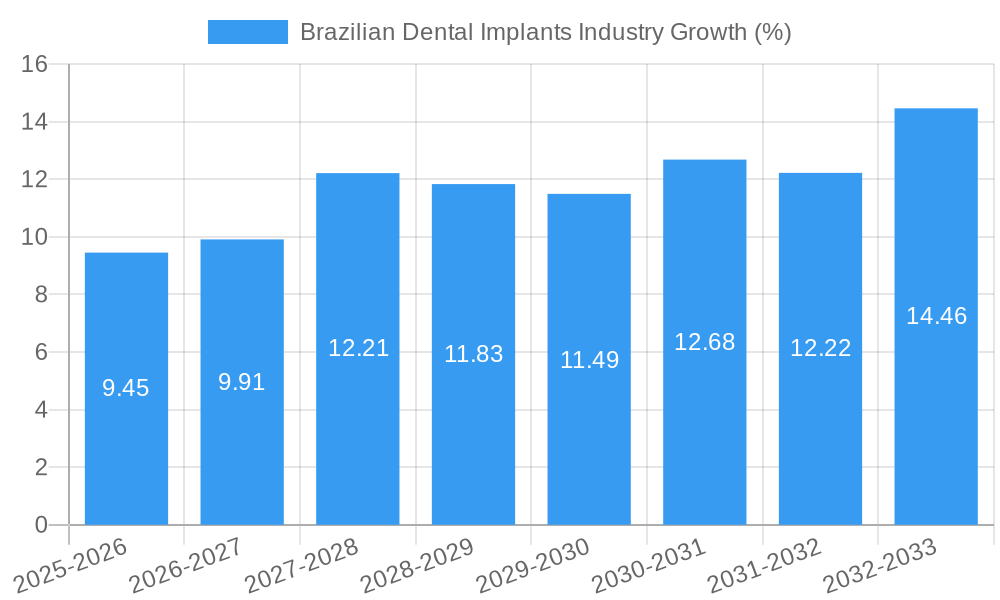

The Brazilian dental implants market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by several key factors. Rising prevalence of periodontal diseases and tooth loss, coupled with an increasing awareness of aesthetic dentistry and improved oral health, drives demand for dental implants. Furthermore, advancements in implant technology, leading to more efficient and minimally invasive procedures, contribute significantly to market expansion. The expanding middle class in Brazil, with increased disposable income and access to better healthcare, further boosts the market. Hospitals and specialized dental clinics constitute the largest end-users, followed by smaller private practices. The segment encompassing general and diagnostic equipment holds a significant share, indicating a strong need for sophisticated tools in implant placement and post-operative care. Major players like Dentsply Sirona, Straumann, and others, are leveraging their established presence and technological advancements to maintain market leadership. However, high costs associated with dental implants and procedures, coupled with the uneven distribution of healthcare resources across the country, pose challenges to widespread adoption. Despite these restraints, the overall outlook for the Brazilian dental implants market remains positive, driven by continuous technological improvements and increasing patient demand for advanced dental solutions.

The competitive landscape is characterized by both multinational corporations and domestic players. Multinationals benefit from strong brand recognition and advanced technologies, while local companies often offer cost-competitive solutions tailored to the specific needs of the Brazilian market. Strategic partnerships, mergers, and acquisitions are expected to shape the market landscape in the coming years, as companies strive to expand their product portfolios and market reach. The government's initiatives to improve healthcare infrastructure and accessibility also play a crucial role in facilitating market expansion. Segmentation by treatment type (Orthodontic, Endodontic, Periodontic, Prosthodontic) reveals varying growth rates, with a strong focus expected on minimally invasive techniques across all segments. Future growth will be influenced by technological innovations, such as digital dentistry and 3D-printed implants, and government policies aimed at expanding access to affordable dental care.

Brazilian Dental Implants Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Brazilian dental implants market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented by treatment (Orthodontic, Endodontic, Periodontic, Prosthodontic), end-user (Hospitals, Clinics, Other End-Users), and product (General and Diagnostic Equipment, Other Dental Consumables, Other General and Diagnostic Equipment).

Brazilian Dental Implants Industry Market Dynamics & Structure

The Brazilian dental implants market exhibits a moderately concentrated structure, with key players such as Dentsply Sirona, Straumann Group (Neodent), and other international and domestic companies vying for market share. Technological innovation, particularly in digital dentistry and materials science (e.g., zirconia implants), is a significant growth driver. The regulatory environment plays a crucial role, influencing product approvals and market access. Competitive pressures arise from both established players and emerging companies offering innovative solutions. The market's demographic trends, including an aging population and rising disposable incomes, fuel demand for dental implants. M&A activity remains relatively active, with larger companies acquiring smaller players to expand their product portfolios and geographic reach. In 2024, approximately xx M&A deals were recorded, representing a xx% increase from the previous year. Market concentration is estimated at xx% in 2025, with the top 5 players controlling xx% of the market share.

- Market Concentration: Moderately concentrated, with xx% market share controlled by top 5 players in 2025.

- Technological Innovation: Focus on digital dentistry, zirconia implants, and minimally invasive procedures.

- Regulatory Framework: Influences product approvals and market access; compliance is crucial.

- Competitive Landscape: Intense competition among established and emerging players.

- End-User Demographics: Aging population and rising disposable incomes drive demand.

- M&A Activity: Consolidation continues through acquisitions and strategic partnerships.

Brazilian Dental Implants Industry Growth Trends & Insights

The Brazilian dental implants market experienced substantial growth between 2019 and 2024, driven by factors such as increasing awareness of dental health, technological advancements, and rising disposable incomes. The market size expanded from xx million units in 2019 to xx million units in 2024, representing a CAGR of xx%. The adoption rate of dental implants has steadily increased, particularly among the middle and upper-income segments of the population. Technological disruptions, like the introduction of digital workflows and advanced implant materials, have significantly influenced market growth, improving treatment efficiency and outcomes. Consumer behavior is shifting toward a preference for minimally invasive procedures and aesthetically pleasing results. This trend fuels the demand for advanced implant systems and related technologies. The market is projected to maintain a robust growth trajectory throughout the forecast period (2025-2033), reaching an estimated xx million units by 2033, with a projected CAGR of xx%. Market penetration is estimated to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Brazilian Dental Implants Industry

The southeastern region of Brazil dominates the dental implants market due to higher population density, greater concentration of healthcare infrastructure, and higher disposable incomes. Sao Paulo, in particular, is a major market hub. Within the segment breakdown, the Prosthodontic segment exhibits the highest growth rate due to the increasing prevalence of tooth loss and the rising demand for fixed and removable prostheses supported by dental implants. Clinics represent the largest end-user segment due to the widespread availability and affordability of dental services.

- Key Drivers:

- Higher population density and economic activity in the Southeast region.

- Well-established healthcare infrastructure in major cities.

- Rising awareness of dental health and improved aesthetics.

- Government initiatives to support healthcare access.

- Dominant Segments:

- Treatment: Prosthodontic (highest growth)

- End-User: Clinics (largest market share)

- Product: General and Diagnostic Equipment

Brazilian Dental Implants Industry Product Landscape

The Brazilian dental implants market showcases a diverse range of products, including various implant systems (titanium, zirconia), abutments, prosthetic components, and related instrumentation. Innovation focuses on improving implant design for enhanced osseointegration, biocompatibility, and aesthetic outcomes. Digital technologies, such as CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) and guided surgery, are increasingly integrated into implant placement procedures, optimizing precision and efficiency. Unique selling propositions include enhanced implant surface technologies for faster bone healing, and sophisticated software for treatment planning.

Key Drivers, Barriers & Challenges in Brazilian Dental Implants Industry

Key Drivers:

- Rising prevalence of periodontitis and tooth loss.

- Increasing affordability of dental implants.

- Growing awareness of cosmetic dentistry.

- Technological advancements leading to improved implant designs and procedures.

Key Challenges:

- High costs associated with implants, limiting access for lower-income populations.

- Supply chain disruptions potentially impacting the availability of materials and components.

- Regulatory hurdles and stringent approval processes for new products.

- Intense competition from both domestic and international players.

Emerging Opportunities in Brazilian Dental Implants Industry

- Expanding into underserved rural areas through mobile clinics or partnerships with local dentists.

- Focusing on developing innovative, cost-effective implant solutions tailored to the needs of the Brazilian population.

- Leveraging digital technologies to improve access to care through telehealth platforms and remote consultations.

- Exploring niche applications of dental implants, such as in maxillofacial reconstruction.

Growth Accelerators in the Brazilian Dental Implants Industry

The Brazilian dental implants market is poised for sustained growth through technological advancements, strategic partnerships, and expansion into untapped markets. Innovation in materials science, digital dentistry, and minimally invasive procedures will continue to propel market expansion. Strategic alliances between implant manufacturers and dental clinics can increase market access and improve treatment affordability. Government initiatives promoting dental health and expanding healthcare coverage will further stimulate growth.

Key Players Shaping the Brazilian Dental Implants Industry Market

- EDLO ITM

- Coltene Brasil

- Baumer Dental Implants

- Dentsply Sirona

- Conexao

- Bicon LLC

- SDI Limited

- Derig Implantes do Brasil

- Angelus Dental

- Institut Straumann AG

- SIN Implant System

- ZimVie Inc

Notable Milestones in Brazilian Dental Implants Industry Sector

- September 2022: DENTSPLY SIRONA Inc. announced the launch of new digital dentistry products at Dentsply Sirona World 2022.

- March 2022: Neodent launched its new zirconia implant system, "Zi," globally.

In-Depth Brazilian Dental Implants Industry Market Outlook

The Brazilian dental implants market presents significant long-term growth potential driven by the factors discussed above. Strategic opportunities exist for companies focusing on innovation, affordability, and expansion into underserved segments. The market's future growth trajectory hinges on continuous technological advancements, strategic partnerships, and favorable regulatory environments. Companies that proactively adapt to evolving consumer preferences and address affordability challenges will be best positioned for success.

Brazilian Dental Implants Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

- 1.1.1. Dental Laser

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic equipment

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

Brazilian Dental Implants Industry Segmentation By Geography

- 1. Brazil

Brazilian Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. High Cost of Device

- 3.4. Market Trends

- 3.4.1. Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic equipment

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EDLO ITM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coltene Brasil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baumer Dental Implants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsply Sirona

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conexao

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bicon LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SDI Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Derig Implantes do Brasil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angelus Dental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Institut Straumann AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIN Implant System

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZimVie Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 EDLO ITM

List of Figures

- Figure 1: Brazilian Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 4: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 9: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Dental Implants Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Brazilian Dental Implants Industry?

Key companies in the market include EDLO ITM, Coltene Brasil, Baumer Dental Implants, Dentsply Sirona, Conexao, Bicon LLC, SDI Limited, Derig Implantes do Brasil, Angelus Dental, Institut Straumann AG, SIN Implant System, ZimVie Inc.

3. What are the main segments of the Brazilian Dental Implants Industry?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Device.

8. Can you provide examples of recent developments in the market?

September 2022- DENTSPLY SIRONA Inc. announced that at Dentsply Sirona World 2022, it would be launching new products and solutions as part of its digital universe, which are designed to bring innovation in dentistry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Dental Implants Industry?

To stay informed about further developments, trends, and reports in the Brazilian Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence