Key Insights

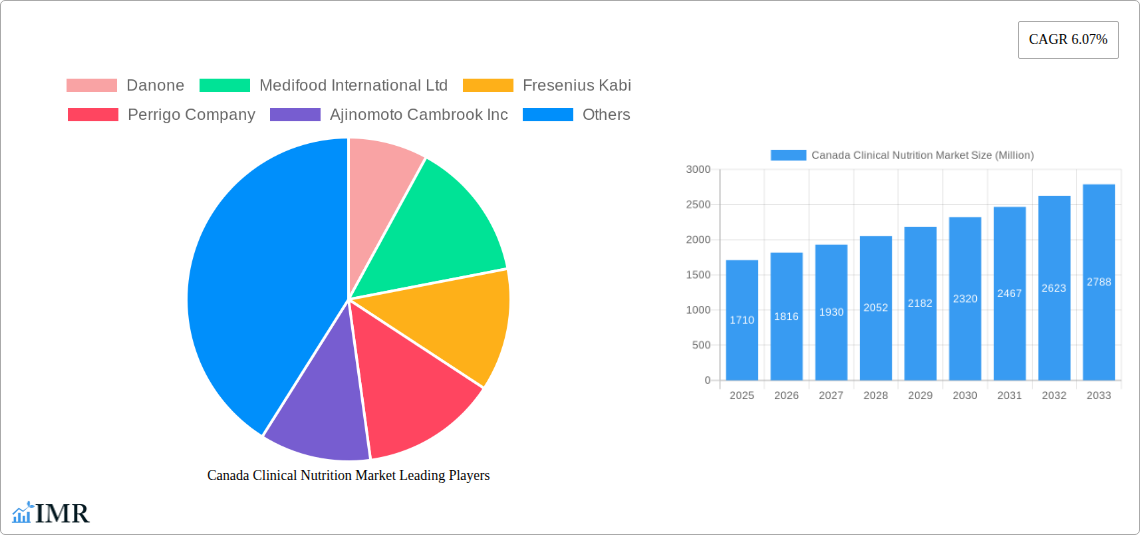

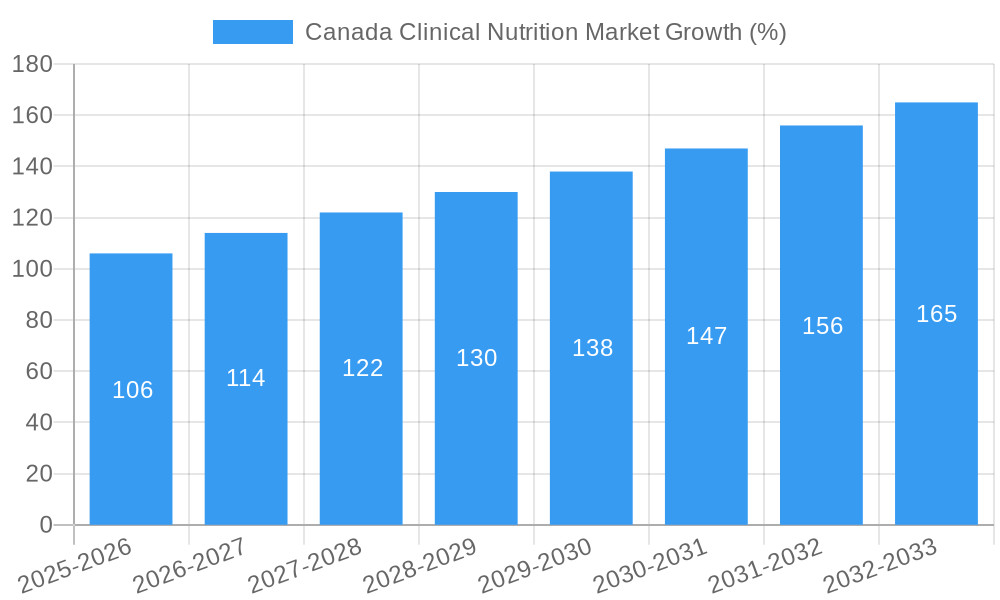

The Canada clinical nutrition market, valued at $1.71 billion in 2025, is projected to experience robust growth, driven by a rising elderly population, increasing prevalence of chronic diseases like cancer and metabolic disorders, and growing awareness of the importance of nutritional support for optimal health outcomes. The market's Compound Annual Growth Rate (CAGR) of 6.07% from 2019 to 2024 suggests a continued upward trajectory through 2033. Key growth drivers include advancements in clinical nutrition formulations offering improved efficacy and palatability, alongside increased government initiatives promoting healthcare accessibility. The market is segmented by end-user (pediatric and adult), route of administration (oral & enteral, parenteral), and application (cancer, malnutrition, metabolic disorders, neurological diseases, gastrointestinal disorders, and others). While the aging population fuels demand, potential restraints include high product costs, stringent regulatory approvals, and the need for skilled healthcare professionals to administer certain clinical nutrition products. The competitive landscape is characterized by both large multinational corporations like Danone, Nestlé Health Science, and Abbott Laboratories, and specialized players like Medifood International and Ajinomoto Cambrook. These companies are focusing on product innovation, strategic partnerships, and expanding distribution networks to capitalize on market opportunities. The oral and enteral route of administration is expected to dominate the market due to its convenience and cost-effectiveness compared to parenteral nutrition. However, the parenteral segment is poised for growth, driven by the increasing incidence of severe illnesses requiring intravenous nutrition support.

The forecast period (2025-2033) anticipates a significant expansion of the Canadian clinical nutrition market. Continued investment in research and development by major players will likely lead to new, more effective products. Furthermore, rising healthcare expenditure and a growing emphasis on preventative healthcare should contribute to sustained market expansion. However, market players will need to address challenges such as managing healthcare costs and improving patient access to advanced clinical nutrition therapies to fully realize the market's potential. Successful navigation of these factors will be key to securing sustained, profitable growth in this dynamic market.

Canada Clinical Nutrition Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada clinical nutrition market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report segments the market by end-user (pediatric, adult), route of administration (oral & enteral, parenteral), and application (cancer, malnutrition, metabolic disorders, neurological diseases, gastrointestinal disorders, others). The report values the market in millions of units and projects robust growth driven by several key factors.

Canada Clinical Nutrition Market Dynamics & Structure

The Canadian clinical nutrition market exhibits a moderately consolidated structure, with key players like Danone, Nestlé Health Science, and Abbott Laboratories holding significant market share. Technological innovation, particularly in personalized nutrition and advanced delivery systems, is a major growth driver. Stringent regulatory frameworks, including Health Canada guidelines, influence product development and market entry. The market also faces competition from substitute products, such as traditional dietary supplements. Furthermore, mergers and acquisitions (M&A) activity, while not exceptionally high, has contributed to market consolidation. The adult segment currently dominates, although the pediatric segment shows significant growth potential.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on personalized nutrition, improved bioavailability, and convenient delivery systems.

- Regulatory Framework: Stringent Health Canada guidelines impacting product approvals and labeling.

- Competitive Substitutes: Traditional dietary supplements and home-prepared diets pose some competition.

- M&A Activity: xx deals recorded between 2019 and 2024, signifying consolidation trends. (Predicted Value)

- End-User Demographics: Aging population driving demand in the adult segment; increasing awareness of pediatric nutritional needs fueling growth in the pediatric segment.

Canada Clinical Nutrition Market Growth Trends & Insights

The Canadian clinical nutrition market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx million units by 2033. Several factors contribute to this growth, including rising prevalence of chronic diseases (cancer, diabetes, etc.), increasing healthcare expenditure, growing awareness of the importance of nutrition in health management, and technological advancements leading to more effective and convenient products. Market penetration rates are expected to increase across various segments, particularly in areas with limited access to healthcare. Consumer behavior shifts toward preventive healthcare and personalized nutrition further contribute to market expansion.

Dominant Regions, Countries, or Segments in Canada Clinical Nutrition Market

The Ontario and Quebec provinces are currently the dominant regions, contributing to a significant portion of market value due to higher population density and better healthcare infrastructure. Within the application segments, malnutrition and cancer treatment are driving significant growth. Within the end-user segments, the adult segment remains dominant, owing to higher prevalence of chronic diseases and aging population. The parenteral route of administration, while smaller in market share currently, shows promising growth due to increasing demand for specialized hospital care.

- Key Drivers (Ontario & Quebec): Higher population density, established healthcare infrastructure, strong physician networks, and robust insurance coverage.

- Dominance Factors (Adult Segment): High prevalence of chronic diseases, aging population, and increased awareness of nutritional needs for health management.

- Growth Potential (Pediatric Segment): Rising awareness of the importance of early nutritional interventions in child development.

- Market Share (Parenteral Route): While a smaller segment, the parenteral route shows strong growth potential due to demand for specialized hospital care.

Canada Clinical Nutrition Market Product Landscape

Product innovation in the Canadian clinical nutrition market focuses on enhanced palatability, improved nutrient bioavailability, and specialized formulations tailored to specific health conditions. Novel delivery systems, such as ready-to-drink formulas and convenient pouches, are gaining popularity. Technological advancements such as advanced protein hydrolysates and prebiotics/probiotics are enhancing product efficacy. Unique selling propositions include personalized nutrition plans, convenient administration, and improved taste and texture.

Key Drivers, Barriers & Challenges in Canada Clinical Nutrition Market

Key Drivers: Increasing prevalence of chronic diseases, rising healthcare expenditure, technological advancements in product formulations, growing awareness of nutritional importance in health management, and supportive government initiatives.

Key Challenges: Stringent regulatory hurdles for product approvals, pricing pressures from generic products, supply chain disruptions affecting raw material availability, and fluctuating costs of key ingredients. Competition from established players and the emergence of new entrants also poses significant challenges. These factors can collectively reduce market growth by an estimated xx% (Predicted value) if not addressed effectively.

Emerging Opportunities in Canada Clinical Nutrition Market

Emerging opportunities lie in the development of personalized nutrition plans tailored to individual needs, expansion into underserved rural areas, and the development of novel formulations targeting specific unmet needs within niche therapeutic areas. Growing demand for convenient and user-friendly products presents significant opportunities, as does the integration of technology to improve patient adherence and monitoring. Furthermore, the growing interest in functional foods with added nutritional benefits provides further growth avenues.

Growth Accelerators in the Canada Clinical Nutrition Market Industry

Long-term growth is fueled by continuous product innovation, strategic collaborations between healthcare providers and nutrition companies, and government initiatives promoting preventative healthcare. Expansion into new therapeutic areas, such as metabolic disorders and neurological conditions, offers significant potential. Investment in research and development, particularly in personalized nutrition solutions, will drive further market expansion.

Key Players Shaping the Canada Clinical Nutrition Market Market

- Danone

- Medifood International Ltd

- Fresenius Kabi

- Perrigo Company

- Ajinomoto Cambrook Inc

- Aymes International Ltd

- Nestle Health Science

- Baxter

- B. Braun SE

- Abbott Laboratories

- Reckitt Benckiser

Notable Milestones in Canada Clinical Nutrition Market Sector

- 2020: Health Canada releases updated guidelines on clinical nutrition product labeling.

- 2021: Abbott Laboratories launches a new line of personalized nutrition products.

- 2022: Nestlé Health Science acquires a smaller clinical nutrition company, expanding its product portfolio.

- 2023: Several key players invest significantly in R&D, focusing on novel delivery systems.

- 2024: A major industry association publishes a report emphasizing the importance of clinical nutrition in disease management. (Example - more milestones to be added based on actual data)

In-Depth Canada Clinical Nutrition Market Market Outlook

The Canadian clinical nutrition market is poised for sustained growth over the forecast period, driven by persistent demand, technological advancements, and increased healthcare spending. Strategic partnerships, mergers, and acquisitions are likely to further shape the market landscape. Companies focusing on personalized nutrition, innovative delivery systems, and expansion into niche therapeutic areas are expected to experience significant growth. The market presents lucrative opportunities for both established players and new entrants.

Canada Clinical Nutrition Market Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Cancer

- 2.2. Malnutrition

- 2.3. Metabolic Disorders

- 2.4. Neurological Diseases

- 2.5. Gastrointestinal Disorders

- 2.6. Others

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

Canada Clinical Nutrition Market Segmentation By Geography

- 1. Canada

Canada Clinical Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation for Clinical Nutrition

- 3.4. Market Trends

- 3.4.1. Malnutrition is Expected to Hold a Major Share in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Clinical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Malnutrition

- 5.2.3. Metabolic Disorders

- 5.2.4. Neurological Diseases

- 5.2.5. Gastrointestinal Disorders

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danone

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medifood International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fresenius Kabi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Perrigo Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Cambrook Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aymes International Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle Health Science

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baxter

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Reckitt Benckiser

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Danone

List of Figures

- Figure 1: Canada Clinical Nutrition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Clinical Nutrition Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Clinical Nutrition Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Canada Clinical Nutrition Market?

Key companies in the market include Danone, Medifood International Ltd, Fresenius Kabi, Perrigo Company, Ajinomoto Cambrook Inc, Aymes International Ltd, Nestle Health Science, Baxter, B Braun SE, Abbott Laboratories, Reckitt Benckiser.

3. What are the main segments of the Canada Clinical Nutrition Market?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population.

6. What are the notable trends driving market growth?

Malnutrition is Expected to Hold a Major Share in the Coming Years.

7. Are there any restraints impacting market growth?

Stringent Regulation for Clinical Nutrition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Clinical Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Clinical Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Clinical Nutrition Market?

To stay informed about further developments, trends, and reports in the Canada Clinical Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence