Key Insights

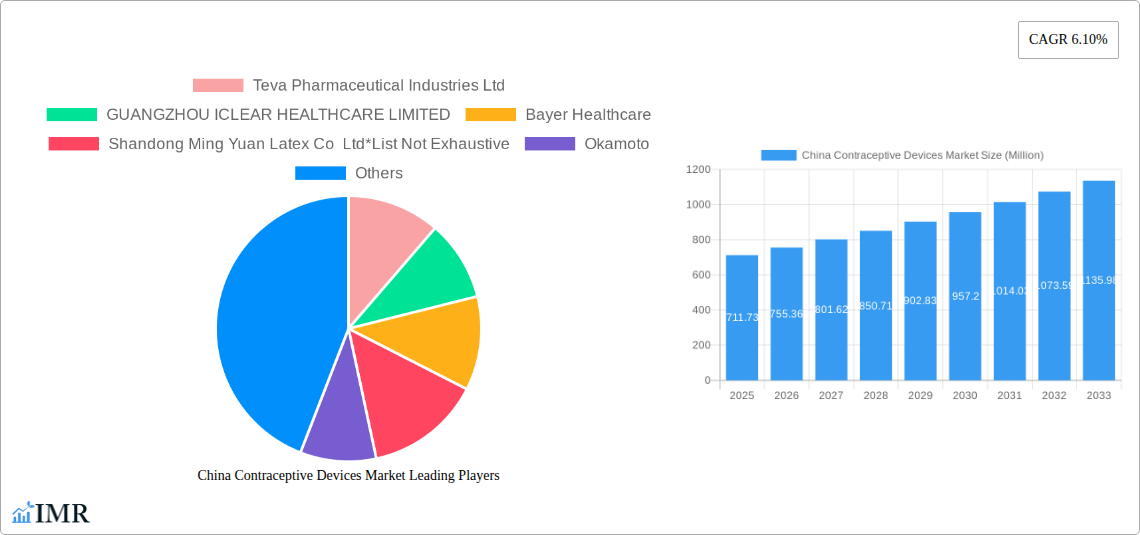

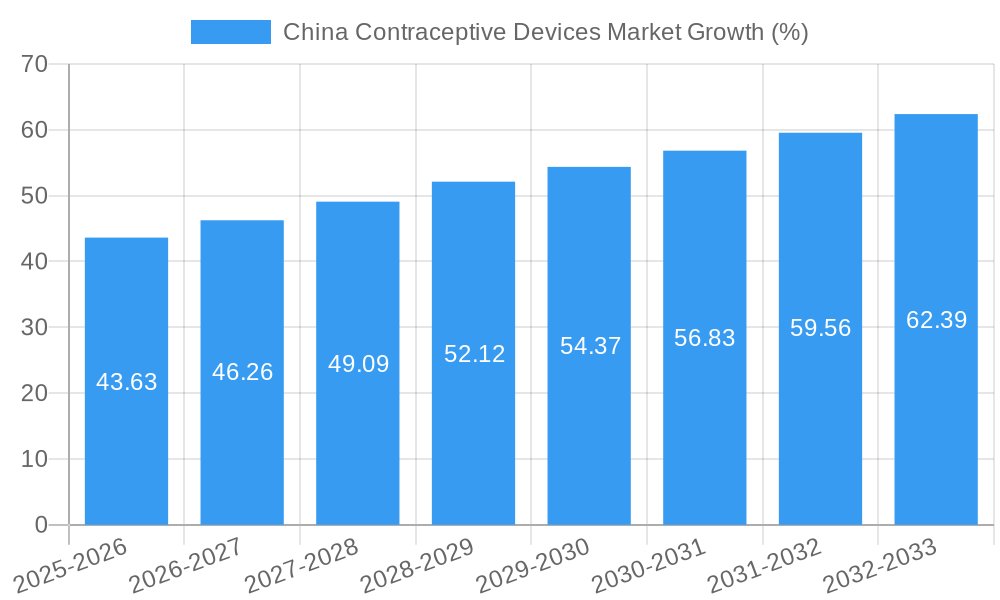

The China contraceptive devices market, valued at $711.73 million in 2025, is projected to experience robust growth, driven by increasing awareness of family planning, rising disposable incomes enabling access to higher-quality products, and government initiatives promoting reproductive health. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant expansion. Key segments include condoms and intrauterine devices (IUDs), with condoms likely holding the largest market share due to wider accessibility and affordability. The female end-user segment is expected to demonstrate strong growth, reflecting changing societal norms and increased female participation in economic activities. Growth will also be fueled by the introduction of innovative contraceptive technologies and the expansion of distribution channels, including online platforms. However, challenges such as cultural stigma surrounding contraceptives in certain regions and inconsistent access to healthcare services in rural areas could impede market growth. Major players like Teva Pharmaceutical Industries, Bayer Healthcare, and Reckitt Benckiser are leveraging their established distribution networks and brand recognition to maintain market dominance. The increasing demand for effective and accessible contraception presents significant opportunities for market expansion, particularly as awareness campaigns and government support continue to grow.

The competitive landscape is characterized by a mix of multinational corporations and domestic players. While multinational companies benefit from advanced technology and established brands, domestic firms possess a better understanding of local market dynamics and preferences. Future growth will be influenced by factors including evolving government regulations, technological advancements in contraceptive methods, and changing consumer preferences towards specific product types. The market's expansion is further bolstered by ongoing research and development efforts focused on improving contraceptive efficacy, safety, and user experience. This includes exploring new delivery methods and developing more convenient and discreet options. The market is poised for considerable expansion, propelled by a confluence of demographic shifts, technological progress, and supportive government policies within China.

This comprehensive report provides an in-depth analysis of the China contraceptive devices market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by product type (condoms, diaphragms, intrauterine devices, other product types) and end-user (male, female).

China Contraceptive Devices Market Dynamics & Structure

The China contraceptive devices market exhibits a moderately concentrated structure, with key players like Teva Pharmaceutical Industries Ltd, GUANGZHOU ICLEAR HEALTHCARE LIMITED, Bayer Healthcare, Shandong Ming Yuan Latex Co Ltd, Okamoto, Reckitt Benckiser, Cooper Surgical Inc, and DKT International holding significant market share. However, the presence of numerous smaller domestic players contributes to a competitive landscape.

Technological innovation, driven by advancements in material science and manufacturing processes, plays a crucial role in shaping product offerings. Stringent regulatory frameworks, including those governing product registration and marketing, influence market access and product development. The market also faces competition from traditional methods and evolving social norms regarding family planning. Mergers and acquisitions (M&A) activity remains relatively moderate, with a projected xx number of deals in the next five years.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Innovation: Focus on improved efficacy, user-friendliness, and material advancements.

- Regulatory Framework: Stringent registration and marketing requirements.

- Competitive Substitutes: Traditional methods of family planning pose significant competition.

- End-User Demographics: Shifting demographics and changing preferences influence demand patterns.

- M&A Activity: Moderate activity, with xx deals anticipated by 2030.

China Contraceptive Devices Market Growth Trends & Insights

The China contraceptive devices market is projected to experience substantial growth during the forecast period (2025-2033). Driven by factors such as increasing awareness of family planning, rising disposable incomes, and government initiatives promoting reproductive health, the market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration rates for various contraceptive methods are expected to increase, particularly in less developed regions. Technological advancements, such as the development of more effective and user-friendly devices, are further fueling market growth. However, societal beliefs and regional variations in access and awareness continue to influence adoption rates. The market size is expected to reach xx Million units by 2033 from xx Million units in 2025.

Dominant Regions, Countries, or Segments in China Contraceptive Devices Market

The coastal regions of China, including Guangdong, Jiangsu, and Zhejiang, currently dominate the contraceptive devices market due to higher levels of urbanization, economic development, and greater access to healthcare. Within product types, condoms currently hold the largest market share, followed by intrauterine devices (IUDs). However, the market for other product types, such as contraceptive implants, is anticipated to witness significant growth due to improved affordability and increased awareness.

- Key Drivers:

- Higher urbanization and economic development in coastal regions.

- Improved access to healthcare and family planning services.

- Increased awareness campaigns by the government and NGOs.

- Growing acceptance of modern contraceptive methods.

- Dominant Segments:

- Product Type: Condoms (xx% market share in 2025), followed by IUDs (xx%).

- End User: Female segment dominates with xx% market share in 2025.

China Contraceptive Devices Market Product Landscape

The China contraceptive devices market offers a diverse range of products, including condoms made from various materials (latex, polyurethane), different types of IUDs (hormonal and non-hormonal), diaphragms, and other contraceptive methods. Recent innovations focus on improving product efficacy, comfort, and user experience. Some manufacturers are incorporating features such as enhanced lubrication, thinner designs, and improved packaging for greater convenience. The focus on user experience and quality differentiates products in a crowded market.

Key Drivers, Barriers & Challenges in China Contraceptive Devices Market

Key Drivers:

- Increasing awareness of family planning and reproductive health.

- Growing urbanization and improved access to healthcare.

- Government initiatives promoting reproductive health education.

Challenges:

- Traditional cultural norms and beliefs surrounding family planning.

- Unequal access to healthcare and family planning services across regions.

- Competition from traditional methods and affordability concerns for certain segments of the population.

Emerging Opportunities in China Contraceptive Devices Market

Emerging opportunities lie in expanding access to contraceptive devices in rural areas and among underserved populations. Increased marketing efforts focusing on improved awareness and education, coupled with the development of more affordable and accessible products, are key aspects of tapping into this potential. Furthermore, innovations in product design and technology, such as advanced materials and delivery methods, can drive market growth.

Growth Accelerators in the China Contraceptive Devices Market Industry

Strategic partnerships between pharmaceutical companies and healthcare providers can increase distribution and access to contraceptive devices. Technological advancements leading to more user-friendly and effective contraceptive options, alongside sustained government support and increased public health initiatives, will contribute to long-term market growth.

Key Players Shaping the China Contraceptive Devices Market Market

- Teva Pharmaceutical Industries Ltd

- GUANGZHOU ICLEAR HEALTHCARE LIMITED

- Bayer Healthcare

- Shandong Ming Yuan Latex Co Ltd

- Okamoto

- Reckitt Benckiser

- Cooper Surgical Inc

- DKT International

Notable Milestones in China Contraceptive Devices Market Sector

- April 2021: Daxiang sues Durex for copyright infringement.

- June 2021: DKT WomanCare and Shanghai Dahua Pharmaceutical reduce Levoplant implant price.

- February 2022: Government launches online campaign promoting responsible childbirth.

In-Depth China Contraceptive Devices Market Market Outlook

The China contraceptive devices market is poised for continued expansion, driven by a confluence of factors, including rising awareness, economic growth, and technological progress. Strategic investments in research and development, targeted marketing campaigns, and collaborations with healthcare providers will be crucial for players seeking to capture market share. The growing demand for accessible, affordable, and effective contraception presents significant opportunities for innovation and market expansion.

China Contraceptive Devices Market Segmentation

-

1. Product Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Intrauterine Devices

- 1.4. Other Product Types

-

2. End User

- 2.1. Male

- 2.2. Female

China Contraceptive Devices Market Segmentation By Geography

- 1. China

China Contraceptive Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding the Usage of Contraceptive Devices

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Intrauterine Devices are Expected to Hold a Significant Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Intrauterine Devices

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Teva Pharmaceutical Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GUANGZHOU ICLEAR HEALTHCARE LIMITED

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Ming Yuan Latex Co Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okamoto

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reckitt Benckiser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cooper Surgical Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DKT International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Teva Pharmaceutical Industries Ltd

List of Figures

- Figure 1: China Contraceptive Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Contraceptive Devices Market Share (%) by Company 2024

List of Tables

- Table 1: China Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Contraceptive Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Contraceptive Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: China Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Contraceptive Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: China Contraceptive Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: China Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Contraceptive Devices Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the China Contraceptive Devices Market?

Key companies in the market include Teva Pharmaceutical Industries Ltd, GUANGZHOU ICLEAR HEALTHCARE LIMITED, Bayer Healthcare, Shandong Ming Yuan Latex Co Ltd*List Not Exhaustive, Okamoto, Reckitt Benckiser, Cooper Surgical Inc, DKT International.

3. What are the main segments of the China Contraceptive Devices Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 711.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding the Usage of Contraceptive Devices.

6. What are the notable trends driving market growth?

Intrauterine Devices are Expected to Hold a Significant Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated with Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

In February 2022, the Government of China began an online propaganda campaign focused on how to respect the social value of childbirth and advocate age-appropriate marriage and childbearing, as well as optimal child-bearing and raising. This campaign is expected to increase awareness about contraceptive devices in the country, which may boost the market's growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Contraceptive Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Contraceptive Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Contraceptive Devices Market?

To stay informed about further developments, trends, and reports in the China Contraceptive Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence