Key Insights

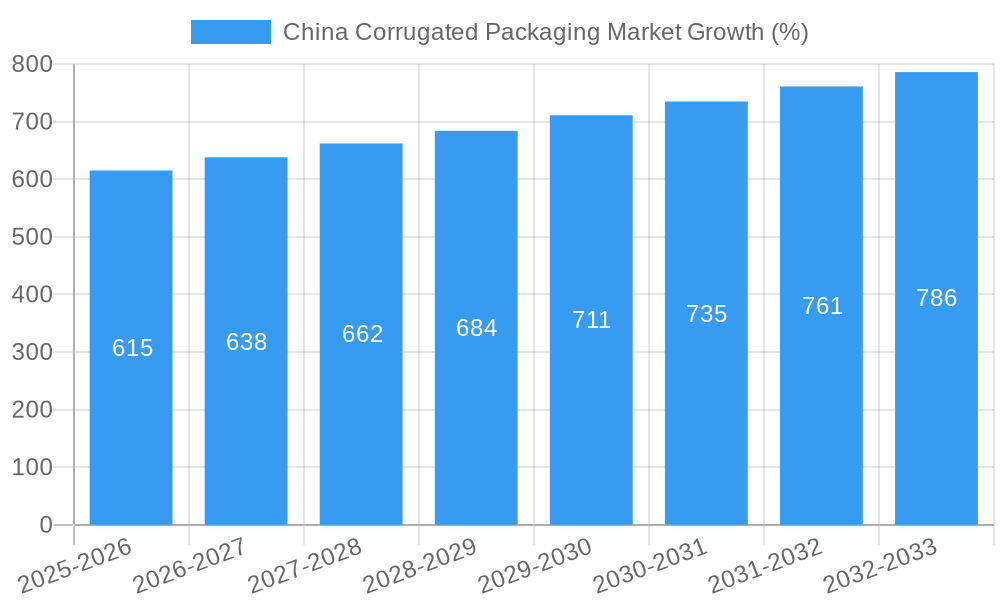

The China corrugated packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in China significantly increases the demand for efficient and protective packaging solutions. Furthermore, the growth of the food and beverage industry, coupled with rising consumer spending and a preference for convenient, pre-packaged goods, further bolsters market demand. Technological advancements in corrugated board manufacturing, leading to lighter, stronger, and more sustainable packaging options, also contribute to market growth. While increasing raw material costs pose a potential restraint, the market's resilience is expected to offset this challenge, particularly given the ongoing investments in sustainable and innovative packaging solutions by major players. Segmentation analysis reveals a strong reliance on the food and beverage sector, followed by electrical goods and household products, indicating diverse applications within the Chinese market.

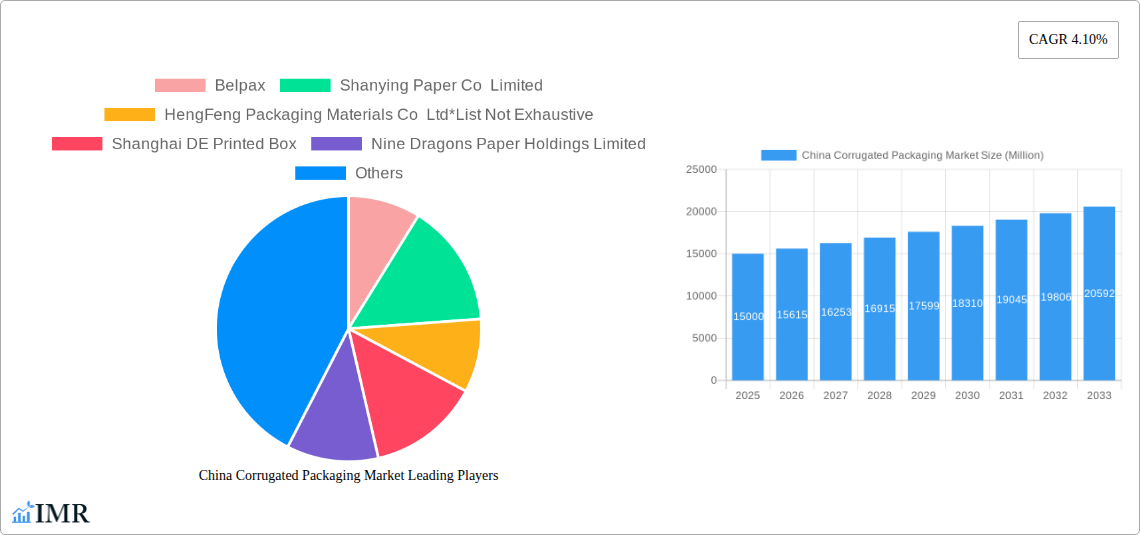

Competitive dynamics within the China corrugated packaging market are characterized by a mix of large multinational corporations and established domestic players. Companies like Belpax, Shanying Paper Co Limited, HengFeng Packaging Materials Co Ltd, Shanghai DE Printed Box, Nine Dragons Paper Holdings Limited, and Hung Hing Printing Group Limited are key participants, competing primarily on price, quality, and customization capabilities. The market is expected to witness increased consolidation as companies seek to expand their market share through acquisitions and strategic partnerships. The geographic focus currently centers on China, but future expansion into other Asian markets is anticipated as Chinese manufacturers look to leverage their established production capabilities and cost advantages. The forecast period, 2025-2033, anticipates continued growth, albeit at a potentially moderating pace as the market matures.

China Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China corrugated packaging market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking a thorough understanding of this dynamic market. With a focus on parent and child markets, this report delivers actionable insights to navigate the complexities of the Chinese corrugated packaging landscape.

China Corrugated Packaging Market Market Dynamics & Structure

The China corrugated packaging market, a significant sub-segment of the broader packaging industry, exhibits a complex interplay of factors shaping its structure and dynamics. Market concentration is moderate, with a few large players and numerous smaller regional entities. Technological innovation, driven by automation and sustainable material adoption, is a key driver, impacting production efficiency and environmental concerns. Stringent government regulations regarding material sourcing and waste management influence operational strategies. The market faces competition from alternative packaging materials like plastic and flexible packaging, demanding continuous innovation and cost optimization. End-user demographics, characterized by a growing middle class and shifting consumption patterns, are influencing packaging demand across various segments. Furthermore, M&A activity within the industry reflects consolidation efforts and strategic expansion strategies. The total value of M&A deals in the period 2019-2024 reached approximately XX Million units, with a projected increase to XX Million units by 2033.

- Market Concentration: Moderate, with top 5 players holding approximately 40% market share in 2024.

- Technological Innovation: Automation, sustainable materials (recycled paperboard, etc.), and smart packaging solutions are key innovation areas.

- Regulatory Framework: Strict environmental regulations on waste management and material sourcing.

- Competitive Substitutes: Plastic and flexible packaging pose significant competition.

- End-User Demographics: Growing middle class and urbanization are driving packaging demand.

- M&A Trends: Increasing consolidation and strategic acquisitions to expand market reach.

China Corrugated Packaging Market Growth Trends & Insights

The China corrugated packaging market has experienced robust growth over the historical period (2019-2024), driven primarily by the expansion of e-commerce, increased consumer spending, and the burgeoning food and beverage sector. The market size reached XX Million units in 2024 and is projected to reach XX Million units by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). This growth reflects rising demand across diverse end-user industries. Technological disruptions, like the adoption of automated production lines and digital printing technologies, have significantly enhanced efficiency and customization options, further fueling market growth. Consumer behavior shifts towards sustainable and convenient packaging solutions influence product innovation and market segmentation. Adoption rates for eco-friendly packaging materials are steadily rising, with an estimated XX% penetration by 2033. Continued e-commerce growth and urban expansion contribute significantly to the sustained market momentum.

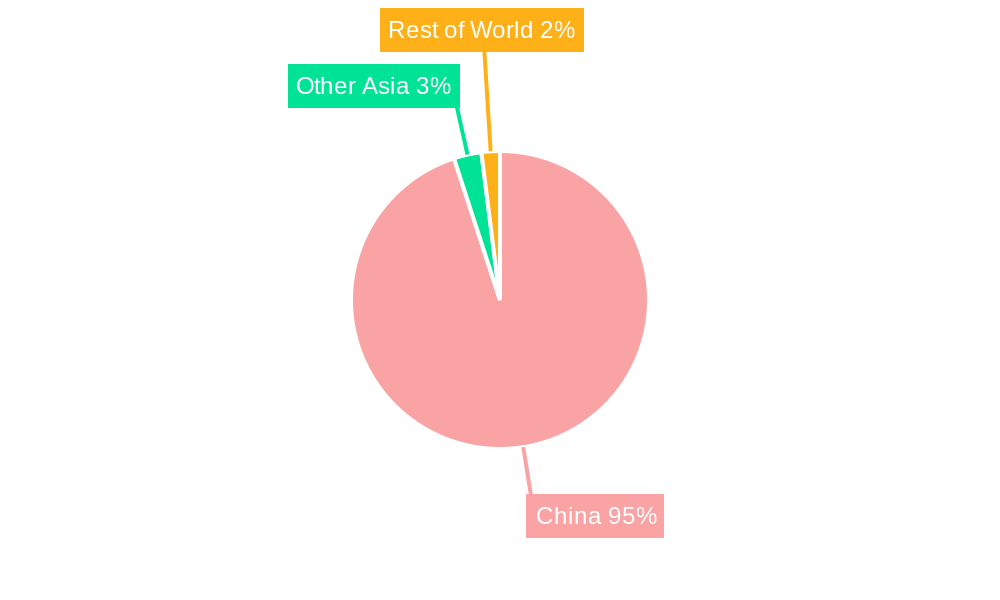

Dominant Regions, Countries, or Segments in China Corrugated Packaging Market

The coastal regions of China, particularly Guangdong, Jiangsu, and Zhejiang provinces, dominate the corrugated packaging market due to their highly developed manufacturing sectors and proximity to major ports. Within end-user industries, the food and beverage sector is the largest segment, accounting for approximately 45% of the market in 2024, followed by the electrical goods and household segments. This dominance is driven by the robust growth of the food and beverage industry, high demand for packaged goods, and increasing exports. Key drivers include favorable government policies supporting local manufacturing, robust infrastructure development enabling efficient logistics, and a thriving consumer market with high spending on packaged food and beverages. The food and beverage segment is projected to maintain its leading position, with a CAGR of approximately XX% during the forecast period. Other sectors, like industrial and stationery, also contribute significantly and are expected to experience moderate growth propelled by rising industrial output and educational expansion.

- Key Drivers:

- Favorable government policies supporting manufacturing.

- Well-developed infrastructure, facilitating efficient logistics.

- High consumer spending on packaged goods.

- Increasing industrial output and educational expansion.

China Corrugated Packaging Market Product Landscape

The China corrugated packaging market showcases a wide array of products, from basic corrugated boxes to intricately designed and customized packaging solutions. Innovations include lighter-weight yet highly durable materials, eco-friendly designs using recycled content, and functional features like tamper-evident seals and integrated handles. These improvements enhance product protection, improve shelf life, and cater to specific end-user requirements. Advanced printing technologies, including digital printing and flexographic printing, enable high-quality graphics and customizable branding, improving product appeal and brand recognition. Furthermore, the increasing demand for e-commerce-ready packaging drives innovation in protective designs and convenient sizes for optimal shipping and handling.

Key Drivers, Barriers & Challenges in China Corrugated Packaging Market

Key Drivers:

The China corrugated packaging market is propelled by the expansion of the e-commerce sector, increasing demand for consumer goods, and government initiatives encouraging sustainable packaging solutions. The continuous growth of the food and beverage sector, coupled with the rising popularity of ready-to-eat meals and convenience foods, drives significant demand. Technological advancements in printing and production efficiency also contribute to market expansion. Favorable government policies supporting the manufacturing sector further bolster the market's growth trajectory.

Key Challenges:

Fluctuations in raw material prices (pulp and paper) pose a significant challenge, impacting production costs and profitability. Environmental regulations related to waste management and sustainable packaging practices require substantial investment in compliance measures. Intense competition from both domestic and international players leads to price pressures and the need for continuous innovation. Supply chain disruptions, especially in the wake of global events, can impact production and timely delivery of products. The overall impact of these challenges is estimated to reduce the annual market growth by approximately XX percentage points in the short-term, although the long-term outlook remains positive.

Emerging Opportunities in China Corrugated Packaging Market

Emerging opportunities lie in the growing demand for customized and personalized packaging solutions, driven by increasing brand awareness and product differentiation strategies. The expansion of the e-commerce sector creates significant opportunities for innovative packaging designs that offer superior protection during shipping and handling. The growing preference for sustainable and eco-friendly packaging materials opens avenues for the adoption of recycled content and biodegradable alternatives. Untapped markets in rural areas and smaller cities offer considerable growth potential. Furthermore, the increasing adoption of advanced printing technologies and smart packaging solutions presents exciting prospects for enhanced brand engagement and product traceability.

Growth Accelerators in the China Corrugated Packaging Market Industry

Long-term growth in the China corrugated packaging market will be accelerated by several factors. Technological advancements, particularly in automation and sustainable material science, will increase efficiency and reduce environmental impact. Strategic partnerships between packaging companies and e-commerce platforms will strengthen supply chains and cater to the rising demand for efficient and protective packaging solutions. Continued expansion into new geographical markets and diversification into specialized packaging segments will drive market growth. Government initiatives supporting the sustainable development of the packaging industry will further stimulate market expansion and innovation.

Key Players Shaping the China Corrugated Packaging Market Market

- Belpax

- Shanying Paper Co Limited

- HengFeng Packaging Materials Co Ltd

- Shanghai DE Printed Box

- Nine Dragons Paper Holdings Limited

- Hung Hing Printing Group Limited

- List Not Exhaustive

Notable Milestones in China Corrugated Packaging Market Sector

- November 2022: Ningbo Unico Packing Co., Ltd. significantly increased its production capacity of rigid gift boxes to 300,000 units per month by implementing a fully automated production line. This highlights the industry's move towards automation and enhanced efficiency.

In-Depth China Corrugated Packaging Market Market Outlook

The China corrugated packaging market exhibits a highly promising outlook, driven by sustained economic growth, rising consumer spending, and the continuous expansion of the e-commerce sector. Strategic investments in automation, sustainable materials, and innovative packaging solutions will further propel market growth. The industry is poised for significant expansion, with opportunities in customized packaging, e-commerce-focused solutions, and eco-friendly options. Companies adopting proactive strategies in innovation, sustainability, and supply chain optimization will be well-positioned to capitalize on the market's long-term potential.

China Corrugated Packaging Market Segmentation

-

1. End-user Industry

- 1.1. Food

- 1.2. Beverages

- 1.3. Electrical goods

- 1.4. Household

- 1.5. Other En

China Corrugated Packaging Market Segmentation By Geography

- 1. China

China Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Electrical goods

- 5.1.4. Household

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Belpax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanying Paper Co Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HengFeng Packaging Materials Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai DE Printed Box

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Dragons Paper Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hung Hing Printing Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Belpax

List of Figures

- Figure 1: China Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Corrugated Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Corrugated Packaging Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the China Corrugated Packaging Market?

Key companies in the market include Belpax, Shanying Paper Co Limited, HengFeng Packaging Materials Co Ltd*List Not Exhaustive, Shanghai DE Printed Box, Nine Dragons Paper Holdings Limited, Hung Hing Printing Group Limited.

3. What are the main segments of the China Corrugated Packaging Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

November 2022: Ningbo Unico Packing Co., Ltd. purchased a fully-automatic packaging machine and successfully set up the full production line for all kinds of custom cardboard rigid gift boxes. The company's production capacity has now increased to 300,000 pieces of rigid gift boxes per month. The machine takes all work from box printing, mold setting up, lamination, and surface add-ons to final assembling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the China Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence